At Super-Spiked, we try to avoid the hot takes and short-term trading reactions to the news of the day. But there is A LOT going on in terms of geopolitics and macro policy with (1) OPEC+ announcing it would gradually return voluntary production cuts to oil markets, (2) Russia-Ukraine ceasefire discussion volatility, and (3) Trump Administration tariff pronouncements to name just a few of the firehose of cross currents. In this post, we will do our best to resist reactionary thinking and focus on the longer-term macro and strategic implications—the “long takes” so to speak.

Our main oil market conclusion is that the OPEC+ news in conjunction with tariff trade war uncertainty is understandably weakening oil commodity and equity sentiment and performance, but that we are not in a 2014 moment where a multi-year downturn followed nor a 2020 moment of extreme near-term downside risk. Instead, we believe the return of OPEC+ barrels removes a market overhang that needs to be worked through but will otherwise serve as a “clearing of the decks,” especially in a world where peak oil demand concerns are fading fast in a new energy pragmatism era.

A potential Russia-Ukraine ceasefire we see as being more relevant to global natural gas markets and could raise a new risk of a “when will Europe start buying Russia gas again” overhang. In our view, the timing of a potential return of Russia gas is probably still measured in years, but perhaps not decades. That said, energy pragmatism is slowly but surely coming to Europe, as even EU leaders are recognizing that de-industrialization is negative for Europe and that it is a net negative for environmental and climate concerns to simply export emissions to countries with weaker environmental and labor standards. As such, if Europe can somehow regain economic relevance, the long-term benefits for energy producers would likely be outweighed by any short-term volatility to global gas pricing whenever that day comes that Russia gas returns.

Our main conclusion regarding the prospects for a tariff trade war is that to the extent it is motivating Europe and Canada to return to supporting pro-business pragmatism, the volatility and uncertainty we are currently experiencing will have been worth it. The outlook for all energy providers would be enhanced if Europe could return to the land of living and breathing economies.

OPEC+ to reverse voluntary oil supply cuts over the next two years

On March 3, the OPEC Secretariat issued a press release (here) that stated that the eight members of OPEC+ that had voluntarily reduced production in November 2023 would gradually return those volumes over the course of 2025 and 2026.

Macro view:

We have been firmly in the SuperVol camp and have regularly stated that corporates and investors should be prepared for inevitable 1-2 standard deviation moves in oil (on a quarterly average basis) both up and down. This corresponds to the risk of at least $20/bbl swings on a rolling 3-month average basis.

There is nothing about OPEC+ headlines, the state of Russia-Ukraine ceasefire discussions, or Trump tariff pronouncements that suggests anything other than SuperVol is the appropriate macro tagline.

For both corporates and investors, it means having dry powder to invest during periods of weakness and to not get carried away during higher priced periods.

