The Good, The Bad, and The Misunderstood Amidst Massive Macro Cross Currents

Making Sense Of A Macro Mess

We have spent the month-and-a-half since the double whammy of “Liberation Day” and OPEC+’s decision to more quickly return withheld production roiled energy markets by mostly producing video podcasts that attempted to work through our thoughts in real time. We now have the prospect—just six weeks from the seeming start of a global trade war death match—of easing trade tensions, OPEC still in full steam ahead mode (to returning barrels), but a growing group of E&P companies pulling back on activity while also noting shale oil is maturing.

What has not changed relative to our pre-Liberation Day views:

The wider world has moved on from 2020-2024’s “The Energy Transition”—i.e., the dubious idea that the world was on-track to quickly replace traditional energy sources only with renewables and unprofitable, yet-to-scale, newer technologies over artificially short time frames in order to meet what advocates viewed as the critical goal of net zero emissions by 2050.

Energy’s natural hierarchy of needs prioritizes availability and reliability as the overarching objective for all 8 billion people on Earth followed by affordability, geopolitical security, and environmental considerations (in that order).

Notably, respecting energy’s hierarchy of needs leaves considerable motivation and scope for growth in renewables + storage and future technologies due to geopolitical and capital flow considerations.

The prospect of an ongoing, perhaps off-and-on trade war and geopolitical reordering contributes to the following views:

Power generation looks like it will grow faster and with more certainty than the crude oil value chain.

All major energy sources used for power generation are on-track for meaningful growth including solar/wind + batteries, natural gas, nuclear, and non-OECD coal. All have pros and cons on a range of attributes that vary by geography and for energy users. We urge readers to resist looking at energy generation sources through ideological lenses. Instead look at attributes, economics, and geopolitical considerations.

Crude oil remains a critically important energy source albeit with conflicting cross currents that are both bullish (US shale maturity tailwinds) and bearish (China slowdown headwinds). While the timing of the OPEC+ production ramp caught us and seemingly most observers by surprise, it in essence trades short-term weakness for tighter long-term markets.

At the sector level, we see the following:

Majors/E&Ps: Diversified (i.e., non-US shale pure-play) upstream business models will come back in vogue. To be clear, “back in vogue” does not necessarily mean “higher multiple.” We focus on the potential for superior risk-adjusted total shareholder returns over multi year periods.

Midstream: Substantial infrastructure needs remain, but corporates and investors will need to think about a macro backdrop where US crude oil possibly goes ex-growth. Natural gas and natural gas liquid-value chains should continue to see meaningful growth ahead.

Canada: Expected to gain in importance in coming decades as US shale oil plateaus.

Major Middle East producers and Russia: Geopolitical relevance reverts to being more important after diminished relevance during the heart of the shale oil revolution.

Power value chain: There is no one-size-fits-all best way to play the power theme. We have seen a mix of traditional utilities, independent power producers, equipment manufacturers, and infrastructure providers perform well thus far. For those that supply the energy used in power markets, it is always and only about being a low-cost producer relative to the full spectrum of energy sources used to generate power.

Oil Macro

The Good: Capital discipline

Traditional energy companies are reacting quicker to downside macro risks than we have seen in the past, prioritizing balance sheet health and protecting long-term profitability over maintaining production growth aspirations. This is a BIG change from the first 33 years of our career, where only the largest integrated oils consistently pursued financial objectives over volumetric aspirations.

We would observe that capital discipline survived the Russia-Ukraine price peak of 2022-2023. And while (potential) downturns are never fun for industry or shareholders, most companies are much better positioned to grind through current choppiness and whatever the macro has to offer.

The Bad: A choppy at best oil demand outlook

Downside risk remains to original 2025 oil demand growth expectations of around +1 million b/d. While the Trump Administration’s max tariff approach has been dialed back (for now), there is still considerable wood to chop on important trade negotiations, in particular with China. China had already been a source of macro (and hence oil demand) concern prior to Liberation Day. At this time, global GDP does not seem on-track in 2025 or 2026 to return to levels that would be consistent with something closer to 1.5 million b/d of oil demand growth that we think is one of the prerequisites to a structural bull market. And to be clear, if oil demand is weaker than 1 million b/d of growth, WTI (West Texas Intermediate spot) oil prices could still languish below the important $60-$65/bbl threshold.

