The emergence of three mega risks—War, Inflation/Stagflation, and Rich Country Government Debt Burdens—is shaping up to add new dimensions of uncertainty to an already messy energy transition era.

WAR: Rising tensions in the Middle East following the horrific terrorist attack by Hamas in Israel two weeks ago add a second theatre of conflict to go along with the ongoing Russia-Ukraine war.

INFLATION/STAGFLATION: After a 40-year post-1970s run of contained inflation and structurally declining interest rates, the 2020s are shaping up to be a very different environment. Energy prices are likely to be one of the meaningful contributors to higher future inflation as both traditional and new energy supply are not on-track to reliably meet global needs. This is the aftermath of a poor decade (2010s) of profitability coupled with ill-conceived "energy transition" policies most notably in Europe and to a lesser degree Canada and the United States. With energy a key input to all economic activity, energy price-driven inflation is likely to persist for the foreseeable future.

RICH COUNTRY GOVERNMENT DEBT BURDEN: When will government deficits and continuously rising government debt levels matter in the United States? We do not know. But the sharp rise in treasury yields suggests the risk of adverse consequences may be increasing. If the choice is between austerity or inflating its debt burden away, there appears to be overwhelming bi-partisan support for the latter.

The magnitude of yet-to-be-met energy demand among the other 7 billion people on Earth beyond the lucky one billion of us in the fully developed world overwhelmingly points to the need for all forms of energy—both traditional and new. It is not a close call on this point.

A prerequisite to removing energy as a source of inflation is a major capital spending cycle. In order to reduce the world's dependence on oil and natural gas (including LNG) supply from the Middle East, meaningfully higher capital spending and export infrastructure is needed in countries with large resource bases like the United States and Canada.

New energy technologies have an important role to play in meeting global energy needs and diversifying dependence on a handful of key oil and gas exporting regions. However, rising interest rates, growing risks around electric grid instability, over dependence on taxpayer subsidies, and irrationally exuberant growth aspirations in a broad range of new energy technologies—which unsurprisingly are now experiencing major growing pains—is a reminder that getting the economics of new technologies right is more important than ideologically- or politically-driven demands for an impossibly fast transition.

As for how investors might think about the impact of the mega risks, the traditional energy sector was already on-track for an extended period of improved profitability. The main near-term risk was one of economic weakness in China, Europe, and the United States. We increasingly believe that the sector will serve as a hedge to the growing mega risks, potentially counter-balancing its recession exposure. As for new energies, which peaked in early 2021 and are now in a deepening downturn (generally speaking), it is about figuring out where real economics and scale up potential exists versus those areas that are likely to remain highly dependent on ultimately unsustainable government largesse.

WAR: Fade geopolitical turmoil? One can hope so, but hope isn't a strategy

The sharp spike and subsequent collapse in oil prices following Russia's initial invasion of Ukraine in 2022 has trained investors to fade geopolitical turmoil. Ultimately, we should all hope that peace breaks out, which is the overwhelming best reason to fade energy price/equity rallies driven by geopolitics. Unfortunately, hope is not a great planning strategy.

We now have conflict in the Middle East between Israel and Hamas, the latter of which has been designated a terrorist organization by the US State Department. The relevance of course lies with Hamas' ties to Iran and the risk of this growing into a broader regional war. The rising risk of a disruption to Middle East oil and natural gas supplies comes at a time when:

Oil & gas sector CAPEX is closer to a structural trough than a peak

OPEC spare capacity is limited

Above ground inventories are at low levels

The US has drawn down its Strategic Petroleum Reserve (SPR)

There is significant pressure on western world administrations to "keep oil and gas in the ground" by climate activists; activist pressure inexplicably focuses on US, Canadian, and European oil and gas fields as opposed to those in hostile nations.

Notably, China has likely added to its version of an SPR. However, it is not obvious one should take comfort in that fact when considering the risk of conflict between China and Taiwan. Of course, it is also entirely possible if not most likely that China simply shares our view of a structurally tight crude oil market and is opportunistically adding to oil storage at a lower point in the long-term cycle.

There are two good ways to reduce dependence on Middle East and Russia oil and gas: (1) produce more oil and gas from friendly areas; and (2) diversify energy sources and demand via new technologies. Both take time and capital, with the latter facing far greater uncertainty on the timing of ramp than what the climate activist crowd and corresponding academics and policy makers would lead one to believe. It is unclear why the lesson needs to be learned over and over again that "keep it in the ground"—somehow targeted only in the United States, Canada, and Western Europe—makes the world less safe and contributes to energy price inflation.