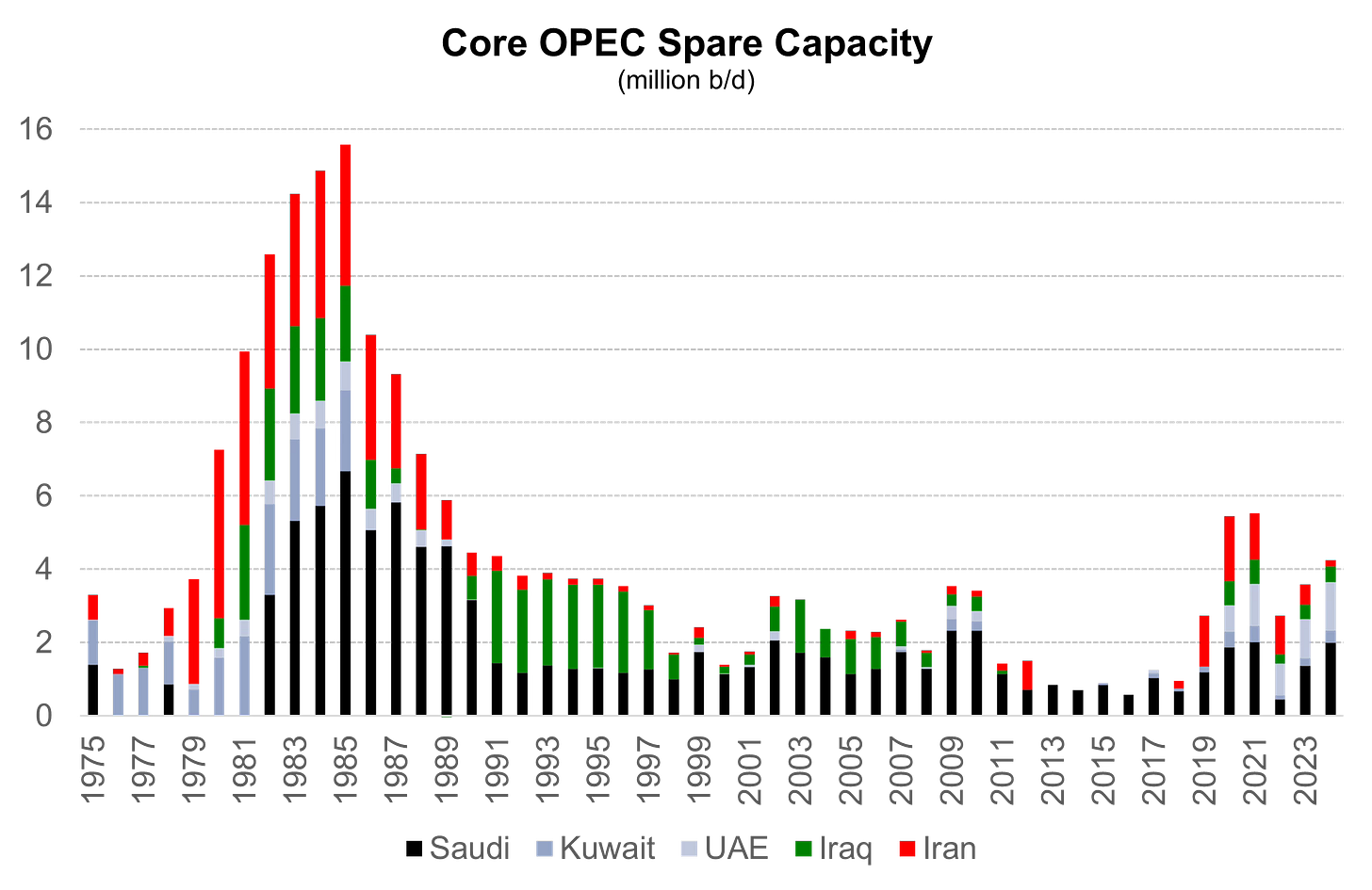

OPEC+ has more spare capacity than it did prior to the voluntary cuts but less than is typically indicated by consensus headline figures. We estimate our preferred Core-5 OPEC producer grouping (Saudi Arabia, UAE, Kuwait, Iraq, Iran) currently holds about 3-4 million b/d of total spare capacity, but perhaps only 2 million b/d above typical minimum levels of spare capacity (which we peg at 1-2 million b/d) (Exhibit 1).

From a long-term perspective, we don’t spend a lot of time stressing about whether OPEC+ brings back the extra 2 million b/d cushion today or in the future. Clearly, short-term balances and sentiment are impacted by the speed and timing by which it returns.

Corporates and investors should never believe that OPEC+ can cut its way to a secular bull market. That requires structural growth in global oil demand in excess of non-OPEC+ production. Investors in particular have never shown enthusiasm for propped up oil prices. Therefore the return of OPEC+ voluntary cuts we see as a clearing event to improved investor interest in the sector in the future.

While being mindful of near-term trading risks is understandable, we are not expecting a multi-year extended down cycle in the vein of the 2015-2020 period to follow.

As such, while the risk of short-term weakness is somewhat higher than before the news, we would look for opportunities to lean-in to any corrections from an M&A or investment perspective.

Exhibit 1: Super-Spiked estimated OPEC “Core-5” spare capacity

Source: Veriten, Energy Institute, IEA.

Implications of the rise of The Energy Pragmatism Era:

We believe concerns are fading that oil demand is in the process of permanently peaking. We say that even as we acknowledge short-term GDP choppiness and challenges in China mean oil demand growth is likely to remain sub-1 million b/d per year for at least the next several years. While oil markets are sufficiently supplied in the near-term, the non-peaking of oil demand suggests new supply sources will be needed in the years and decades ahead irrespective of the timing and speed by which OPEC+ removes voluntary cuts.

There is no substitute to countries having healthy and growing domestic oil and gas industries. The US economy is far less impacted by OPEC+ decisions than prior to the shale revolution. Canada is also in the enviable position of producing more than its domestic demand.

