With this post, Super-Spiked will now be exclusively affiliated with Veriten, a research, strategy and investing firm focused on understanding the long-term energy landscape. It will continue to be published free of charge on Substack. Please see the “On A Personal Note” section for additional details.

We all know that last decade was not good for traditional energy and there isn't a single investor that has forgotten that notwithstanding the 2-year run of much improved ROCE (returns on capital employed), free cash flow, and shareholder capital returns (i.e., dividends and share repurchases). Strong memories have resulted in an environment of extreme risk-avoidance, which I believe is creating a unique opportunity for corporates and investors willing to zig while other zag.

Key Super-Spiked themes are colliding and have conflicting implications:

Theme 1: Oil and natural gas demand is likely to be far more resilient than the "IEA Net Zero by 2050" consensus fears.

Theme 2: Insufficient CAPEX in light of perpetual demand concerns is driving a Super Vol macro backdrop of price spikes followed by price busts, with the latter serving to reinforce pessimism on the long-term outlook.

Theme 3: High inherent commodity price volatility is reinforcing an environment of risk avoidance, a higher cost of capital, and a strong preference for shareholder capital returns over reinvestment back into the business.

I recognize that it is an impossible ask for investors to consider acquisitions or mega projects at a time when memories of the bad ole days of 2010-2020 are still fresh and where there is understandable uncertainty on how "energy transition" will play out. The easy button is (1) hunker down; (2) minimize CAPEX spend; and (3) pay-out max dividends/stock buybacks.

As a life-long energy equity research analyst, I get it. And I have long been a proponent that the only purpose of a business is to generate excess profitability; it is not to grow to some arbitrary size. But oil and gas is still a critical underpinning to the global economy. Without adequate supply, world economies cannot grow. Oil and natural gas supply is needed today and will be needed for far longer and in much greater quantities than the global elite, rich western world consensus currently believes.

And to be sure, for some, hunkering down may be the best path forward. No publicly-traded E&P management would ever acknowledge a willingness to try liquidation mode, but past results suggests some should consider it. At a minimum, liquidation while waiting for the dream deal is perhaps the more palatable phraseology. Kind of like the old "shrink to grow" restructuring strategy that both investors and executives teams could rally around. "Liquidate while you wait" might be a viable forward path.

But we are in a world where structural oil and natural gas supply growth is not on-track to keep pace with resilient demand. There are going to be opportunities to earn outsize returns on acquisitions and to invest in mega projects that can generate a base of free cash flow for decades into the future, either of which shareholders will ultimately enjoy.

Where will the energy world be in 10 years?

In my view, we will still be consuming at least as much and likely more crude oil, refined products, natural gas, and even coal. New technologies will take up some portion of the growth pie, but, in my view, represent a diversification opportunity for the world rather than a substitution of one form of energy for another.

