Energy security and the case for Canada

Part 1: Canadian oil and gas is better than most alternatives

⚡️ A personal note before getting to the main post: I would like to express how deeply saddened I am to watch the tragedy unfolding in Ukraine and to offer my sympathies and condolences to everyone that is impacted.

The fight is here; I need ammunition, not a ride.

- Volodymyr Zelensky, president of Ukraine 🇺🇦

This post is dedicated to president Zelensky and the people of Ukraine and neighboring countries that are suffering from the unfolding tragedy. I also recognize that I have readers of both Ukrainian and Russian heritage, some of whom I have known and enjoyed interacting with for many years. I wish peace for everyone.

Russian president Vladimir Putin's decision to invade Ukraine is an unfortunate wake-up call to the world that a singular focus on climate ideology contributes to energy insecurity, un-affordability, and potentially un-availability while simultaneously making the world less safe and less economically and environmentally healthy. It's not super complicated: when you take steps to limit energy supply from geopolitically friendly countries, you end up more dependent on geopolitically unfriendly nations.

Let me be clear, I am not blaming climate ideology for the invasion; president Putin fully bears that responsibility and the tragedy that is unfolding. Rather my point is that the world is ill-prepared to deal with his actions as many of the richest countries/regions including the EU, parts of the United States (federal and states) and Canada (federal and provinces) have prioritized climate goals above all other energy considerations to the detriment of not only their citizens but the developing world as well.

As I have written previously, ensuring energy is available, affordable, and reliable for everyone on Earth should be the over-arching objective for global policy makers. At the same time, there is a need to provide that energy with as small of an environmental and carbon footprint as possible. The goals do not have to be mutually exclusive. But if forced to choose, energy availability will always win. Policy that prioritizes addressing climate concerns as the #1 goal is doomed to fail, in my view, with the climate, environment, and global economic health all suffering and geopolitical turmoil increasing.

Examples of bad policy decisions taken in the name of climate/environment by western countries (partial list):

Prematurely retire nuclear plants (Germany)

Reject the Keystone XL pipeline from Canada (United States)

Ban fracking (United Kingdom, France) and discourage other domestic resource development (Netherlands, UK North Sea)

Increase regulatory hurdles to oil and natural gas pipeline infrastructure (New York, Massachusetts, other US states, US federal government)

Examples where western oil and gas companies have not done enough to ensure broad-based support for domestic oil and gas drilling and need to do better looking forward (all comments are at the industry level):

Poor profitability over the last decade, which has disincentivized investor support for faster supply growth;

Slow-footing methane mitigation efforts;

Lack of self-policing on orphan wells and related blights;

Lack of self-policing on holding all companies to the highest bar set by some on traditional health, safety, and environment considerations (HSE).

Q&A - Yes or No (mostly):

Do we need to address the negative externality of too much CO2 that comes from the world's reliance on fossil fuels? Yes.

Is there any logic to US, Canadian, and various European countries taking proactive steps to limit or impede domestic oil and gas resource supply growth without any ability to control geopolitical, economic or environmental conditions in other resource-rich areas such as Russia? No.

Does impeding fossil fuel growth in the US, Canada, and Europe show that these areas are "getting serious about climate"? No.

Who gets most hurt by these poor policies? Everyone on Earth, though the top 5%-10% wealth/income brackets can better withstand energy price hikes.

Why do various global elites, politicians, enviro extremists, and the mainstream media not recognize the harm ill-advised climate policies create? I have no idea and there is not much evidence of self-reflection from this group.

What do we NOT need now? More "answers" from the same global elites, politicians, and enviro extremists that have contributed to the current energy crisis conditions we find the world in. It's going to be up to the average person to push through the mis-information coming from the ruling class.

Isn't increasing fossil fuel investment incompatible with achieving our climate goals? This is a false choice. It is exactly the type of wrong question that various global elites and climate activists have been pushing. It is a motivation for creating Super-Spiked.

