Next 10 Years of Perpetual Transition: China

Perpetual Transition

We ended summer with a trio of video podcasts that evaluated the last 30 years of “perpetual transition” in the energy sector through the lens of the broad energy macro (here), sectors & corporate strategy (here), and geopolitics & policy (here). With that groundwork, we now look ahead to big changes we expect over the next 10 years. We start our new series with a peek into China—undoubtedly the dominant driver of broad commodity markets over the past 20 years—given growing concerns about the prospect for slower GDP and energy demand growth in the coming decade.

Among energy markets, we see China uncertainty as being most meaningful for crude oil, surprisingly less relevant for refining, and irrelevant to biofuels. For natural gas/LNG (liquified natural gas), we expect China to be price-sensitive buyers given its massive, low-cost indigenous coal resource. With that said, there are energy supply diversification and perhaps geopolitical benefits that support continued growth in LNG imports into China.

Our over-arching conclusion with China is that it is pursuing logical, “China First” energy policies that prioritize availability, reliability, affordability, and geopolitical security. It is clearly pursuing an “all of the above” approach to energy but where there is a strong national interest to try to moderate future growth in crude oil imports. As we have long believed, China would much rather have coal-fired EVs (electric vehicles) than USA/Saudi/Russian oil-fired ICE (internal combustion engine) vehicles.

Crude oil: China material for crude oil, but not refining

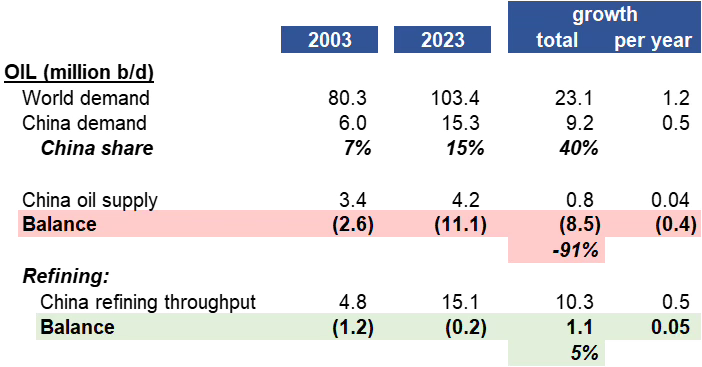

Starting with oil markets, China is unsurprisingly highly relevant to crude oil markets but perhaps less expected is that it far less important to the outlook for refining looking forward (Exhibit 1).

Over the past 20 years, China accounted for 40% of global oil demand growth, contributing about 0.5 million b/d per year on average out of total global growth of 1.2 million b/d per annum on average.