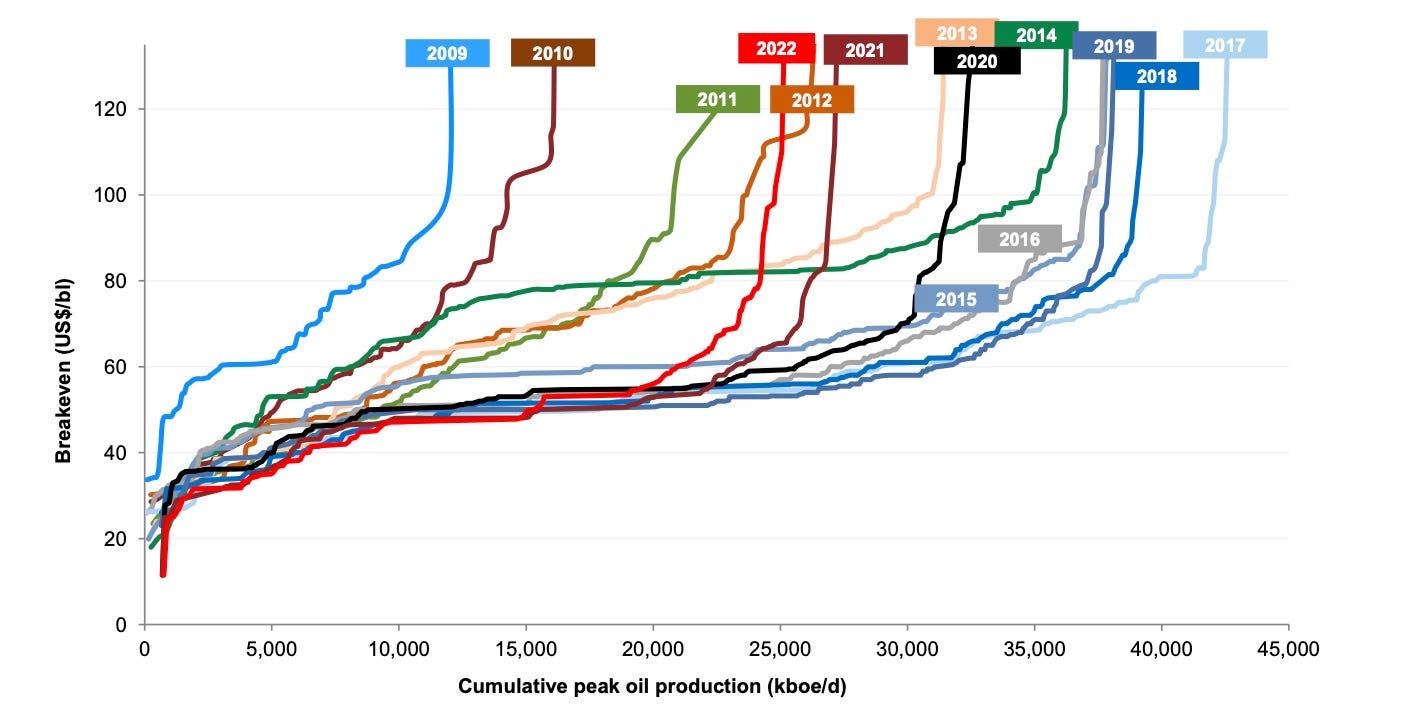

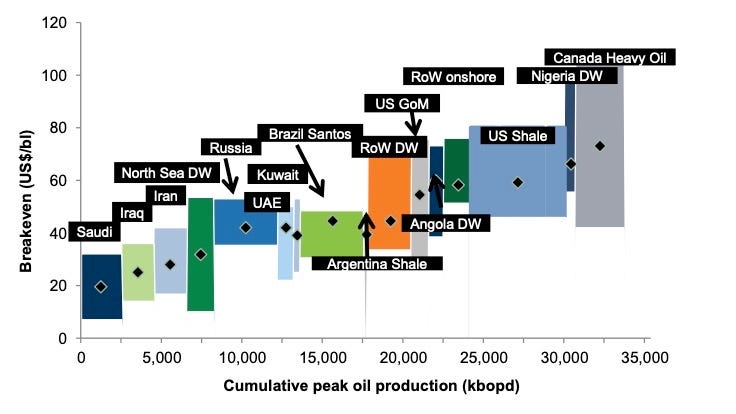

For the oil and gas business, history informs us that the hot area of the prior cycle isn't necessarily going to be the focus area for the next one. Oil and gas cost curves are dynamic: it's always about trying to invest in areas that will be at the low end of the future cost curve (Exhibits 1 and 2).

Exhibits 1: The oil cost curve is not stagnant

Exhibit 2: Every region has low/mid/high cost areas

To be clear, the Permian Basin and US shale more broadly is likely to remain a critically important supply basin for the coming decade. But that is well known and is showing signs of being a less robust driver of growth versus what we saw over 2010-2020.

What areas have been forgotten by the shale tsunami?

