A Look At Traditional Energy Profitability Amidst A Trade War-Driven Macro Mess

Navigating The Energy Macro

We take a break from our recent run of video podcasts discussing “long takes” on President Trump’s global trade war to look at where traditional energy profitability and fundamentals stand after the 2021-2024 mini-cycle, a subject we had originally intended to write about in early April during what turned into the immediate aftermath of a “Liberation Day” market swoon. Overall, industry is at a healthier starting point to navigate choppy macro conditions than was the case prior to the last two downcycles in 2020 and 2014-15, and is much improved versus the especially disappointing 2015-2019 years. To be clear, it is possible that a full downcycle over the next 12-18 months could be averted, but risks have clearly increased driven by the combination of rising recession concerns plus the “pump for Trump” ramp in OPEC+ supply.

We emphasize some key distinctions with where traditional energy is in 2025 versus prior major macro and industry downturns in 2020 (COVID), 2014-15 (end of Super-Spike era), 2008-9 (Great Financial Crisis), and 1986 (end of Arab Oil Embargo super-cycle):

Unlike the 2014-15 and 1986 downturns, the current period of potential weakness is not coming at the end of a structural bull market for traditional energy. Industry CAPEX has generally remained subdued and most companies have maintained improved balance sheet health.

For the first time in our 33-year career, the broad industry—not just the largest integrated oils—are emphasizing profitability and other important financial metrics rather than volume growth for the sake of volume growth.

We see the Trump Trade War as more like the macro shocks of COVID and the GFC albeit one that is voluntary and could change course on a dime. In those prior episodes, sector weakness reversed as soon as broader macro indicators turned positive. This is a critical point as the market has seemingly looked past otherwise much-improved industry fundamentals evidenced over the past four years owing to concerns that profitability could decline to below mid-cycle levels in a recession scenario. While we have no idea how long or deep the trade war overhang will be, whenever we do see global macroeconomic “green shoots,” we would expect traditional energy shares to react favorably consistent with the sector’s otherwise improved fundamentals this decade versus last.

While we do not believe the trade war genie can or will be fully put back in the bottle so to speak, it is still possible that an all-out trade war of the US versus the entire rest of the world narrows to the US versus China. Of course a US versus China trade war hardly makes for a benign macro backdrop. As such, companies and investors should be prepared for an extended period of macro uncertainty; Super Vol remains our framing.

In terms of corporate strategy for the traditional energy sector, we highlight the following:

US shale oil, which has been the over-arching engine of oil supply growth over the past decade, is showing signs of maturation, with a growing list of companies contemplating plans for what comes after US shale oil. The ability to favorably (or not) navigate through business model evolution at a time of great macro uncertainty is likely to be a key differentiating driver of corporate and share price performance.

Some of the best M&A activity has come during prior downcycles or periods of macroeconomic uncertainty, though the fact that much of industry is in healthier shape this time around reduces the odds of distressed sellers at this time.

The demand outlook for US and global natural gas as well as power generation appears to be more favorable than for crude oil, even though we are not believers that so-called “peak oil demand” is imminent. Profitability and risk/reward can vary significantly depending on where in the value chain companies choose to engage in both natural gas and power.

