The end of The Energy Transition EraTM is giving way to a decisive return to energy pragmatism in regions that had most meaningfully embraced a “net-zero-is-all-that-matters” policy set. No reasonable person still believes it is sound energy policy to only emphasize an aggressive ramp in renewables while disincentivizing oil, natural gas, coal, and nuclear output primarily in friendly nations (i.e., Europe, Canada, and the United States). That was the worst-of-all-worlds outcome of high-and-volatile commodity prices, diminished geopolitical security, and negative environmental (including climate) outcomes that motivated the creation of Super-Spiked and our un-retirement to Veriten.

The rise of what we are calling the energy pragmatism era presents opportunities in areas that looked like lost causes such as Europe. In Canada, Trump Administration tariff policies have created a unifying event for the country’s political left and right that enhances our long-standing favorable view of its energy sector. Our dark horse candidate for a return to energy pragmatism is California, with the tragic fires raising the odds that single party rule will end.

The drivers of the return to energy pragmatism vary for each of these areas as do the energy investment opportunities. For Europe, an erosion in industrial competitiveness is a huge issue, but so is the need to solve for geopolitical security by reducing overdependence on energy imports. In the case of Canada, its geopolitical dependence is the over-reliance on a single customer, the United States, for energy exports and overall trade flows. For California, all issues around competitiveness and resilience are based on the unfortunate, self-imposed, questionable policy choices its elected leaders have made.

For all the talk of “drill, baby, drill” in the United States, the reality is that we have being doing exactly that across administrations for the past 15 or so years. As others have quipped, we really need to “build, baby, build” energy and power infrastructure in the United States and ensure we can dominate both traditional but also new forms of energy. While we are not expecting the slogan to go global, Europe would benefit from encouraging investment in its own oil and gas producing regions, even as we see the logic for it to ramp up non-oil and gas forms of energy including nuclear in order to reduce energy import dependence. Canada is a strong candidate to both drill and build. With US shale maturing, the world would benefit over the long run from Canada stepping up its energy export growth rate. In the case of California, the bar is low to moving to a better balance of “all of the above” energy infrastructure growth versus its traditional emphasis on the environment.

Europe

Europe has been the ring-leader and home to the loudest voices of the idea that the world needs to urgently transition off of fossil fuels and into renewables. Most Super-Spiked readers will be aware of the history of Russia natural gas import dependence, Germany’s decision to prematurely retire its nuclear fleet, and the opposition to oil and gas drilling in the United Kingdom and many other countries (Norway a partial exception on this point). It is no coincidence that corporate and country net zero objectives reference the “Paris agreement.” U.K. leaders have proudly stated that their country started the age of coal at the dawn of the Industrial Revolution and that they would be the first to fully retire their own coal fleet. As US Secretary of Energy Chris Wright recently stated, the U.K. approach has not turned out well for ordinary citizens and has merely exported carbon emissions to other countries, most (all?) of which have worse labor and environmental standards than does the U.K. or Europe.

Degradation in country and corporate performance have gone hand-in-hand. To be sure, it is not fair to blame “climate only” policies for all of Europe’s woes. Demographic challenges and a heavy-handed regulatory mindset that extends well beyond the energy sector are major contributing factors. Our prayer for the United States has long been for our electorate and politicians to please not turn our country into New Europe West.

While a change toward energy pragmatism was inevitable, the re-election of President Trump this past November unquestionably accelerated whatever course correction Europe was due to make to its energy policies. The fact that Germany—the traditional heart of Europe’s economic engine—may be looking at its third straight year of economic contraction signals code red has arrived.

At the corporate level, we saw BP most aggressively look to transition away from oil and gas into new energies followed by Shell. The latter, however, made a well-received change to its senior leadership in 2023 and has been in the process of returning the company to what we think will be a much healthier path going forward. Europe has also seen other companies like Orsted and Neste pursue aggressive new energies strategies, which originally looked promising but have hit major road-bumps in recent years.

Major questions for Europe’s energy outlook:

Will industrial activity stabilize, which would improve confidence in long-term natural gas demand especially as the dream of a quick ramp in “green” hydrogen dies?

If the Russia-Ukraine war ended, will significantly higher volumes of Russia natural gas return at some point, obviating some amount of LNG (liquefied natural gas) imports from the United States and elsewhere?

What opportunities exist to power European data centers?