Mega oil projects in the Middle East and North Africa

Canada's oil sands region

Deepwater Gulf of Mexico, West Africa, and Brazil

Acquisition and exploitation of conventional oil and gas assets in a variety of international locations

I am sure this is a far from complete list

The return of oil & gas globalization

It is interesting that at a time there is a lot of talk of degloblization and reshoring supply chains in other industries, the oil and gas industry may be headed the other way. This has been an industry that has created many good paying jobs in America via the shale revolution. Capital flowed here (to the USA) from elsewhere. I suspect though that the oil and gas industry, generally speaking, is going to at least partially start heading back in the other direction.

Globalization "green shoots":

It's been a while since we have seen a flurry of cross border deals. Somewhat ironically relative to the gist of this note, we have recently seen two transactions where foreign players added assets in the Eagle Ford Shale in Texas: (1) INEOS (UK) purchasing Chesapeake Energy assets and (2) Baytex (Canada) announcing it was buying Ranger Oil.

We have seen news of acreage purchases in Algeria, an asset acquisition in the UAE, and new LNG deals in the Middle East.

Perhaps the most exciting oil project in the world right now is the ExxonMobil/Hess development offshore Guyana.

We have yet to see national oil companies (NOCs) return to large-scale foreign asset purchases. I divide NOCs into two buckets: (1) consuming (importing) country NOCs in places like China and India; and (2) producing (exporting) country NOCs in places like the Middle East or Latin America. The consuming country NOCs in particular are driven by a need to ensure adequate resources are available for domestic consumption. Given what is still dominant "climate only" ideology in the western world, there would appear to be a window for NOCs to expand globally without meaningful competition from western oil and gas companies or private equity-backed firms.

Resource co-development between producing country NOCs and western world majors and E&Ps is something I think can return, especially in countries that are in need of significant capital and possibly technical help. Examples include various countries in Latin America and Africa.

Acquisitions and mega projects in a Super Vol world

Basic math: A sequence of $70, $80, $75 averages $75, as does a sequence of $50, $100, $75. The market will typically ascribe a higher value to the former owing to its preference for stability despite the mathematical equivalence of the outcomes. Fine. What is noteworthy of the second scenario is that in the real world of oil and natural gas supply/demand needing to balance, it will for some period of time—5 years? 10 years?—drive an improving underlying trajectory as the volatility keeps capital and CAPEX on the sidelines (Exhibits 3 and 4).

Exhibit 3: A 1 standard deviation move in the quarterly average WTI oil price is pushing $20/bbl…

Exhibit 4: …and companies and investors should prepare for 1.5-3 standard deviation moves in quarterly WTI

Spending that has a chance to be be good includes:

In areas of competitive advantage for a company.

When pursued earlier in an upcycle when everyone else is still in hunker down mode and focused on max dividends/buybacks.

A clear articulation of the financial, operational, and strategic risk/reward is addressed...as opposed to the more typical presentation philosophy of only emphasizing upside scenarios.

Management figures out the best executive and employee team that will effectively integrate an acquired asset or company into the parent entity.

Exhibit 5: It is early days in the CAPEX cycle, which remains well below the “danger zone” levels seen in the Super-Spike era last time

Every company involved in the upstream oil and gas business needs to add inventory...if not today, then tomorrow. If you are not adding inventory, you are de facto liquidating. Unfortunately, the only spending anyone remembers is the bad kind that happened late in the last cycle at inflated costs and acquisition prices.

All spending, in particular acquisitions or mega projects, needs to be evaluated on a case-by-case basis. The goal as always is to invest in projects that will be at or near the low end of the future cost curve inclusive of purchase price or upfront capital paid. The last point is not to be over looked. A high cost asset purchased for pennies on the dollar might be more attractive than a premium price paid for a favored asset.

To be clear on my main message: it is NOT that all spending, acquisitions, or mega projects pursued early in the cycle are inherently good. That is definitely not the case. Rather, it is that I disagree with the consensus investor view that all spending is inherently bad.

That said, liquidate-while-you-wait is a perfectly reasonable request on the part of investors. There should not be any urgency to do a deal just to add size. But in a world where consensus is convinced the entire industry is on borrowed time, there must be opportunities worth pursuing. Now and over the next few years is the time, not 10 years from now when everyone is bulled up, fat, and happy.

