Following a really poor decade of performance, the need to prioritize return on capital improvement and fixing the balance sheet was non-negotiable coming out of the deep COVID trough. Two and half years later, profitability is now dramatically better and balance sheets are largely fixed. The 2021-2022 get-better-or-die stage is over.

The question now is how to stay on the good side of the ledger. This is something that will not be possible for every company, but, in this messy energy transition era, should include everyone in the top two performance quartiles and possibly further down the list. In order to sustain advantaged returns on capital, there is a need for ongoing reinvestment including in new areas and projects via both organic opportunities and M&A. Investors are understandably un-excited about any new spending after last decade’s debacle and many companies are complicit by either explicitly or implicitly over-stating inventory life.

In our view, a way to bridge the gap between investor fears and the need to reinvest is to shift the conversation to how CAPEX and M&A impacts sustainable free cash generation and shareholder distributions, rather than the historic emphasis on production volumes and reserves. In our view, a company’s ability to demonstrate that it can grow base distributions at a faster clip than the S&P 500 will go hand-in-hand with gaining investor trust with spending plans.

As usual, Super-Spiked is focused on what it will take to be a top quartile energy company with the goal of being "must own" for portfolio managers by outperforming the S&P 500 (or comparable major index) over rolling 5-, 10-, and 20-year increments. That said, there is of course no one-size-fits-all operational or financial strategy and different value creation models exist. While investors typically have the most confidence in base (i.e., non-variable) dividends, there is no reason a company cannot declare a “base” stock buyback that it vows to pay year-in, year-out as is implicit in the base dividend.

A very different macro backdrop than past cycles driven by “energy transition” pessimism

As we have been writing since starting Super-Spiked in November 2021, the messy energy transition era we find the world in is creating an environment that requires a different playbook from traditional energy companies than what has been pursued in the past.

A few points seem clear:

A “Super Vol” macro backdrop remains the best descriptor for commodity prices as the need to regularly bump up against demand destruction pricing due to a lack of spare capacity and adequate CAPEX essentially means the boom-bust ups and downs will happen more frequently (every few years).

Production growth is no longer a key metric for investors. Goodbye and good riddance.

Shale play inventory life, in particular for “Tier 1” acreage, has decreased for many companies, with the quality of disclosures varied among companies (some have been clear…others, not so much). I would refer readers to research from firms like FLOW and Enverus for more detailed analyses on shale play running room.

So-called "manufacturing mode," a presumed advantage of shale exposure, really doesn't apply to the vast bulk of shale E&Ps. It has been an over-used term that has contributed to the notion that there wouldn’t be a near-term need to pursue new areas, meaningful M&A, or major projects.

An ability to maintain and grow a base level of shareholder returns is valued by investors.

Other points seem completely unclear:

Will investors recognize that the time frame for so-called “energy transition” is significantly longer than consensus perceives, suggesting traditional energy is unlikely to be a sunset business any time soon?

Or will more rapid boom-bust cycles create a mindset that the end is always near (even if it isn't)?

Is there a pathway to a meaningfully lower cost of capital (i.e., higher valuation)?

If not, what is the pathway to beating the S&P 500 over 5-, 10-, and 20-year periods?

Will public and private financing opportunities slowly fade away analogous to what the US coal sector has experienced? I don't know the answer and believe it should be "no way", but who knows what the next generation of capital and insurance company leaders will do.

In our view, companies may want to start thinking of the following:

Consider worrying less about your current cash flow multiple and focus more on what will drive sustained outperformance versus a broad index like the S&P 500 over the long run. What will make your company a better long-term investment?

Growth in base shareholder distributions should become the ultimate key growth metric for many (though not all) companies, replacing production CAGRs.

Companies are free to grow and shrink as opportunities materialize. The "volume growth only" mindset was a major contributing factor to disappointing profitability.

“Self privatization” is a viable alternative via the use of stock buybacks to materially lower shares outstanding over time.

Extending the runway to grow base distributions

"Extending the runway" has been a key 2023 Super-Spiked theme with the idea that a core objective as shale matures will be for companies to pursue new opportunities that allow advantaged returns on capital and shareholder distributions to continue.