Major producing areas that contribute to a safer world and lower long-term energy prices but face opposition from domestic politicians and activists include:

Canada's oil sands region

Alaska

US shale

US Gulf of Mexico

INFLATION/STAGFLATION: Goodbye to the low inflation, low interest rate world

Energy is the ultimate input to all economic activity, improving living standards, human prosperity, and lifting people out of poverty. Without it, you have literal and figurative darkness and an inability to do very much of anything. Just about everyone takes energy for granted, with the notable exception of energy company employees, sector research analysts, and the billions of people living without energy abundance.

Energy pricing is indeed volatile and therefore excluded from so-called core inflation metrics. During normal periods of volatility within a contained band of commodity prices, it is reasonable for economists to look through commodity price noise that is caused by factors like economic growth (or lack thereof), temporary supply impacts, or weather. We do not believe that normal commodity price volatility is the framework to use for the 2020s—it is a Super Vol world we now live in.

A few points to consider:

All the issues mentioned above about low CAPEX, limited inventories and spare capacity, depleted SPRs, and "energy transition" pressure points are contributing to an environment where supply challenges are inevitable and price risk skews to the upside.

Despite a generally lackluster global GDP growth backdrop, demand for all forms of energy continues to increase.

The rising percentage of intermittent wind and solar generation in many western world electric grids is raising the risk of blackouts and grid instability.

We are in an environment where the incentive to spend on traditional energy CAPEX doesn't exist, the new stuff is going through growing pains, geopolitical turmoil in key energy producing regions is rising, and demand continues to grow. As such, we are setting up for regular periods of sharply higher energy prices, including for crude oil, refined products, natural gas/LNG, and electricity pricing.

We would observe that when looking at crude oil prices as an example, in the last two super cycles oil rose by 10X in the 1970s ($3/bbl to $30/bbl) and by 5X in the 2000s ($20/bbl to $100/bbl). We still prefer Super Vol over super-cycle to describe the commodity macro backdrop. What we are wondering—and we caveat this by acknowledging that we are not macro economists by background—is the potential for regular, sharp increases in energy pricing to feed through to core inflation.

Exhibit 1: Inflation measures, as shown here by US PCE, are at their highest levels since the 1970s

Source: Bloomberg

RICH COUNTRY DEBT BURDEN: When does this start to bite?

Without further turning this into a macroeconomic post that is beyond the scope of our core areas of expertise, the risk of unsustainable rich country government debt burdens, most notably in the USA, is a mega risk that bears watching. Up until very recently, rising debt and structural US government deficits have seemingly not mattered when looking at interest rates, inflation, the US stock market, or any number of macroeconomic indicators. We recognize that there are some macro-observers that have been worried about this risk essentially since the Great Financial Crisis of 2008-2009, if not longer. There have been many wrong (premature?) calls that now is the time when US government debt and deficit spending is unsustainable. We get it—it’s the boy who cried wolf.

That said, it will matter when it matters, and we cannot rule out that it could be within the coming decade. If there is a basic choice for the US government and Federal Reserve to choose between austerity (i.e., lower entitlement spending or returning to something like the gold standard) versus inflating the debt burden away, we strongly suspect the latter will be the choice made. If this turns out to be a contributing factor to structurally higher inflation, we believe hard assets like crude oil, natural gas, and many other commodities would gain in value in US$ per unit terms.

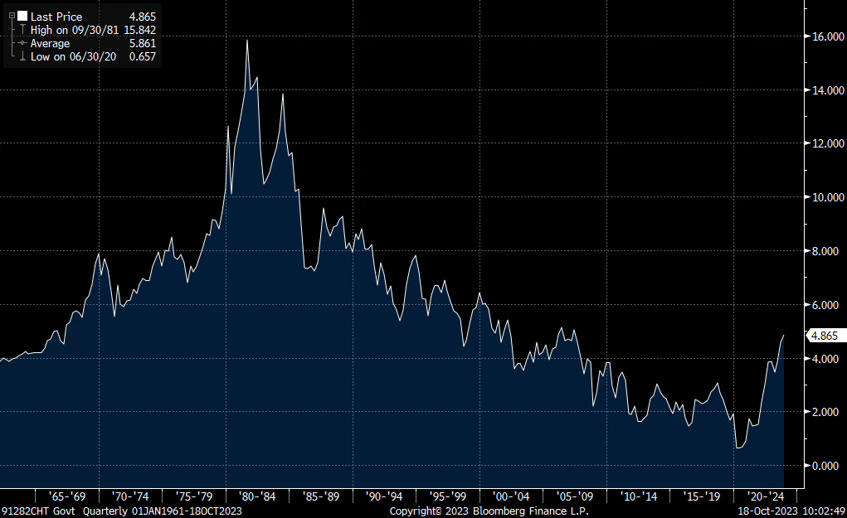

Exhibit 2: A 40-year downtrend US Treasury yields appears to be over (10-year US Treasury yield shown here)

Source: Bloomberg.

