Last week's introductory energy M&A post raised more questions than I actually intended to answer. I am clearly in need of a Q&A-styled clarifications follow-up.

Are you making a call that an M&A wave will consolidate US E&P in coming years?

No. The point of Energy M&A Post #1 (here) was to introduce the idea that essentially all upstream companies will eventually need an M&A plan and that M&A denialism is not going to be a successful strategy. M&A needs can creep up on companies suddenly and unexpectedly. Furthermore, well-timed M&A may not always neatly match up with when companies optimally need additional inventory. For most companies, it's better to be ready to take advantage of good opportunities that arise when they arise rather than stick to the illusion of perpetual organic growth.

OK, but will we have a wave of E&P M&A even if that wasn’t the point of last week’s post?

At a sector wide level my answer remains “no”. While there will be periods of more intense and less intensive activity, I have never thought the concept of “a wave of M&A” was the right framing for US E&P.

What is the right framing for US E&P M&A?

Basin-level M&A in North America I do find to be a more interesting concept. For example, in Canada’s oil sands, we are basically down to Canadian Natural Resources, Cenovus Energy, Suncor Energy, and I suppose MEG Energy as the major independents along with 69.6% ExxonMobil-owned Imperial Oil. Other companies have interests in various projects and the recent sale by BP of its stake in the Sunrise project to Cenovus is an example of the kind of basin-level consolidation that seems sensible. In the US, the two leading basins—the Permian for oil and Appalachia for natural gas—are moving toward a more consolidated status, though there is still room for additional transactions especially in the Permian.

Whether it is the oil sands, the Permian, or Appalachia, there are economies of scale to be had with optimizing development programs over large swaths of acreage. Infrastructure needs like gathering and pipeline takeaway capacity, water handling, other environmental considerations, and methane mitigation efforts I believe are better done at the basin level. This argues for fewer companies involved in the decision process, with capital costs more easily absorbed by larger entities.

As an example, I don't believe the Pathways Alliance for net zero being pursued by the leading companies involved in Canada's oil sands would exist if there were tens let alone hundreds of oil sand producers. I am a big fan of the responsible growth efforts being under taken by the Canadian oil sands companies. It is a role model for the Permian and other basins.

We did have a Super Major M&A wave in the late 1990s/early 2000s, no?

Correct. In the 1990s, there were perhaps twenty US and European integrated oils that consolidated into five super majors plus another 3 or so large integrated oils. I agree that era was a Super Major M&A wave that my friend and former competitor Doug Terreson is well known for having called when he was the covering analyst at Morgan Stanley.

Why can’t we have a similar E&P wave?

