The quick answer to what is admittedly a tongue-in-cheek title is almost certainly “no” though we expect both the tedious genre of corporate sustainability reports (a notable exception is Liberty Energy’s excellent Bettering Human Lives report found here) as well as the increasingly massive ESG industrial complex to persist. The inspiration for both the title and this post is the reaction to the passage of Bill C-59 under Canada’s Competition Act from a number of Canadian oil and gas companies to remove their so-called ESG (environment, social, governance) reports from their websites (Exhibit 1). The controversial bill notionally aims to address deceptive marketing around environmental practices for all (i.e., not just oil and gas) Canadian companies. It puts the onus on companies to prove their environmental claims are valid “based on internationally accepted standards.” It is beyond the scope of Super-Spiked to get into the legal complexities and nuances of the bill; we are instead narrowly focused on its practical implications for market participants.

Exhibit 1: Example of a Canadian oil company website notification post passage of Bill C-59

Source: Suncor Energy.

We have seen backlash from some industry observers that we would characterize as friendly to the oil and gas industry that the new Canadian bill has (or will) unfortunately put a chill on ESG reporting for traditional energy companies. We have a different take: why would any fundamental investor care if this ends corporate sustainability reporting? In our 32 years of analyzing energy companies, both traditional and new, we have never relied on so-called ESG reporting to make an investment decision or conduct sector or company analyses. This is worth repeating: we have literally never used even a single datapoint provided in any ESG or equivalent report in our energy sector and corporate analyses and evaluations. Over the past 2.5 years of publishing Super-Spiked on a weekly basis, we have spent a lot of time discussing profitability cycles, the long-term energy outlook, how to think about growth in a mature sector, geopolitics, M&A, commodity price volatility, and more; we have spent zero time analyzing ESG-oriented data. If this Canadian bill results in companies no longer publicly providing ESG disclosures, it will have literally no impact on our outlook for those companies.

Recognize that we are not saying there is zero relevance to some of what ESG reporting attempts to capture. In this post, we provide historic examples of how we incorporated what is now called ESG into our investment analysis. At JP Morgan Investment Management (JPMIM), we spent a lot of time thinking about the “E” in regards to the independent refiner Tosco. In all of our career stops, the “S” has come into play when trying to distinguish between value stocks versus value traps. Finally, the “G” came into consideration when at Goldman Sachs we were asked to cover Brazil’s state-owned oil company Petrobras. Notably, we did not require ESG data, corporate sustainability reports, or consultation with ESG-dedicated personnel (which largely did not exist earlier in our career) in order to assess these companies or investments.

Regarding the current existence of corporate sustainability reports, we recognize that the ESG/Sustainability functions at most US, Canadian, and European asset managers now require essentially all publicly-traded companies to provide increasingly robust “voluntary” disclosures for a range of ESG items. This in turn drives considerable work on the part of traditional energy companies to produce what is being asked from ESG/Sustainability groups within asset managers. Pragmatically, we recognize that publicly-traded companies have little choice other than to continue publishing such reports, with various regulatory bodies actually looking to mandate disclosures in coming years. Our pushback is that these reports carry little by way of investment relevance and are not needed in order to make reasonable investment judgements on companies.

To be clear, we do not consider ourselves to be “anti-ESG” in that we expect companies to meet regulatory and societal requirements around the environment, in regards to the people that comprise its board, management team, and employee base, and in adhering to best-in-class governance standards. Rather, we are pushing back on the current incarnation of ESG as a movement that has mutated the topic to where it is now distorting markets in an apparent attempt to remake capitalism through a social- and climate-focused lens. We are increasingly uncomfortable with what ESG has become, which is well-removed from how we historically used ESG-like concepts in our investment analysis.