2021-2024 Energy Mini-Cycle: A Sharp Improvement from 2015-2019

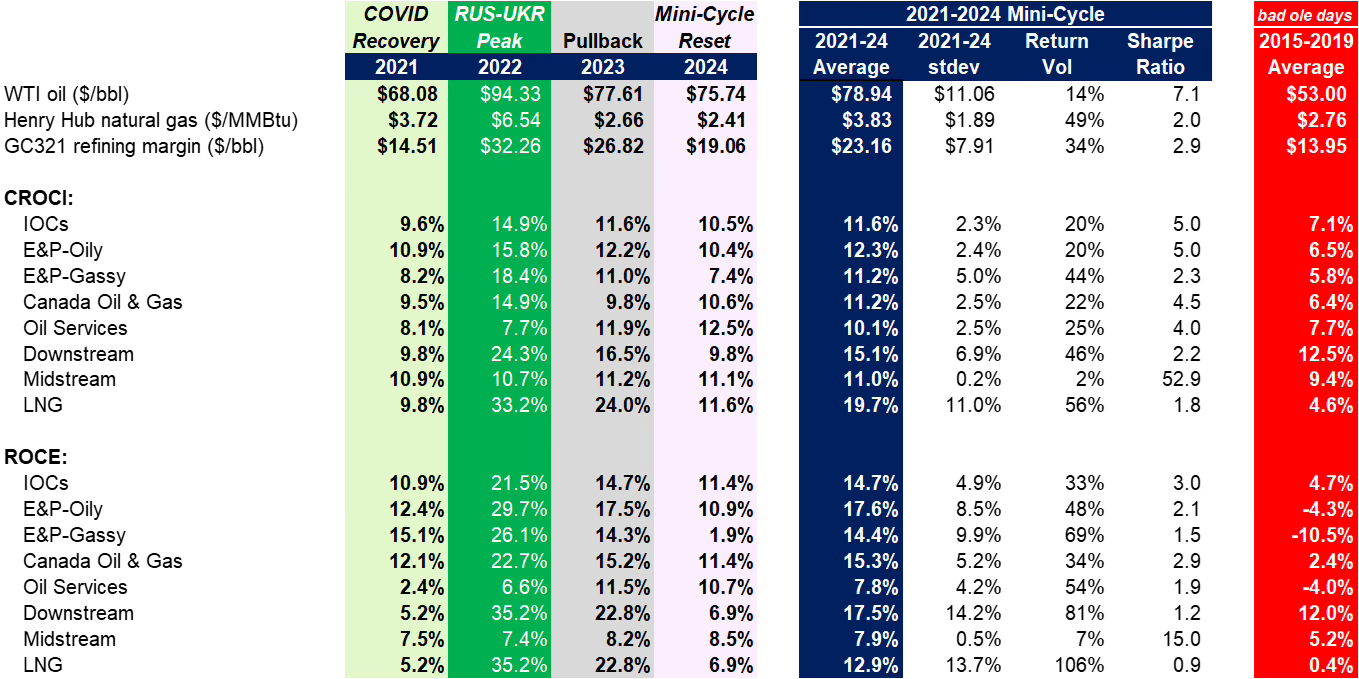

The 2021-2024 period was a full mini-cycle for the traditional energy sector, with energy commodity prices and sector profitability having returned in 2024 to levels slightly better than 2021, which we would characterize as around cost of capital, and well ahead of the bad ole days of 2015-2019 (Exhibit 1). 2024 followed an especially strong peak in 2022 and still robust 2023.

It was a tale of two distinct periods:

COVID recovery in 2021 that transitioned into the Russia-Ukraine oil and natural gas price peak by late 2022 and

the subsequent period of normalization for both commodity prices and profitability during a time that the artificial intelligence (AI) megatrend took off (Exhibit 1).

We continue to believe that the COVID-driven deep trough in 2020 marked the end of what was a 12-year structural downcycle for traditional energy (2008-2020), and that 2025 will be year five of a structurally better era that we see lasting at least until 2030.

Exhibit 1: Energy profitability and commodity prices in 2024 were broadly similar to 2021, with WTI oil and GC 321 refining margins slightly higher and Henry Hub natural gas lower

Source: Bloomberg, FactSet, Veriten.

