Lessons from 2023: RIP "Fast Energy Transition" Narrative

The Energy Transition Needs To Transition

Welcome to the 2023 holiday season! In this week's post we'll look at key takeaways from the year that is ending. If we were to pick a singular theme for 2023 it is the death of the idea that an absurdly fast energy transition is possible, desirable, or on-track. In the current year, we have seen the following:

a collapse in a broad swath of new energies equities as a combination of higher interest rates and cost inflation has led to a major reset in investor expectations on the viability of various business models.

new highs for oil, natural gas, and coal demand and the growing recognition that "scenarios" calling for an imminent peak appear to be driven by wishful thinking more than a reality of the actual world we live in.

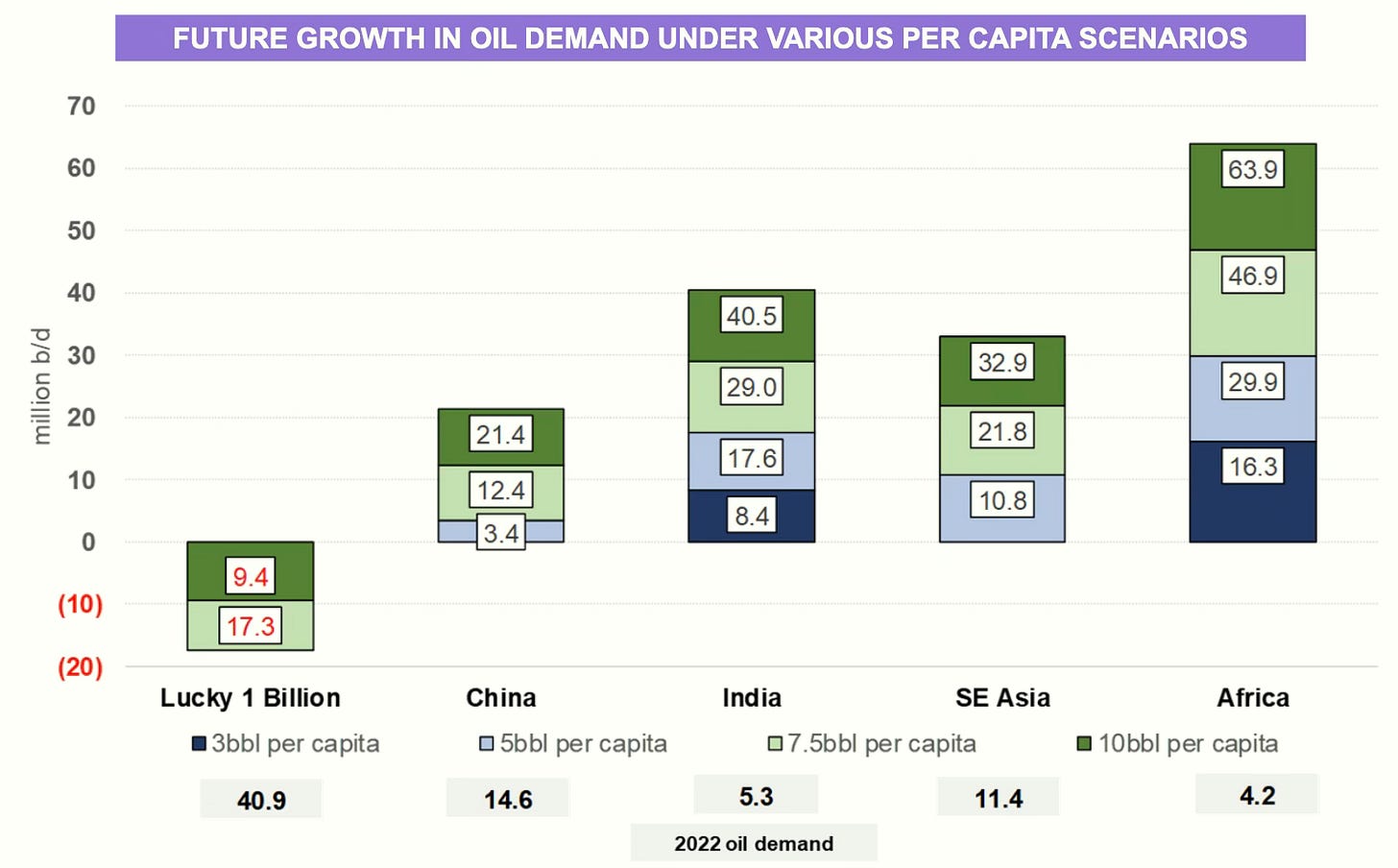

major "all of the above" energy demand growth in China, which we see as a sign of what is to come in the event China escapes the so-called middle income trap and as the other three 1.4 Billion People Club members—the rest of southeast Asia, India, and Africa—inevitably move up the economic and energy s-curve. The substantial energy demand growth that is yet to come from the developing world highlights the silliness of the rhetorical protest against various individual traditional energy projects in the US, Canada, or Western Europe.

It is that last bullet that is the opportunity for both investors and corporates. We are going to need massive amounts of all forms of energy, new and old. Amongst the wreckage of the new stuff, what will be worth spending time on? Amongst old energy, which companies are better positioned to navigate a Super Vol macro backdrop and take advantage of opportunities that will arise?

