In the United States, we unfortunately live in a time where the extremes of the two major parties dominate public attention, media headlines, and populist sentiment. If we have learned anything in over 2.5 years of publishing Super-Spiked, it is that there is a market for objective and pragmatic commentary on energy and its related issues of reliability, affordability, geopolitics, and the environment. As of this writing, it appears in the US that we are headed for a showdown between President Donald Trump’s “drill baby drill” and Vice President Kamala Harris’ “frack ban” energy sentiments. On the environment, we are offered “green new scam” versus “existential climate crisis.” Lovely.

We have written this many times but not recently: at Super-Spiked we abhor partisan politics. We are going to add to that sentiment our disdain by which legacy media and cable news tend to discuss energy by playing to the competing extremist rally cries of the major parties. But this is not intended as a rant about politics and energy news coverage. In this week’s post we will look at what the numbers say about presidents and how it has impacted the energy macro.

In a nutshell, the dog barks but does not bite. There is no discernable trend on share price performance, crude oil or natural gas production, LNG exports, or US or global CO2 emissions based on which party holds the US presidency. In contrast to broad-based perceptions, traditional energy shares had four of their worst years on record during the first Trump administration, while new energies soared. Through the first 3.5 years of the Biden administration, those trends have sharply reversed with traditional energy experiencing significant outperformance and new energies lagging badly. As the saying goes, be careful what you wish for. To be clear, we do not attribute those results to the party in power, but rather the fact that broader commodity macro, global economic, geopolitical, and sector factors drove results.

Does it make a difference to traditional energy sector stock price performance which party wins the presidency?

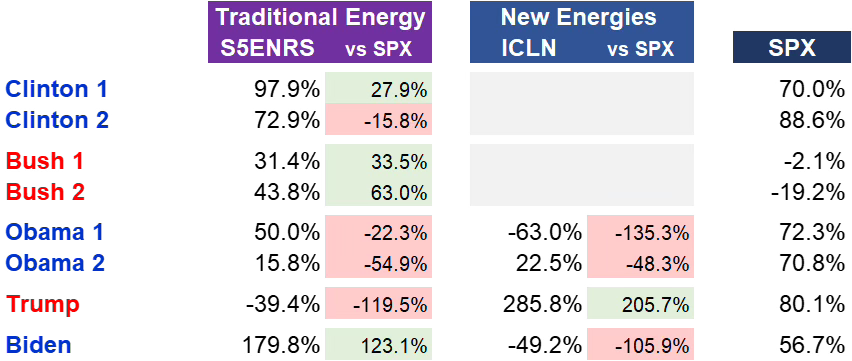

Exhibit 1 examines stock price performance for traditional energy (S5ENRS Index, which is the energy equities in the S&P 500), the ICLN (an exchange traded fund (ETF) focused on new energies), and the S&P 500 (SPX) by administration. Key points:

Under five Democratic presidencies, traditional energy outperformed the S&P 500 twice and lagged three times.

Under three Republican presidencies, traditional energy outperformed twice and underperformed once.

Notably, under President Trump, traditional energy had by far its worst performance among the 8 administrations shown since 1992. New energies had their only positive performance under President Trump.

Conversely, under President Biden, traditional energy has dramatically outperformed and new energies have badly lagged.

The actual stock price performance of traditional and new energies under both President Trump and President Biden is the precise opposite of what just about everyone on Wall Street, in media, among executives, or the general public would have expected.

Our ultimate conclusion is that broader energy macro, global economic, and geopolitical factors drove share price performance for both traditional and new energies, and certainly overwhelmed whatever policy leanings existed by the various administrations. One cannot conclude that Republican administrations are good for the share price performance of traditional energy and bad for new energies or that the opposite is true for Democrat administrations.

That said, individual companies can be impacted by specific policy decisions. An example would be the hostility from Democrats to oil and gas pipeline expansions, which negatively impact affected upstream and midstream companies as well as energy consumers. Similarly, if a future Republican administration were to remove subsidies favoring a particular new energy technology, companies in that sector might be negatively impacted.

Exhibit 1: Performance of traditional energy and new energies sectors versus the S&P 500 by administration

Source: Bloomberg, Veriten.

Does it make a difference to traditional energy sector profitability which party wins the presidency?