The case for (more) Canadian oil and gas

The free, peace-loving world would benefit from a healthy, growing Canadian oil and gas industry. Canada is blessed with massive crude oil and natural gas resources. The challenge is that the ability to access the resource is highly dependent on sensible energy infrastructure development policies from many different governments including US federal, Canada federal, Canada provincial, and US state entities. There is a lot of red tape to overcome and potential opportunities for anti-development activists to create hurdles.

If the world is serious about its over-arching challenge which is to eliminate remaining global poverty, provide a rising standard of living for all, while minimizing climate and environmental externalities, Canadian oil and gas will need to be part of the solution.

In this note I will focus on crude oil and will turn to natural gas in a future post. Exhibit 1 shows global oil supply growth for key areas. Remarkably, USA plus Canada contributed a net 87% of total oil supply growth over the past decade (2010-2019 to avoid potential COVID distortions). US shale was the overwhelming driver, but, notably, Canada grew at twice the rate of Russia.

Exhibit 2 shows that in 2021, USA + Canada oil supply and demand were essentially in balance. The oil and gas industry in both countries has done a remarkable job overcoming environmental and government hostility. It is a testament to free market capitalism practiced in the USA and Canada (versus much of the rest of the world; this is not a post on the pros/cons of capitalism and potential reforms to reduce “crony” capitalism which I do not support). As such, relative to Europe, USA + Canada together are better positioned to withstand geopolitical volatility.

Still, there is a major opportunity to help reduce the world’s dependence on Russian exports. Exhibit 3 shows that overall Russia exports just over 7 million b/d of oil (simplifying, it would actually be a mix of crude oil and refined products). Using the average oil supply growth rate from USA + Canada over the past decade, it would take just over 5.5 years of growth to offset total Russian oil exports. If we narrow down to Russian crude oil exports to the EU, USA, and Canada (over 90% of which is to the EU), historic USA + Canada oil supply growth could offset Russia exports in just 2.0-2.5 years. This is a goal we should look to achieve.

In times of global crisis as we are in today, it seems plausible that federal governments in the USA and Canada could work with industry to help motivate a faster oil supply response than we are currently on track to have. Yes, the oil industries in both countries are privately owned (mostly through publicly-traded companies). It’s an over-used phrase, but a “Marshall Plan” to displace geopolitically unfriendly countries hardly seems out of the question and, I believe, would garner investment community support.

Seems like this post should be titled the case for US shale…why emphasize Canada?

While Exhibits 1-3 illustrate the importance of US shale, the role of Canada should not be under appreciated. Today Canadian oil production of 5.6 mn b/d is about half the level of Russia’s 11 mn b/d. In my view, the potential exists for Canada to double its level of production within a decade, which would on its own just about displace likely Russian net exports. Unlike US shale, production from a Canadian oil sands project stays essentially flat over 20-30 years with only modest CAPEX. With shale, a high level of ongoing drilling activity is required to simply maintain production, which otherwise would decline rapidly each year.

In addition, it is not clear how many more years of circa 1 million b/d of US shale growth is possible. Some believe sustainable shale growth will not be much more than 0.3-0.5 mn b/d per annum, and few see even that level of growth sustaining over a decade (my personal view leans toward the more optimistic end of shale supply potential but that is not the point of this post). In contrast, significant export infrastructure bottlenecks have contributed to slower-than-possible Canadian oil supply growth in recent years. As such, I believe it is important to figure out the drivers to accelerate Canadian oil supply growth well before shale maturity becomes evident.

The final reason this note emphasizes the need for Canada when US shale is clearly going to be an important contributor to world oil markets is that the risk of investment obstruction in Texas (home of the Permian Basin) is significantly less than what we are seeing with Canadian oil export infrastructure. May God Bless the great state of Texas. The world could well use the doubling of Canadian production that I think is possible. It will make us safer and, I believe, will come at a reduced environmental and climate footprint vis-a-vis alternative sources of crude oil from Russia. I ❤️ 🇨🇦 Oil & Gas.