In my view leading traditional energy companies will have the following characteristics:

GROWTH: Grow base distributions faster than the S&P 500.

RETURNS: Generate full-cycle ROCE of at least 15%, trough ROCE of 5%-8% at a "normal" trough and 0% at a deep trough. Never lose money!

BALANCE SHEET: Near zero net debt for the portion of a company's asset base in traditional businesses subject to significant commodity price volatility and long-term refinancing risk. (The appropriate balance sheet leverage for lower volatility business lines is for a future post.)

Exhibit 1 shows the rolling 5-year CAGR of dividends for the S&P 500 (via the SPY exchanged traded fund) and the XLE (energy sector ETF that represents the energy stocks in the S&P 500). The dividend CAGR for the XLE peaked in 2015, the first full-year of a major oil price downturn, ultimately reaching a trough in 2020. Energy sector dividend growth rebounded sharply in 2021 and 2022.

In order to attract income funds and possibly even GARP (growth at a reasonable price) investors, base dividend growth will likely need to exceed that of the S&P 500 for the foreseeable future; almost certainly so long as investors perceive energy to be a sunset industry and apply a higher cost of capital to it. While the base dividend growth for the S&P 500 is a moving target, it has averaged about 7% per annum over the past 20 years and this seems like a reasonable approximation of the type of growth that will be needed to be competitive going forward.

Exhibit 1: Rolling 5-year dividend CAGR for the S&P 500 and XLE

M&A talking points could use a refresh

In the hopes of encouraging more companies to provide improved disclosures when engaging in M&A activity, we offer some commentary on what we believe analysts and investors would find more helpful to know versus what is typically shown.

It would be helpful to understand the impact of a transaction at a range of price decks a company thinks is reasonable: trough, mid-cycle, and peak. Only showing the financial impact at current strip pricing is not especially helpful.

At the respective trough, mid-cycle, and peak deck, how does the deal change the outlook for ROCE, free cash generation, and shareholder distributions capacity, both near- and long-term.

What does a stress test of a near-term collapse in commodity prices imply for post deal balance sheet health?

How does the volatility of ROCE and free cash generation change post deal? For example, is total company ROCE more or less sensitive to commodity price changes post deal?

How does the capacity for shareholder distributions change over the near and long term?

I personally could care less what the near-term EPS or cash flow per share accretion/dilution is using current strip pricing. This is almost always shown. For what purpose?

The relative multiple of the pre-deal company and asset can be relevant if comparable to existing operations. However, it is less relevant if it is a diversifying deal or the company itself is diversified. Too often too much emphasis is placed on some notion of the acquirer's multiple (or free cash yield) versus the acquired asset or company. It is not as make-or-break of a metric as often seems perceived. The goal of M&A or spending is to improve a company; pairs trading should be left to the long-short hedge fund community.

A remarkable CEO/analyst exchange on PR's 4Q2022 earnings call

My first earnings season was for Q2 1992. Q1 2023 will be my 124th. When I was a covering analyst, there was no period of time more painful than quarterly earnings season. It is an unrelenting grind. There was no way around some amount of "maintenance" research, a concept I despise but at times was unavoidable. But every now and then, conference call drudgery yields a nugget.

From the Permian Resources 4Q 2022 earnings call:

Derrick Whitfield (equity analyst, Stifel)

"That’s terrific. And while I understand it’s challenging to sustain productivity [in a] depletion business, how long could you sustain 2023 levels of capital efficiency based on your 15-plus years of inventory?"

James Walter (co-CEO, Permian Resources)

"Yes, it’s a good question. I mean, as we think about it, of that 15 years, about two-thirds of it is all in kind of Wolfcamp and Bone Springs Sands formations, which are the most productive of the – kind of in the Delaware Basin. So feel really good about 10 years of it. There’s probably the last few of those 10 years being probably a little bit of less capital efficient development. But I think you can get really comfortable for the next five, six, seven years that we can maintain the same level of capital efficiency."

This is an incredible exchange. Within a four sentence answer, "most productive" inventory life falls from 15 years to perhaps as little as 5-7 years. I have never covered PR and don't know the co-CEO or management team. I respect and appreciate the honesty of Mr. Walter's answer—a good sign in my view that the company has a realistic understanding of its asset base.

