Sentiment Watch: The 3Rs - ROCE rebounding, Recovering S&P weight, Rescued assets

It is still early days in the new energy crisis era

Sentiment toward the traditional energy sector is improving, albeit from the deep depths of pure hatred by all—traditional investors, ESG investors, and left-leaning politicians and policy makers in the rich, western world. Still, it bears remembering that at just over 4% of the S&P 500, energy is still well below its historic 6%-12% weighting. In fact, a furious rally has only gotten energy back to its pre-COVID January 2020 starting point versus the broader market, which itself had followed a decade of underperformance.

We are still a long way off from the sector garnering the type of capital inflows that would be consistent with the major CAPEX cycle that undoubtedly is required in a world where Russia is in the process of being ex-communicated from the normal global order, above- and below-ground inventories and spare capacity are exhausted, and global consumers did not get the memo that they were supposed to stop demanding so much oil due to climate concerns. The latter is particularly shocking given broad-based tolerance for pipeline obstructionism; I thought if we stopped building new oil pipelines, oil demand would magically disappear? (relax, these last two sentences are a joke.)

As sentiment improves, there are many different avenues toward value creation. One area that I find particularly intriguing is the change in sentiment that is likely to come to previously “stranded” assets that investors, die-hard climate activists, and corresponding politicians argued were no longer needed. I think the new term needs to be “rescued” oil and gas fields. It has been grudgingly acknowledged by most that the Permian Basin and core OPEC would likely be the “last barrels” produced in the energy transition. As we push out (possibly well out) in time that last day, more regions undoubtedly are moving back in-the-money. Terminal and going concern valuations for traditional energy is on the rise.

What do we know or think we know?

Up until very recently, the traditional energy sector was despised by just about everyone — traditional investors, ESG investors, and politicians and policy makers sympathetic to current leadership in the United States and Canada. Whether you were a die-hard climate activist or merely a run-of-the-mill mutual fund portfolio manager, you wanted the traditional energy sector to simply go away.

Returns on capital ended a 15 year downturn in 2020, with a big bounce in 2021 to around 10% and 2022 on-track to get back to very healthy levels potentially above 20% (Exhibit 1).

While sentiment toward the sector is decidedly less negative among traditional investors with Energy back to 4.2% of the S&P 500 versus a historic trough of 2% in October 2020, we are still well below its “normal” historic weighting of 6%-12% (Exhibit 2). In fact, despite the sharp outperformance in 2021 and 2022-to-date, all we have seen is a recovery of lost ground from the 2020 COVID sell-off.

Above-ground inventories are exhausted. OPEC spare capacity is essentially exhausted. The world is in the process of ex-communicating Russia, which is a Top 3 global crude oil producer and exporter. Producers in regions that accounted for 70% of global oil supply growth last decade—the United States and Canada—face overt hostility from their own countries’ respective governments.

Global oil demand has recovered to pre-COVID levels of around 100 mn b/d. With the eventual loss of Russia supply, possibly short-term but almost certainly long-term, balancing oil supply/demand and rebuilding inventories will require a combination of demand destruction and a major CAPEX cycle.

Remember the starting point: a despised-by-all traditional energy sector that for the better part of the previous decade was generating structurally poor profitability and whose existential existence was being seriously called into question. The reaction time to flipping the switch back to CAPEX growth mode is sure to take longer and require a bigger mindset shift change and sentiment improvement than what we have seen thus far.

What do we need to find out or are likely to find out in the coming year?

Are we past the point of no return with Russia where it will move to pariah state status and essentially be removed from the global order of nations? I personally think Russia is past that point, but, as I have written here, cutting off Russia will not be simple and will involve significantly greater global pain than previous pariah state examples of Iran, Iraq, Venezuela, and Libya.

If for whatever reason there is no meaningful reduction in Russia’s oil supplies, we still need a major traditional energy CAPEX cycle that up until five minutes ago exactly no one wanted.