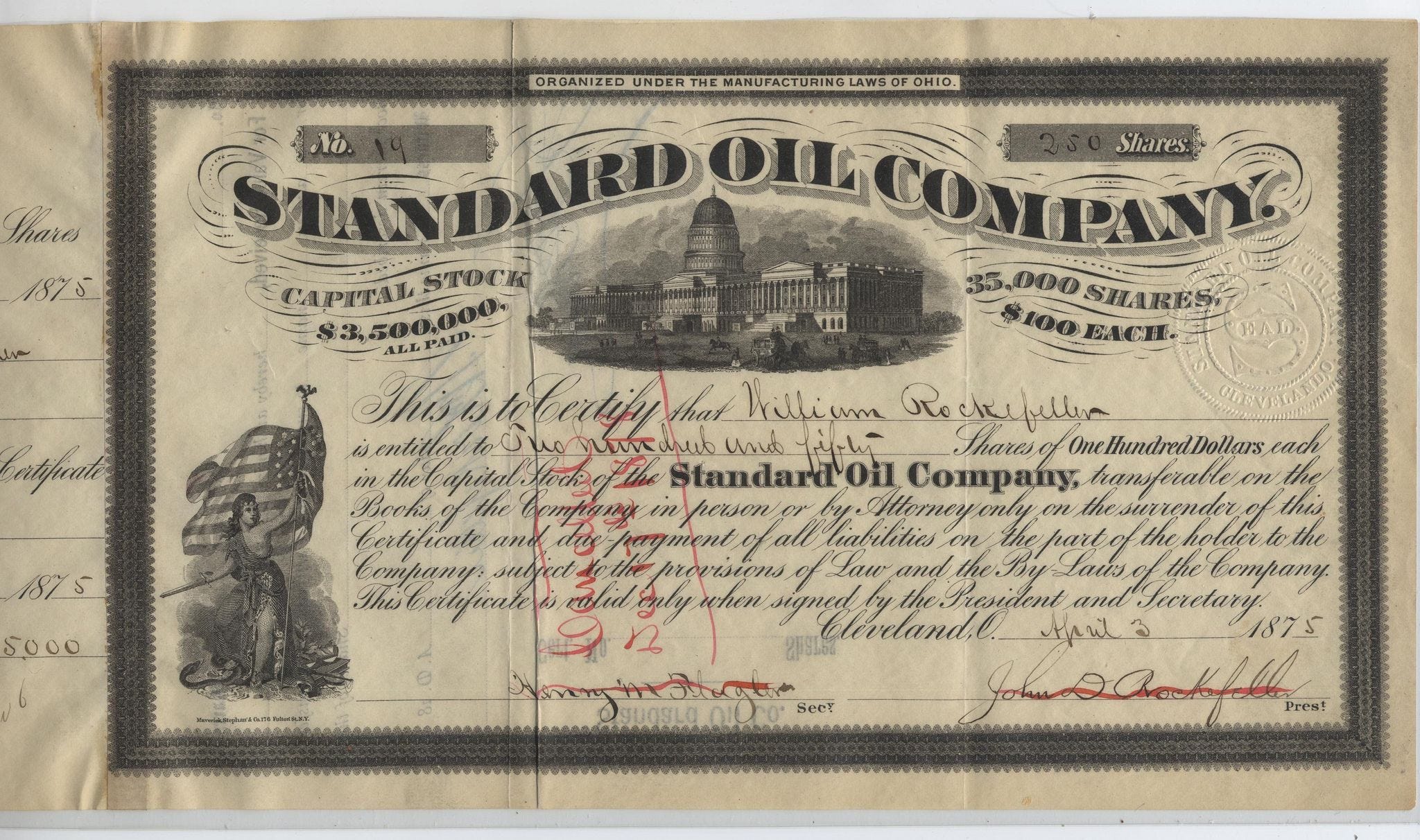

There are always way too many E&Ps in the United States. This was John D. Rockefeller’s original motivation in the creation of Standard Oil: break the backs of E&Ps to end the ruinous boom-bust cycles. The good news is we have a dynamic E&P sector here in the US that has contributed significantly to energy availability, affordability, reliability and security for the United States and its allies; energy is of course key to economic development and favorable health and environmental outcomes.

The IPAA estimates there are some 9,000 independent oil and natural gas producers in the USA. The significant competition at times led to over-supply and periods of low profitability. Even if you whittled that down to only larger players, it does not seem reasonable to believe industry could consolidate to just a handful of relevant players like we see in other sectors both inside and outside of energy.

If companies have over five years of high-quality drillable inventory, doesn't that delay the need for M&A?

Sure, but this gets to the heart of the point I was trying to make. Yes, there may not be an urgent need for M&A for companies with a seemingly long running room of Tier 1 locations. But that doesn't mean companies should solely focus on so-called organic growth to the extent there are good M&A options that would be logical. Ideally, the bar can be high versus a company more desperate for acreage. But you never know when good rock is going to become available at a reasonable price. Companies that get caught up in the short-term straight jackets Wall Street place on them to be “organic growth only” run the risk of sub-optimal long-term outcomes.

Why emphasize this subject now when companies are doing a great job returning excess cash to shareholders?

There is absolutely no call here that companies should curtail capital return strategies or revert to becoming "undisciplined" with capital. Frankly, I have been pleasantly surprised that so many E&Ps are now committed to returning excess cash to shareholders, something super majors have long done and was embraced by the refiners over the past decade to their benefit.

However, unlike refiners that can maintain production capacity and through cycle free cash generation over many, many decades, E&Ps do not enjoy that luxury given the inherent decline rate of oil and gas fields. Incorporating well-conceived (key words) M&A is in fact likely to extend the duration of competitive capital return strategies.

Why are you giving these companies a license to spend money on M&A? Don't let them off the hook!

I am not letting any company off any hook! I am giving companies that have earned the right to spend via competitive through cycle ROCE generation, a fortress balance sheet, and ESG excellence to spend money. I acknowledge that I am willing to look forward on the notion of competitive through cycle ROCE generation. Ultra low reinvestment rates and what I believe is the start of a new energy crisis era combined with the newfound commitment to capital returns points to a much improved ROCE outlook. At the same time, we are still early in the new energy crisis era with most observers still doubting sustainability.

As I noted in last week's post, where we are in the bigger macro cycle is often an important indicator on the probability of M&A being successful. This point I think is too often not fully understood or analyzed. Many Street analysts and investors tend to have short time horizons (and memories). The strength of management teams usually resides in geologic and engineering knowledge, not macro or financial analysis.

