We continue our holiday season Lessons From 2023 series with a focus on our favorite topic: profitability! The resurrection in traditional energy return on capital employed (ROCE) continued in 2023, as ROCE, while lower than 2022, remained at very healthy levels despite a sequential pullback in commodity prices. Remarkably, sector ROCE is significantly higher than the Super-Spike era of the 2000s despite what have been volatile but ultimately range-bound commodity prices; 20 years ago, it was a 3X-5X increase in oil prices that initially drove profitability higher.

Between 1990-2020 there were three distinct ROCE regimes, with the sector averaging 9% ROCE over the full period and upper quartile companies averaging 14%. We believe 2021 marked the start of a fourth distinct ROCE regime that is tracking to be the best yet. While we do not expect high-teens-to-over-20% ROCE to prove sustainable into perpetuity for either the sector or upper quartile companies, mid-teens-plus ROCE seems possible for the remainder of this decade, in particular for leading companies. Paradoxically, it is "energy transition" obsession that will likely be a key driver of sustaining improved ROCE.

Despite (1) the overwhelming need for all forms of energy, (2) the obvious benefits of having a healthy, profitable, and growing US, Canadian, and Western European oil and gas industry to balance OPEC+ nations, and (3) rising oil and natural gas demand, major policy makers such as the International Energy Agency (IEA) continue to demand that western oil and gas companies more aggressively transition to renewables and other new energies sectors. We disagree with these calls. We would note that whatever intrigue may have existed among some institutional investors in 2020-2021 for companies to examine more aggressive transition strategies is now essentially non-existent. We can see this even in Europe via the recovery in Shell shares since Wael Sawan took over as CEO.

To the credit of the leadership teams of traditional energy companies, they mostly did not take the bait in 2020-2021. The 2023 collapse in new energies equities broadly speaking, CAPEX write-offs in areas like offshore wind, and "going concern" warnings from some all support a go-slow, if at all, approach to new energies from traditional energy. It remains our view that new energies are best pursued by companies dedicated to the space, though there are of course exceptions to that rule. To be clear, we are going to need a broad range of new energies sources and technologies to supplement traditional energy if the world is to meet the substantial untapped energy demand of everyone on Earth over the next 50-100 years. Our issue with the topic entirely rests with the notion that oil and gas companies MUST transition.

At the end of the day, all for-profit companies exist to generate profits for their investors. It is the profit motive that moves society forward as individuals and companies create goods and services that consumers, businesses, and governments demand. By investing in areas that will perpetuate advantaged ROCE, the traditional energy sector is helping to meet the world's energy needs.