Will we see an improvement in incentives for exploration and development in the North Sea, both in the U.K. and Norway?

Will we see incentives improve for higher risk exploration in various Arctic or Arctic-adjacent areas?

Which, if any, European oil and gas companies can narrow the valuation gap with American peers?

Are any of the new energies companies that have fallen sharply in valuation now oversold?

Exhibit 1: Growth in oil production in select areas since 2000

Source: Energy Institute.

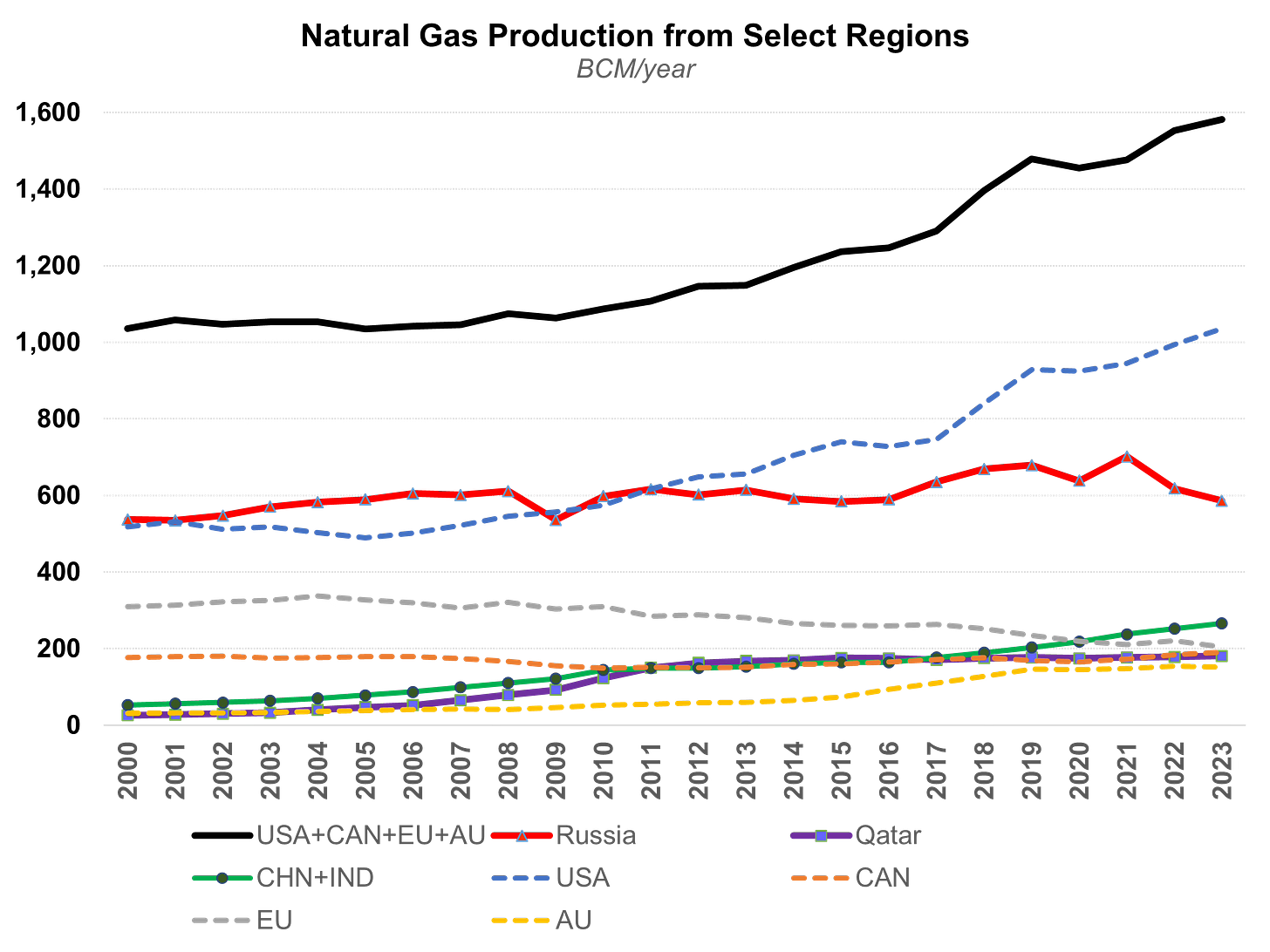

Exhibit 2: Growth in natural gas production in select areas since 2000

Source: Energy Institute.