Examples of how we historically used ESG-like concepts in our investment analysis

E - Tosco

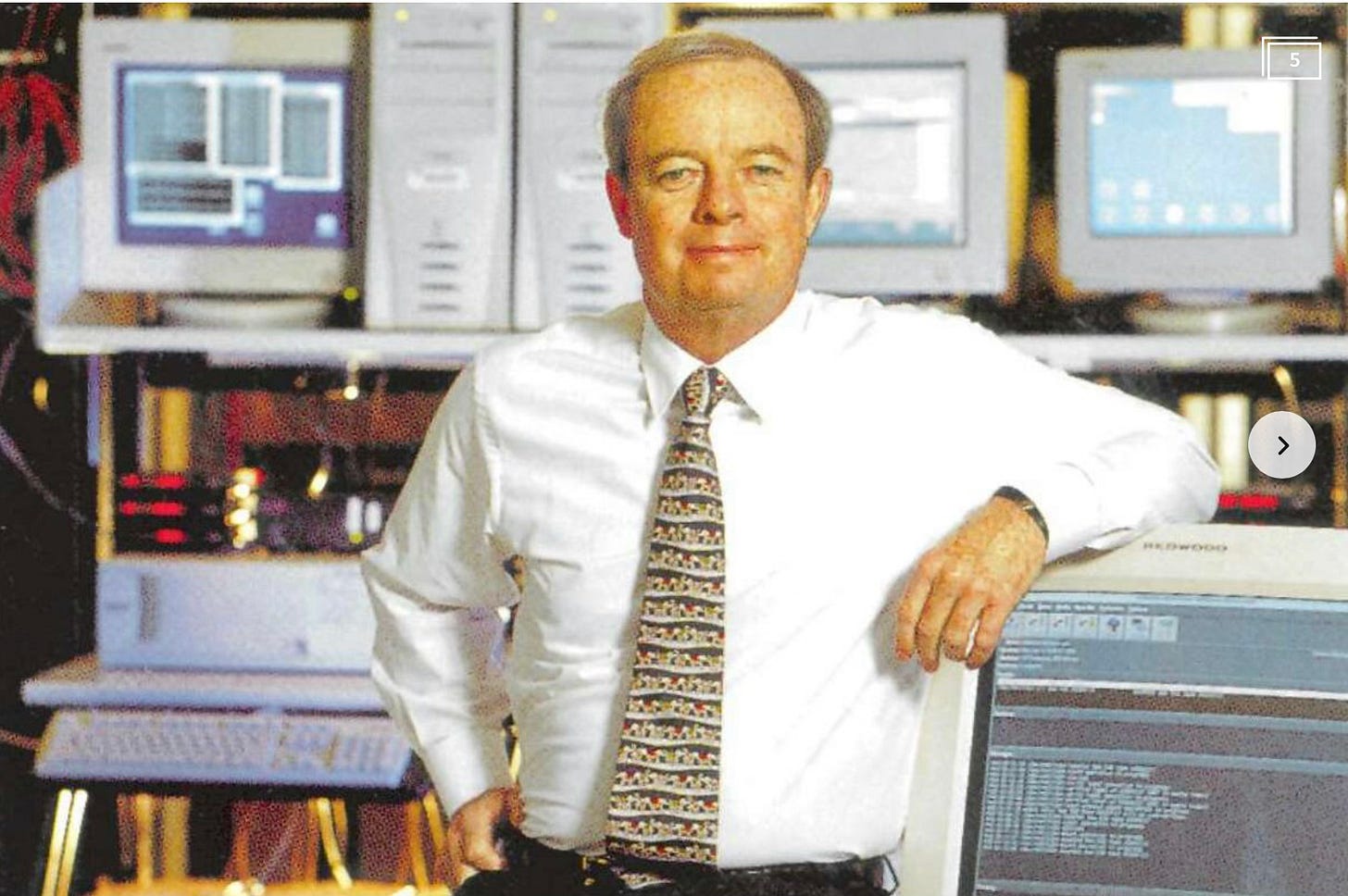

We joined JPMIM in 1995 and shortly thereafter were asked to take a look at some company called Tosco that had just purchased the convenience store retailer Circle K, which was owned by one of the small-cap portfolio managers. This became our introduction to both the refining sector and a legendary CEO, the great Tom O’Malley (Exhibit 2). At a time EVERYONE hated the refining sector for being capital intensive, subject to increasing environmental regulations, and low return on capital in nature, Mr. O’Malley used the overwhelming negative sentiment to buy refineries the major oils were shedding for pennies on the dollar (which generally means the purchase price was a small fraction, perhaps as little as 10%-30%, of what a new build refinery would cost) to remake an industry. As we have highlighted in prior posts, what we now call the downstream sector is the most profitable within the traditional energy space and has generated by far the best stock price performance for investors over the past decade.

