The EV S-Curve Rorschach Test

The Energy Transition Needs To Transition

We start this week with a look at some recent electric vehicle (EV) headlines:

Global EV sales reach new highs!

Ford cuts production runs for its F-150 Lightning EV SUV!

BYD passes Tesla in quarterly sales volumes!

Tesla cuts Model Y and Model 3 prices, again!

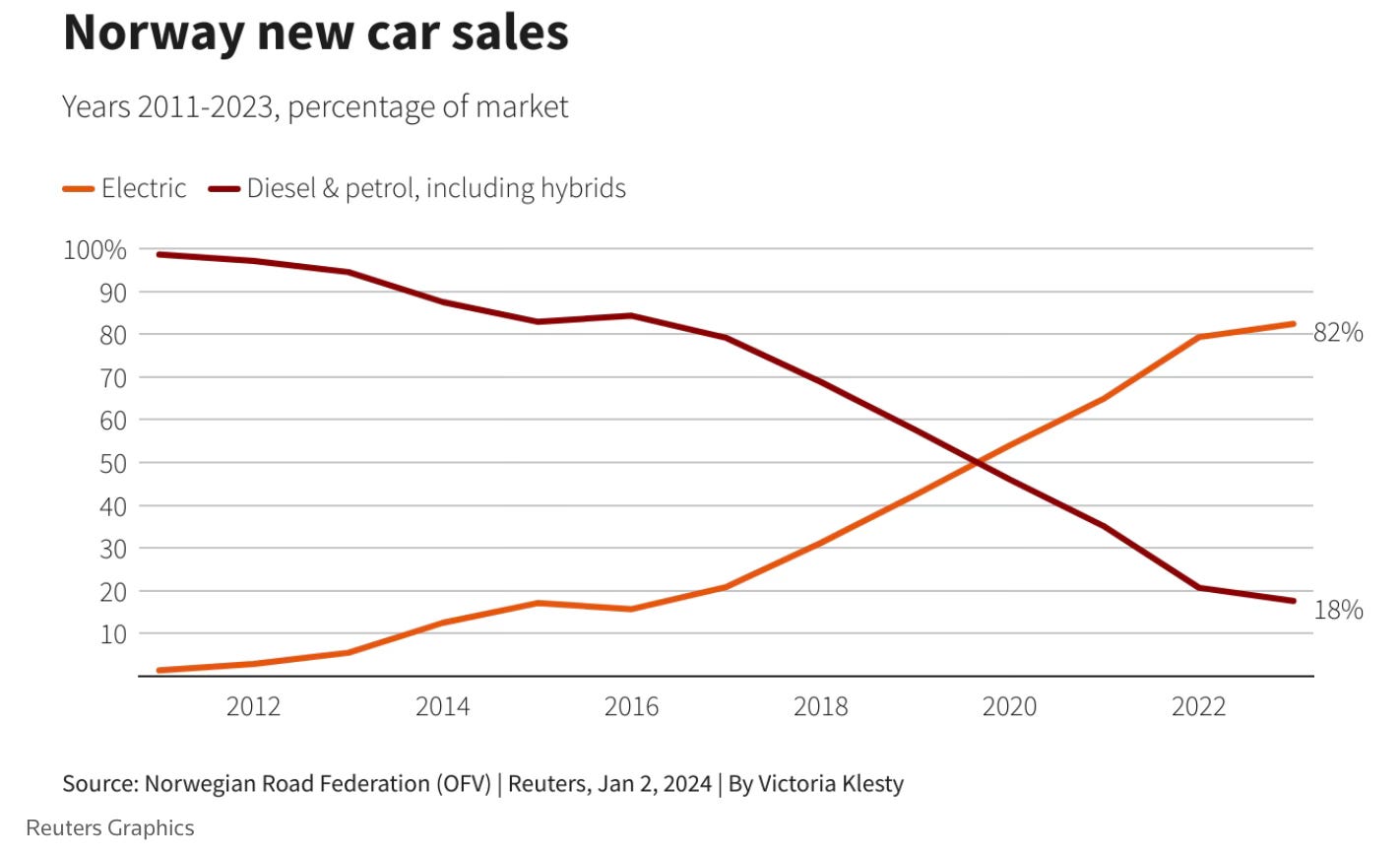

In Norway, EVs were over 80% of new vehicle sales in 2023, up from essentially nothing a decade ago!