Arjun, oil is over $100/bbl, sector ROCE is well over 20% and the XLE has massively outperformed the S&P 500 this year, are we not closer to a peak than trough?

I won't rehash all the points from previous posts other than to say:

I agree that major pullbacks are always possible with energy as we are in the midst of experiencing now; I subscribe to a “super vol” mindset for traditional energy;

I disagree that we are closer to a long-term peak than a trough, however, when (1) reinvestment rates and capital spending are near trough levels, (2) there is limited spare capacity anywhere in the world, (3) a Top 3 oil and gas producer (Russia) is turning into a pariah state, and (4) current western world politicians and policy makers remain stuck in apocalyptic, Malthusian “climate only” ideology;

Respecting and taking advantage of a super vol environment has long been a core principle; volatility is an under-analyzed variable;

In the 2000s super-cycle, when oil first traded above $30/bbl after a period between $15-$22/bbl (nominal) in the 1990s, just about everyone prematurely called peak; history appears to be repeating, or at least rhyming.

It sounds like you think bigger is better?

Not necessarily. While I admittedly do tend to skew my writing toward solutions for larger-cap companies, I do not believe size in and of itself is ever the goal. It can help and it can hurt. It is mid-teens (or better) through cycle ROCE, break-even (or better) profitability at cycle troughs, a fortress balance sheet, and leadership on substantive ESG metrics that is likely to correlate with competitive long-term share price performance. That said, I do think it would be difficult to be a one-trick, one-basin pony and expect to be an S&P 500 (or Russell 2000) leader over multiple decades.

Isn't diversification by a small-cap, pure-play always a loser?

I get it and recognize that investors hate when pure-plays diversify by buying lower-quality assets in basins they do not know. I am not suggesting that as the goal. I'd argue the better approach for many small-cap pure-plays is to consider selling the company before a particular play matures or is under cut by a new, lower cost basin.

Ultra Petroleum standing still in the Pinedale comes to mind on the negative side. On the positive side, I have told XTO's tale many times now. It sold not only near the peak of the Super-Spike era but as importantly just before its core Barnett Shale acreage was to be undercut by lower-cost Appalachia natural gas (technically, XTO was not a single basin player, but it was an early shale gas winner).

The bar to a pure-play moving to a multi-basin strategy should be high. But there are not too many basins where the need to diversity won't exist. Examples of areas where western oil and gas companies likely do have long-term running room I think is limited to Canada' oil sands, the Permian Basin, and Appalachia. I am not sure any other area crosses the "single basin may be all you need" bar. Notably, both Canada's oil sands and Appalachia are beholden to governments allowing export pipeline capacity to be built and to push back against environmental obstructionism. This leaves the Permian Basin as the king of oil and gas basins for western companies.

What are the top M&A mistakes companies make?

Not recognizing where industry is in the long-term cycle. Are we at the end of the bust period or near the start of a major new upcycle, which is generally a great time for M&A? Or are we beyond the mid-point of the super-cycle or at the beginning of the bust period, which usually is a bad time for M&A? The long-term CAPEX cycle is as good of a sign as any as to where you are. Right now, we are close to trough CAPEX (Exhibit 3).

Not recognizing commodity price volatility is a fact of life. I think many investors would say that companies are often too bullish on oil or natural gas prices as a reason for unsuccessful M&A. But companies can also be too pessimistic in missing opportunities based on too low of a price deck at the trough of the cycle. The bigger issue, in my view, is recognizing that downside volatility can always happen at any time. How do you protect post-deal downside risk if it happens next quarter or next year before you've had a chance to reduce incurred debt?

Resource mistakes in terms of buying assets that disappoint on a combination of size of field and cost structure could arguably top this list. It’s an obvious one. Field disappointments are classic. But the worst example is buying into yesterday’s assets that are about to be undercut by tomorrow’s fields. The opposite of course can also be true, where assets that are out of the money at the trough of the cycle are about to regain value as conditions improve.

What are the top M&A mistakes investors make?

Not recognizing where industry is in the long-term cycle. Managements and investors are oddly aligned in having recency bias as well as under-analysis of long-term cycles.

Whereas companies can be too complacent about downside volatility, it is my experience that especially toward the end of a bust period and the start of a new super-cycle, investors are not sufficiently respectful of upside commodity price volatility and how well-run companies can be favorably transformed and poorly run companies bailed out by a new price cycle.

It's difficult to criticize investors for demanding capital discipline after last decade's very poor ROCE track record. But the world needs more oil and natural gas supply. It's not going to bubble out of the ground on its own. There is an opportunity for disciplined CAPEX bumps at a time industry is on-track for 20%+ ROCE. The world is better off with healthy, publicly engaged, and modestly growing US and Canadian oil and gas companies.