Exhibit 2 looks at return on capital employed (ROCE) and cash return on gross capital invested (CROCI) by administration for our universe of traditional energy companies that we have regularly highlighted in prior posts that focused on profitability. Key points:

The conclusions are even more muted here. Sector profitability steadily improved under both Clinton and both W. Bush administrations, reaching a high point in Bush 2 (the peak of the Super-Spike era).

Profitability then fell under both Obama administrations and under President Trump.

Under President Biden, there has been a major recovery in sector profitability, which has returned to healthy levels last seen during the Super-Spike era.

Our conclusion is that profitability cycles are decadal-plus in nature and are not materially impacted by whomever or whichever party holds the presidency.

Exhibit 2: ROCE and CROCI for our universe of traditional energy companies by administration

Source: FactSet, Veriten.

Does it make a difference to US oil production which party wins the presidency?

Exhibit 3 shows US crude oil production by administration. Key points:

This should not surprise anyone, but prior to the commercialization of shale oil in the Bakken, Eagle Ford, and Permian basins, US crude oil supply was in long-term decline. Since shale oil started up during the first Obama administration, it has been structurally growing.

Importantly, shale oil (and natural gas) began and grew rapidly during both Obama administrations. While there was a lot of focus on the Obama Administration’s decision to not approve the Keystone XL pipeline from Canada, which we thought should have been allowed to move forward, it is noteworthy that shale oil was born and blossomed during President Obama’s time in office. We recall him being for “all of the above” energy sources; somehow, that was only 8 years ago.

Shale oil grew at comparable rates under President Trump as it did under President Obama, despite a much weaker oil price backdrop.

While shale oil growth has slowed during the first three-plus years of President Biden, most industry analysts had been calling for a slowdown driven by greater capital discipline from industry and due to the growing maturity of the leading shale oil plays. We do not attribute the slowdown to either real or perceived hostility by the Biden Administration toward the “fossil fuel industry.”

Our conclusion is that oil play megatrends have driven US crude oil production, with no observable impact from a particular presidential administration or political party.

Exhibit 3: US crude oil production by administration

Source: EIA, Veriten.

Does it make a difference to US natural gas production or LNG exports which party wins the presidency?

Exhibit 4 shows US dry natural gas production and US LNG exports by administration. Key points:

Shale gas was born under President W. Bush, blossomed during both Obama administrations, and has continued to grow under presidents Trump and Biden. Incredibly, the US natural gas industry has doubled in 20-plus years thanks to the commercialization of low cost-of-supply shale gas.

Large-scale LNG exports were born toward the end of the second Obama administration and have blossomed under both President Trump and President Biden.

While the controversial “LNG pause” put in place by the Biden Administration earlier this year is an unfortunate development, the United States under two Democrat and one Republican administration has gone from negligible LNG exports to surpassing Qatar and Australia in 2023 to lead the world. It is absolutely amazing.

Like with crude oil, our main conclusion is that natural gas play megatrends have driven US natural gas production, with no observable impact from a particular presidential administration or political party. That said, it is meaningful that both Republicans and Democrats, at least up until the recent Biden pause, have supported LNG exports. As we noted in the crude oil section, opposition to individual pipeline projects has negatively impacted certain companies.

Exhibit 4: US dry natural gas production and LNG exports by administration

Source: EIA, Veriten.

Does the US presidency matter to the long-term trajectory of CO2 emissions?