Global oil demand exceeds pre-COVID levels and makes an all-time high!

Yes, with EVs, you can find a narrative that fits your world view. Are you in the "urgent climate crisis," "Just Stop Oil" camp and believe we need to ban new sales of internal combustion (ICE) vehicles by an upcoming round number year? You can point to Norway and China's "s-curve" adoption success as models for climate action. Is “apocalypse never” and "the climate change agenda is a socialist hoax to remake society" your cup of whiskey? Picking on GM or Ford is like shooting fish in a barrel, never mind the fact that the cool kids are now losing money on $TSLA (note: we stand by our declaration that the $TSLA bulls won; this is now about what come's next).

As is usually the case with all aspects of the energy sector, the real takeaways are nuanced and not easily divided into good versus evil framings. Our views:

We do not believe it is possible to predict the decade let alone year when global oil demand will permanently peak, given the substantial unmet energy needs of the other 7 (soon to be 9) billion people on Earth.

It is likely that over the next decade-plus gasoline demand will underperform other uses of oil (i.e., diesel, jet fuel, petrochemicals), as US maturity and China's EV s-curve offset underlying economic and energy demand growth.

The slowly evolving nature of energy and oil demand is consistent with our Super Vol macro framework; it is imperative that corporates and investors prepare for a Super Vol backdrop and invest accordingly.

Our Super Vol outlook applies not just to crude oil markets, but all aspects of energy including refining margins, global gas pricing, and the timing and scaling of new energies technologies.

As the overall size of energy demand grows but its composition evolves relative to history, risk/reward opportunities will abound throughout the energy value chain (new and traditional) for both corporates and investors.