The fourth and thus far best ROCE regime of the past 30 years

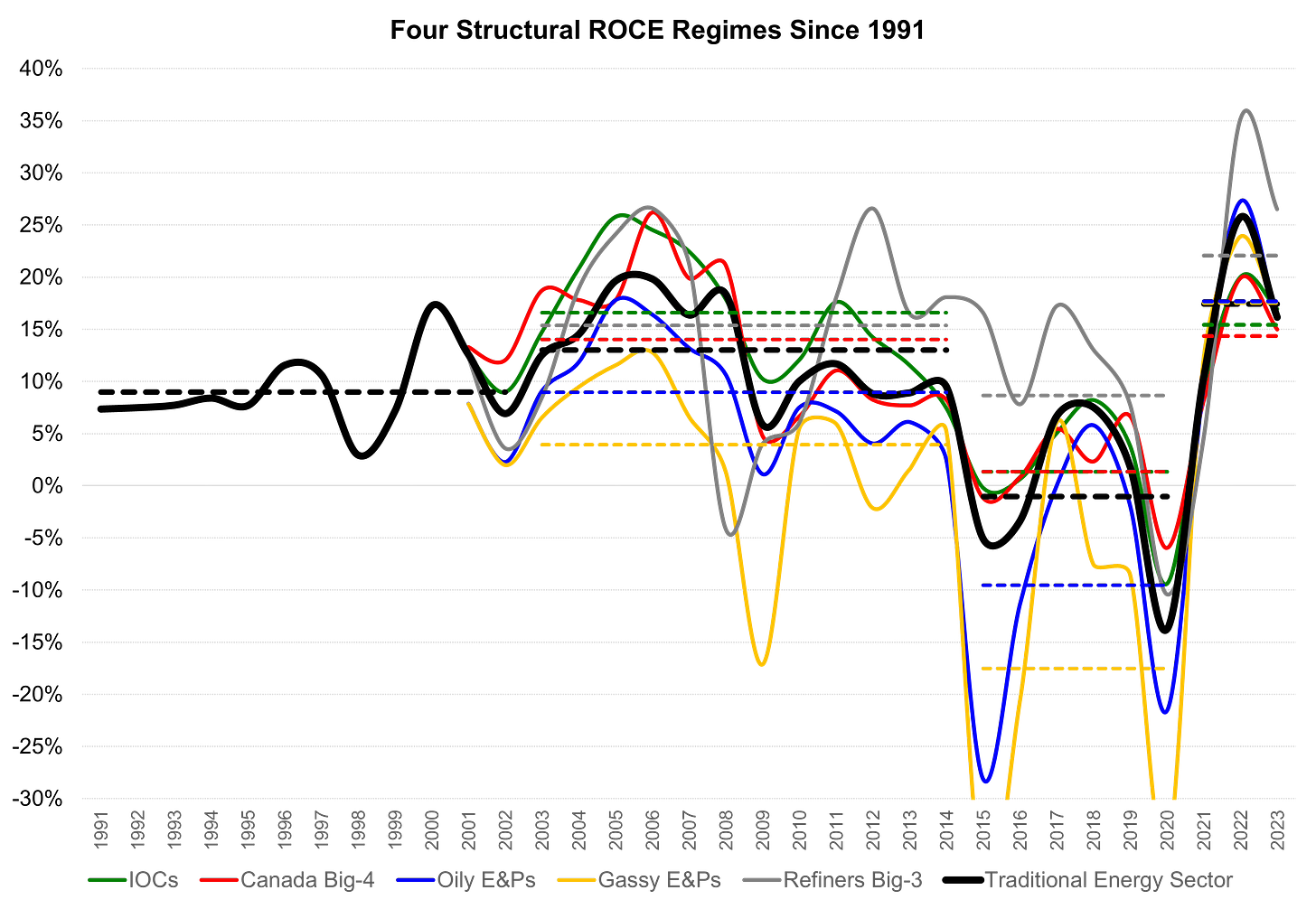

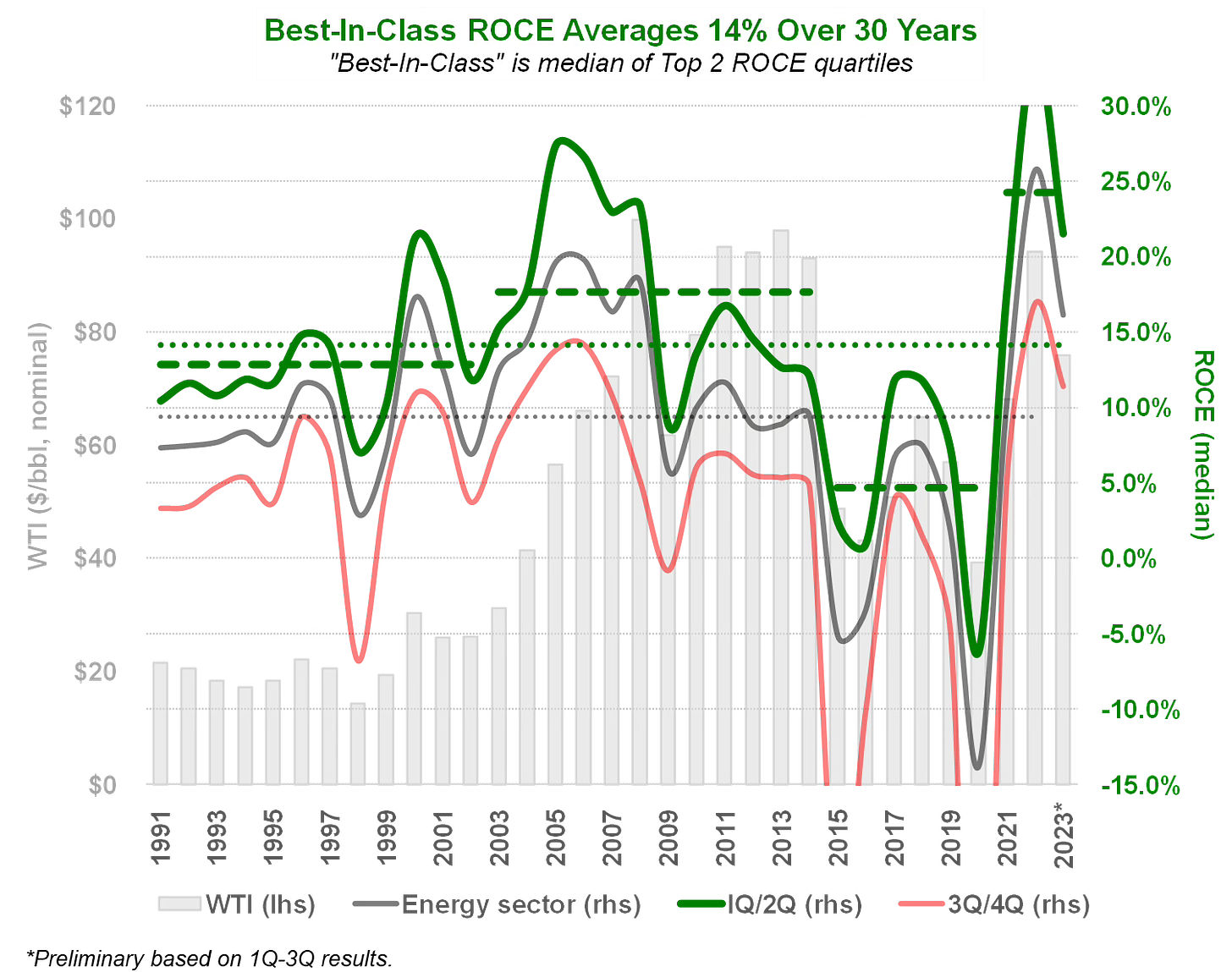

As we update our ROCE analyses to include the first nine months of 2023, we continue to believe 2021 marked the start of the fourth ROCE regime since 1990 (Exhibits 1 and 2).

Exhibit 1: Four structural ROCE regimes since 1991

Source: FactSet, Veriten.

Exhibit 2: Best-In-Class ROCE has averaged a strong 14% since 1991

Source: FactSet, Veriten.

(1) Regime 1: Lackluster 1990s (1991-2002)

Oil prices were range bound between $15-$25/bbl (nominal) for West Texas Intermediate (WTI).

Sector ROCE averaged 9%.

"Best in class," which we define as the median company of the top two ROCE quartiles, averaged 13%.

(2) Regime 2: Super-Spike Era (2003-2014)

Oil prices ultimately rose 5X from around $20/bbl to about $100/bbl.

Sector ROCE averaged 13%.

"Best in class" ROCE averaged 18%.

(3) Regime 3: The post-Super-Spike Bust (2015-2020)

Oil prices collapsed from around $100/bbl to circa $50/bbl.

Sector ROCE averaged an incomprehensibly pitiful negative 1% (as a reminder, we use reported GAAP earnings to calculate ROCE; we do not adjust for write-offs or other self-disclosed “one-time” items).

"Best in class" ROCE was a disappointing 5%.

(4) Regime 4: Messy Energy Transition Era (2021-???)

A Super Vol macro backdrop exists.

Sector ROCE is thus far averaging a stellar 17%.

Best-in-class ROCE is averaging an incredible 24%.

Sub-sector profitability: Will US Big-3 refiners remain ROCE kings?