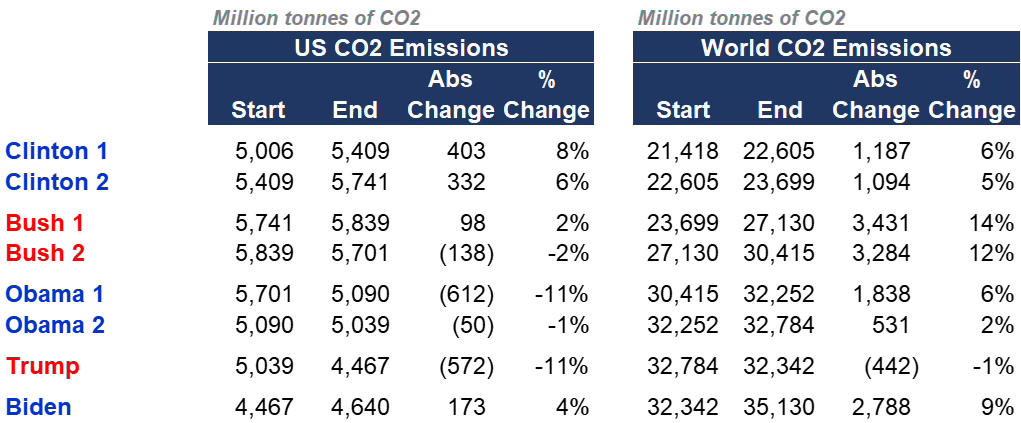

Exhibit 5 shows US and global CO2 emissions attributable to energy by administration. Exhibit 6 shows US CO2 emission from energy since 2001 as a continuous graph. Key points:

US CO2 emission peaked in 2007 during the second Bush administration just ahead of the Great Financial Crisis (GFC).

Since 2007, CO2 emissions have fallen at a consistent 1.5% CAGR, though the data reported in the Energy Institute’s Statistical Review of World Energy shows some ups and downs along the way within the broader long-term, downward sloping trend.

The GFC that straddled the end of Bush 2 and Obama 1 skews the results for President Obama; similarly, COVID at the end of President Trump’s first term skews his data as well.

If we adjust President Obama to start one year later and President Trump to end one year earlier, the results will show somewhat greater reductions under President Obama versus President Trump, but not the kind of spread implied by media coverage. Since the 2007 CO2 peak, the retirement of coal power plants with first natural gas and now solar power has driven the bulk of the declines in US CO2 emissions attributable to energy.

Global CO2 emissions show a different story of continued growth driven by non-OECD (i.e., developing) countries, most notably China.

We conclude that the impact of a US President on domestic emissions is not proven in the historic data, and, perhaps more importantly, is far less dramatic than what you hear in media coverage of the issue. Looking forward, we appreciate that there is a larger debate to be had on the role of policy on future domestic CO2 emissions. That said, we do NOT support the idea that lowering domestic carbon emissions should be the main objective of energy or “climate” policy for the United States.

When one looks at the staggering rise in China’s carbon emissions, we consider two factors. First, there is the healthy portion of their CO2 emissions increase that comes from the growing size of China’s economy (i.e., Chinese population gaining in wealth). The part that we question would be the outsourcing of various industries to China that used to be domestic. It is almost certainly true that the overall environmental footprint of US manufacturing industries is superior to those in China. Reshoring would therefore be positive for overall environmental outcomes, even if it means higher domestic carbon emissions. The carbon intensity of manufacturing in the developing world versus the United States (and Canada and Western Europe) is worthy of further discussion, debate, and examination.

Our second main conclusion is that the US president has zero impact on global emissions. Other countries are going to pursue economic, security, and environmental models that they perceive to be in their own interests. “My Own Country First” is, or should be, every leader’s natural policy position. That will be true irrespective of whether a Republican or Democrat (or future Independent) sits in The White House. The idea that “the fate of climate” rests on whether one votes for President Trump, Vice President Harris, another candidate, or no one is simply ludicrous and lacking in objective perspective.

Exhibit 5: US and global CO2 emissions from the energy sector by administration

Source: EI Statistical Review of World Energy 2024, Veriten.

Exhibit 6: Continuous US CO2 emissions from the energy sector

Source: EI Statistical Review of World Energy 2024, Veriten.

Will the US presidency matter to the long-term trajectory for global oil, natural gas, or coal demand?

As an extension to the carbon emissions discussion, we believe US presidents will have no impact on the outlook for global oil, natural gas, or coal demand. A debate over whether the Inflation Reduction Act should be repealed, reformed, or enhanced is well worth having (we are in the reform camp, though we have more sympathy for repeal over enhancing it). Whatever its fate, we believe it will have no bearing on global oil, natural gas, or coal demand. The same is true whether “drill baby drill” or “frack ban” triumphs as a rallying cry or not.

There are plenty of policy steps a president and especially individual states can take that could positively or negatively impact US crude oil or natural gas supply. Given the substantial market share US crude oil and LNG exports have had in helping meet global demand in recent years, it is quite possible that negative supply impacts could lead to higher commodity prices if US supply growth was to become curtailed. Demand, however, is an entirely separate issue.