The Misunderstood: OPEC+

The recent decision by OPEC+ leaders to more quickly return previously withheld barrels to the market caught oil observers by surprise. We view this as a clearing event for oil commodity and equity markets, removing what was a long-standing overhang. Higher OPEC+ supply in the near term undoubtedly creates a looser near-term market versus prior expectations. But ultimately this simply represents a shift in where oil is held—from below ground reservoirs to above ground storage tanks and terminals. It remains our view that OPEC spare capacity is limited to a handful of OPEC leaders and that the amount that can be brought on in total is less than what many in the market seem to assume.

The idea that OPEC+ leaders are more quickly unwinding production cuts because they are mad at Kazakhstan following the recent start-up of the Tengiz expansion project we think is silly. The notion that after four years of capital discipline, US shale oil producers are now deserving of punishment—especially as a growing chorus are publicly stating the best days of shale growth are in the past—is a similarly non-sensical explanation. We conclude that the most likely reason for OPEC+’s change of heart around near-term supply management is driven by the result of last November’s US presidential election—"Pump for Trump” as we have been calling it.

Over the past decade of US shale oil dominance, we observe two distinct periods that were separated by the deep COVID downturn (Exhibit 1). The first was from 2015-2019 when shale oil was growing rapidly and OPEC abandoned its supply management seen over the 2010-2014 period. WTI oil was generally between a $40/bbl and $65/bbl band. Post COVID, shale growth was steady and the new OPEC+ grouping engaged in stricter supply management, yielding a $60-$85/bbl band for WTI, excluding the Russia-Ukraine peak. We now appear to be entering a new era where shale oil may be going ex-growth, a near-term OPEC+ unwind creates downside risks in 2025 during a period of global GDP uncertainty, but sets up for potentially stronger conditions long-term if the global economy can get back on-track and OPEC has otherwise unloaded the bulk of its spare capacity.

Exhibit 1: Two historic WTI oil price trading bands, with a 3rd era seemingly emerging

Source: Bloomberg, Veriten.

Shale Oil Maturity

The Good: Less growth from a dominant supplier

In last week’s video podcast (here), we highlighted comments that the leading Permian Basin pure-play Diamondback Energy made in its latest Letter to Shareholders (here) that noted that US shale oil was reaching a stage of maturity that suggested the days of rapid growth are in the past. With US shale accounting for the vast bulk of net global oil supply growth over the past decade—helping keep oil prices range bound—the odds of a future oil super-cycle increases with the fading of a major supply growth driver. As noted in the prior section, we believe stronger GDP and oil demand growth is a critical part of the equation to a sustainably stronger oil macro backdrop, which we do not appear to have at this time. For complex US refiners (i.e., those with advanced processing capabilities), we would note that growth in generally heavier and more sour (i.e., greater sulfur content) crude oils from Middle East producers is a favorable trade-off relative to light-sweet US shale oil (since heavy/medium-sour barrels trade at a discount to light-sweet).