It is highly unlikely that PR is the only shale E&P where its high-quality inventory is a fraction of stated total inventory. We can see this in rising M&A activity. In our view, greater disclosure on cost of supply (or a similar metric) of various acreages would be helpful from more companies. And to be clear, cost of supply should be inclusive of all costs, not simply well drilling break-evens.

CAPEX or M&A is required to sustain ROCE and shareholder distributions

A declaration of being returns focused is not the same thing as actually being able to generate competitive ROCE or any other relevant profitability metric over the long run. A key 2023 theme has been a growing investor recognition that especially among shale-oriented E&Ps, asset quality and inventory duration does not always correlate well with a simplistic "years of inventory" metric. This point was masked by the DUC (drilled but uncompleted) drawdowns of 2021 and 2022 that effectively boosted production volumes at less than full-cycle CAPEX.

As the shale business matures, a growing number of companies are finding themselves on the wrong side of inventory "half life," which we will define as the point in time when a company has less than a decade's worth of "Tier 1" wells to generate flattish production. While a decade's worth of low cost of supply inventory may seem like an arbitrary definition, the basic idea is that major new projects or even advantaged M&A can be many years in the making. A company can not wait until it is down to just a few years of running room to pursue whatever is to come next.

The default reaction seen in many recent transactions has been for companies to purchase privately-owned shale companies, presumably as a means to extend inventory life. Time will tell whether these deals were good, bad, or indifferent to shareholder value creation. This post is not about analyzing any specific transaction.

Rather it seeks to ask the question: Is buying private shale E&Ps really the only viable strategy? To be clear, some deals will make sense for the buyer, but some will not. The bigger point is that recent M&A trends would indicate that industry still seems mired in the "shale is the only game in town" mindset. I don't think it is anymore.

As shale matures, a diversified business model may improve the odds of achieving leadership metrics on returns, growth, and balance sheet. It is not a prerequisite and a small handful of pure-plays need not go down the diversification road. But there are also companies with existing diversified, non-shale business models that have generally been out of favor during the shale revolution that are likely worthy of a fresh look.