By contrast, a mis-guided prioritization of climate over geopolitical security has rendered Europe’s economy to be far more vulnerable to the whims of the rest of the world be it OPEC+ members or any other country including the United States. It is not clear to us why Europe would not want to maximize its own domestic oil and gas production. While European leaders and voters appear to be awakening to the need for a major course correction on a range of issues including energy and climate, there are still many steps and actions needed to get Europe on a healthier economic and energy policy track.

If downside risks were to materialize in 2025 (i.e., sub-$60/bbl WTI), deep value opportunities might become especially interesting in regions like California, Alaska, Alberta, and perhaps even the North Sea where some combination of federal or local energy policies in the name of climate have been hostile to oil and gas development.

Our main conclusion for crude oil markets are as follows:

Oil markets are not facing a 2014 moment where a multi-year downturn ensued. We are also not expecting a 2020 moment of extreme downside risk.

Instead, we recognize that a normal 1-2 standard deviation downside move to oil prices is possible—i.e., sub-$60/bbl WTI—but we would see that as a clearing-the-decks event for the next move higher.

Potential Russia-Ukraine ceasefire

Macro view:

We see the Russia-Ukraine conflict as more relevant to global gas and LNG (liquefied natural gas) markets than crude oil.

The potential return of Russia natural gas flows to Europe following a ceasefire is a major overhang, even as such a return seems unlikely to occur in the short-term. The real question is how long before memories fade and the temptation of inexpensive Russia gas triumphs over the reality of higher priced LNG imports and non-existent green hydrogen markets? The time lag to answering this question is likely measured in years, but perhaps not decades.

We can only conclude that SuperVol also applies to global natural gas, US natural gas, and LNG markets. Said another way, the implications are probably more around cost of capital in the near term (i.e., continuous market speculation that Russia gas could return), with long-term downward European price risk if or when Russia gas flows do actually return.

Implications of the rise of The Energy Pragmatism Era:

Similar to oil, peak natural gas demand is even less likely and unlike oil it does not suffer from excessive China slowdown and substitution concerns. We see significant potential for natural gas to be a critical future fuel to help meet global power and industrial demand.

The rise of energy pragmatism seems especially relevant to the outlook for European natural gas demand. European de-industrialization is now broadly understood with price-competitive energy a pre-requisite to a healthy industrial economy.

We are highly skeptical that green hydrogen will prove cost competitive any time soon. The challenge for Europe and US LNG exporters is that LNG is not exactly an inexpensive fuel source for importers even as it volumetrically is viable in a way that the so-called hydrogen economy is not.

In the best case for its own citizens, Europe would take steps to meaningfully stimulate new domestic natural gas production sources. But if local environmental hostility remains a bottleneck, we believe Europe could some day fall prey to the temptation of allowing inexpensive Russia gas to return.

Our main conclusion for LNG markets is:

Europe matters for LNG in a way that it really doesn’t anymore for crude oil. This is a dual edged sword at the moment.

Europe’s “net-zero-is-all-that-matters” energy policy madness has made it dependent on LNG imports for the foreseeable future. But LNG is expensive to import and overall high energy costs are a major driver of de-industrialization on the continent.

As such, if Russia gas did return someday, it would likely prove disruptive to global LNG trade (for a period of time while it was being reabsorbed), but along with a grudging move towards energy pragmatism, a brighter outlook for Europe’s economy should be welcomed by all energy producers.

Trump Administration tariff trade war

We will preface this section by stating that while we have long been in the “free-trade-is-best” camp, we recognize that changes to the global economic order of recent decades are needed, are happening, and that the drivers and nature of change can be messier than what global elites (including ourselves) sometimes think is sensible. We should all be humble and acknowledge that there is plenty of evidence that the upper echelons of society do not always know what’s best for their fellow citizens or the wider world. Former presidential candidate Ross Perot famously warned in the 1990s about the giant sucking sound of American jobs going to Mexico (and eventually China and other regions). He was right about industrial job losses. President Trump is ushering in an uncertain new era of needed course correction.

Macro view and the implication of the rise of The Energy Pragmatism Era:

We have argued in recent months that every country’s strategy toward energy should be “[My Country] First” with a prioritization of energy abundance and reliability followed by affordability and geopolitical security, only after which are environmental and climate concerns considered. The Trump trade war we think is likely to reinforce this idea.

In the short-term, we recognize that downside risk to global GDP has increased due to the trade war as a mixture of disrupted trade flows and potentially higher inflation will have an uneven impact around the world.

In the long-run, the need to have strong domestic energy industries and manufacturing bases could be enhanced by the fact that citizens will be unified to prioritize the economic and geopolitical health of their country over environmental obstructionism. We see early signs of this movement happening in Canada and Western Europe, the latter of which has seen its economic and military relevance deteriorate significantly in the decade since the Paris Agreement became its defining objective.