Traditional Energy as a hedge to the mega risks

In our view, most market and industry observers are way too complacent about the energy macro backdrop. The risks and timing are inherently uncertain. The fundamental question for investors is a classic buy-and-hold versus chase-after-the-fact investment call.

While we titled the post to think about traditional energy as a hedge to various mega risks, it is worth remembering that the sector was already on-track for what we believe will be an extended period of above-normal profitability and shareholder distributions coming off a very challenging last decade. As we have now said many times, traditional energy cycles are long-term in nature: 10-15 years up, 10-15 years down; we just ended a 15-year profitability downturn (2006-2020) and appear be in year three of a new uptrend.

While traditional energy is up off its lows, there is still a wide gap between its current S&P 500 weighting of 4.7% versus an 8%-10% weighting that would be implied by current profitability. This gap suggests investor have various concerns, including:

Recession risk, in particular in the three largest energy consuming regions of China, Europe, and the United States

Concern that oil demand may peak/plateau in coming years

Concern that improved profitability is not sustainable

We have addressed each of these points in prior posts. We share the concerns about weak GDP in important areas, hence our Super Vol rather than super-cycle framing. On the other two points, we strongly disagree. So-called "peak oil demand" we think is pure fantasy and we believe we are early in the new profitability upcycle.

The question we are starting to wonder about is whether rising mega risks highlighted in this post serve to counter-balance weak GDP risks in the aforementioned regions.

⚡️On A Personal Note: "If you ain't first, you're last"

As a Yankees fan, I thought watching the Astros’ continued success this season was going to be painful. It is actually worse watching two ex-Yankees, Jordan Montgomery and Nathan Eovaldi, help win games 1 and 2 for the Texas Rangers in the American League Championship Series. Yankees general manager Brian Cashman traded away Montgomery last year—despite being a home grown lefty at Yankees Stadium—for a backup centerfielder we give away at the waiver deadline one year later? And I am aware of Eovaldi's injury history, but it certainly isn't worse than all the disastrous, injured pitchers that succeeded him in recent years. In fact, in the rotation we de facto swapped Montgomery for Frankie Montas who has been an utter disaster for the Yankees in the few innings he has been healthy enough to pitch.

Brian Cashman has been the Yankees GM since 1998. It's been 25 years. And while they have not had a losing record during that stretch and have made baseball's expanding post season in all but a handful of years, under Cashman the Yankees have only won a single World Series in 2009 since the 1996-2001 dynasty teams...not much of a showing for all the spending and regular season success. There is not a Yankees fan that doesn't subscribe to George Steinbrenner's motto, later adopted by Hall of Famer Derek Jeter, that if you don't win the World Series, the season is a failure. It's been 14 years of failure. Perhaps the great Ricky Bobby said it best, "If you ain't first, you're last." Amen Lord Baby Jesus.

As for October baseball, there are simply no great choices especially when one considers the Philadelphia Phillies are very much alive in the National League. After USC’s crushing loss to Notre Dame last weekend, we are left with Penn State and the Big 10 and the coming start of Knicks basketball and Rangers hockey. And I almost forgot that there is still plenty of Dallas Cowboys football torture ahead for me.

⚖️ Disclaimer

I certify that these are my personal, strongly held views at the time of this post. My views are my own and not attributable to any affiliation, past or present. This is not an investment newsletter and there is no financial advice explicitly or implicitly provided here. My views can and will change in the future as warranted by updated analyses and developments. Some of my comments are made in jest for entertainment purposes; I sincerely mean no offense to anyone that takes issue

Always the first thing I read on Saturday mornings! Throwing some thoughts out to the comment section:

If I could summarize the alternative view, not directly opposing a super-vol framework, but a sort of longer-term bearish framework (basically Citibank's view), it seems to be this:

(1) O&G gas demand has peaked, or will soon peak, due to EV's/transition/etc. (you've addressed this at length already);

(2) China's large SPR reserves put a cap on oil prices somewhere around $100 every time we get near $100 in the cycle;

(3) there is significant spare capacity in OPEC of 5M+/barrels/day;

(4) that US shale still has a lot of production left and keeps surprising to the upside.

This view sees plenty of supply available to meet price spikes every time we get one, so the spikes will be smoother and shorter, more like the last cycle than a new super-vol one. Personally I don't understand how that view can so easily discount the constrained CAPEX and two major hot-war conflicts in this cycle, but they don't see it as a significant supply problem.

Regarding unsustainable wealth country spending and debt levels, particularly post-GFC: "That said, it will matter when it matters, and we cannot rule out that it could be within the coming decade." Ray Dalio's work on this is great, he's my go-to for macro debt and spending, I would highly recommend to anyone Principles for Navigating Big Debt Crises available for free as a download https://www.bridgewater.com/big-debt-crises/principles-for-navigating-big-debt-crises-by-ray-dalio.pdf.

Thank you Arjun!