As we have written about extensively in prior posts, the overarching driver of global energy demand growth is the reality that the other 7 (soon to be 9) billion people on Earth aspire to lifestyles The Lucky 1 Billion of Us take for granted. There is no president or party in the United States that can impact those ambitions, certainly not over the long run.

📘 Appendix: Clarifications for Exhibits

For exhibits shown in this post that are tied to the various administrations, we use the calendar first year of a presidency through the last calendar year as the period shown; in other words, January 1 just prior to inauguration through December 31 following the election at the end of the given presidential term.

For President Biden, we use 2023 actual data for all exhibits, except crude oil where we use an approximation of year-to-date production; we will update our Biden administration results once 2024 ends and actual data is available.

For share price performance, we use total returns (i.e., including dividends) using the COMP function on Bloomberg.

🎤 Streams: Smarter Markets podcast

Last Saturday Arjun joined host David Greely on The Smarter Markets Podcast to discuss his ”American Energy Exceptionalism” video. The 40minute episode is linked here.

⚡️On A Personal Note: Hulkamania and the search for neutral news

All three of my kids will be voting for president for the first time in this election. Choose wisely children! As a family, we watched all four nights of the Republican convention in Milwaukee last week. Whether you are an R, a D, independent, or a non-American who could care less, it was certainly a convention like no other. Who knew Hulkamania was still a thing!?! The everyday Americans were excellent; more regular people plus fewer career politicians was a welcomed development.

As we were flipping among the cable news channels between speeches in an epic search to find balanced, non-hyperbolic commentary, our youngest asked: “Why aren’t there any neutral news channels?” Great question. There must be a market for neutral, fact-based, unbiased, non-partisan news. Sadly, “neutral news” doesn’t seem to exist today.

As we highlighted in last week’s videopod Can You Trust The United Nations on Energy and Climate? (here), what are the institutions or sources of objective information and analysis? When you know something about a particular subject, let’s say energy in my case, and you see how mis-covered it frequently is in the news or by supposed expert institutions like the United Nations, what does that say about all the subjects you are not an expert in? Who can you trust?

When news broke that President Trump had been shot at a rally in Pennsylvania, I was impressed that my kids did not take any of the videos or coverage at face value. A question from my oldest in response to all the early speculation on who the shooter was, how it could have happened, what the secret service did or did not do, etc., was “how do you know this [particular reporting or video angle or witness statement] isn’t fake?” Their inherent distrust of what was being presented to them on television and on social media surprised me and was refreshing. Always have a questioning attitude!

At a time when people my age or older have worried about deep fakes, the younger generation already knows that you can’t take anything you see or hear at face value, be it on social or traditional media. You have to do more work—your own work—to figure out what is real and what is truth versus spin, bias, or outright mis-information. The future may be bright after all.

⚖️ Disclaimer

I certify that these are my personal, strongly held views at the time of this post. My views are my own and not attributable to any affiliation, past or present. This is not an investment newsletter and there is no financial advice explicitly or implicitly provided here. My views can and will change in the future as warranted by updated analyses and developments. Some of my comments are made in jest for entertainment purposes; I sincerely mean no offense to anyone that takes issue.

A great read Arjun, I guessed the conclusion as soon as I read the title.

I spent over 20 years involved in Toronto real estate and anyone who lived through that will recall the pattern of federal, provincial and municipal government changes and policy announcements each with the express goal of making housing more affordable, each having zero impact to the market. After our 2017 Fair Housing Act completely failed to have any impact on the market (up or down), I began to realize that what the developers are saying was correct: that the fundamental supply and demand drivers were not being materially affected and so nothing was going to change. I also thought back to conversations with people in China (re: TO real estate), a few times people had remarked that Westerners are so obsessed with the election cycle and various candidates, but they didn't see why because the various administrations came and went quickly and usually had little real impact to fundamentals; I was a little offended at the time, but I came to understand that they were correct.

Nice analysis. Clearly the two parties have taken different ideology and rhetoric on all things energy and emissions. In such regard they are virtually polar opposites.

The reality comes when we remember America is still a (mostly) free market with strong personal property rights and a private ownership of the development rights for energy. As long as that remains, neither party can really affect our energy supply.