Norway 🇳🇴: EVs boom, overall oil demand flat

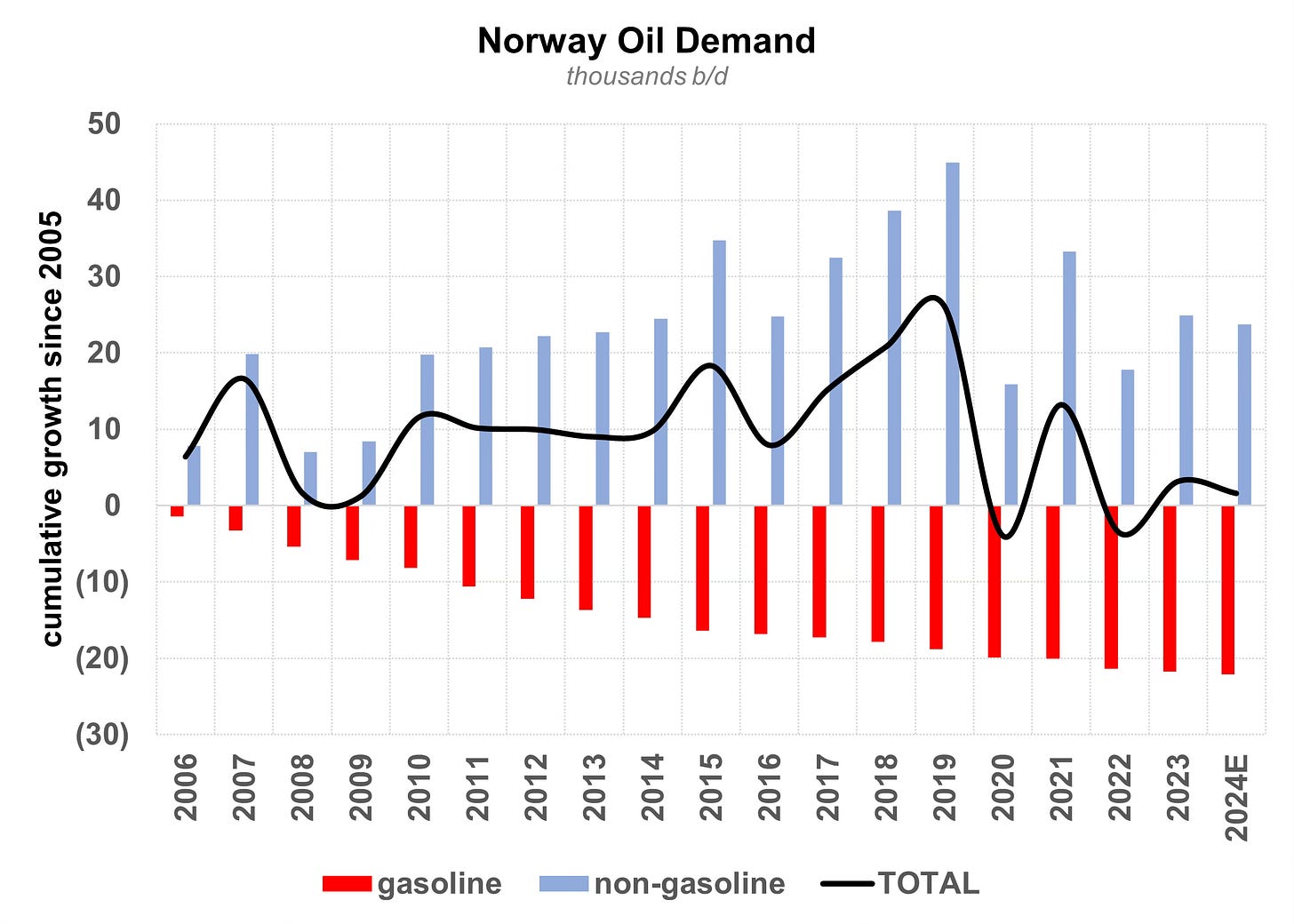

Over the past decade, EV sales in Norway have gone from essentially zero to over 80% of new vehicle sales in 2023. The sharp EV rise has negatively impacted Norwegian gasoline demand, which is down 22,000 b/d since 2005. Notably, demand for all other oil products is up by a similar amount, fully offsetting the EV impact (Exhibits 1 and 2).

We would note that in Norway, gasoline was only 16% of total oil demand in 2005 and is now down to 7%. This compares with gasoline comprising about 25% of global oil demand, around 45% in the United States, and just under 25% of oil demand in China.

What are the takeaways from the Norway example:

EV adoption s-curves are possible, when policy matches with vehicles consumers actually want to drive.

Killing overall oil demand is hard.

Norway is a small, homogenous, rich country of 5.5 million people and was able to source EVs from a broad range of auto manufactures.

Exhibit 1: EV new vehicle sales have surged in Norway

Source: Reuters (here).

Exhibit 2: Norway’s overall oil demand is flat despite the massive EV ramp

Source: IEA, Veriten.

China 🇨🇳: Highly motivated to limit growth in future oil imports

While it's tempting to dismiss Norway as a small country that is not relevant to global oil demand, China is showing EV adoption s-curves are possible at 1+ billion people scale. A few highlights from China:

Chinese EV leader BYD sold more battery electric vehicles (BEVs) than Tesla in 4Q2023 (per media and analysts that cover the companies).

In contrast to EV sales in the US which are dominated by higher-end brands (and overwhelmingly Tesla models), BYD produces less expensive "mass market" vehicles.

China is now the largest oil importer in the world and is highly motivated to displace as much future oil demand as possible (Exhibit 3).

