A Look Back at 2024 Tactical Questions

Navigating The Energy Macro

In our final post of the year, we take a look back at the ten tactical questions for 2024 we asked in January (here). Our self-evaluation is that we did a so-so job previewing the key tactical themes in what turned out to be a disappointing year for traditional energy and another poor year for new energies equities. We had two big misses or oversights that cast a pall over the items we got right. First and foremost, we neglected to highlight in that 2024 outlook post how important of a year it would turn out to be for themes around the power sector. The fact that power is not within our traditional area of expertise is no excuse for having ignored it. In addition, while we have been firmly (and correctly) in the “Super Vol” rather than super-cycle camp for oil markets, we were too optimistic that aggregate sector profitability would remain at mid-teens levels using return on capital employed (ROCE), with the year looking more like it will turn out to be a little better than cost-of-capital for the traditional energy sector overall. The corresponding extended negative EPS revision cycle has kept a lid on sector performance versus the broader market, despite what we believe are otherwise inexpensive valuations for many traditional energy companies.

We have grouped our 2024 tactical questions into four broad themes: (1) macro oriented; (2) profitability and sub-sector outlooks; (3) corporate strategy and M&A; and (4) geopolitics and policy. We judge that we correctly called 6 of the 10 questions and that 9 of the questions were important themes to have highlighted. While not an awful track record, our Wall Street training leaves us more bothered by what we missed than what we got right. We will look to do better with our tactical questions for 2025, which we are aiming to publish early in the new year.

The broader purpose and motivating drive of Super-Spiked has been to argue in favor of energy policies and perspectives that prioritize everyone on Earth some day becoming energy rich as the overarching goal. This contrasts with Malthusian “net-zero-is-all-that-matters” frameworks that became the consensus approach to evaluating energy over the past half decade in rich, western countries. As we wrote in Reflections on the End of The Energy Transition™ Era (here), we believe we have done better on this score as there is a broadening movement toward our worldview on energy. That said, we need to be better at marrying the long-term with the tactical, which is never easy.

A major focus of ours for 2025 will be better framing what it means for everyone on Earth to some day be energy rich. In particular, the obsession with energy scenarios that only toggle between various carbon emissions profiles we would argue is the biggest mistake being made by companies and policy makers. No one on Earth prioritizes net zero carbon emissions as their primary objective. Counterintuitively, it is our view that by solving for maximum societal wealth everywhere, there will be significant motivation for companies and countries to pursue alternative energy sources and technologies.

As noted, this is our final Super-Spiked publication for 2024. We would like to wish all subscribers a happy holiday season and New Years. We will see you in January.

Macro-Oriented Themes

Question 1: Will US shale oil supply growth (finally) slow in 2024?

Original answer: Yes, but...

Judgement: Correct call.

Was this an important theme for 2024? The slowing is relevant, but was superseded by other non-OPEC growth and disappointing oil demand.

Q2: Does the build-up in OPEC spare capacity point to a needed downgrade of our "Super Vol" macro framing to "Normal Vol"?

Original answer: No, not really.

Judgement: While the band oil prices traded in did narrow versus prior years, we judge the volatility theme as correct.

Was this an important theme for 2024? Yes, in the sense that uncertainty remained high and the fact that 2024 confirmed that Russia-Ukraine did not signify a new super-cycle was upon us.

Q3: Will demand for oil, natural gas, coal, EVs (electric vehicles), and renewables grow in Asia?

Original answer: Yes, of course...and the answer will be "yes" for the foreseeable future.

Judgement: Correct call.

Was this an important theme for 2024? Yes. The wider world is starting to remember that “all of the above” is really the only viable scenario for energy development.

We would assess the efficacy of our macro outlook for 2024 as having some good and some bad. On the positive side, our belief that The Energy Transition™ was a marketing term (perhaps an aspiration for some) as opposed to something that was actually happening is proving correct. We expect all forms of energy to grow for the foreseeable future in order to meet the massive unmet energy needs of the other 7 billion people on Earth that are not amongst The Lucky 1 Billion of Us living in rich-world countries. This is our North Star and mega theme and we believe the world is coming our way.

We also believe we have been correct in calling for a Super Vol commodity macro backdrop rather than a super-cycle. We judge ourselves as being accurate on this point, even as the trading range for oil prices was narrower in 2024 than in prior years.