Exhibit 2: Tom O’Malley, Tosco’s Hall of Fame CEO

Source: Stamford Advocate.

In the early days of Tosco’s strategy, there were questions as to whether it could operate the purchased refineries as well as the operating teams of the major oils had and if it was investing enough capital to adequately maintain the refineries. Running an oil refinery is no joke: high temperatures, high pressures, many intricate and interrelated processing units, and a combustible input (i.e., crude oil) can lead to serious accidents including worker fatalities when things go wrong. Even the most callous, “profits are all that matter” investor or analyst would agree that if a refinery is not run safely, there will be no profits to be made.

This effort to understand the safety and environmental performance of Tosco’s operations would today broadly fall under the “E” category. We did not require Tosco to write a corporate sustainability report to analyze its efforts in this area. We did not seek any input from ESG personnel at JPMIM, which did not exist at the time. We instead spent a lot of time with the company, with refining executives at other companies, and did all we could to try to get a handle on whether Tosco’s low cost structure was the result of superior efficiency (good) or whether they were keeping costs low by cutting corners with required maintenance (bad).

If we are being honest, there is no bright line here. We ultimately concluded Tosco’s operating practices were in fact within industry norms even as its cost structure was lower. While the company was not immune from unplanned downtime (industry parlance for unexpected problems at your plant), Tosco’s overall operating and financial performance was better than peers. Our recollection is that the value of our investment in Tosco tripled during our multi-year ownership period in an era where traditional energy was not broadly in favor. Tosco was the first big (correct) call of our career.

S - Value versus value traps

We are going to keep the “S” example more generic as we try to be polite at Super-Spiked. Assessing management quality and integrity has always been our number one focus in evaluating companies. Very simply, “can you trust this management team to invest your capital wisely?” This is a lesson we learned early in our career. Too often companies that appeared inexpensive on valuation metrics like EV/EBITDA (enterprise value to pre-tax, pre-interest cash flow) were cheap for a reason: underlying asset quality was inferior. We learned via some poor investment calls that bad assets were highly correlated with bad management teams. It is true that good companies do need to engage in restructurings at times; it’s not always a straight line up. However, the most painful mistakes we made were believing a company that appeared inexpensive and had a poor track record could be improved by the same management team that got the company in that position in the first place.

Do management teams have a process of rigorous debate and discussion about macro trends, asset quality and maturity, and future opportunities? Are different perspectives and backgrounds brought to bear? An assessment of management quality we will put in the “S” category though there is overlap with governance (G) and there are also other dimensions in the social bucket that do not quite fit this value versus value trap example.

G – Petrobras

We can still clearly remember hosting a Goldman investor trip to Doha, Abu Dhabi, and Dubai in the 2006-7 time frame and receiving a phone call from the late Anthony Carpet, then Goldman’s co-Director of Research (whom we eventually succeeded) “asking” if we would pick up lead coverage of Brazil’s publicly-traded state-owned oil company Petrobras. Petrobras is generally well known, but as a quick recap it has long been a leader in deepwater oil exploration with its focus on Brazil’s prolific offshore basins. While publicly traded, there has never been any confusion that it was ultimately controlled by the Brazilian federal government. As such, there has always been a governance question on the role the state would play with investment decisions being made by Petrobras management. Over our 30 year career, Brazil, and therefore Petrobras, has swung back-and-forth from on the margin being driven more by capitalism and profitability to on the margin being more driven by socialism and forced government spending via various works programs.