A peak/plateau in China's gasoline demand seems plausible in the years ahead, if EV sales continue to move up the s-curve; however, we see continued growth in overall Chinese oil demand driven by non-gasoline products and China's determination to escape "middle income" status. China's gasoline demand is just under 25% of its overall oil demand.

Growing vehicle electrification is coming with continued growth in coal production; it remains our view that China would prefer a coal-fired EV over an OPEC- or US shale-fired ICE vehicle.

China is a dominant refiner/processor of various critical minerals used in the EV value chain, which helps its ability to ramp EVs at scale.

Exhibit 3: China is highly motivated to limit future growth in oil imports

Source: EI Statistical Review of World Energy, Veriten.

USA 🇺🇸: What does "peak $TSLA," growing pains at F and GM, and the share price collapse of non-TSLA EV companies mean for the U.S. EV adoption s-curve?

What had been a sharp rise in EV sales, in particular Tesla's Model Y and to a lesser degree its Model 3, is showing signs of near-term saturation in the United States. Bloomberg Opinion's Liam Denning captured it well in a recent article: EVs Take A Gap Year (here). Signs of EV growing pains in the US market abound:

Retrenchment, run cuts, and a pushing to the right of various EV sales objectives by Ford (F) and General Motors (GM).

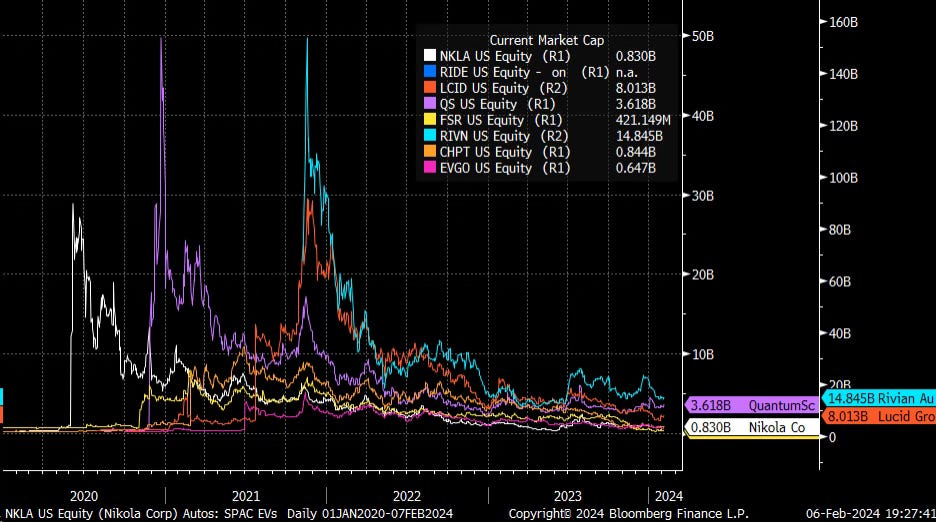

Price cuts at Tesla and what may, finally, be growing evidence that its stock price is past peak, at least for the time being (Exhibit 4).

Collapse in the share prices of just about all of the start-up companies in and around the EV space (Exhibit 5).

Exhibit 4: TSLA share price looks like it peaked in early 2021

Source: Bloomberg

Exhibit 5: Collapse in the market capitalization of EV start-ups

Source: Bloomberg

We are highly skeptical that the US will follow China or Norway’s EV adoption s-curve. Key reasons:

Gasoline demand accounts for about 45% of US oil demand, significantly higher than most other parts of the world; a suburban and rural, consumer-oriented, "drive everywhere" culture is part of what it means to be American.

We believe US policy is currently incorrectly focused on making luxury vehicles inconsequentially more affordable via tax credits.

EV charging infrastructure expansion we believe is overly focused on replicating the gas station model.