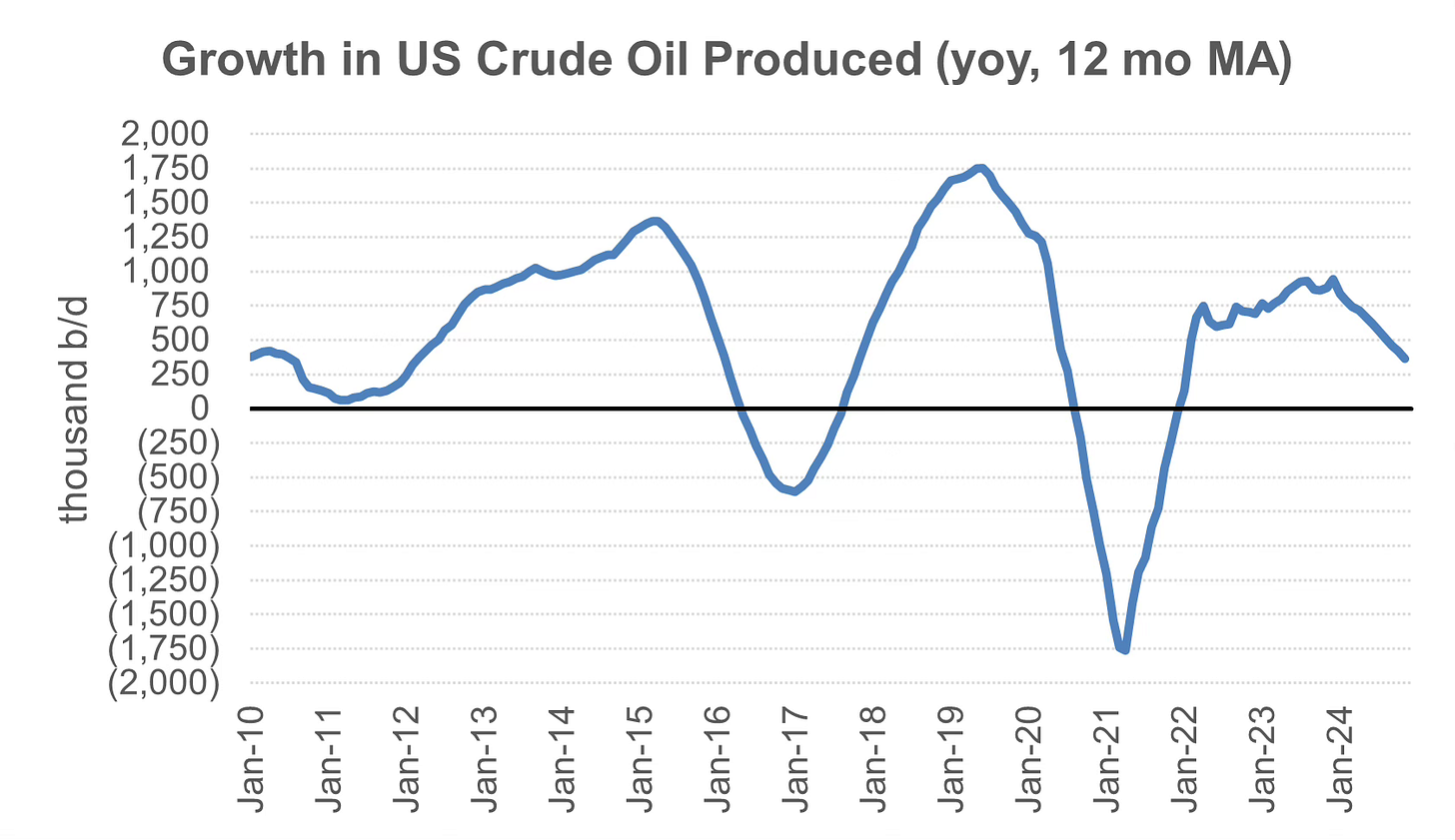

What we missed in 2024 was a deeper slowdown in oil demand growth to about 1 million b/d, below our beginning of year expectation of closer to 1.5 million b/d. Even though US shale oil supply slowed about in-line with our expectations (Exhibit 1), the corresponding slower oil demand growth allowed healthy growth from Guyana, Brazil, and Canada to keep oil markets well supplied, and OPEC+ has had to maintain ongoing supply cuts to keep spot oil prices from falling.

Exhibit 1: US shale oil has slowed in-line with expectations, but weaker oil demand kept markets worried about downside risks to oil prices

Source: DOE, Veriten.

We also either ignored or under-emphasized weakness in global and US natural gas prices for much of 2024 which had a depressing impact on sector earnings. Similarly, we did not explicitly call for a collapse in refining margins. We are guilty of being too crude oil focused in our commentary, but will fix that going forward.

Looking forward, we highlight the following long-term macro themes:

Obliterating peak oil demand: We see no evidence that oil demand is on-track to permanently peak anytime soon, with the biggest near-term risk being ongoing sluggish global GDP growth.

What replaces US shale oil? Over the last decade, the world has been heavily dependent on massive growth from US shale oil producers. The day will come when we will need new sources of crude oil, which, combined with our long-term demand outlook, is the case for a super-cycle eventually returning to crude oil markets.

Significant US and global gas demand growth: We see natural gas as a key energy source for booming US and global power markets, an emerging source in select transportation markets (e.g., China LNG trucking), as well as to meet industrial and other needs. There is not a person on Earth that wants temporary power some of the time. Natural gas will be a critical source of dispatchable power for many, many decades to come. That said, there is an open question on where in the natural gas value chain offers the best opportunity set for companies and investors.