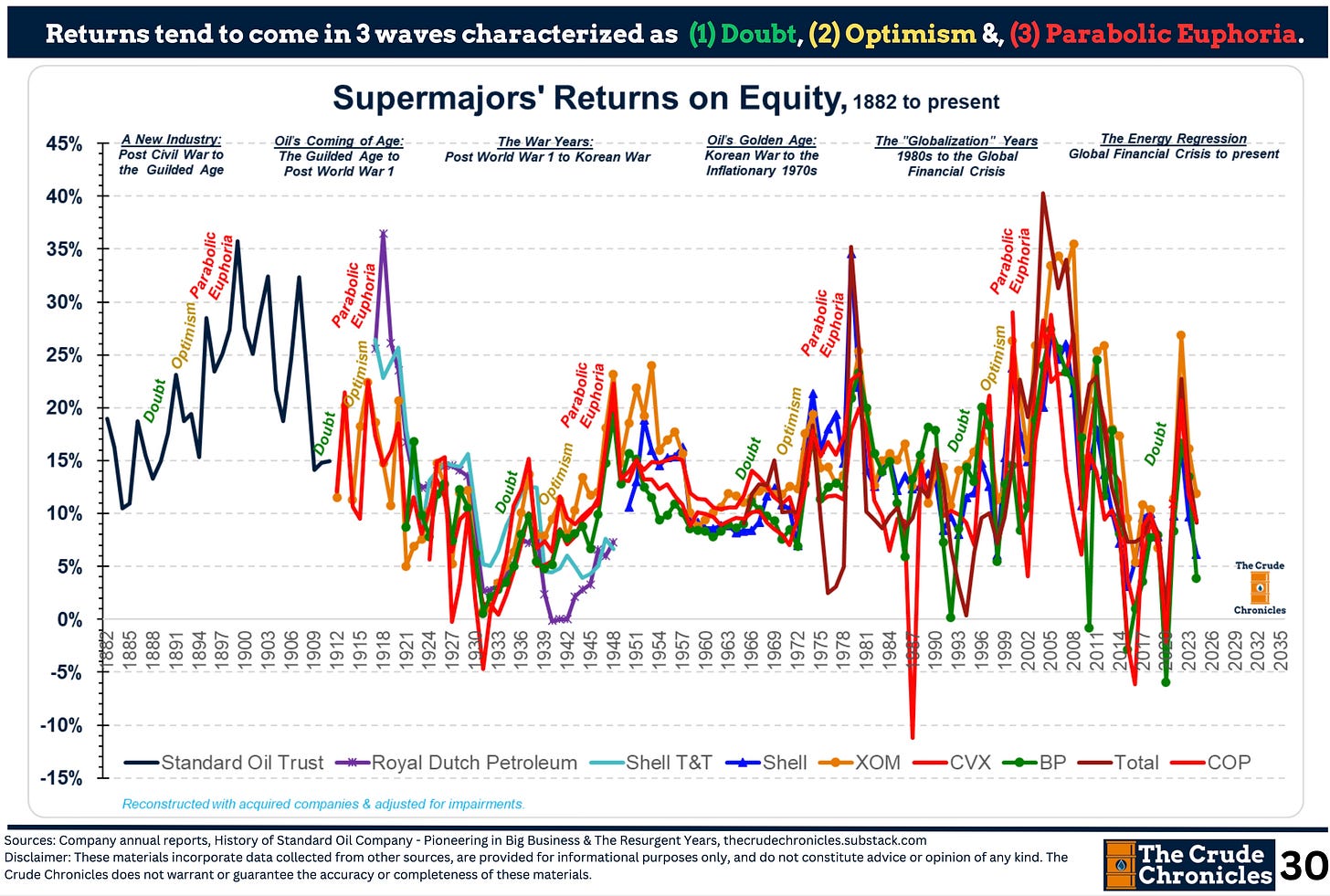

As we have regularly noted, structural traditional energy cycles are long-term in nature: 10-15 years up, 10-15 years down. This has been true since the industry’s founding as documented by Rob Connors, publisher of the must-read energy Substack The Crude Chronicles (here) (Exhibit 2). Within the underlying, long-term trend, mini-cycles are common.

Exhibit 2: Profitability cycles have been long-term in nature since the Standard Oil era

Source: The Crude Chronicles.