Canada may be the best example where focusing solely on CO2 is a mistake

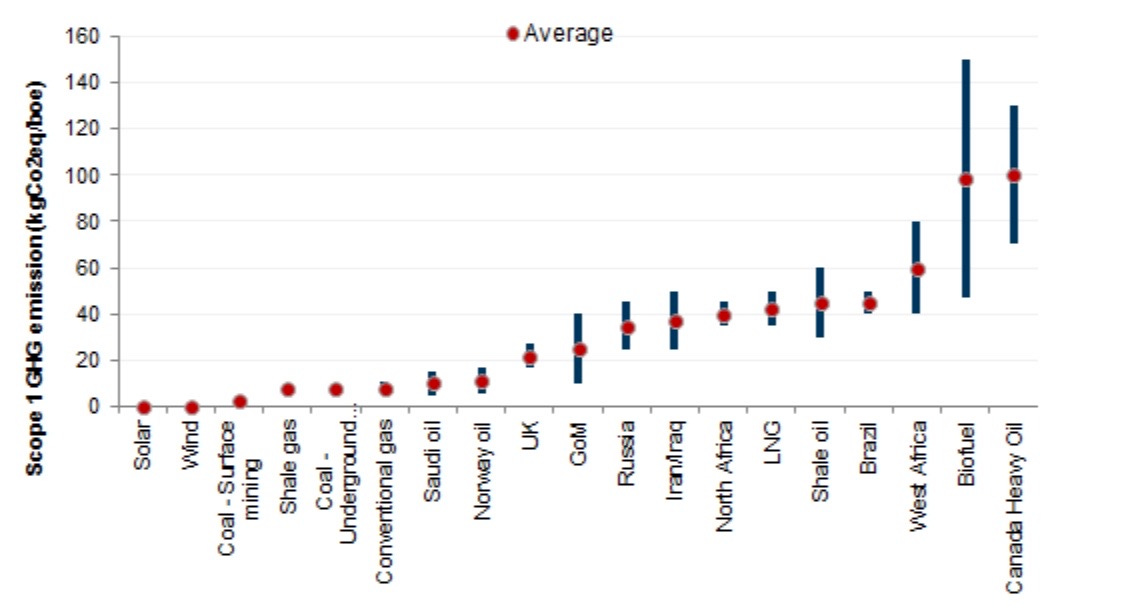

The obvious knock on Canada's oil sands industry is that it has a higher CO2 content than other sources of crude oil. When looking only at Scope 1 (direct) emissions the differences in carbon content are striking (see Exhibit 4). The reason for this is that extracting and developing oil sands resources requires significant amounts of energy.