We have not formulated a percentage estimate at this time, but EV ubiquity we believe will require a significant number of homes, apartment and work parking spaces, and hotel/motel destinations to offer charging-for-all. Hotels no longer advertise the availability of "color TV." This is where EV charging eventually needs to get.

It is highly uncertain whether inexpensive BYD imports will be able to flood the US market, as happened with Japanese imports after the 1970s energy crisis; this is a key area to watch along with home/destination-based charging progress.

We are highly skeptical that ICE vehicle bans in places like California will stand the test of time. We do not believe the majority of Americans support heavy-handed, Big Government over-reach.

As always, we do not claim to have perfect foresight on the future US EV adoption curve and welcome feedback. We are confident that climate-centric curves are way too optimistic. But those that dismiss EVs entirely do not appear to be tracking growth in overall EV sales.

EV adoption s-curves impact on sub-sectors

Here is our initial take on some key questions and perspectives for various energy sub-sectors:

Refiners:

Will structural gasoline oversupply materialize and, if so, how will it impact refining margins?

To what degree can or should refiners attempt to adjust product yields away from gasoline?

How does supply destruction, in particular refinery closures and renewable diesel conversions, compare with possible demand erosion at a local and global level?

What commercial opportunities exist in different markets, which could have radically different supply/demand balances for various refined products?

Midstream:

It is a similar set of questions, albeit without the direct exposure to volatile refining margins.

In regions where local refineries are closing at a faster pace than product demand, what opportunities exist for pipeline/terminal growth to meet end demand?

Commercial trading opportunities exist for midstream companies that are so inclined.

Upstream:

It is not obvious to us that upstream strategies need to change based on a slowly evolving end product demand mix.

Yes, crude oil barrels that contain a high yield of middle distillates will likely earn a higher netback, all else equal, than a similar barrel that yields more gasoline. But since all else is never equal, we strongly suspect all the other considerations that go into profitably producing crude oil will trump marginal yield differences.

EV headlines and the year-to-year timing of any gasoline weakness vis-a-vis other product strength can impact some combination of crude oil prices and upstream sector valuations.

Auto OEMs and EV Infrastructure:

The two most successful EV companies are newbies: Tesla and BYD. They are, thus far, crushing the traditional auto original equipment manufacturers (OEMs).

Which, if any, of the traditional OEMs can compete with Tesla and BYD?

Which, if any, of the other (i.e., non-Tesla or BYD) EV-related start-ups can gain traction?

EV charging: We believe the nature of EV charging in the United States will not follow the path of our gasoline distribution infrastructure. Charging at home and at key destinations like work or hotels we expect to be the key driver of greater EV adoption in the US. The time frame to reaching a required saturation on home, work, and hotel charging we think is measured in many, many decades.

⚡️ On A Personal Note: What I've learned from 8 years of driving a Tesla in America

I purchased my first Tesla in Spring 2015 as a birthday gift to myself after retiring from Goldman Sachs. I went to our local mall, did a test drive, and ordered it on the spot. My super awesome and understanding wife recognized at the time that there are worse mid-life “gifts” in which one can indulge; a $100,000 Model S was, frankly, quite mild. I was also interested in researching what life would be like with an EV. In 2020, I downsized to a Model 3, which is what I currently drive.

What I love about my Tesla experience:

Charging at home. I do not understand how anyone enjoys going to a gas station, even if you live in the great State of New Jersey that still does not allow consumers to pump their own gas (this law should and will never change!)

Driver assist. In my view, Tesla’s “auto pilot” driver assist is significantly better than the others I have used, most notably BMW’s. Subaru’s is in second place.

One pedal driving, regenerative braking, instant acceleration. It is very hard to go back to a gasoline car after driving a Tesla.

Modern user interface. Computers and software ate the world a long time ago. For whatever reason, only Tesla seems to have recognized this among auto OEMs. I do not understand why legacy auto manufacturers insist on having a gazillion analog buttons to control everything. Everyone uses an iPhone and other mobile computing devices. Please legacy manufacturers, stop it with all the buttons!