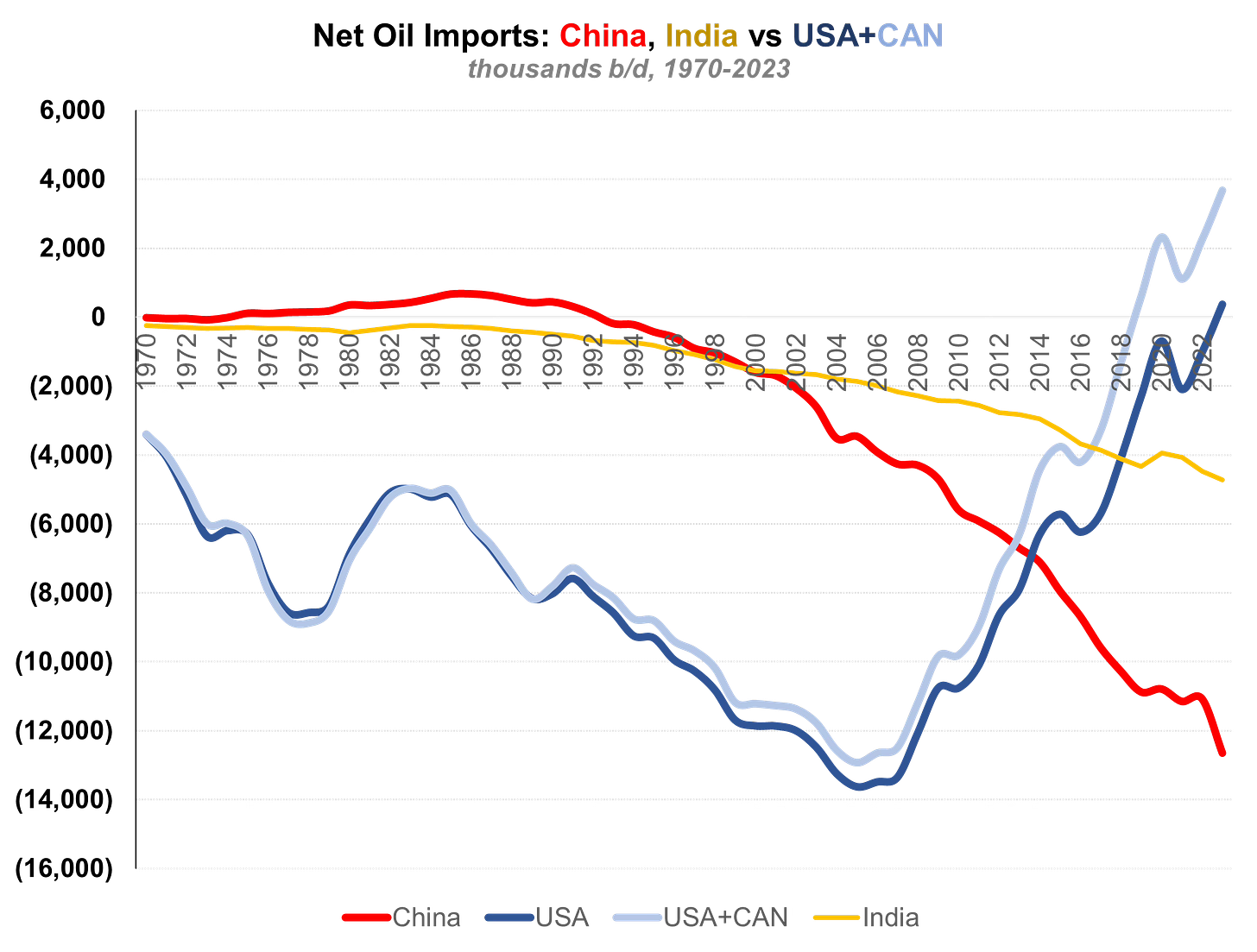

China’s growth in oil demand far exceeded a more modest uptick in its domestic oil supply, resulting in it becoming by far the world’s largest crude oil importer (Exhibit 2). Notably, over 90% of China’s growth in oil demand was met by increasing crude oil imports, with a call on crude oil imports that grew by an average of just over 0.4 million b/d per year for the past two decades (Exhibit 2).

China has flipped places with the United States where the shale revolution has essentially eliminated our dependence on net foreign oil imports (there is a refining infrastructure need for the United States to export light crude oil barrels and import heavier grades).

China did, however, grow its domestic refining capability to essentially match domestic demand. With few, known refinery projects on the docket, we do not see potentially slower China oil demand growth as particularly relevant to the outlook for global refining. A slowing China we see as much more of a risk for crude oil rather than refined products markets.

For global oil markets, the current uncertainty around China is reminiscent of the transition from the Asia “Tigers” and “Tiger Cubs” in the late 1990s to eventually China by the mid-2000s, which we discussed in our inaugural 30 Years of Perpetual transition video (here). We expect India and other Asia countries to eventually take the mantle from China as the key driver of oil demand. However, the intervening period could be rocky, consistent with our Super Vol commodity framework.

For China, and sticking with the Asia Tigers precedent, we would not be surprised to see it return to more meaningful oil demand growth after a period of transition, especially if the country does in fact march higher on the economic s-curve.

Exhibit 1: Oil: China material to crude oil markets, but not Rest of World refining

Source: Energy Institute, Veriten.

Exhibit 2: China met over 90% of its growth in crude oil demand via imports

Source: Energy Institute, Veriten.

Biofuels: China is irrelevant

We have been spending time (re-)ramping up on biofuels and renewable diesel in particular so are including this section to make a few observations about China and biofuels in general.

Despite massive economic and energy demand growth over the past 20 years, and despite being short crude oil, China is non-existent in biofuels (Exhibit 3).

We believe this is consistent with our long-held view that biofuels are not a serious competitor to petroleum products due to the poor, unsubsidized economics of most (all?) biofuels, including corn ethanol, biodiesel, and renewable diesel.

It bears repeating: China is short crude oil, has experienced massive growth in its oil imports, but has ostensibly been uninterested in biofuels.