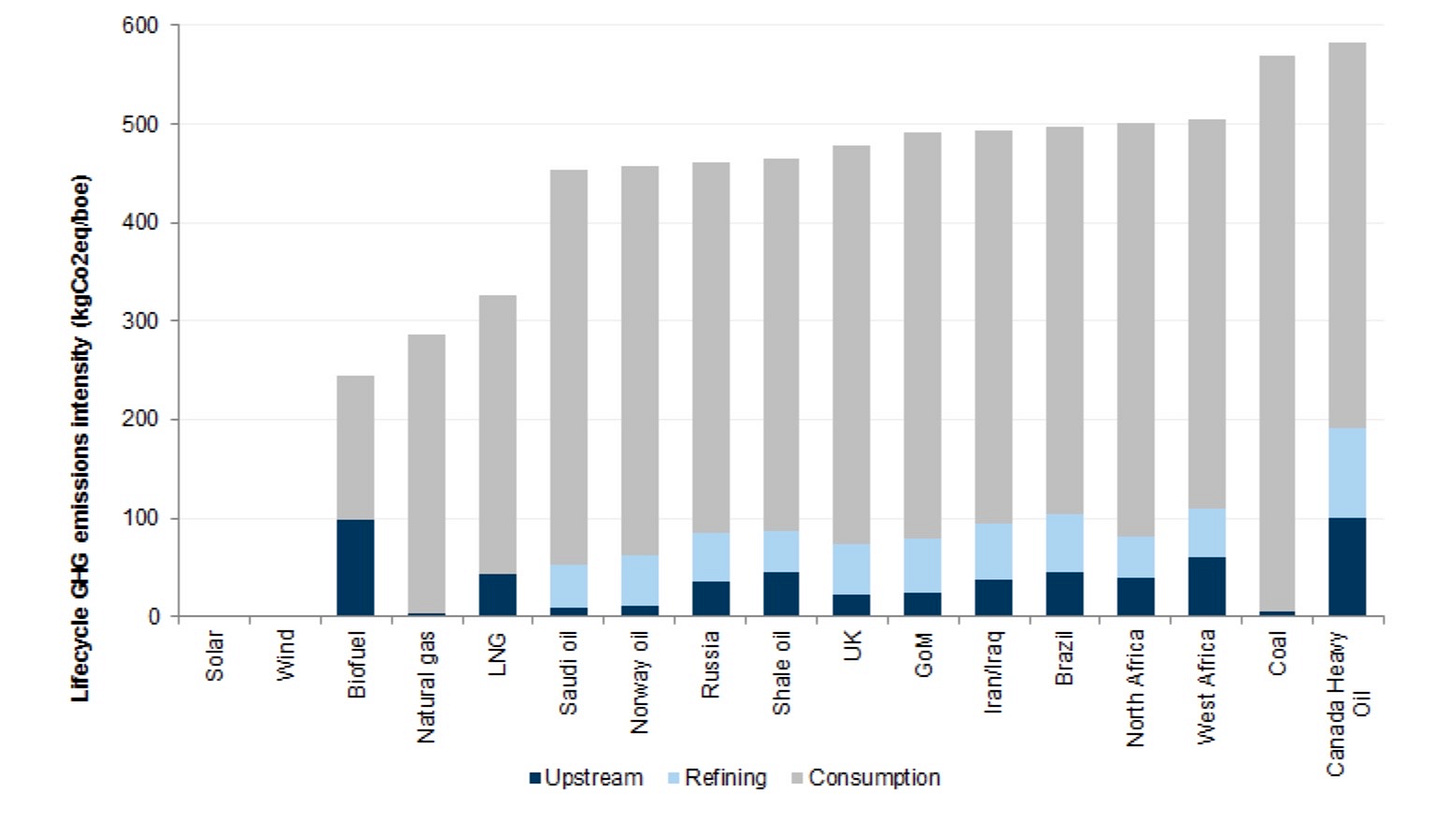

However, as any climate scientist would tell you, the bulk of the carbon emissions issue with fossil fuels comes during combustion. When including combustion, Canadian oil remains higher than alternative crude oils, but the difference becomes less meaningful (see Exhibit 5). Yes, it is still higher. But with absolute levels of CO2 from combusting various sources of crude oil not materially different from a big picture standpoint, in my view, the inherent carbon content of Canadian crude oil is not a disqualifier vis-a-vis alternatives such as Russia. Furthermore, Exhibits 4 and 5 do not account for the steps Canadian oil and gas companies and the Canadian government are taking to offset carbon emissions (discussed briefly below).

Cost/benefit analysis of Canadian crude oil

Benefits:

Canada is a democratic, geopolitically friendly country that, to the best of my knowledge, has never invaded another country.

Canada respects western values, such as freedom and liberty.

Canada respects the ideas of gender equality and the right to live openly and happily with whomever you desire.

Canada welcomes immigrants and refugees from other countries.

Canada, when not impeded by environmentalists or politicians, is a dependable supplier of crude oil, frankly, even more so than the United States, where supply has been more volatile (price cycle driven).

Canada has a massive oil sands resource that rivals Saudi Arabia and Venezuela in size and potential that can provide affordable, reliable, secure energy supply for all people.

Canadian oil sands production is long-lived and has only modest maintenance CAPEX requirements once significant upfront spending is completed.

Canadian oil and gas companies generate competitive returns on capital versus western peers (to be discussed in a future post)

Cons:

When combusted, Canadian oil produces about 25% more CO2 than alternative crude oils like Russia.

Greenfield Canadian oil sands projects are often found at the higher end of the global cost curve, making the activist/political bottlenecks all the more of a challenge.

What is being done to address the cons (partial list):

Canada is one of the few countries that has a price on carbon.

Canadian oils are investing in low-carbon projects.

Canadian oils have announced a CCUS hub.