The prospect of a healthier relationship between the current federal governments in the United States and Canada to my surprise (not being sarcastic in this case) has not budged even after Russia-Ukraine. It’s unfortunate, but it is what it is. That said, we have seen some movement on the part of at least some of the left-of-center, “climate only” crowd to recognizing we will need higher oil supply from at least US shale oil producers. Furthermore, elections happen and we shall see if citizens intuit that a radically different approach to energy and climate policy is needed versus what is currently on offer (from either party in the USA).

What are the highest confidence implications of the above points?

Higher returns on capital will attract capital back to the traditional sector. The S&P weighting will go up; I had previously forecast a return to above 5%—a pretty wimpy forecast and a sign I am exhibiting the symptoms of unhelpful over-caution. So let me be more clear: energy’s S&P weighting should return to at least 10% within the next few years given the improvement in profitability it has already and I believe will continue to demonstrate. The one word of warning that does still bear mentioning is that it’s never a straight-line with this sector—“super volatility” is the new norm.

The sector’s shareholder base will go through its traditional evolution from deep value to value to GARP (growth at a reasonable price) and, ultimately, to the periphery of growth and momentum; I can’t wait to again engage with the always fun mo-mo crowd (Exhibit 3)! Deep value curmudgeons demand dividends above all else and “maintenance only” CAPEX. When mainstream GARP investors ultimately return, I would expect the usual upward creep to CAPEX and growth expectations to return as well. When mo-mo returns, it will be time to start looking for the exits.

And let me be clear, the comments in the paragraph immediately above are based on 30 years of covering the sector as an equity research analyst. In this instance, this is not necessarily my view of what any particular company or group of companies should or should not do; I will save that advice for a separate post on navigating the new energy crisis era.

On the growth point, traditional energy is of course currently NOT and is unlikely to ever become again a true growth sector in the vein of areas like technology or consumer discretionary. But its weighting in growth indices (e.g, Russell Growth Index) can increase from de minimis to at least several percentage points as we saw in the 2000s super cycle era. Today, energy is less than 1% of Russell Growth, a range it has been stuck in since 2015; in 2010-2011, Energy reached 10%-12% of the RLG (Exhibit 4). I will forecast that Energy will get back to at least 5% of Russell Growth within the same time frame it reaches 10% or more of the S&P 500. Heck, with streaming apparently replacing shale as an over-built, over-hyped, low-return business, the return to “growthy” investor acceptance could be faster than many expect.

When returns on capital were low and concerns about “peak oil demand” were at their highest in the 2020 time frame, there was significant talk about “stranded” oil and gas assets. The script is flipping. Previously “stranded” assets are being rescued by the combination of cyclical improvement and the new energy crisis era we have entered. Welcome back!

What are the most interesting “rescued” assets?

The main crude oil regions that investors expected to survive previous peak oil demand concerns were the Permian Basin, core OPEC (Saudi, UAE, Kuwait, Iraq, and Iran), and a handful of other areas like Guyana. I am sure I have forgotten an oil basin or two but there really wasn’t much confidence beyond these areas.

The forgotten areas that I think will garner renewed investor and corporate attention include Canada’s oil sands region and important deepwater basins such as the Gulf of Mexico, West Africa, and Brazil. To be sure, this is not a comment on 2022 capital spending. And a region like Canada might require a change in US and Canadian administrations in coming years, which is not possible before 2025 for both countries (I am pretty sure Mr. Trudeau’s current term runs until 2025).

We should all remember that during the initial 2000s-era super-cycle run-up between 2003-2010, there wasn’t even a faint inkling that US shale oil would be THE major oil supply driver over the subsequent decade. It is entirely possible that the next big growth basin could be a surprise that no one yet knows about. Of course with exploration no longer an activity in which oil companies partake, it may be the next decade before we figure this out—i.e., the 2030s.

How does energy transition impact all that I have written in this post?

We should still try to decarbonize in coming decades. New, low-carbon energy technologies combined with sensible (key word) energy and climate policies can help improve energy availability, affordability, reliability, and security. At this time, there is no evidence of sensible energy and climate policies anywhere in the western world that I can see.

Nothing in this note should be construed as: (1) a call to stop the decarbonization drive; (2) advocacy for a return to drill-baby-drill; or (3) a call to gut climate and environmental objectives.