Exhibit 1 includes ROCE for key sub-sectors including the international oil companies (US and European super majors plus other large, legacy integrated oils), US oily E&Ps, US gassy E&Ps, US Big-3 refiners, and the Big-4 Canadian Oils.

Key points:

The IOCs have generally been ROCE leaders and Canada’s Big-4 Oils are a close second.

E&Ps, and especially US natural gas-leveraged E&Ps, historically were laggards (note: ROCE dispersion is wide and some companies performed much better than others). Notably, both oily and gassy US E&Ps are now showing improved performance; we are optimistic that leading E&Ps have the capacity to sustain ROCE that is competitive with IOCs in the coming decade.

The most improved group over the past 30 years is the US Big-3 refiners, which managed to generate respectable profitability over the 2015-2020 period that was especially challenging for upstream companies; the US Big-3 refiners outperformed the IOCs last decade.

There is unsurprisingly an inverse correlation between cash flow reinvestment rates and ROCE (Exhibit 3).

All traditional energy sectors are currently reinvesting at or near the low end of historical reinvestment ranges.

We believe investors are likely to remain intolerant of companies incapable of generating free cash flow at mid-cycle or higher commodity prices.

Exhibit 3: Sector reinvestment rates are inversely correlated with ROCE

Source: FactSet, Veriten.

"Climate only" ideology is helping sustain improved profitability

We appreciate that many Super-Spiked subscribers seek perspectives that are not at the extremes of energy and environmental policy and perspectives. However, it is worth recognizing that almost every aspect of the "we need to have a fast energy transition to deal with the urgent climate crisis" narrative is constructive for traditional energy profitability.

Widespread concern that oil and gas demand will peak/plateau in the coming decade dis-incentivizes the pursuit of major, long lead-time projects and any notion of returning to a growth mindset among producers.

Pressure on banks, insurance companies, and capital markets to transition financing away from traditional energy disincentivizes capital spending and promotes a "fortress balance sheet" mentality.

Activists protesting individual fossil fuel projects might negatively impact specific companies, but ultimately reduce available oil and natural gas supply.

Regulatory uncertainty created by "climate only" policy makers disincentivizes capital spending.

In a nutshell, the conspiracy to "keep it in the ground" is on-track to keep western oil and gas companies from returning to growth mode, something many traditional investors have long supported but could never implement. The catch to what will sound like mostly good news from the perspective of institutional investors (i.e., less capital spending than might otherwise be the case) is that the sustainability of advantaged ROCE requires ongoing investments in future low-cost projects. While we are not calling for a return to growth mode, there is urgency to ensuring companies are leaning into areas of future competitive advantage.

Moreover, global oil and gas demand we believe is on-track to rise for the foreseeable future. We do not believe it is possible to predict the decade let alone year when "peak" demand will occur. Western oil and gas companies risk missing out on investing in advantaged projects that can help meet inevitable oil and gas demand. Oil and gas supply WILL grow globally to meet rising demand. If it does not come from the United States or Canada, it will come from other areas, including regions that are hostile to us.

Comment on IEA’s Oil & Gas in Net Zero Transitions report

Ahead of COP28, the IEA published a report titled The Oil & Gas Industry In Net Zero Transitions (here). The opening tag line states that "a moment of truth is coming for the oil and gas industry," with the report imploring the oil and gas industry to accelerate its own transition away from oil and gas to new energies. We could not disagree more with the editorial.

The portion of the report that discussed profitability we believe is especially off-base. From the report: “Oil and gas projects currently produce slightly higher returns on investment, but those returns are less stable. We estimate that the return on capital employed in the oil and gas industry averaged around 6-9% between 2010 and 2022, whereas it was 6% for clean energy projects. Oil and gas returns varied greatly over time compared with more consistent returns for clean energy projects.”

The main issues we have with this section are as follows:

The IEA uses 2010-2022 which over indexes for an especially low return period for the sector in the context of the last 30 years. It's not that its calculations are incorrect, it's that it is arbitrarily (willfully?) using a low-ROCE era.