Are permitting bottlenecks getting in the way of expanding energy infrastructure? Are certain domestic lands being placed off limits due to pressure from progressive crusaders? The combination of energy pragmatism coupled with “My Country First” economic policies suggest the opportunity exists to remove domestic investment barriers that have arisen in rich countries like the United States, Canada, and Europe. Build, baby, build is not just an energy thing; it ought to apply to manufacturing as well, underpinned by abundant, reliable, affordable, and domestic (i.e., geopolitically secure) energy.

Our main conclusion from the Trump tariff trade wars is that if they can drive pro-business pragmatism in places like Europe and Canada (federal government), the noise and volatility may well be worth it.

⚡️On A Personal Note: THRIVE and the ballpark formerly knowns as Minute Maid

This past week I had the great pleasure of attending Daniel Energy Partners THRIVE Energy Conference at the ballpark formerly known as Minute Maid Park and recently rebranded to Daikin Park. I believe Daikin is a Japanese HVAC company of some kind. As a diehard Yankees fan who has only experienced the horrors of Minute Maid, the new name can only be good news. Yankees fans have not had the hearts ripped out at Daikin, at least not yet. And for the record, I do not discredit the Astros 2017 title due to their advanced use of technology. In my book, denigrating that title is losers talk. The Astros won and the Yankees haven’t since 2009. We have been stuck at 27 World Series titles for a long 15 years and counting.

Baseball nightmares aside, great job by John Daniel and everyone at Daniel Energy Partners for putting on a terrific and unique show. I know all of us at Veriten appreciated the opportunity to attend the event and host a lunch discussion with a leading NOC. Given that DEP has a Street research/markets background not dissimilar from my own, I really appreciated their unique value proposition and niche.

THRIVE was part traditional sell-side conference with industry executives discussing their outlook. However, the inclusion of analysts from various Street banks, buy-siders, and other outsiders—yours truly included—as co-moderators added a unique flavor to the panels and fireside chats. The conference is also part trade show, especially for the supply chain side of the energy business. The opportunity to interact with non-c-suite industry participants is unique and welcomed, in particular at an event that is not simply a trade show but had the c-suite, leading buy-siders, and other sell-side analysts.

While the energy business has always had boutique capital markets firms—I started at Petrie Parkman in 1992—that mixture of unique content with a “we are friends with everyone and enemies of no one” feeling that DEP exudes stands apart. My THRIVE experience started with waiting in a short line at the start of Day 1 to check-in and pick up my badge. That is where I met John Daniel who came out to apologize to attendees for what was maybe a 180-seconds-long line to get into a major league ballpark. Great customer service. Great event. Thank you for having me.

Good times at the ballpark formerly known as Minute Maid

Source: Super-Spiked selfie.

⚖️ Disclaimer

I certify that these are my personal, strongly held views at the time of this post. My views are my own and not attributable to any affiliation, past or present. This is not an investment newsletter and there is no financial advice explicitly or implicitly provided here. My views can and will change in the future as warranted by updated analyses and developments. Some of my comments are made in jest for entertainment purposes; I sincerely mean no offense to anyone that takes issue.

“Our main conclusion regarding the prospects for a tariff trade war is that to the extent it is motivating Europe and Canada to return to supporting pro-business pragmatism, the volatility and uncertainty we are currently experiencing will have been worth it.”

Potentially permanently destroying a trusting multi-decadal trade paradigm composed of almost completely free trade painted as tough love for neighbours is taking bending over backwards for the new regime to the next level, no?

I have to respond to this notion that the “trade war” presently directed at Canada could not only be some kind of short term irritant but that by making us more “pro-business” it could even prove to be beneficial.

For my first observation I will quote the following excerpt from the speech that President Kennedy gave to the Canadian Parliament on May 17, 1961.

“Geography has made us neighbors. History has made us friends. Economics has made us partners. And necessity has made us allies.”

May I suggest that the only part of that statement remaining is the “neighbour” part, a part that I currently wish we could dispense with.

My second observation is that the Wall Street Journal has not only called these tariffs “stupid” but it added that the stupidity part might even have been understated. No Arjun, this is not a short term irritant, we are talking about long term permanent damage.

My last observation is that as an American you should be equally worried. Don’t you have something called “Congress” to stop this nonsense or do you think Americans prefer to be ruled by a Putin twin?

Michel Lafontaine