Canada

The nature of Canada’s energy pragmatism awakening is very different than Europe’s. Canada enjoys a massive bounty of oil and natural gas that is well in excess of its domestic needs. The country has long been a major oil and natural gas exporter. It has also been (and remains) highly integrated with the United States, which receives the bulk of its exported energy. Hence, Canada’s geopolitical risk resides with its very high dependence on the United States—a point that had not been a front burner issue that we can recall until the past month or so.

Over the last decade of the Trudeau Administration, Canada drifted toward a European-like mindset via its version of “climate only” energy policies. Like the states of Texas or North Dakota, the province of Alberta, which holds the vast bulk of Canada’s oil and natural gas abundance, has been able to provide some protection for domestic producers from anti-oil and gas sentiments held by the federal government and in other parts of Canada. However, Alberta cannot on its own construct export infrastructure to the west or east or even to the south, as we saw with the Obama Administration’s rejection of the Keystone XL pipeline in 2015—a previous example of energy infrastructure politicization but one that did not rise to the level of existential concern for Canada seen in the recent row over country-wide tariffs.

President Trump’s tariff pronouncements clearly struck a nerve within Canada, highlighting its broad-based dependence on a single trading partner. The concern is economy wide, with the two countries highly integrated. The reality, though, is that the trading dependence is existential for Canada but not for the United States. Hence, the outraged reaction from as best as we can tell all of Canada.

Major questions for Canada’s energy outlook:

Will we see the country stay united over the long run on the need for business and energy infrastructure expansion, even if President Trump eventually rolls back the tariff threats or via a future US administration that is not as tariff focused?

Will we see improved collaboration between the province of Alberta and the federal government (irrespective of whomever replaces Prime Minister Trudeau in the next election) on energy infrastructure?

Will non-Albertans better recognize the need for a healthy, growing Canadian oil and gas sector to help meet the world’s growing energy needs?

Will the Trump tariff experience prove motivating to accelerating growth in Canada’s LNG export sector?

Are there currently stranded natural gas opportunities that would make sense for future LNG export?

Will new opportunities and incentives arise for Canada’s share of the Arctic?

California

The lack of energy pragmatism in California is both perplexing and perhaps most easily fixable, at least in theory. Technically, California is one of our fifty states! It is not an independent country facing its own geopolitical challenges. It is settled science that California’s energy issues are entirely man-made. Ironically, one of the shining examples for why we all should still care about diversity is with California and what happens when a large state’s political apparatus goes entirely in one direction. Single party rule and the lack of healthy debate that could challenge the ruling elite’s political orthodoxy is a root cause problem. Policies that are looking to ban ICE (internal combustion engine) vehicles on an absurdly fast time horizon and that are de facto ending oil and gas drilling in Bakersfield are leading examples of what we believe are mis-guided energy policies being pursued by California politicians like Governor Newsom. The list is much longer than just these two items.

On behalf of all of us at Super-Spiked and Veriten, we remain deeply saddened by the tragic fires that led to a devastating loss of property and life in January. The local reaction to the fires has surprised us in that questions about water and fire management practices, the numerous anti-business rules and regulations that exist in California, and the management capabilities of its political leadership have been at the center of citizen anger over the magnitude and scope of the devastation. The open question is will we see California voters move away from what can only be described as progressive rule without debate. We shall see.

Major questions for California’s energy outlook:

Will California embrace some version of an “all of the above” energy strategy?

What opportunities exist for natural gas production and infrastructure if a tack back to toward the middle were to occur?

Are there deep value opportunities to drill for oil and gas onshore or offshore California?

What are the implications for refiners and related product infrastructure?

What would an “all of the above” energy approach mean for California’s low carbon fuels standard (LCFS) and related tax credits?

Exhibit 3: Oil production in key US states

Source: EIA.

⚡️On A Personal Note: 100 Written Posts

The difference between the issues we were thinking about for post #1 and today’s 100th written post (plus 59 video podcasts) is striking. Super-Spiked was created with the tagline “a messy energy transition arrives.” Post #100 marks our belief that we have now transitioned to a welcomed, new era of energy pragmatism. Hallelujah! And let’s hope we are right. For this 100th On A Personal Note, I will answer the burning questions I know you all have.