The point we are trying to make is that we needed to study Brazil as a country, understand where its leadership was moving, and then apply those perspectives to how we thought about Petrobras as an investment for our clients. None of that required an ESG report from Petrobras or anyone else or communication with ESG-dedicated personnel at Goldman. Instead, we traveled regularly to Brazil, meeting with on-the-ground Goldman analysts, salespeople, traders and our investor clients in the country.

Does ESG as a stand-alone concept have a future?

Early in Super-Spiked’s publication we were calling for a move to ESG 2.0. In reviewing prior posts, we never really defined what we meant by “2.0” beyond expressing our view that traditional energy should not be pressured into making ill-conceived new energies investments, that we supported methane abatement and addressing orphan wells, we were not fans of Scope 3 accounting, and that we have long considered areas like HSE and governance in our sector analysis but did not view ESG as a stand-alone asset class.

With this post, let us be clearer on what we see as the future of ESG:

The co-opting of ESG by climate activists to redefine ESG as an exercise in so-called “climate action” has perverted the topic to the point of rendering it useless if not outright damaging to corporate and sector performance.

Being “good” or “bad” on ESG-styled metrics cannot be determined by reading corporate sustainability reports. This is a lesson we learned in the late 1990s/early 2000s when at least one non-US-domiciled company started publishing early versions of nicely colored corporate responsibility reports, but where their actual operating track record unquestionably did not match the pretty brochure.

ESG is not a stand-alone area of investment or analysis but is incorporated into corporate or sector analyses at various points of the investment process. It is best done by the relevant portfolio managers or analysts that directly oversee the investment.

Incorporating the underlying ideas of traditional ESG does not require the publication of corporate sustainability reports or mandated disclosures.

Non-financial information that is required by regulators can be made public if a company so chooses, but it should not be mandatory.

Greater transparency on key metrics that underpin required financial disclosures (e.g., in a Form 10-K report) is always welcomed.

We are going to rebrand what we had been calling “ESG 2.0” to “ESG Zero,” which to us means a return to its traditional behind-the-scenes positioning that recognizes the E, the S, and the G and no longer serves as a trojan horse for “climate action” or social movements unrelated to corporate profitability or properly functioning markets.

⚡️On A Personal Note: Vacation Golf

My oldest child has given her parents the greatest gift a child could give post college graduation, leaving southern California and moving home for her first job in New York City. With her start date not until mid-July, we booked a last minute holiday to southern Tuscany over July 4th week, a region my wife and I last visited during my 2 week break between JPMIM and Goldman Sachs in July 1999, when we were still dating. In fact, this week coincidentally marked the 25-year anniversary of our engagement in Radda In Chianti on that very trip.

Notably, we dated while I was in wind-down mode at JPMIM, were engaged during the period I was working on my Goldman coverage initiation, and then were married later that year only 4 days after I actually went live at Goldman (free advice to younger readers: do not launch coverage on a sector at a major investment bank four days before your wedding). JPMIM in those days was not 24/7/350 in the way that Goldman was, so perhaps there was some false advertising while dating on what my work-life balance would look like. But hey, I feel I made up for it by retiring early just 15 years later! A Goldman partner’s income also isn’t the worst thing for a family to be blessed with even as it came with the sacrifice of my wife being a de facto single parent for about 12 years (early 2002 to early 2014).

But none of that is the point of this week’s OAPN. Instead our Tuscany visit reminded me of some great vacation golf, where golf was not the main purpose of the trip. I am providing a distinction for vacations where the golf was incidental versus dedicated golf trips to places like St Andrews, Ohoopee, or Pinehurst. I am also not including work-related golf outings in this accounting. Below are my Top 10 favorite golf experiences while on vacation where golf was not the primary objective.

#1 Normandy, France - Omaha Beach Golf Club (August 2014)

This was in my first year of playing golf during my Goldman wind-down year. A family trip to Normandy, France ranks as one of our all-time favorites. I have to say the thought of playing golf on hallowed ground did cause me to pause. That said, the course exists and people play it. There was a war memorial on almost every hole, which kept some missed shots during the round in perspective. Glad my son (who was nearly 11 at the time) and I got to play it.