⚡️On a Personal Note: Enemy Territory

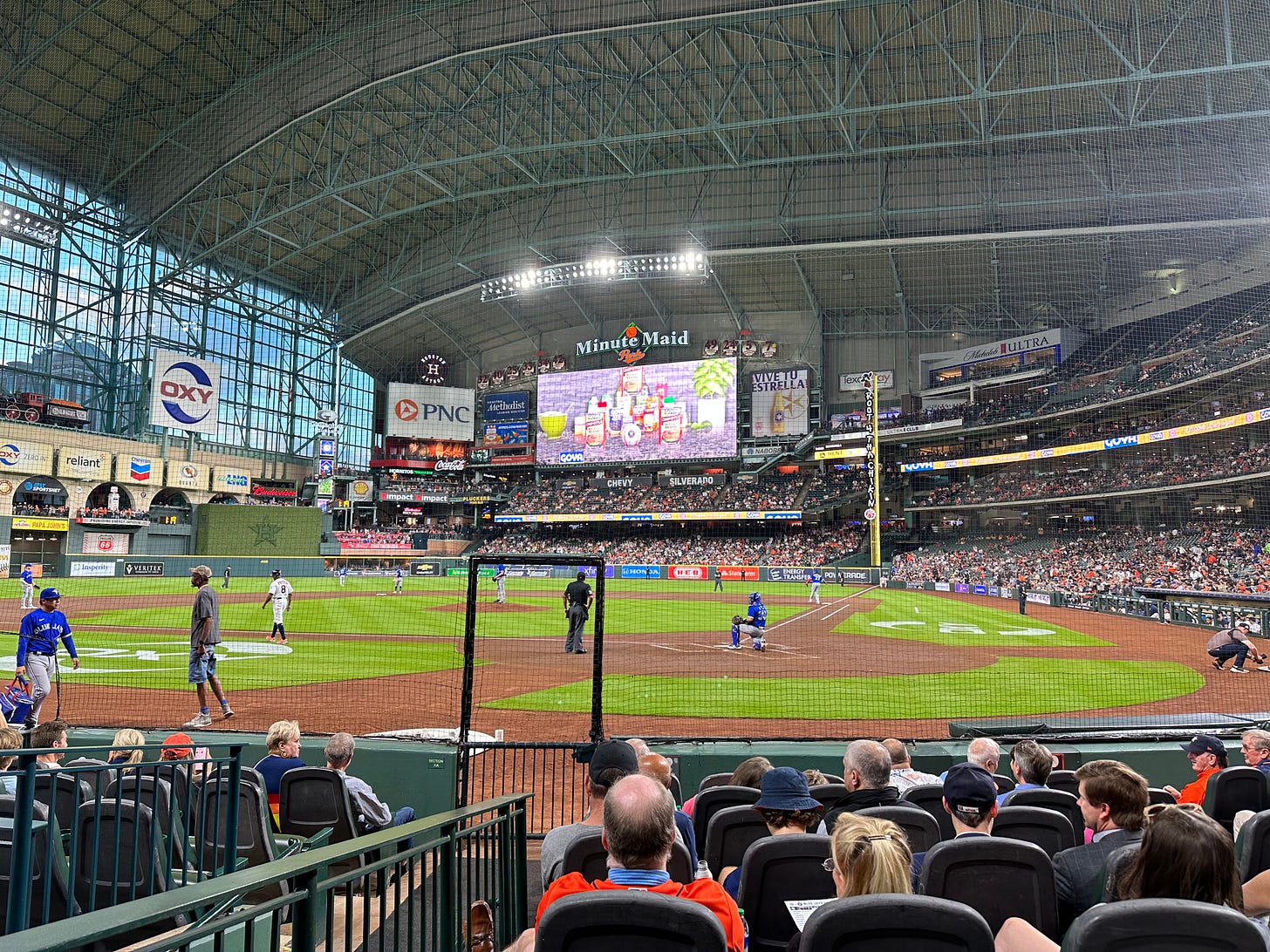

This past week I attended my first ever baseball game at the ballpark formerly known as Enron Field. To my surprise, it was a perfectly enjoyable experience. I'd go back.

The best parts:

Driving along Texas Avenue going to the game is an 8 million times better experience than driving on the Major Deegan to Yankees Stadium. The area of the Major Deegan might well be the worst stretch of highway in America, save for the glorious site of Yankees Stadium itself.

The energy wall of corporate sponsorships was impressive and I liked the OXY logos next to the on-deck circles. Houston is unquestionably the energy capital of the world and quite commercially oriented to boot if the sponsored foul poles are any indication.

Parking attendants can be super friendly and helpful. Who knew?

A few suggestions for Astros fans and ballpark management:

When your starting pitcher gives up four runs and has to be pulled down 4-0, you might try booing rather than cheering. At least a few groans of disgust. But cheering? Come 'on. And I have seen America’s Team booed off the field at AT&T Stadium. Is this participation trophy cheering just a Houston thing?

Why was Long Islander Billy Joel's "Piano Man" the crowd karaoke song? How about some Johnny Cash, Waylon, or David Allen Coe instead? A New York song seems an especially odd choice. Beating the Yankees does not mean you should want to expropriate our musicians.

"Security" consistently greeted us with a cheerful "Hello. Welcome. I hope you enjoy the game." What kind of security is that? At least have a taser in your hand.

⚖️ Disclaimer

I certify that these are my personal, strongly held views at the time of this post. My views are my own and not attributable to any affiliation, past or present. This is not an investment newsletter and there is no financial advice explicitly or implicitly provided here. My views can and will change in the future as warranted by updated analyses and developments. Some of my comments are made in jest for entertainment purposes; I sincerely mean no offense to anyone that takes issue.

I have gone through the five stages of grief with shale. I am heavily weighted to Canadian names...

This isn't directly related to this post, but it's so relevant to your philosophy that everyone deserves a chance at secure cheap energy that I wanted to just go ahead and post it to you:

https://twitter.com/JusperMachogu/status/1642391693075836928