What commentary gets the most feedback? This does! It’s not a close call that On A Personal Note elicits the most comments. I think a lot of people are simply skipping the main body text and going to this section. I really believe some of the stuff that comes before OAPN is interesting and worthy of your reading.

Why publish or produce content nearly every week? I have at times been tempted to switch to a twice or thrice monthly approach. But that would frankly be lazy, would run the risk of making individual posts too long, and would likely narrow the topics covered. We plan to keep Super-Spiked weekly for the foreseeable future.

How far in advance do you write or produce a video? Typically 2-4 days prior to publication. Only video podcast #59 was created more than a week in advance.

How do you decide what to write about? Energy is a massive sector that encompasses a broad range of topics, especially within our general areas of macro, corporate strategy, and geopolitics & policy. Coming up with post ideas is not hard.

What would you like to write or talk about but don’t? Individual company strategies and outlooks, including companies I know really well. Unfortunately, it’s not appropriate for many reasons, especially since various companies could be Veriten clients or competitors of Veriten clients. I also don’t think its appropriate for former Wall Street equity analysts to give investment advice for free and in a loose “this is not investment advice even when it sure sounds like it is” kind of way. You should either have a stock recommendation business you charge for or not. If you are giving investment advice and are a current or former Wall Street professional, I believe you should do so consistent with applicable rules and regulations.

What view of yours has changed the most since issue #1? The idea that new energies can be very beneficial to geopolitical security and reducing capital outflows for countries that import energy is not something I had previously considered. New energies should not just be thought of as a climate thing.

What view of yours has changed the least? Oil and gas is a critical sector underpinning human prosperity and should not be forcibly or prematurely retired—least of all only in friendly areas like the United States, Canada, and Europe—before more of the new stuff is ready for prime time. This applies to our macro outlook, corporate strategy, and geopolitical viewpoints.

What are you most proud of? The quality and breadth of my subscriber base, both on Substack and via Veriten’s network. I enjoy engaging with senior energy sector executives and policymakers as well as many of you that have subscribed anonymously on Substack and regularly engage, including those that agree and disagree with my views. The fact that one of my posts had both an environmentalist and a “MAGA” oil company CEO tweet out different quotes from the same post was especially gratifying.

What would you do differently? I think I remained too oil market focused for a stretch in 2023 and 2024, which means I was late to areas like power even as our core thesis clearly applied to all areas of energy, not just upstream/downstream oil & gas.

Should Super-Spiked continue if “a messy energy transition era” is no longer a thing? It is about as interesting and exciting of a time in energy as has existed in my 33 year career. The topics and areas of emphasis need to evolve. The name and publication cadence are staying the same.

Are you still glad you un-retired to Veriten? Heck yes!!! I have been super lucky to have had the career stops I’ve had: Petrie Parkman, JP Morgan, Goldman Sachs, various boards, and now Veriten. Many of you know and love Maynard, but the entire team is great. The biggest surprise has been my enjoyment at working for a Houston-based firm. While New York is obviously the center of the world, people are nicer in Texas, winter weather is warmer, taxes are lower, regulations are more business friendly, and the Astros may (finally) be beatable this year. My wife and I are looking forward to spending a greater portion of our time in the great state of Texas in the coming years.

When will you re-retire? If board work counts as not being retired, I don’t think I will so long as I am of able mind and body. The energy sector is too much fun and interesting to think I would not be engaged in some manner for my remaining years. Thank you God for making me an energy equity research analyst.

⚖️ Disclaimer

I certify that these are my personal, strongly held views at the time of this post. My views are my own and not attributable to any affiliation, past or present. This is not an investment newsletter and there is no financial advice explicitly or implicitly provided here. My views can and will change in the future as warranted by updated analyses and developments. Some of my comments are made in jest for entertainment purposes; I sincerely mean no offense to anyone that takes issue.

“Build Baby Build”. I love it!

This isn't directly related to this post, but regarding industry level reinvestment rates and capex, do you have any way of adjusting your historical and current data for gains in efficiency? We've seen a trend over the past few years of needing significantly less capex per barrel recovered it seems. Exxon has said it historically only recovered about 10% of oil in the ground and is now close to it's goal of 20% recovery for newer wells. Also rig counts have went down drastically while total oil production is at record highs. It seems like some kind of adjustment needs to be made in order to account for these significant efficiency gains.