Double-digit CROCI and ROCE over 2021-2024

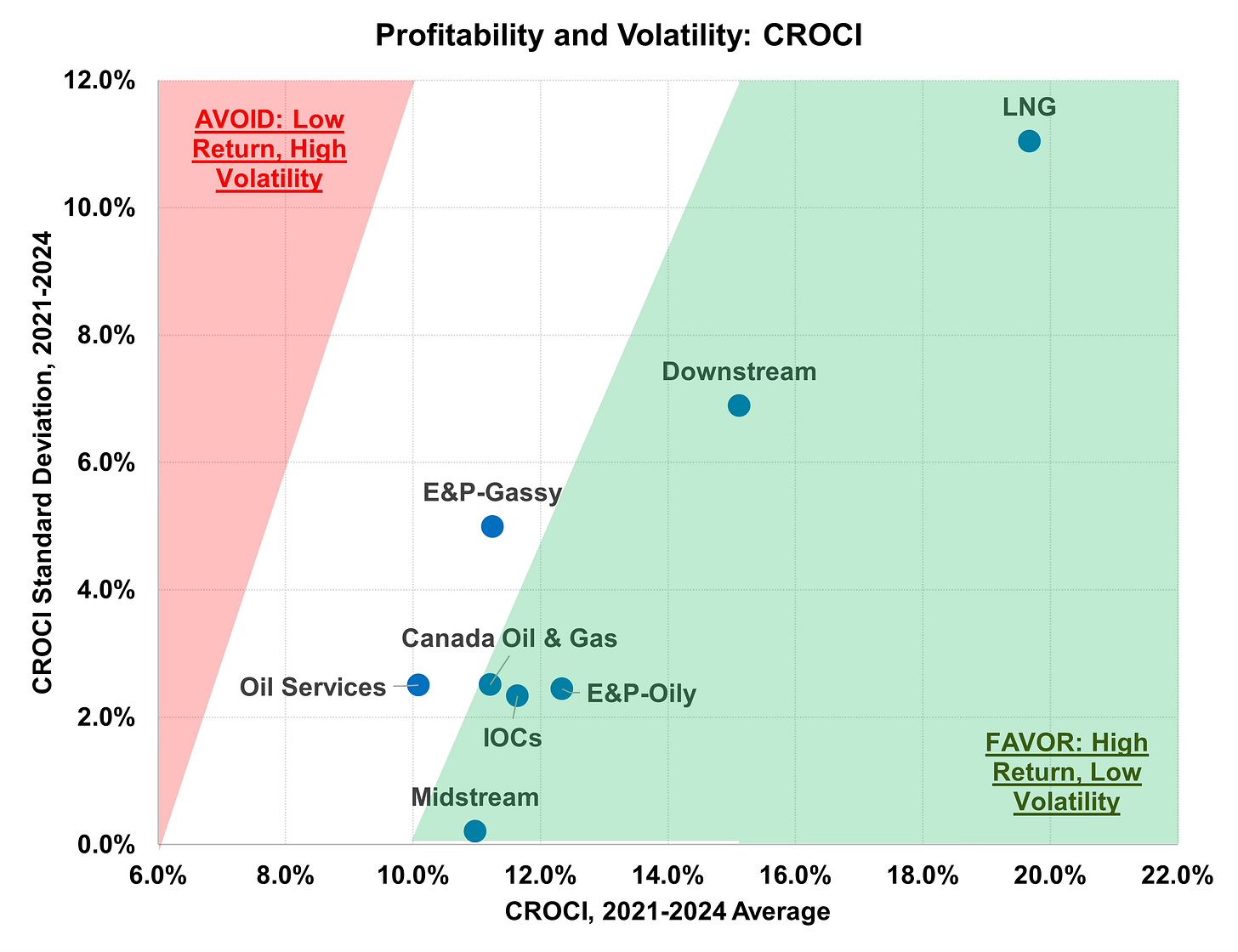

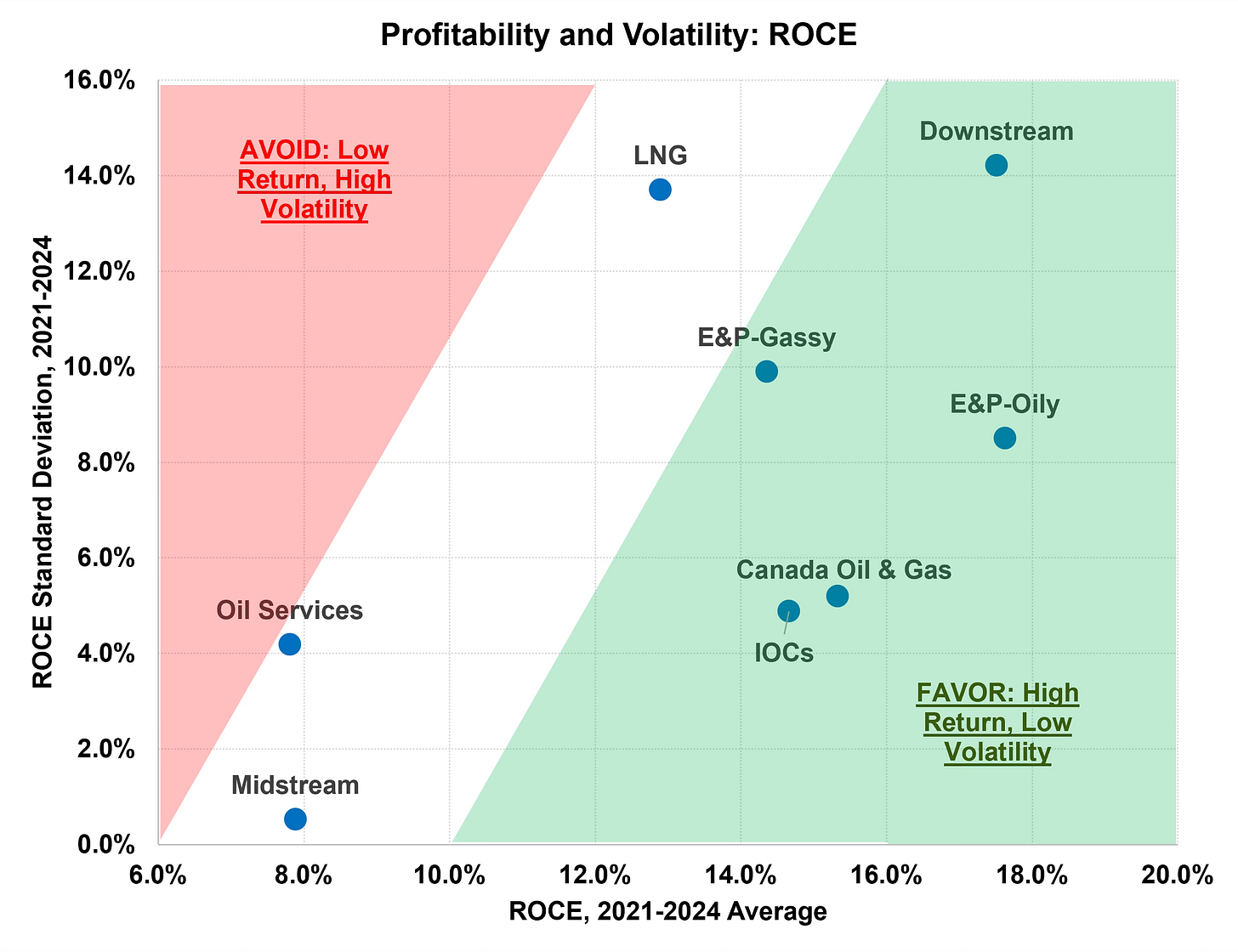

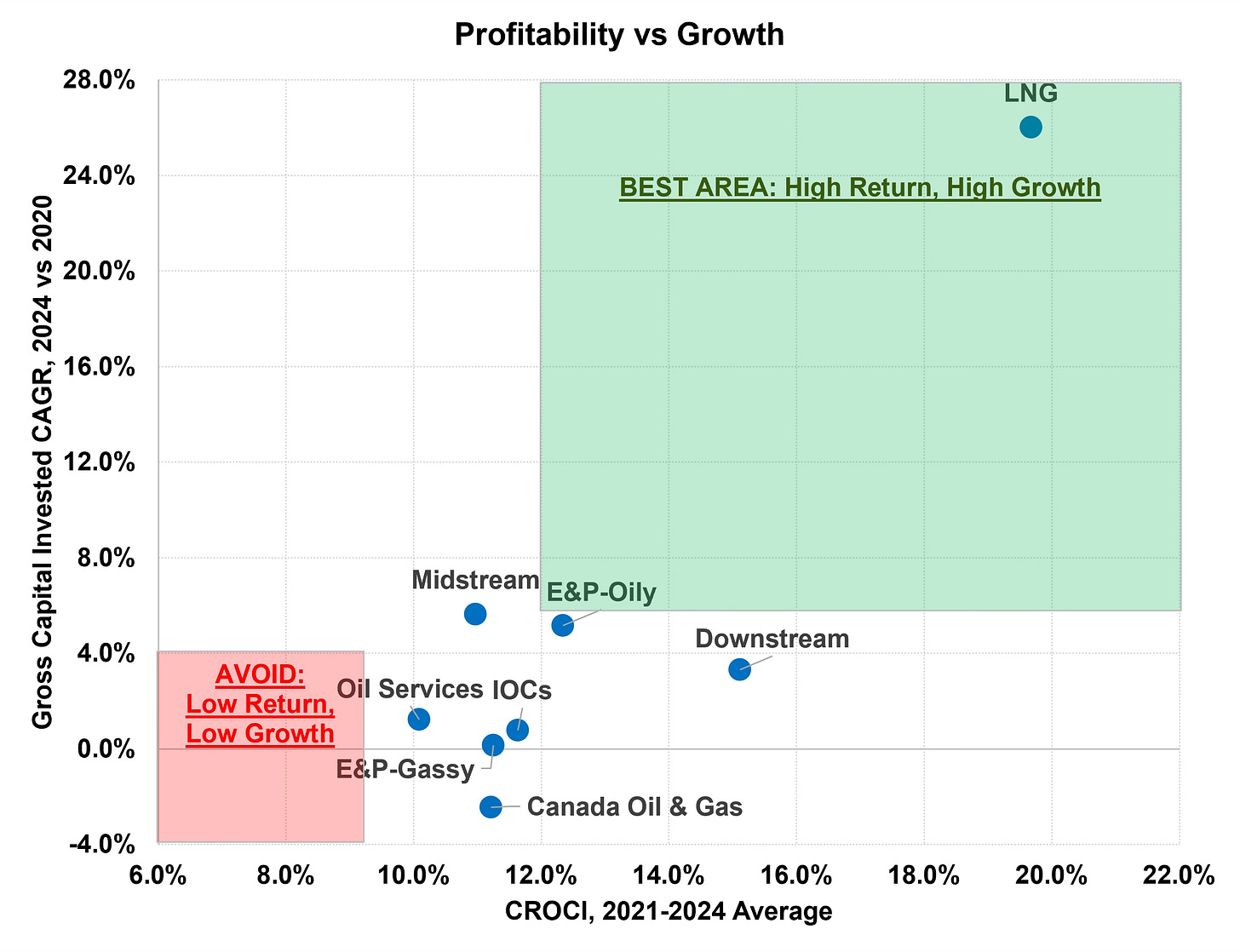

We have analyzed profitability using return on capital employed (ROCE) and cash return on gross capital invested (CROCI) for the various traditional energy sub-sectors over 2021-2024 (Exhibits 3-5). We also calculated the volatility in profitability, which we defined as the 1 standard deviation change in profitability relative to the average over 2021-2024. For growth, we have looked at increases (or decreases) in gross capital invested.

A few takeaways:

We prefer the CROCI comparisons over this shorter time frame (i.e., the last 4 years) as it is a cash flow-based metric that avoids the boost to ROCE for many companies that was simply the result of large write-offs taken in 2020 (or prior years).

Using CROCI, all sectors earned at least 10% on average over 2021-2024, which we view as the threshold “cost of capital” level. We believe 12%+ CROCI is likely needed in order for sustained better performance versus the broader stock market for non-midstream sub-sectors. For mid-stream, we believe at least 7%-8% CROCI is likely needed for sustained outperformance, with the much lower inherent volatility the key driver of its lower CROCI threshold.

We are now tracking an expanding list of LNG (liquefied natural gas) pure-plays, which have been in high-growth mode. The LNG pure-plays and downstream sub-sectors generated the best CROCI, albeit with notably higher volatility. That said, in this case the experienced volatility was “good” in that both earned amazing peak returns over much of 2022 and 2023.

Interestingly, both LNG and downstream we think of as long-lived, high fixed cost, low variable cost businesses. LNG is in a major growth wave. Downstream, especially in the OECD, is facing perhaps the exact opposite of LNG in terms of shrinkage and consolidation.