"Liquidate while you wait", the new "shrink to grow"

Over the past 20 years, when integrated oils and E&Ps became over-extended in terms of asset or project breadth and financial health weakened, investors and managements would often rally around a "shrink to grow" objective. I want to give the old Exxon in the late 1980s credit for being the first to do this but it might have been someone else. The idea was to sell assets, reduce head count, cut costs, and otherwise narrow the focus of the company. As the theory went, from the smaller base, a company would be in a better position to resume growth from the smaller size.

These days, no one wants growth. But the underlying concept in some respects still holds. It should be acceptable to essentially partially liquidate the company by letting production decline and using free cash flow to eliminate external obligations like debt and to pay out dividends or stock buybacks. The improved financial position, even if from a smaller size, can position a company to take advantage of a truly interesting acquisition or investment opportunity.

It is conceptually the same premise as "shrink to grow" but without necessarily doing the asset sales or cost cutting portion of that strategy. Rather, production organically declines via under-investment.

⚡️On a Personal Note: Truth In Energy

If you are going to save the world, we need to start by saving the conversation. - Veriten

Super-Spiked takes aim at what looks like an increasingly messy energy transition by examining the clash of energy commodity & equity markets with climate policy, ESG investor initiatives, and geopolitics. - Super-Spiked

Super-Spiked was created on the idea that we could use a lot more "truth in energy" and a lot less partisanship, extremism, virtue signaling, and, in particular, really bad policy prescriptions. Veriten, loosely translated, means “truth in energy”.

As of this post, Super-Spiked is now exclusively affiliated with Veriten. It will remain free of charge and on Substack for the foreseeable future.

I am now un-retired and sticking with a Q&A format to explain.

Why am I am un-retiring?

I have been having a lot of fun writing Super-Spiked and re-engaging with the broader world over the past 16 months.

We have a major, new energy cycle upon us.

I really, really disagree with how the global elite consensus in rich, western countries discuss "energy transition".

My children are leaving home. Free advice to high achieving, younger dads: If you ever get the chance to spend real time with your family while they are still at home, just do it. There is no amount of compensation that will give you back the time with them. Once the natural process of full-time childhood parenting expires, you will never get that back (short of starting family #2, which I have no plans to do!). Thank you to my wife for being a de facto single parent during my time at Goldman Sachs.

What does this mean for public access to Super-Spiked?

Not a thing. The intention is for Super-Spiked to remain free of charge and on Substack so long as Substack continues to thrive as a platform. I am a huge Substack fan.

Veriten produces a successful Close of Business Tuesday (COBT) video for free on its website (here). I would encourage Super-Spiked subscribers to sign up for it.

My new colleagues at Veriten and I share a common mission to help educate the world on energy realities, with COBT and Super-Spiked complimentary offerings.

Why join Veriten? Why not start charging for Super-Spiked or otherwise pursue an independent research model?

I have zero desire to pursue an independent research model.

I may have strong opinions and at times out of consensus views on all things energy, but I am not insane. I helped run a major investment bank's research division. It is really hard work.

Charging directly for research is a reasonably thankless and limited profitability task and has the potential to introduce compromises I am not interested in making, such as short-term-ism, extremism, pro-industry-ism, permabull-ism, etc.

Haven't you been enjoying the freedom that comes with all your advisory/board roles? Why would you want to work full time again?

I view Veriten as a natural and complimentary extension of what I have been doing since leaving my analyst career in 2014. I don't view it as returning to the type of full time work that I did during my first 22 years on Wall Street.

It is really a consolidation of go forward advisory work onto a platform of like-minded colleagues.

I have been really fortunate with the various board and advisory positions I have held since retiring from Goldman and am excited to continue serving those organizations. Each of my positions is synergistic with the others.

The only thing that is changing is that I will now run all future requests for my time through Veriten.

I am finding that requests for my expertise have been increasing dramatically since I started publishing Super-Spiked. I believe the Veriten platform is an excellent way to help other organizations think through the energy landscape. I believe it is a better model versus trying to be an independent contractor.