How good is your company’s corporate planning department?

In my observation, professional investors place a lot of weight on CEO and CFO commentary around M&A. This is understandable since final decisions will come from the top. But when I was a covering analyst, we used to spend a lot of time with the heads of various assets or basins to learn about exploration and development plans and prospects. I don’t think I spent enough time getting to know the corporate planning teams beyond the CFO discussions. I’d argue this should be a greater area of emphasis for investors to lean how the corporate planning people go about evaluating competitors and asset opportunities.

The E&P industry classically is quite insular. But the modern big data world we live in is widening horizons. I have been fortunate to have had career stops where the folks doing the M&A work, be it investment bankers, investors, or corporate teams have been top notch. Like with anything, there are differences in quality and I am not sure investors spend enough time discerning great from good and good from not so good.

What about cultural fit?

I don’t know. I get why it's discussed, especially by management teams. But I wonder if it is over-stated as a reason to not do something. You do need a dominant culture to prevail, while incorporating some of the better characteristics of the other company. Kind of like the old “melting pot” approach to US immigration we used to talk about when I was a kid (for younger readers, my children tell me the phrase “melting pot” is no longer used; I like it, you don’t have to.) I do wonder if the excuse of a lack of culture fit is a bit of an excuse to not do transformational deals.

What do you think of OXY-APC, XEC-COG, etc. etc.?

I have refrained from publicly commenting on contemporary transactions or strategies for individual companies. Since retiring from Goldman in 2014, I have continuously maintained various macro models to evaluate the sector. However, for the most part I no longer maintain the kind of detailed, individual company models that I used at Goldman. That fact along with the nature of some of my current engagements leaves me thinking it is not appropriate for me to make comments on what specific companies are doing today. But I will give this more thought and see if there is an avenue for some company-specific discussion on current strategies.

⚡️On a personal note…

One of the best pieces of advice I ever received came from a senior partner and investment banker (IB) at Goldman when I first joined the firm. In those days, equity analysts and bankers were allowed to meet, something future rules changes post the tech bubble burst prohibited without a chaperone (yes, a literal chaperone who would listen in on calls/meetings between analysts and bankers).

It’s too bad the rules were changed as I always found the interactions, especially in person, to be thought provoking and helpful to me as an analyst for the ultimate benefit of my buy-side client base. The concern about inappropriate pressure from bankers toward analysts is something I never felt in my 15 years at Goldman, including when I was early in my career and new to the firm. Credit to Goldman Sachs senior management, Goldman’s natural resource investment bankers, and the partners that ran research whom I worked for and supported us analysts for nurturing a healthy working environment for equity analysts.

I had joined Goldman from JP Morgan Investment Management, where I was a buy-side analyst (i.e., an investor) with strong views on putting shareholders first (in contrast to putting company managements or investment bankers first!). I recall the conversation with the IB senior partner like it was yesterday. I brought up the fact that my analysis will always be geared toward giving my buy-side investor clients the best advice and analysis I could from the perspective of trying to evaluate which energy companies would perform better or worse versus either the broader stock market or their energy peers. The point was that if I thought a company had a weak outlook, I wouldn’t sugar coat things and would not be falsely positive in order to potentially protect or enhance Goldman’s investment banking relationships with a management team.

The senior investment banker’s comment back to me was (paraphrasing): “From my perspective, your being always positive doesn’t help me. Thoughtful, insightful analysis is of use. But what can be most helpful is that if you don’t like what a company is doing or you have concerns about its outlook, please suggest the two or three things they could do to make things better and improve their outlook.”

It was great advice: Don’t just be a critic, give constructive feedback for improvement. That philosophy underpins my approach to Super-Spiked.

⚖️ Disclaimer

I certify that these are my personal, strongly held views at the time of this post. My views are my own and not attributable to any affiliation, past or present. This is not an investment newsletter and there is no financial advice explicitly or implicitly provided here. My views can and will change in the future as warranted by updated analyses and developments. Some of my comments are made in jest for entertainment purposes; I sincerely mean no offense to anyone that takes issue.

Regards,

Arjun

P.S. There will be no Super-Spiked published next Saturday during the July 4th holiday weekend celebrating the declaration of the United States of America's independence from England in 1776.

If you are a larger sized pure play in an area with long term running room, a good M&A approach would be to make appropriate and timely acquisitions within the basin that the company has familiarity with. It would be interesting to see if they can achieve going concern status as a pure play through doing this, if they also have the other important qualities such as a heathy full cycle ROCE, fortress balance sheet and the right ESG framework for the new energy transition.

Thanks Arjun. That was really helpful. Cheers John.