In contrast, China is in the midst of a major ramp in EVs, which we have viewed as a more serious competitor to gasoline than biofuels.

Biofuels growth in the United States and Europe we believe is entirely due to it being required by law. China, to its credit, has not followed the US or Europe down this road.

Exhibit 3: Biofuels: China has been uninterested

Source: Energy Institute, Veriten.

Coal: Geopolitical security blanket, abundant, affordable, reliable

China is now overwhelmingly—and it’s not a close call—the king of coal markets (Exhibit 4). It has accounted for just over 100% of global growth over the past 20 years and is now 56% of global coal consumption. Coal is an abundant, inexpensive domestic resource that allows for dispatchable power generation, in addition to supporting domestic jobs and investment opportunities.

It is not a core focus of this post, but we would observe that all “net zero” scenarios we have seen assume a sharp and quick decline in global coal consumption starting within the next few years through 2050. We are skeptical—or certainly see zero evidence—such a scenario will be pursued by China and other developing market economies. It is not even obvious coal demand will flatten out on a global basis in coming decades.

Exhibit 4: Coal: An abundant, reliable, affordable, geopolitically-secure domestic resource for China

Source: Energy Institute, Veriten.

Natural gas: Supply diversification opportunity

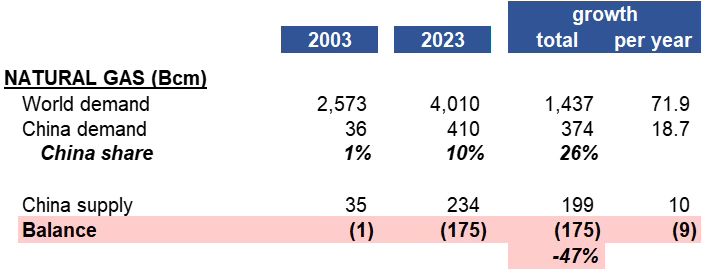

China’s role in natural gas markets is interesting and does not lead to simple bull/bear conclusions. Over the past 20 years, China has accounted for 26% of global growth in natural gas demand, but a little over half of the growth from domestic supply expansion, with the remainder from a combination of pipeline and LNG imports (Exhibit 5). We see natural gas as an important balancing fuel for China in terms of providing energy supply diversification at a reasonable cost. Given its massive domestic coal resource, we would expect China to be price-disciplined buyers of imported natural gas (pipeline or LNG).

Exhibit 5: Natural gas: Energy supply diversification opportunity

Source: Energy Institute, Veriten.

Super Vol macro framework in an era of China uncertainty

Our core energy commodity macro framework remains one of “Super Vol” as opposed to “Super Cycle” when considering crude oil, refining, and natural gas prices. Of those three areas, refining seems most likely to have the opportunity for a super cycle, or perhaps another “Golden Age,” given our expectation for continued growth in crude oil demand juxtaposed against a paucity of new refinery projects anywhere in the world post 2025.

For the past 18 months, crude oil has traded in an increasingly narrow trading band between $70-$90/bbl for WTI (West Texas Intermediate spot oil), which has recently further narrowed to $75-$85/bbl (Exhibits 6 and 7). The collapse in crude oil volatility we do not believe is sustainable, and the downdraft this past week could well be a hint of what is in store. A number of high-profile Street energy commodity analysts have highlighted downside risk concerns for 2025 WTI owing to lackluster global GDP growth (and hence oil demand growth) coupled with a mini-surge in non-OPEC oil supply in 2025.

We are mercifully no longer in the short-term barrel counting or oil price forecasting business and instead offer these thoughts:

Crude oil prices have hung in better than refining margins or Henry Hub natural gas, both of which look to be closer to the low end of likely trading ranges.

A flush in WTI oil to a $50-$60/bbl level might be what is needed to reinvigorate interest in energy equities, which have similarly been in a stubborn trading range since reaching highs in October 2022 that closed a 2-year period of strong outperformance versus the S&P 500. To reiterate, we no longer publicly forecast short-term oil prices and will take no credit (or blame!) if such a flush happens or doesn’t happen.

Rather, and as always, we believe corporates and investors should always be prepared that in any 12-month period a “normal” trough (e.g., $50/bbl WTI) is possible; building cash during higher priced-periods and saving dry powder for inevitable downside volatility is a staple of our corporate strategy and investment framework.