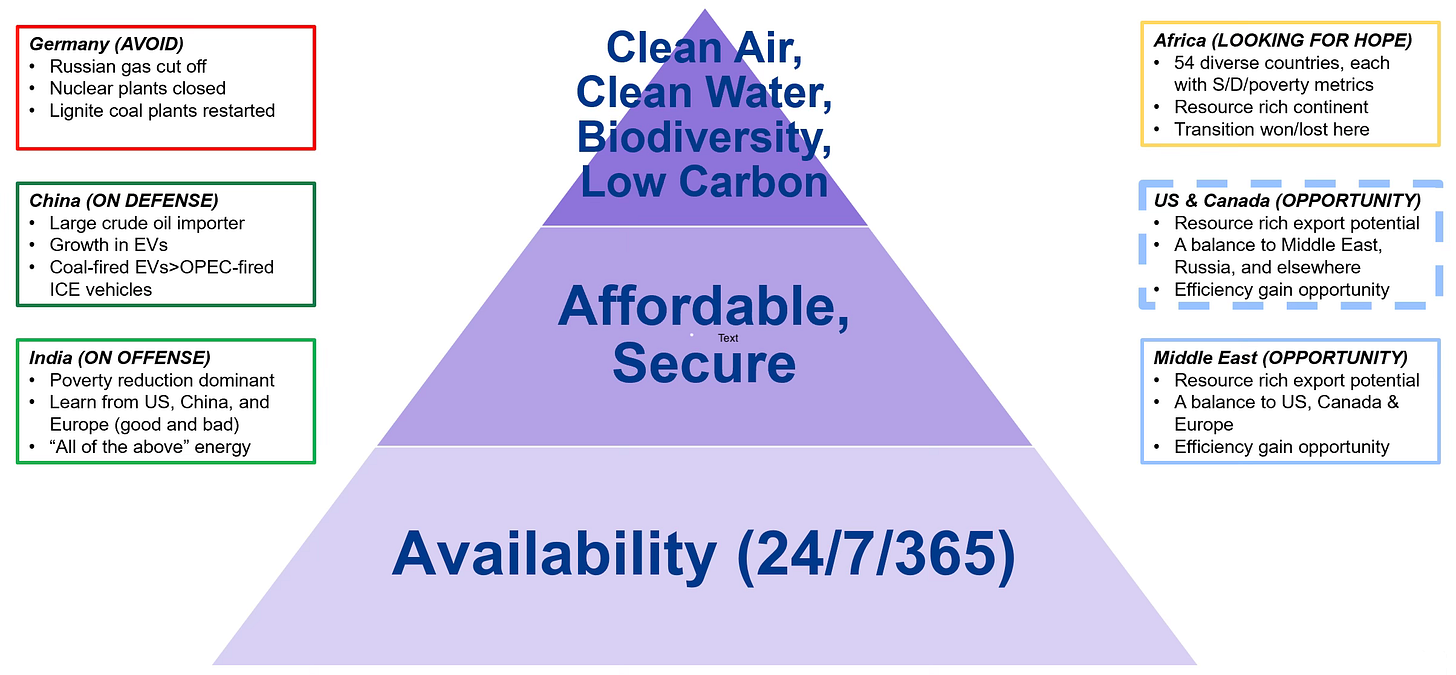

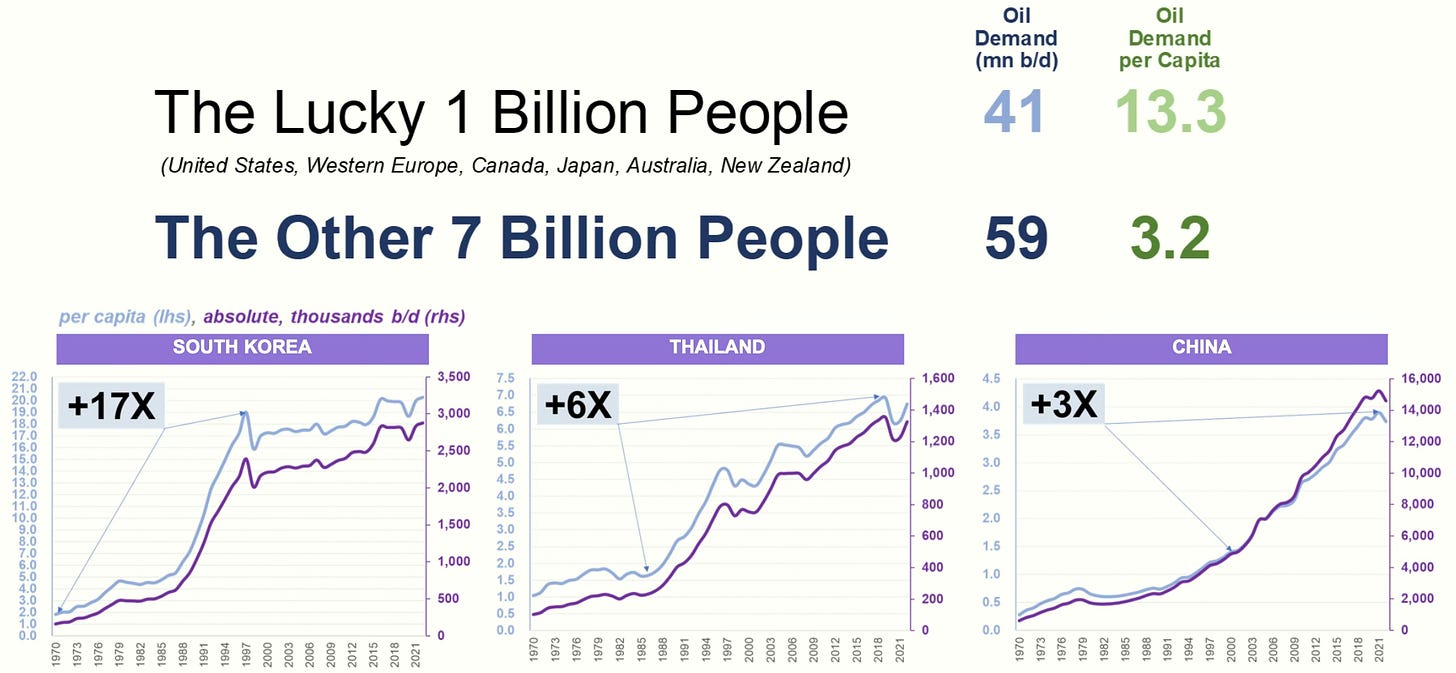

Ultimately, a new narrative is needed. One that recognizes that the world's environmental challenges will never be met without first solving for the fact that it is an inalienable right for every person on Earth to have access to abundant and affordable energy 24/7/365 (Exhibit 1). Thus far, only The Lucky 1 Billion of us that live in rich, developed areas enjoy energy abundance. The outlook for energy markets and meeting environmental objectives will be driven by satisfying the substantial unmet energy needs of the other 7 billion (soon to be 9 billion) people on Earth that use a fraction of the energy a small portion of us take for granted.