By focusing on brownfield expansions, Canadian oil sands projects have the potential to be quite competitive with alternate sources of supply; it is greenfield expansions that are typically higher cost (a goal of doubling Canadian oil production would likely necessitate greenfield expansions).

Regarding recent controversial actions taken by Prime Minister Justin Trudeau to quell the so-called Ottawa Truckers protest movement, I will refrain from taking a public view on it. I know how much I dis-like when non-Americans weigh in on our domestic politics when engaging in a professional capacity. In the context of this post which focuses on the Canadian oil and gas industry, I view the Ottawa Truckers protest as a Canadian domestic issue where Canadian (or other) readers can decide for themselves how they feel about it. For those that disagree with the controversial actions taken by the Trudeau government, it does not change my view of the benefits of Canada and where it stands vis-a-vis other major oil producers.

Sinners and saints

It is possible if not likely that historically the Canadian oil and gas industry made mistakes or was not sufficiently proactive in addressing environmental or community concerns as I believe it now increasingly is. That is unfortunate but is generally true of all companies in all sectors when looking backwards. It is why we have government agencies, laws, regulations, boards, and shareholders. Based on my history of covering closely (as an equity research analyst) the large-cap Canadian oils, I am optimistic that the sector will be among the go-forward ESG leaders on substantive issues including reaching net zero emissions on scopes 1 and 2.

I would also differentiate individual fossil fuel company executives and companies from the broader industry and most importantly from the critical role the Canadian oil industry has to provide abundant, affordable, reliable, and secure energy for all, ideally with as small of a climate and environmental footprint as possible. It is quite possible that past (or current) individual executives may have personality characteristics or taken actions that were less than ideal in dealing with any number of circumstances or situations. Such situations can be dealt with either by shareholders or boards or via laws/regulations depending on the issue. And it’s possible some may have gotten away with any number of real or perceived bad behaviors. None of this changes the fact that Canada's oil and gas is a treasure for its citizens and the world. I would also note that a few (possible) bad actors need not define a sector.

It is up to the Canadian oil and gas industry to be future leaders on substantive ESG metrics and to be held accountable by board members, investors, regulators, environmentalists, and the media. By the same measure, climate ideologues (politicians, activists, academics, media) would benefit from developing a holistic world view and recognizing the significant harm hostility toward the Canadian oil and gas industry causes toward, ironically, cherished climate and environmental causes, and, most importantly, the billions of people on Earth that critically need the oil and gas Canada has to offer.

⚖️ Disclaimer

I certify that these are my personal, strongly held views at the time of this post. My views are my own and not attributable to any affiliation, past or present. This is not an investment newsletter and there is no financial advice explicitly or implicitly provided here. My views can and will change in the future as warranted by updated analyses and developments.

Regards,

Arjun

💿 Super-Spiked Energy Transition playlist update 📼

While the Super-Spiked Energy Transition playlist is my artistic attempt to highlight the absurdity and ridiculousness of much of the discussion around energy & climate, recent world events compel a more somber tone this week. To recognize President Zalensky's inspiring leadership, this week's playlist addition is dedicated to him and everyone in Ukraine, neighboring countries, and around the world that have been negatively impacted by president Putin's actions. Please use this YouTube video link (Triumph) of a long forgotten 1980s hard rock trio from Canada.

I would be interested to read a similar analysis of Brazil vis-a-vis the last two paragraphs. Petrobras is also trying to overcome the reputational blow caused by past mistakes and the current political environment presents a different kind of obstacle to investment. Nevertheless, they have a strong ESG focus and are sitting on some of the most impressive assets in the world,

I do not see why would points 2,3 and 4 bellow bear any benefit for foreign buyers of its oil. Besides that, second point is very questionable in light of the "truckers' " issu?!:

Cost/benefit analysis of Canadian crude oil

Benefits:

Canada is a democratic, geopolitically friendly country that, to the best of my knowledge, has never invaded another country.

Canada respects western values, such as freedom and liberty.

Canada respects the ideas of gender equality and the right to live openly and happily with whomever you desire.

Canada welcomes immigrants and refugees from other countries.