Over-the-air software updates. Unlike most cars, Teslas actually add functionality over time via regular over-the-air software updates. While the changes are by nature incremental, they are nice nonetheless. Yes, other companies are starting to offer this. In the case of Tesla, it is as seamless and probably about as frequent as iOS updates on your phone.

The car turns on and off without pushing a button. I do not understand why in my wife’s BMW X-5, I have to physically turn off the car. It should just turn off when I park. It’s 2024!

What I don’t like about my Tesla:

No Apple Car Play. While I was just praising the modern UI, I do not like that Tesla doesn’t allow Apple CarPlay to control music and maps in particular. It is my biggest complaint.

Curb parking. For some reason, the wheels stick out more than other cars and often scrape the curb when parking. I never have this problem with any other car. I don’t think it’s me, it’s the Tesla wheels.

For long distance travel:

For me, long distance travel is manageable when the place I am going to offers on-site charging. This allows for half- or top-off charging along the way. Waiting around for a full charge is not fun. A 15-20 minute half-charge is ideal to use the restroom and check on texts, emails, or markets.

In my original Model S, during that fifth year of ownership, I noticed that super charging (on long distance trips) was taking significantly longer than in my first several years of ownership. I believe through a software update Tesla slowed super charger times for older models to preserve battery. That was not a good experience.

Over the past year or two, I have stopped taking my Tesla on the occasional longer trip when my destination does not offer charging. It’s simply not worth the hassle.

Personal choice:

While I prefer driving a Tesla, I don’t see it or EVs as a revolutionary product analogous to mobile phones versus land lines. It is the tired “India skipped land lines and went straight to cell phones” analogy that I think causes some energy analysts to over-estimate global EV adoption curves.

If I was someone who liked driving pickup trucks as an example, I am going to guess that the last car I would want is any type of EV.

For those that drive larger SUVs, I am highly skeptical that it makes economic or environmental sense to purchase an EV SUV. The fact that the US incentivizes the purchase of EV SUVs is pure insanity. Seriously, what the heck.

🎤 Streams

ENERGY THINKS PODCAST: My appearance on the Energy Thinks podcast was published this week (Adamantine website, Apple Podcasts, or Spotify). I really enjoyed the conversation with host Tisha Schuller who got to the heart of the issue of why we use fossil fuels, the role of traditional energy in an evolving global landscape, and how to think about meeting the world's demand for energy while taking into account negative externalities.

WICKED ENERGY WITH JG PODCAST. I also appeared on Justin Gauthier’s Wicked Energy with JG podcast (Apple, Spotify). This is my third time on Justin’s show and always enjoy our conversations.

⚖️ Disclaimer

I certify that these are my personal, strongly held views at the time of this post. My views are my own and not attributable to any affiliation, past or present. This is not an investment newsletter and there is no financial advice explicitly or implicitly provided here. My views can and will change in the future as warranted by updated analyses and developments. Some of my comments are made in jest for entertainment purposes; I sincerely mean no offense to anyone that takes issue.

Most important fact about Norway relative to EV adoption…its grid is 98 % hydro. Few countries in the world have this luxury.

Great article, but my only nitpick is about the "analog buttons." Getting rid of analog buttons makes the driving experience more dangerous because you have to take your eyes off the road to make any adjustments. It's a lot easier to have knobs that adjust your AC then having to focus 100% on a touchscreen in order to be able to hit the AC buttons on the touchscreen since there is no tactile feedback.

Heck, I think it was VW that is bringing back knobs due to this. Personally, I think getting rid of analog knobs is a step backwards in tech because it actually makes it more dangerous to drive. Not to mention, it's frustrating trying to hit little buttons on a screen.

Oh, and I hope you're enjoying retirement! Unfortunately, I never worked at GS, so I can only afford a Chevy Bolt EUV.