Exhibit 6: WTI volatility over past year at unsustainably low levels

Source: Energy Institute, Veriten.

Exhibit 7: Crude oil has, thus far, hung in better than refining margins or Henry Hub natural gas, but we do not expect this increasingly narrow trading band to persist

Source: Bloomberg, Veriten.

Strategy and investing takeaways

Our key takeaways from our “Next 10 Years of Perpetual Transition” look at China are as follows:

Super Vol not Super Cycle we believe remains the correct call for energy commodity macro markets, in particular crude oil.

A flush in oil markets we think would clear the deck for the next major leg up in energy equities, where our long-term outlook of rising oil and natural gas demand coupled with structurally improved sector profitability otherwise remain intact.

The area of energy that looks closest to moving to super cycle mode is refining, though inherent margin volatility make the old “Golden Age” branding (credit to my friend and former competitor Doug Terreson for coining the term) the better descriptor. Unlike crude oil, we do not see refining as meaningfully impacted by a potential slowdown in China’s oil demand growth.

For LNG markets, we believe companies that have long-term contracts, supply and markets diversification, and have leading commercially optimization capabilities are best suited to thrive in the decade ahead.

Finally, the source of supply bottlenecks and demand needs are likely going to be more volatile than the past 20 years, providing significant opportunities for midstream and infrastructure companies.

⚡️On A Personal Note: Emptied Nest!

Our baby is now in college. And while the oldest, thank goodness, moved back to New York following her own recent graduation, the house is quiet. As of publication time, we will be two weeks in. The big winner so far is our golden doodle, who is happy to have back all three sections of our main relaxation couch, with no more adult kiddies hogging her favorite spots. Unsurprisingly, organic depletion rates for stored beer and wine have slowed.

Fortunately, there is a lot to look forward to in coming months. We are about to start Fall golf, my favorite golf season in the US Northeast, with the flighted Club Championship starting at our club on September 8. Trips to Houston, Oxford, St Andrews, Austin, Denver, and Boulder are on the docket for September and October. Finally, it is the golden period of the start of college football and the NFL along with the baseball playoffs. Thrilling week one victories for the CU Buffs and USC Trojans provide hope that we could have college football cover for the risk of another disappointing Yankees playoffs run and a similarly uncertain outlook for America’s Team. Fortunately, we are also only six weeks away from a promising Knicks season kicking off!

Empty Nest winner: Doggie outlasted the competition for couch spots

⚖️ Disclaimer

I certify that these are my personal, strongly held views at the time of this post. My views are my own and not attributable to any affiliation, past or present. This is not an investment newsletter and there is no financial advice explicitly or implicitly provided here. My views can and will change in the future as warranted by updated analyses and developments. Some of my comments are made in jest for entertainment purposes; I sincerely mean no offense to anyone that takes issue.

Excellent article! Three super conclusions from this article:

1. "We believe this is consistent with our long-held view that biofuels are not a serious competitor to petroleum products due to the poor, unsubsidized economics of most (all?) biofuels, including corn ethanol, biodiesel, and renewable diesel."

Biofuels are hopeless losers. These industries only exist by the fleecing of taxpayers and capturing the police power of the state to decide winners and losers.

2. "Biofuels growth in the United States and Europe we believe is entirely due to it being required by law. China, to its credit, has not followed the US or Europe down this road."

I repeat: Biofuels are hopeless losers. These industries only exist by the fleecing of taxpayers and capturing the police power of the state to decide winners and losers.

3. "As we have long believed, China would much rather have coal-fired EVs (electric vehicles) than USA/Saudi/Russian oil-fired ICE (internal combustion engine) vehicles."

"China is now overwhelmingly—and it’s not a close call—the king of coal markets (Exhibit 4). It has accounted for just over 100% of global growth over the past 20 years and is now 56% of global coal consumption. Coal is an abundant, inexpensive domestic resource that allows for dispatchable power generation, in addition to supporting domestic jobs and investment opportunities."

World coal consumption has a very bright future. The West, especially Europe, imperils its own prosperity by demonizing coal. The world needs to consume massively more energy if the world economy is to continue to grow.

Thanks Arjun. You know that I always look forward to reading your views. I think that you meant “peek into China” not “peak”. Good luck with the club championship. Channel Scottie and you’ll do well.