The Bad: Non-US shale growth has been better than expected

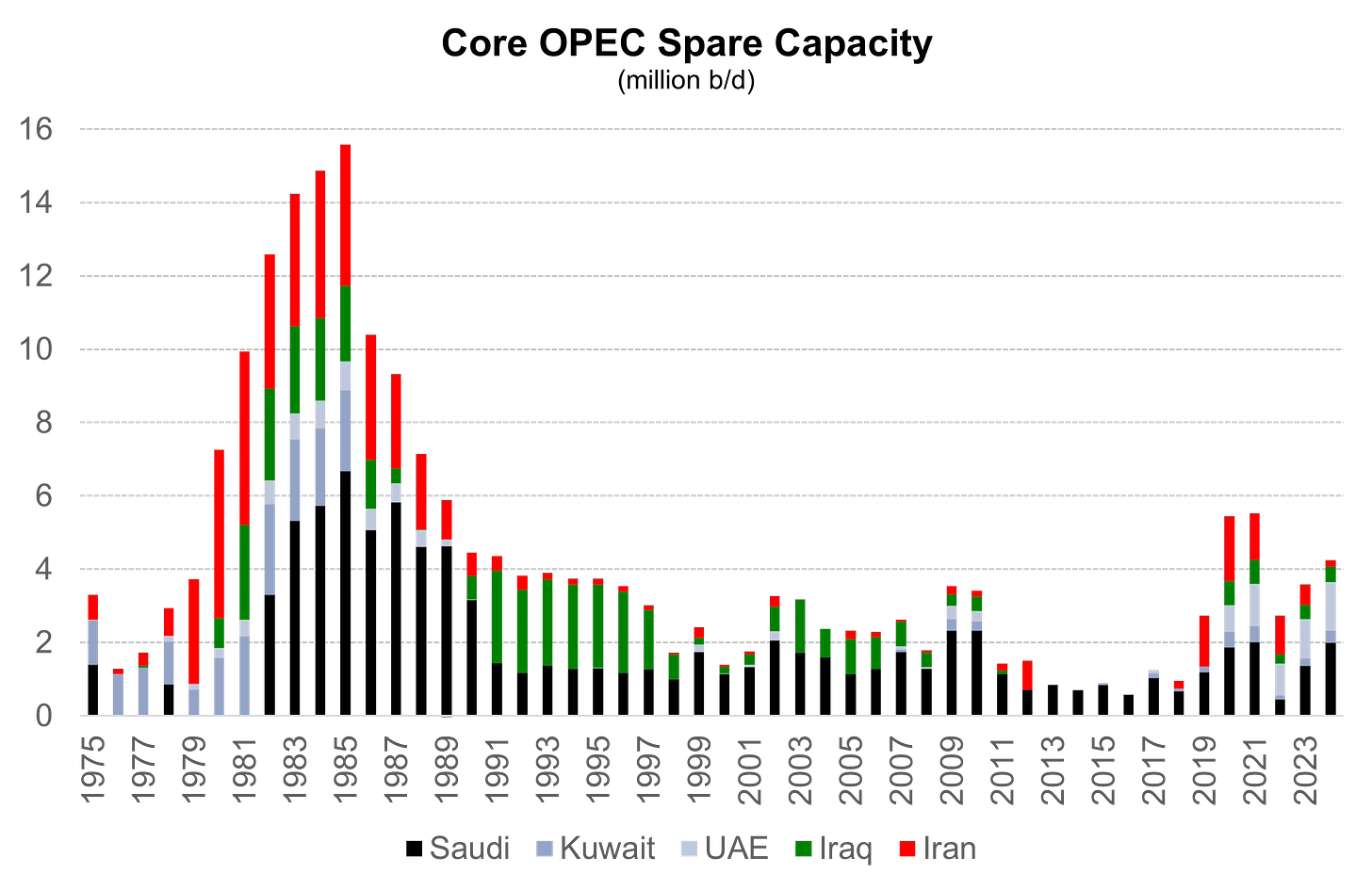

Relative to general expectations coming out of the 2020 COVID trough, global oil supply excluding US shale oil we would characterize as generally surprising to the upside. There is also some spare capacity that can be brought back to market by major OPEC producers (Exhibit 2). Over the remainder of 2025 and 2026, we think it will take a much stronger oil demand environment than we are currently on-track for to easily absorb this growth.

Exhibit 2: We see more limited spare capacity among core OPEC producers

Source: Veriten.

The Misunderstood: Peak oil demand is not a thing

We remain highly skeptical that anyone today can possibly know when global oil demand is going to permanently peak and subsequently decline or even plateau. Not when the other 7 billion people on Earth that are not amongst The Lucky 1 Billion of Us are still only using a fraction of the energy we do. The tricky thing this decade is that China’s slowdown and overall lackluster global GDP growth is driving slower oil demand irrespective of our pushing back on what had been fashionable peak oil demand calls at the height of urgent energy transition madness in recent years.

Traditional Energy Corporate Strategy If US Shale Oil Is Maturing

The Good and The Bad: Individual company results will vary

We are lumping “The Good” and “The Bad” together as the implications of shale oil maturity will vary by company based on remaining inventory depth and quality. It has long been our view that most pure-play upstream business models are moment in time in nature. There are exceptions to that comment in that major oil basins like Canada’s oil sands, Saudi Arabia, and the Permian Basin might allow sufficient opportunity for pure-plays to persist.

The major strategic question facing most US upstream shale oil producers is what comes after shale? Is it going after what is currently considered Tier 2 and Tier 3 acreage (i.e., acreage that requires over $80/bbl or $90/bbl in order to generate attractive full-cycle returns on capital)? Selling to a larger company? Going overseas including Canada? Turning into a yield vehicle that distributes the bulk of excess cash flow back to shareholders?

As we have noted, all companies should fear turning into what we have called cycle riders (i.e., share prices simply go up and down with commodity prices as returns on capital are no better than cost of capital) or, worse, the living dead, the latter of which are companies that persist but structurally underperform the S&P 500 by more than 100% over time. We use greater than 100% relative underperformance as a threshold to signify when a company has become the living dead and bankruptcy would have been better than continued existence.