Exhibit 1: Energy: A hierarchy of needs

Source: Veriten

The motivating theme for the creation of Super-Spiked was the idea that we are in the midst of a messy energy transition era catalyzed by a "climate only" ideology that believes (1) killing fossil fuel supply (and infrastructure) in the United States, Canada, and Western Europe—primarily by demonizing oil and gas firms within those regions and protesting random individual projects—will somehow lead to global oil and gas demand reductions; (2) we should "electrify everything" but only use intermittent energy generation (plus battery storage, grid optimization, etc.) going forward; (3) we can dictate that developing areas "skip" fossil fuels and only use low-carbon energy sources and technologies; and (4) that all of this somehow will be deflationary and lead to economic, environmental, and climate "justice." No part of any of this ever made much sense to us; the wider world appears to be catching on. We are optimists by nature and see 2023 as the inflection point back toward a healthier direction for energy policy and literacy.

Good riddance to some of the worst ideas from the COVID trough

The COVID fog is finally lifting and with it some of the worst ideas that came out of that very tumultuous period, including:

Unrealistic net zero by 2050 "scenarios," some of which were created in good faith in an effort to address environmental challenges, others of which were cynically developed to aid-and-abet those that adhere to Malthusian, de-growth philosophies.

LCOE (levelized cost of energy) as a reliable metric upon which society-wide energy policy can be based (i.e., in this case the idea that renewables are ALWAYS and in ALL locations cheaper than all other forms of energy).

The idea that rich western world institutions can dictate energy policy to developing countries.

As a reminder, when we evaluate the total addressable market (TAM) of global energy needs, we believe it is an inescapable truth that all forms of energy will be needed (Exhibit 2). At least some of the new stuff better be able to scale or the world risks slower economic growth and ongoing energy inadequacy for far too many people. Geopolitical security for countries that are not blessed with oil, natural gas, or coal resources is also enhanced via the use of new energies that are not dependent on these feedstocks.

Exhibit 2: Total addressable market (TAM) for oil/energy is substantial: New energies will be needed

Source: EI Statistical Review of World Energy, IEA, Our World In Data, Veriten.

One does not need to be a student of University of Manitoba professor Vaclav Smil to have recognized how off base high-profile reports like the International Energy Agency's (IEA's) May 2021 Net Zero By 2050 were from the get-go. More recent "Net Zero" updates from the IEA seem to fall into the classic analyst trap of sticking one's head in the sand when circumstances have clearly changed. We have seen this many times in traditional energy, with the most recent example being the shale oil equity boom of 2015-2016 after the collapse from the $100/bbl oil world of 2011-2014 to the $50/bbl post-crash reality.

The IEA remains the gold standard for historical supply/demand data for crude oil and other energy commodities. Unfortunately, its current leader is turning the IEA into a something of a climate activist organization; we would advise readers to continue to use the IEA for historic oil supply/demand data and simply tune out its "net zero" advocacy.

The collapse of new energies equities marks the death of the "fast transition" narrative

Stocks go up and down and most industries have boom-bust cycles. None of that is new. The fact that the new energies sector is now going through its own cycle is neither novel, surprising, nor damning (Exhibit 3). For those that have been more skeptical of new energies, we would guard against the belief that none of it will ever work; that is almost certainly not true. For proponents, we suggest at least a modicum of humility on what is possible within various time frames.

Exhibit 3: New energies equities have collapsed

Source: Bloomberg.

The key takeaways from our vantage point are as follows:

Capital intensive growth is not easy in any sector, least of all in newer areas.

Profitability is often at odds with rapid growth, a lesson traditional energy has repeatedly learned over the first 150 years of its existence.

The collapse in large swaths of the new energies sector reinforces what has been an obvious point to us that so-called "energy transition" is a perhaps century-long endeavor; it will be neither fast (i.e., <30 years) nor easy.

It is not obvious to us that comparisons to the bursting of the internet bubble are applicable here, as the internet clearly transformed the way we live our lives and run our businesses; that is (mostly) not the nature of energy supply. Unlike consumer or business-oriented products and services, almost no one cares about the source of their energy supply. Available and low-cost will win the vast bulk of the time.

For investors and corporates, we believe it will be important to differentiate between:

viable technologies simply going through a correction phase (residential solar?) versus those where the path to viable, profitable business models is less certain (offshore wind?).

areas where individual projects are viable with government subsidies from legislation like the Inflation Reduction Act in the United States, but where the timing of being able to achieve scale ex-subsidy is less certain (many hydrogen projects?).