Midstream jumps out favorably as showing the highest growth rates excluding LNG, and the best Sharpe ratio (profitability adjusted for volatility). An 11% CROCI with almost no volatility we consider to be excellent performance.

The lower CROCI and ROCE for oil services is consistent with the decreased growth ambitions of the upstream sector. This is leading many oil service companies to examine new business opportunities in a variety of newer areas.

Operating free cash flow (cash flow from operations less CAPEX) was positive for all sub-sectors in all years except LNG.

Better sector profitability has come with a reduction in growth rates (again, excluding LNG which is growing rapidly).

Exhibit 3: Traditional Energy CROCI For 2021-2024

Source: FactSet, Veriten.

Exhibit 4: Traditional Energy ROCE For 2021-2024

Source: FactSet, Veriten.

Exhibit 5: Traditional Energy Profitability vs Growth For 2021-2024

Source: FactSet, Veriten.

Exhibit 6 shows the last four years of crude oil, US natural gas, European LNG prices, and Gulf Coast refining margins, all of which peaked in 2022 and have since corrected sharply. While energy commodity prices are not at what we would consider trough levels that could occur if a US/global recession were to materialize, all are well below the 2022 peaks and within a range that we think most investors would consider around normal if not slightly below normal (e.g., crude oil).

Exhibit 6: Energy commodity prices are back to undemanding levels and well below the Russia-Ukraine peak

Source: Bloomberg.

Energy battles the Magnificent-7 to a surprising 4-year draw

If you had asked us to guess how much the so-called Magnificent-7 stock market leaders had outperformed Energy since the start of 2021, we would have assumed it was massive. In fact, it has been a draw, with the two groups’ relative performance inversely correlated with each other (Exhibit 7).

Energy versus Mag-7 performance over 2021-2024 had two distinct periods to it. From the start of 2021 to the end of 2022, Energy massively outperformed the Mag-7 as energy commodity prices went from COVID recovery mode to being turbocharged by Russia-Ukraine disruptions. Mag-7 names actually fell sharply on an absolute basis over the course of 2022.

This initial period of Energy outperformance peaked in late 2022 as extreme commodity price optimism began to reverse and, coincidentally, the world experienced the viral launch of ChatGPT in November 2022 that kicked off the AI boom. Over the course of 2023 and most of 2024, the AI trade and Mag-7 names absolutely smoked the Energy sector, which traded sideways.

This period of extreme Mag-7 optimism came to a screeching halt with the introduction of DeepSeek’s R1 model in January 2025 and the recognition that exceptionalism in the AI race may not simply be an American thing. Both Mag-7 and Energy names have declined since Liberation Day.

Through the ups and downs of the past four years, Energy is now essentially even with the Mag-7. We would never have guessed that. While the groups have moved in tandem (generally downward) since Liberation Day, we would not be surprised to see inverse relative performance return as or when the macro settles down.

Exhibit 7: Energy has performed in-line with the Magnificent-7 S&P 500 leaders since 2021

S5ENRS is the energy equities in the S&P 500; BM7P is Bloomberg’s index for the so-called Magnificent-7 companies

Source: Bloomberg.

Q&A on the 2021-2024 Mini-Cycle And What Comes Next

What are we most surprised about over the last 4 years?

Energy and the Mag-7 played to a near draw! Absolutely amazing. It didn’t feel that way.

Is it surprising that upstream-exposed companies stayed disciplined?

When looking at industry broadly, we have to admit that we are surprised at the overall discipline shown (we were more confident that the leading players would stay disciplined). In our 33 years of analyzing the sector, we believe the current crop of senior leadership teams are as financially focused and disciplined as we have ever seen. Profitability and returning cash to shareholders have finally gained the upper hand over volume growth for the sake of volume growth.

If US shale oil is maturing, doesn’t that create new risks as companies look to new areas?

Yes, for sure. There is no one-size-fits-all approach to business model evolution. Some companies will rightfully conclude that selling to a larger company is the way to go. For others, there will be logical merger-of-equals combinations. And some will look to new opportunities. A choppier macro backdrop could reward patience, as the pressure to chase a bull market will not be there.