Mercifully at Veriten I will not be determining anyone's compensation or delivering 360 degree reviews. I am looking forward to mentoring younger colleagues and working with the broader team.

Why Veriten?

I believe the opportunity to do what I enjoy most has the highest chance of being achieved at Veriten.

I love analyzing the energy sector and evaluating both new and old companies through the lens of "how can they be great" or "what are the risks they could fail" over the long run. I much prefer writing about the sector with a long-term view and not having to engage in short-term buy/sell decisions for individual securities.

I find it really rewarding interacting with industry executives, board directors, senior policy makers, and pragmatic environmentalists.

I enjoy meeting new companies and doing field trips to visit assets, projects, and the people that work in the field.

I am excited to work with a group of colleagues that culturally fit with the type of organization I am attracted to: genuinely nice people, collaborative, inclusive, non-partisan/non-ideological, humble, self-reflective, with global perspectives, but American and markets oriented in culture.

Veriten Founder and CEO Maynard Holt and I were colleagues at Goldman back in the early 2000s. He long ago made my list of all-time favorite industry colleagues. Mike Bradley and I also go back to that same era; over the past 20 years we have alternated being each other’s client or friendly competitor...we are going to have a lot of fun working together, finally. The other Veriten team members I have enjoyed getting to know over the past year as the company has ramped and I joined its advisory board. It’s a remarkable group that have come together and built a strong foundation in year one of their existence.

Closing the career circle

Veriten also represents a closing of my career circle. My career began at a start-up oil & gas-focused investment bank in Denver; I joined Petrie Parkman & Co. as a junior research associate in March 1992, year 3 of its existence.

The final interview I had with Tom Petrie stands out as a career highlight as does meeting Jim Parkman, a person I was scared to death of until seeing him in cowboy boots in the elevator of what I think was then the tallest building in downtown Houston…might have been called Texas Commerce Tower?

At Petrie Parkman, I was fortunate to have worked for and been mentored by Paul Leibman. The analytical rigor, relentless strive for perfection, and intolerance for lazily accepting conventional narratives comes from him. “Arjun, what is your edge? What are you bringing to the table? Everyone already knows this. What do they not know?”

Are you moving to Houston?

I love the great state of Texas but have no plans to become Texan myself.

New York is the financial capital of the world and in close proximity to other relevant cities like Washington D.C., Boston, and Miami. A Veriten presence in this region I believe will be helpful to serving Veriten's clients.

But I am pro-Texas…and own several pairs of cowboy boots. I am also a life-long fan of the Dallas Cowboys along with the Yankees, Knicks, and Rangers.

Why do you root for the Cowboys and not a New York football team? You don't have to be from Dallas to root for the Cowboys. They are America's Team.

The plan is to represent Texas and the energy industry in New York. Texans understand energy and oil and gas. New Yorkers and other coastal elites? Not so much and that needs to change. And in case you were wondering: (1) Met Life is arguably the worst major sports stadium in the world in sharp contrast to Jerry Jones’ AT&T Stadium, one of my favorites; (2) the Cowboys demolished the Giants on this cold December day in 2021; (3) it’s always a pleasure to run into friendly fellow Cowboys fans in a hostile parking lot.

⚖️ Disclaimer

I certify that these are my personal, strongly held views at the time of this post. My views are my own and not attributable to any affiliation, past or present. This is not an investment newsletter and there is no financial advice explicitly or implicitly provided here. My views can and will change in the future as warranted by updated analyses and developments. Some of my comments are made in jest for entertainment purposes; I sincerely mean no offense to anyone that takes issue.

i recently started following you - and I am grateful I did ! I really value your experience and outstanding writing. I am fascinated by the world of energy - it is what makes civilization possible. I invest in energy companies and attempt to follow the industry with a global perspective. your writing projects your personality as a "good guy" ! all the best and thank you!

Arjun, it was Texas Commerce Tower. Until 1990, it was the tallest building west of the Mississippi River. Also the original home of Pogo. Looking at it right now from our high rise on Kirby.

Welcome back to the Goldman diaspora!