The IEA ignores the downside risk to "clean energy" projects that have obviously materialized in 2023. Why?

The IEA does not differentiate between the top two ROCE quartiles for traditional energy, which have earned superior ROCE versus the bottom two ROCE quartiles that should not be investing in new or old energy. This is a major oversight.

It is reasonable for there to be a range of opinions regarding future strategy options for traditional energy companies. But please spare us this line: "A productive discussion on this crucial topic requires a solid evidence base and dispassionate analysis." Yes, that would have been nice.

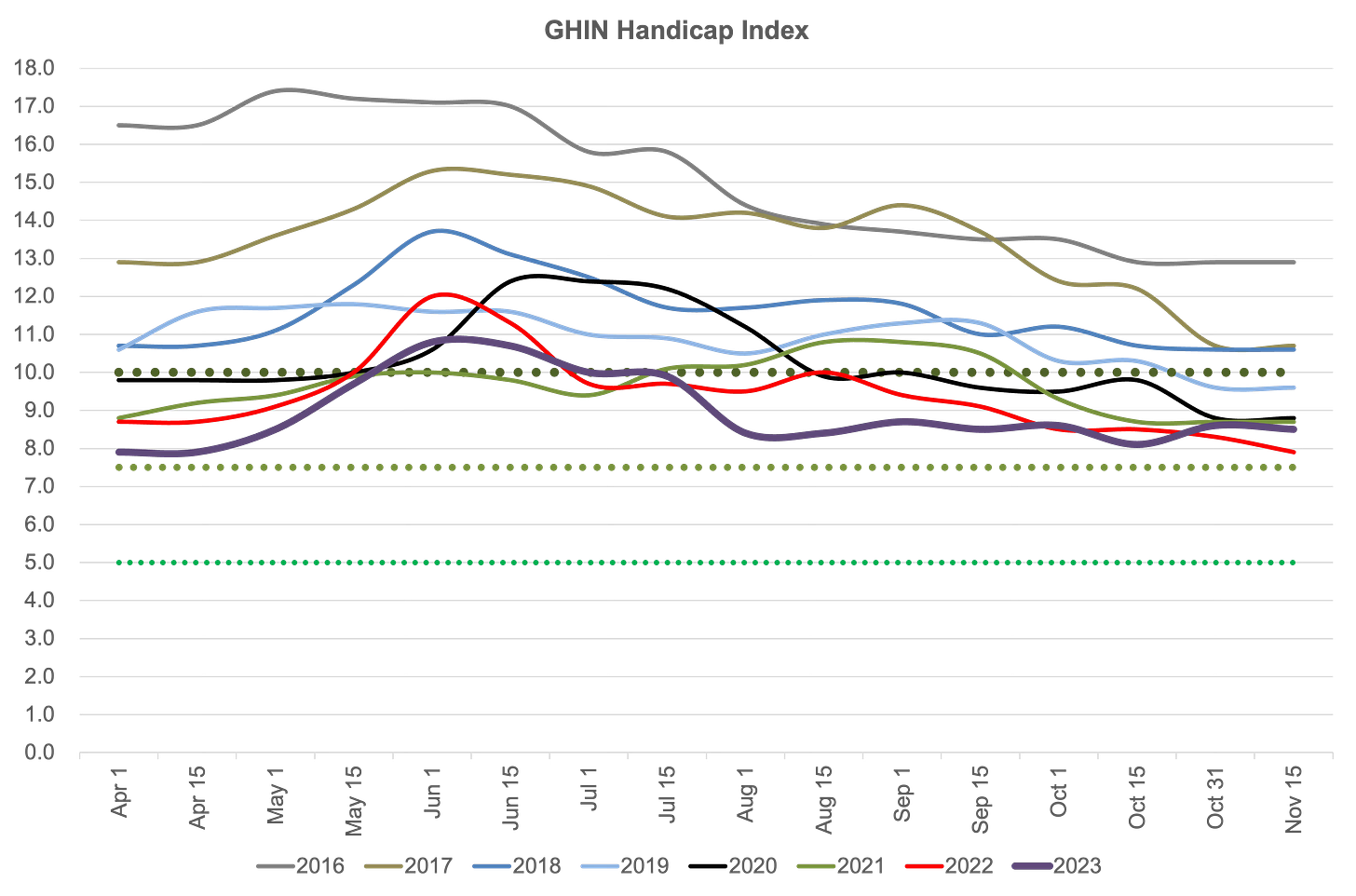

⚡️On A Personal Note: 80 Rounds In 2023 Isn't Terrible

At the start of the year, I set a goal to play 60-65 rounds in calendar 2023. As a reminder, the core golf season in the US northeast runs from early April to mid-November (posting season is officially April 1-November 15). The basic math was 2 rounds per week times 30 weeks equals 60-65 rounds. I am pleased to announce that by the time 2023 ends, I will have played around 80 rounds of golf.

While my GHIN hit an all-time low of 7.6 this past Spring, I ended the 2023 posting season at 8.5, marking the first year since I took up golf in 2014 that my GHIN did not fall to a new low by the end of the posting season (see Exhibit). I attribute the stagnation to significantly diminished practice time this year, which came in at just 20 hours, versus a pre-Veriten history of 34 hours in 2022 and 44 hours in 2021. Practice time includes dedicated time at the driving range, short game area, putting green, and meter stick at home, but excludes pre-round warm-up.

Exhibit: My GHIN handicap index over time

Source: Super-Spiked.

I had a lot of great golf moments in 2023. Below are my Top 10 favorite (in chronological order):

Chevron Championship Pro-Am (April). Got to play with the LPGA pros, which was awesome...not to mention a great four-some of energy sector colleagues.

Winged Foot (MGA Event) (May). Glad I was able to check a round at Winged Foot off the list; it was not my best round of the year, but MGA events are always a lot of fun.

The Castle Course (May). I played an admirable round in challenging conditions with three members of the University of St Andrews golf team.