Countries will seek to reduce geopolitical and energy price inflation exposures for the benefit of their citizens. As such, new energies development will understandably have a heavy policy component to it. Many new energies areas will see substantial growth in coming decades. What we have not seen yet is a silver bullet solution that will allow the other 7 billion people on Earth to enjoy the energy wealth The Lucky 1 Billion of us take for granted without using growing quantities of traditional energy. By the same token, we do not believe it makes sense to rely on traditional energy alone to satisfy energy's global TAM. We will need everything.

China is choosing an all-of-the-above approach to energy in contrast to "climate only" wishful thinking

China is becoming the energy Rorschach test for what you believe when it comes to energy. For those that (still?) believe rapid energy transition is possible, one can point to China leading the world in renewables growth, electric vehicle sales, and processing and producing critical inputs for new energies. For those skeptical of new energies (1) China is now by far the largest consumer of coal and is driving global coal demand to all-time highs and (2) in a few years China will eclipse the United States as the largest consumer of oil and is a major contributor to global oil demand being on-track for continued growth for the foreseeable future.

What is the takeaway? When you are trying to improve the living standards of 1.4 billion people, you need A LOT of all forms of energy. To summarize China's geopolitical challenges around energy, it is our view that China would strongly prefer its citizens use coal-fired EVs over OPEC- or US shale-fired ICE vehicles. The environment, or at least the clean air category, might well benefit from its EV push. But this to us is much more about reducing its now massive oil import dependence than a feel-good "net zero by some round number year" pledge (Exhibits 4 and 5).

Exhibit 4: China motivated to reduce its massive oil import dependence

Source: EI Statistical Review of World Energy, Veriten.

Exhibit 5: China per capita demand has tripled, yet is still half the level of Thailand and well below rich countrie

Source: EI Statistical Review of World Energy, Our World In Data, Veriten.

China is but one of four groupings of 1.4 billion people we have highlighted, with the others being the rest of southeast Asia, India, and the continent of Africa. The rest of southeast Asia is comparable to China today. India and Africa are well below these areas. All four are well below where The Lucky 1 Billion are in terms of economic development and hence energy usage.

Honestly, it's not a close call on these points. We can certainly debate the quality of host governments, local institutions, and the potential to achieve or sustain economic lift off. But it is just a question of timing in our view. The long-term formula for economic prosperity is proven: capitalism, in all its forms, fueled by access to abundant and affordable energy. The only ideology we promote at Super-Spiked is that we are pro-capitalism, anti-socialism. We also encourage strong pushback to Malthusian, de-growth pessimism.

We need fewer scenarios and more projections

The fundamental underpinnings to structural growth in oil, natural gas, and coal demand—along with eventual growth in many new energies areas—stand in stark contrast to various "net zero" scenarios from western world institutions like the IEA and, ironically, most of the major oil companies that publish energy outlooks.

In a nutshell, all of the high-profile, western world energy authorities appear to solve for various CO2 outcomes and then back-solve for implied oil, natural gas, and coal demand; hence the smooth downward sloping oil/gas/coal demand lines. All are heavily caveated if you read the fine print. But it should be to no one's surprise that the scenarios are typically treated by some as explicit pathways and have been weaponized to support a "keep it in the ground" approach to energy supply and infrastructure.

Some will push back with the point that the IEA and others have various "business as usual" (BAU) scenarios and not just net zero pathways. The BAUs all seem to imply pessimism about economic growth and energy usage from the other 7 (soon to be 9) billion people on Earth. China appears to be treated as a one-off from 2003-2019, even as it has only achieved middle income status with clearly higher aspirations (which may or may not be achieved).

One of the few groups to make a long-term projection grounded in pragmatic reality is OPEC's research arm via its recently updated World Oil Outlook (here). We are discovering that the research group at OPEC does excellent work. Some will dismiss its efforts given it comes under the OPEC banner. We would suggest actually reading the materials and drawing your own conclusions.