Does the LNG experience over 2021-2024 prove that growth and returns do NOT have to be inversely correlated in Energy?

It’s not a straightforward yes or no answer. Over 2021-2024, the LNG business benefitted massively from the one-time gain of Russia gas no longer flowing to Europe and the urgency by which Europe sought to replace it with LNG. In that sense, the super-sized profitability in 2022 and 2023 is something investors are unlikely to assume is repeatable. However, we are expecting significant growth in global LNG demand in the decades ahead, as natural gas is a critical future fuel to meeting the massive unmet energy needs of the other 7 billion people on Earth. The LNG industry is in the midst of a major expansion phase to meet expected demand.

While the phrase “major expansion phase” will cause many legacy energy investors to shudder, we note that there are a wide range of business models being pursued, which leads us to conclude that overgeneralizing about being bullish or bearish on LNG is not appropriate. Major international oils have an overall favorable track record with LNG measured over many decades. Newer entrants with very different approaches to the business have also seen success under a range of business conditions.

Undoubtedly there will be bumps along the way when an industry is looking to grow as rapidly as LNG. However, we believe taking a company-by-company approach to LNG makes more sense than declaring one broadly bullish or bearish on the sector from an investment or corporate strategy standpoint.

How do you explain downstream profitability having done so well?

In many respects, downstream (refining) is the polar opposite of LNG. Especially in the developed world, refining is broadly seen as mature, an area to minimize organic investment, and where the only question on capacity is how much is closing this year and next. The fact that global oil demand continues to grind higher coupled with rich-world capacity rationalization is what keeps us of the view that US downstream companies as a group are capable of generating competitive profitability and free cash flow.

Midstream had a similar CROCI to the IOCs and US and Canadian E&Ps, what do you make of that?

Midstream jumps out favorably for a far superior combination of non-volatile profitability that at least over the last few years was frankly not much different than the more volatile results seen amongst upstream-leveraged sub-sectors. To be sure, this profitability point applies to CROCI more so than ROCE, though significant E&P write-offs in 2020 artificially boosted upstream ROCE for many companies. We see midstream as an interesting area of opportunity for the decade ahead.

⚡️On A Personal Note: Spring Recommitment to Work-Golf Balance

It is time for my annual recommitment to maintaining a semblance of work-golf balance. Five key elements for 2025:

First, I have retired the phrase “un-retired to Veriten,” which was a helpful crutch during the transition back to the real world. It is no longer needed. My unretirement journey is over. I am fully embracing the fact that I am again employed full-time. I am really lucky to be having a career analyzing the energy sector.

Second, and as a follow up to the first point, maintaining work-golf balance is a key check on not returning to the unhealthy life choices of my first 22 years on Wall Street, which were tragically golf free.

Third, finding time for short game and putting practice is as important as playing full rounds. I am committing to at least forty hours of total practice time during the core April-October golf season in the US northeast, with an emphasis on short game and putting.

Fourth, I should be able to average 2 full rounds per week during the 30-week core golf season, which totals a minimum 60-65 rounds in 2025.

Fifth, I will look to better supplement the US northeast offseason with more rounds in Houston, where my wife and I now have a condo. An incremental 5-10 rounds seems highly doable, which would bring the full-year target to 70.

⚖️ Disclaimer

I certify that these are my personal, strongly held views at the time of this post. My views are my own and not attributable to any affiliation, past or present. This is not an investment newsletter and there is no financial advice explicitly or implicitly provided here. My views can and will change in the future as warranted by updated analyses and developments. Some of my comments are made in jest for entertainment purposes; I sincerely mean no offense to anyone that takes issue.

"Profitability and returning cash to shareholders have finally gained the upper hand over volume growth for the sake of volume growth." The companies I am involved with seem to be focused on returning cash and avoiding production growth, so glad to hear this seems to be generally the case.

During the huge run up in late 2022, several people were telling me to take what I had off the table and wait out the coming rate hike cycle. Because I'm a glutton for punishment I told them I was going to tough it out, after all, who needs a peaceful, stable, life anyway?

TY for the shout out my friend!

I am also working on my short game and have been working with a new swing coach all winter. Cant wait to see what fruit it bears this season!