That said, pipeline/infrastructure obstructionism advocated or pursued by many in the die-hard climate crowd needs to be explicitly and forcefully called out as something that is bad for energy availability, affordability, reliability, and security. I also firmly believe it is BAD for the climate and environment, as oil and gas production simply shifts from the USA and Canada to geopolitically hostile and environmentally-challenged areas like Russia and Iran.

A related notion we hear from the current Biden and Trudeau administrations as well as a surprisingly large number of left-of-center policy makers, I am now calling the “anti-Field of Dreams” approach as their core energy & climate policy. In essence, they argue that if we don’t build it, they won’t come (i.e., demand it). I actually think some sincerely believe that oil supply drives oil demand, not the other way around. Watching White House pressers does not give me much confidence the mainstream media understands these issues any better than politicians or policy makers. They all seem to believe that restricting new oil and gas pipelines and federal drilling permits is good for the climate, as opposed to something between bad or, at best, irrelevant (again, if you don’t produce it here, it will get produced elsewhere).

Where would I critique the oil and gas industry on climate? Slow-footing methane containment. Yes, technology, measurement, and attribution are not yet perfect even as significant strides have been made in recent years. Still, we are sufficiently progressed that an industry-wide or basin-wide methane containment strategies or regulation (ideally self-regulation) is urgently needed.

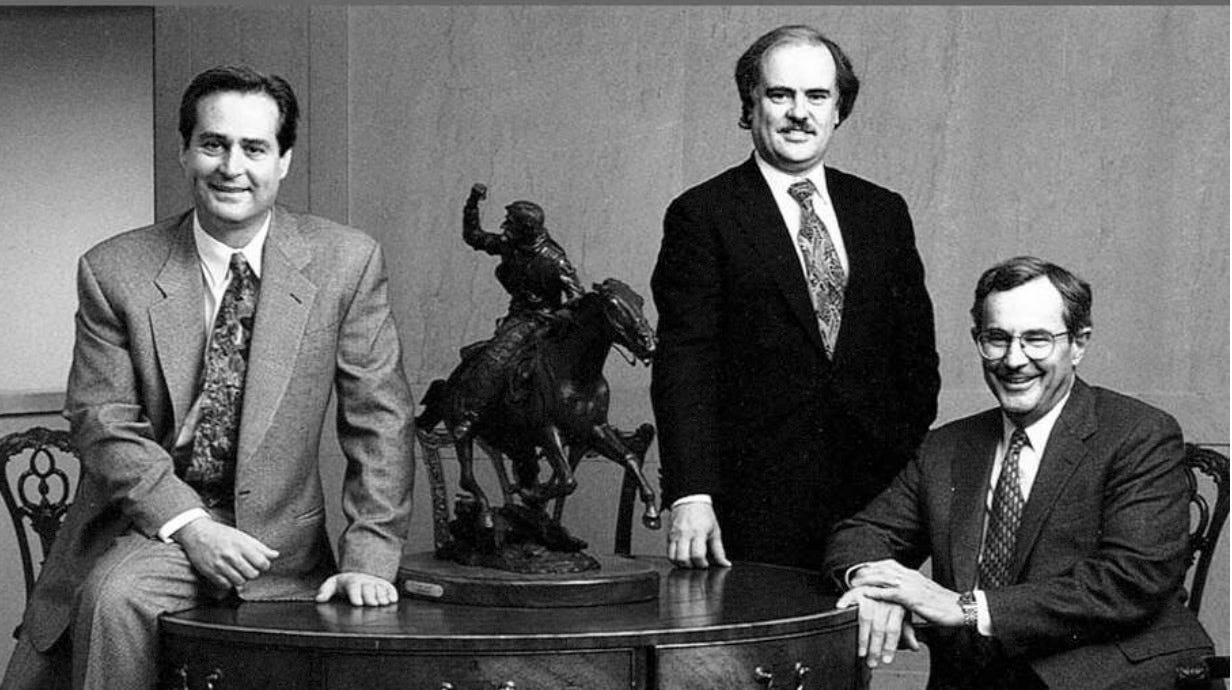

💰 + 🌳 Economic and Environmental Heroes: Inaugural edition featuring the founders of Cross Timbers