Chip-in at our flagship Member-Member event (May) (see Exhibit). This is the #1 highlight of the year. The great energy from our caddie when the ball rolled in the hole made it all worthwhile; a moment I will never forget for as long as I live.

Glenmoor CC (July). Played a fun round with one of my all-time favorite but now retired energy executives on his home course in Denver.

Couples 8-11 Scramble (August). A total team effort from our foursome that included myself, my wife, and our good friends Mike and Katie J. Katie sunk a long putt for net birdie on the last hole that turned out to be our margin of victory over the field.

Balcomie Links (September). Links golf in Scotland is the best golf in the world. Another fun round with University of St Andrews golfers.

Whispering Pines (October). The best part about un-retiring to Veriten is the increased opportunity to play hard-to-access courses like Whispering Pines. If you get an invite to this place, drop everything and say yes.

Father-daughter "All Par 3s" (November). November Fall golf at our club includes some non-traditional set-ups. It was magical to play with our last child that has yet to leave us.

Westwood GC (November). Always enjoy playing a round with a former Goldman colleague whom I have long since forgiven for quitting his (great!) job as our senior oil services analyst on bring-your-daughter-to-work day (2009 time frame). He long ago made up for it by inviting me to various BMO golf events at Pinehurst, Myopia, and Old Sandwich. He is now an energy sector buy-sider.

Exhibit: Chip-in celebration during shootout portion of our club’s flagship Member-Member

Source: Super-Spiked.

⚖️ Disclaimer

I certify that these are my personal, strongly held views at the time of this post. My views are my own and not attributable to any affiliation, past or present. This is not an investment newsletter and there is no financial advice explicitly or implicitly provided here. My views can and will change in the future as warranted by updated analyses and developments. Some of my comments are made in jest for entertainment purposes; I sincerely mean no offense to anyone that takes issue

My Saturday morning is complete. Thank you Arjun. Your posts are very important and valuable for me. Happy Holidays my friend!

From another perspective, note that Japanese foreign policy increasingly includes openly warning Oz and other friendly producers to be wary of the geopolitical implications of cutting investment.