⚡️On A Personal Note: 2-Year Anniversary of Super-Spiked

November 18 marked the 2-year anniversary of Super-Spiked. It has been a ton of fun re-engaging with the broader world on the outlook for energy. To all readers, we can only say thank you! Your comments, engagement, and feedback are why we have been producing content just about every week for the past two years. We will use the Q&A style to answer the burning questions I know you all have.

How do you come up with your topics each week?

If I feel strongly about an issue, content creation is more or less effortless. It is by being engaged in the sector through all of my past and present affiliations as well as through engagement with readers that I decide what to write about each week. There is no magic trick; there is not even much of a "future topics to write about" list. In my view, the best content is created and delivered from the heart.

What do you struggle with most when creating content?

Trying to maintain an even-keeled, inclusive tone while still expressing our strongly stated views. I don't think anyone will confuse Super-Spiked for being a left-wing publication. But we also work hard to keep it from being right-wing in the US context of the term. Terms like "moderate" or "pragmatic" should NOT suggest an inability or unwillingness to hold strong views. As someone who still identifies as an equity research analyst, the goal is simply to call what I think is actually on-track to happen.

Why aim for inclusivity?

I hate partisan politics and see zero reason why energy sources or technologies should be in the domain of one side or the other. I consume a large swath of energy-related content. It is pretty clear that those producing content at one extreme ("urgent climate crisis") or the other ("CO2 is good as it makes the world greener!") are not on-track to make the right call when it comes to the outlook for energy—either in terms of projections or when it comes to formulating policy to address the challenges that exist on energy abundance, affordability, geopolitical security, and the environment. The risk in not being inclusive would be missing out on opportunities that do not fit a prescribed narrative.

What are your plans for year three of Super-Spiked?

Content always needs to evolve both in substance and style. I appreciate there are many requests to provide explicit investment advice; I have no interest in doing so via Super-Spiked. I recognize that my subject matter often skews toward "oil" or generically "new energies." Natural gas, midstream/downstream/infrastructure, power, and various new energies sub-sectors are all opportunity areas for year three and beyond. We continue to add to our analytics around all aspects of energy and we will look to not simply default to our oil background in as many posts.

How has un-retiring to Veriten impacted Super-Spiked?

The decision to un-retire and join Veriten in 2023 is on-track to have been as good of a decision for me personally as was my retirement from Goldman Sachs in 2014. Perhaps the kids will come home after completing college and it will be time to re-retire (a minimum of five years to go). I could play golf, ski, and travel with my family 24/7/365 without the kids' schooling getting in the way once they all graduate. Of course, it's also possible, some might say preferred, that they go on to live their own lives with their future families. For those of you with post college kids that live near (though perhaps not with) you, I am sure you already realize how super lucky you are!

Network expansion is the key benefit as it relates to Super-Spiked, which is incorporated into content through a better understanding of energy supply/demand, policies, and technologies. As an example, at Veriten we have our NexTen energy fund, which is focused on investing in new energies (including improving the environmental impact of traditional energy). The ability to hear about a broad range of new energies companies has helped me better understand the opportunities and challenges that come with almost all of the new areas.

⚖️ Disclaimer

I certify that these are my personal, strongly held views at the time of this post. My views are my own and not attributable to any affiliation, past or present. This is not an investment newsletter and there is no financial advice explicitly or implicitly provided here. My views can and will change in the future as warranted by updated analyses and developments. Some of my comments are made in jest for entertainment purposes; I sincerely mean no offense to anyone that takes issue

Excellent piece as always Arjun. Hopefully our politicians will evolve to the idea that we need to consider tradeoffs -- economic growth with mitigation strategies and multiple energy sources (renewable and non-renewable) instead of reduced emissions at all costs.

Arjun,

Another great write-up and start to the holiday season.

Agree 100% with your note and the need for all modals of energy source to be utilised over the next few decades at a minimum.

Governments need to get out of the target dates and just acknowledge that the transition is going to take time.

Would love more commentary in Year 3 around the prospects for residential solar, offshore wind, and the realistic adoption of EV’s in the developed world ie The Lucky One Billion and impact on the energy transition.

Not looking for specific company investment ideas, but more around areas of focus e.g. pipeline, refiners, drillers, etc..

Very happy you are enjoying personal success.

Happy Holidays.

Steve