#2 Big Island, Hawaii - Hualalai Golf Club (July 2018)

The Four Seasons Hualalai is arguably my all-time favorite resort anywhere in the world. If you go, just don’t look at the bill for any meal or drink or anything. This was a round with my youngest daughter who was just taking up golf at her school and can now bomb her drive 230+ yards. Neither of us can deal with too much sightseeing—she’s always been the one ready to relax at the hotel with her Dad and to skip a random hike, local attraction, or other similarly boring endeavors. On this day, since neither of us enjoy helicopter rides, we avoided the volcano flyover and instead played 18. Great decision!

#3 Stanford, California - Stanford Golf Course (March 2019)

During junior (high school) year Spring Break college visits for my oldest, my son and I skipped the Stanford college tour and instead played its golf course, Tiger Woods’ home course in college. It was not the best of conditions weather wise, but we loved our back-to-back rounds. Our last stop on that trip was to the University of Southern California, where my daughter graduated from this past May and is now coming home. Fight On!

#4 Iceland - Brautaholt Golfvöllur GBR (July 2022)

This is an awesome 12-hole course set amongst the volcanic rock and surrounded by water and scenic views. On this day, 12 holes made far more sense than the public lagoon visit the girls did.

#5 Mexico - Cabo Del Sol (December 2019)

One of my all-time favorite courses anywhere in the world. At some point in the mid-to-late 1990s, one of my best friends from high school was married in Cabo. A few of us played Cabo del Sol on that trip and I remember declaring that I would quit golf until my career was over and I could dedicate more time to the sport. I didn’t play golf again until retiring from Goldman in 2014. It was great to come back to Cabo with a much improved game in tow.

#6 Maui, Hawaii - Kapalua, Plantation Course (July 2018)

It was very windy on the day we played and the Titleist high-end clubs were not sufficiently forgiving for my swing at the time. Still, spectacular views and a great course. I need to go back and give it another go.

#7 Cape Cod - Cranberry Valley Golf Course (many times)

My parents spend the bulk of their time on Cape Cod and this nearby public course is a real gem. I could happily play this daily if I lived there. As a public course, the greens and bunkers are not what you would expect were it a private club, but it more than makes up for that with a fun layout that offers its challenges.

#8 Tuscany, Italy - Argentario Golf Club (July 2024)

Totally unexpected bonus golf, with credit to my wife for finding and booking it for me. It’s a tight layout that calls for a 3-, or 5-wood or 5-iron off most tees. The greens are small and fairways narrow. If you happen to find yourself in southern Tuscany, I’d say this is worth playing. I was solo and got around the course in a mere 2.5 hours (using a buggy). Pictured below is the spectacular par 3 second hole.

#9 Costa Rica - Ocean Course, Peninsula Papagayo (March 2020)

We did not know it at the time, but this family vacation concluded a mere two days before President Trump shut down New York City area airports in the early days of COVID. We were at The Four Seasons resort, which was spectacular, and perhaps would have been the better location to ride out the early weeks of New York area COVID lockdowns.

#10 Sedona, Arizona – Seven Canyons (April 2023)

Another course I’d like to go back to as the bunkers were under renovation at the time. Spectacular views and some fun holes. Again, bonus golf as was not expecting to play on this trip and again credit to my wife for finding and booking.

⚖️ Disclaimer

I certify that these are my personal, strongly held views at the time of this post. My views are my own and not attributable to any affiliation, past or present. This is not an investment newsletter and there is no financial advice explicitly or implicitly provided here. My views can and will change in the future as warranted by updated analyses and developments. Some of my comments are made in jest for entertainment purposes; I sincerely mean no offense to anyone that takes issue.

As a Producer we once thought HSE mandates were a pain in the ass. What we wouldn’t give to return to focusing on such practical and actual life saving matters instead of the virtue signaling of ESG that largely replaced it.

Lead with the good stuff first, namely your ten best "non-golfing" trips. The ESG portion could have been aptly summarized in a brief postscript: "ESG creates employment opportunities for clueless activists and propagandists but is mostly ignored as irrelevant and impractical by the investment community."