A core view of Super-Spiked is that sensible energy policies lead to a healthy economy AND a cleaner environment and climate. Energy is the primary variable to get right; climate is an aspect of sensible energy policy, not the other way around. In this inaugural edition of Economic and Enviornmental Heroes, I would like to recognize the founding team of Cross Timbers Oil Company, which was eventually better known as XTO Energy. Cross Timbers/XTO Energy were among the early breed of shale mavericks that were buying US oil and gas assets in the late 1990s and early 2000s at a time all of the so-called smart money absolutely knew without a shadow of doubt that the US was mature and you had to go international or offshore. In fact, this could turn into a future Dumb Calls I Made as a Street Analyst post as I was amongst the crowd that favored non-US E&P investment at that time.

XTO bought well and, ultimately, sold well—a rarity in the oil and gas business—cashing out to the tune of $41 billion from ExxonMobil in 2009. They ignored all of us that said you can’t make money in US oil and gas in the late 1990s and early 2000s. And then ignored us a second time when we argued the super-cycle still had many years to run; XTO was highly leveraged to US natural gas and the shale gas drilling boom it helped unleash put an end to that cycle by the end of the 2000s. (The one part of this call I did get right was my negative view of the XTO purchase from the perspective of ExxonMobil; see my Goldman research from that time frame.)

The shale gas boom of course is the main reason the USA has been able to significantly reduce its use of higher-emission coal for power generation. It has also helped ensure US natural gas prices have remained amongst the lowest in the world to the benefit of American consumers and businesses that use energy, which is everyone!

The shale gas boom ultimately moved from the Barnett Shale in Texas (a core XTO asset) to places like the Marcellus of Pennsylvania and the Haynesville of Louisiana (ArkLaTex). The United States is now a major liquefied natural gas (LNG) exporter thanks to shale gas; prior to shale, the US was projected to become a major LNG importer (yet another thing I incorrectly forecast in the early 2000s).

Europe, which took a different tact to domestic oil and gas development, is now dependent on friendly energy suppliers, like the USA, to displace hostile nations like Russia. Europe is also increasing its usage of coal at a time it has over-indexed to not-ready-for-prime-time renewables, prematurely retired zero-carbon nuclear capacity, and has insufficient local natural gas supply. There is no part of the European experience that we should look to emulate here in the USA.

No one would confuse the three men pictured below for climate activists or ESG virtue signalers. But whether on purpose or by accident they have done more than most to help create an economically healthy and environmentally cleaner future for the United States and its allies. May God Bless America, the American oil and gas industry, and the founders of Cross Timbers Oil Company.

⚡️On a personal note…

I was never the lead analyst covering Cross Timbers or XTO but am fortunate to have met Mr. Simpson and Mr. Brumley; I probably met Mr. Palko as well, but cannot specifically recall it. I did attend one of XTO’s legendary Cayman analyst meetings; I want to say it was 2003 or 2004. A good friend of mine who covered XTO in those days recently told me that he recalls Mr. Simpson’s then wife being pregnant at that meeting. I believe that child now attends the same college and is friend’s with one of my children—an absolutely crazy small world. All Americans including my family are better off for the success he and his colleagues had at Cross Timbers and XTO Energy.

⚖️ Disclaimer

I certify that these are my personal, strongly held views at the time of this post. My views are my own and not attributable to any affiliation, past or present. This is not an investment newsletter and there is no financial advice explicitly or implicitly provided here. My views can and will change in the future as warranted by updated analyses and developments. Some of my comments are made in jest for entertainment purposes; I sincerely mean no offense to anyone that takes issue.

Regards,

Arjun

Thank you for the nice salute, jon brumley

Arjun…..where might we look for “stranded” assets / assets that could be resuscitated in a SuperSpike world? We all laughed at the TMS back in the day, for example….but people gave it value in 2013! What is Floyd Wilson up to these days? :-)