The Misunderstood: Diversification

We get it. Diversifying from a pure-play status is often thought of by investors as “di-worseifying” for a given company. Existing diversified energy companies are often falsely labeled—especially during activist situations—as conglomerates. In our view, the idea that being a diversified energy company inherently yields weaker share price performance or profitability is without question not true. During shorter time frames, we agree that pure-plays favorably exposed to the in-vogue area will often outperform. The issue is that the energy business is always changing and that there are best-in-class management teams and organizations with proven abilities to generate superior returns on capital and total shareholders returns over the long run from diversified asset bases.

Power Value Chain

The Good: Power sector value chain less exposed to tariff-driven economic downside

We are going to lump a bunch of non-oil areas together here. Broadly speaking, US and global natural gas, renewables + storage, and US/global power generation we see as less exposed to Liberation Day tariff uncertainty or of course recent OPEC+ supply actions. Perhaps most meaningfully, the slowdown in China GDP we see as more impactful to crude oil and some non-energy commodities than we do for energy sources and infrastructure companies exposed to the power generation theme (e.g., natural gas and renewables + storage).

The Bad and The Misunderstood: Energy source politicization and extremism

All energy sources have positive and negative attributes. For reasons that do not make sense, natural gas versus solar/wind + storage have been caught up in ideological good versus evil battles. All anyone cares about is reliability followed by affordability. At the country level, geopolitics matter including capital and trade flows, which in some cases favors renewables + storage in other cases favors natural gas and LNG and in some places will favor coal. Market and policy-based incentives that ensure power producers are motivated to add new supply that over the short- and long-term will allow for reliable power generation is what all people and businesses in all countries want. We suspect that in most markets it will be various mixes of renewables + storage, natural gas, nuclear, and coal (primarily in developing markets) that ensures reliable and eventually affordable power exists.

⚡️On A Personal Note: Houston Living, Two Months In

It has been almost two months since we closed on our Houston condo. Texas real estate was never on our bingo card. Credit to everyone at Veriten and our great group of partner companies (i.e., clients) for motivating what has been a great decision so far.

The Good: We are admittedly in the honeymoon phase of new home ownership, but so far my wife and I have loved our new place. Surprising on the upside: having a doorman for the first time since a mid-1990s NYC apartment, Houston’s restaurant scene, ease of getting around and finding parking spots, and the quality and quantity of home furnishing stores. The weather has been spectacular when we have been there, and we look forward to what we are sure will be a wonderful summer (or maybe fall and winter).

The Bad: So many people, including children (!?!), wearing Astros jerseys. #sad. Fortunately, the team I think is in a rebuilding mode so maybe they won’t demolish the Yankees this year.

The Misunderstood: For the first 33 years of my career, I basically only visited oil company office towers, Café Annie’s, and Willie G’s. It turns out Houston is more than the sum of its oil and gas company headquarters and two restaurants. Super friendly, welcoming people. More green space than I realized. Excellent restaurants. Really easy to get around. Getting in and out of ballparks, arenas, and stadiums is a piece of cake and the exact opposite of the pain and suffering one has to endure going to Yankees Stadium or Met Life. I’ve even enjoyed the two museums we’ve visited—I am not a museum person by nature. If you are from the US Northeast and asked or have the opportunity to move to Houston: I recommend it!

To Do: I need to join a local golf club. The public driving range at Memorial Park is totally fine and many friends have been very kind to invite me to play their clubs, all of which have been great. But I need to join a club myself. The golf game is suffering big time this year, with rounds way down and my handicap up.

⚖️ Disclaimer

I certify that these are my personal, strongly held views at the time of this post. My views are my own and not attributable to any affiliation, past or present. This is not an investment newsletter and there is no financial advice explicitly or implicitly provided here. My views can and will change in the future as warranted by updated analyses and developments. Some of my comments are made in jest for entertainment purposes; I sincerely mean no offense to anyone that takes issue.

A correction: A former New Jersey and New York resident.

You can love Texas as I do and still acknowledge that summers in Texas are awful. But that is why jet planes were invented. I believe you live in New Jersey. As a born and raised New Jersey resident, I look at the news: 1) EWR a disaster; 2) NJ Transit on strike, demanding $170,000+ salaries; and utility prices up 17%. Plus no state income tax and no state capital gains tax. It is fun to return to homeland, but living here is so much easier.