Refining: Like crude oil markets, weaker-than-expected oil demand trends coupled with recent larger expansions in various countries (e.g., Mexico, Nigeria, India) contributed to a sharp correction in second half 2024 refining margins. Long-term, we believe refined product demand will grow at a faster pace than announced projects net of expected closures.

Power: Power is now arguably THE energy theme driving most discussions. An aging grid in rich countries like the United States, the growing share of intermittent energy sources (i.e., solar, wind) in numerous power grids around the world, rising power demand due to economic growth in the developing world, and the turbo-charging of demand growth in both rich countries and emerging economies with new data centers has made power a critical area of focus for businesses, consumers, and policy makers.

Profitability and Sub-Sector Outlooks

Q4: Will median ROCE remain at mid-teens-plus levels for the traditional energy sector?

Original answer: Yes, assuming circa $70/bbl WTI.

Judgement: Incorrect call.

Was this an important theme for 2024? Yes in the sense that negative EPS revisions (and corresponding weaker profitability) contributed to underperformance of the sector versus the broader S&P 500.

Q5: Will US refiners/downstream remain best-in-class on ROCE?

Original answer: We think so.

Judgement: Incorrect call.

Was this an important theme for 2024? Yes in the sense that getting this wrong was emblematic of broader weakness across traditional energy.

Q6: How do Pipeline/Midstream companies fit into our outlook for traditional energy?

Original answer: Super interesting with a significant, diverse opportunity set.

Judgement: Correct call to highlight.

Was this an important theme for 2024? Yes, infrastructure growth has been a key energy theme.

Our two specific ROCE calls for 2024 proved to be incorrect. We said in January that at $70/bbl WTI, median ROCE for the sector would be around 15%. In fact WTI is on-track to average about $76/bbl and median ROCE looks like it will be closer to 11% (Exhibit 2). By ignoring, or at least not explicitly stating our natural gas price and refining margin assumptions, we unnecessarily simplified our call to one solely based on crude oil prices. In addition, some amount of cost creep and the impact of M&A activity on capital employed have contributed to weaker ROCE in 2024.

Exhibit 2: Sector ROCE in 2024 has been weaker than we anticipated, adjusted for the level of WTI oil prices

Source: DOE, Veriten.

With all that said, a recovery in US and global gas pricing that is expected coupled with the fact that industry capital spending generally remains subdued suggests that we are still well on-track for structurally improved ROCE in the 2020s versus the 2010s. Most importantly, we focus on companies in the top two ROCE quartiles, which did successfully maintain mid-teens ROCE in 2024 and we think will do so going forward.

Regarding our sub-sector calls, our infrastructure focus we think remains correct and supports an optimistic view of both midstream and downstream companies. Refining margins have always epitomized “super volatility" where the good times feel great but the bad times feel bloody awful. This too shall pass.

Corporate Strategy and M&A

Q7: Is E&P-oriented M&A good, bad, or neutral for the traditional energy sector, especially at a time commodity prices are not obviously near trough levels?

Original answer: It depends...

Judgement: Correct call.

Was this an important theme for 2024? Yes.

Q8: Will we see new company formation in traditional energy?

Original answer: We need it, but it's likely only if energy significantly outperforms the broader market.

Judgement: Correct call.

Was this an important theme for 2024? No, not really as it is not consistent with our Super Vol over super-cycle framing so could have waited for a future year.

Q9: Amongst the new energies carnage, is there an area that traditional energy should venture into to?

Original answer: There must be.

Judgement: Incorrect call based on non-sensical original answer.

Was this an important theme for 2024? Yes, in the sense that it was important to determine whether or not to shift capital into “low carbon” technologies. That said, with hindsight, we really dislike our idiotic “there must be” answer. It does not take a stand or offer any specific areas to focus on. In our old role as co-director of research at Goldman, we would have not been OK with any of our analysts writing such gibberish.

M&A of course has remained a big theme in energy and consistent with our “it depends” answer that one cannot make a blanket statement that all transactions are good, bad, or indifferent. As for lamenting the lack of new traditional energy names, it will take a bigger upcycle that we were not calling for in 2024 to create the spark of new company formation. Therefore, the question itself did not deserve to be posed in our outlook report as we haven’t been calling for a commodity super cycle.

As for new energies, our unapologetic and unambiguous view that we regularly and widely express in writing, in meetings, and on podcasts has been that most traditional energy companies should stay clear of most new energies areas. We have never believed, as some have argued, that there is some kind of responsibility for traditional energy to aggressively move into new energies. If anything, the opposite is true: traditional energy, especially companies in friendly, allied areas like the United States, Canada, and Western Europe should seek to profitably produce as much oil and gas as the world demands for as long as it continues to demand it. Our January 2024 answer was unnecessarily ambiguous and non-sensical. It is the kind of wishy-washy answer we despise; our editorial instincts seem to have only kicked in upon reflection nearly a year later.

Geopolitics and Policy

Q10: Will a US presidential election year present an opportunity for healthy dialogue and intelligent debate around pressing energy and environmental issues?

Original answer: LOL! 🤣

Judgement: Incorrect call!!!

Was this an important theme for 2024? Yes.

To our complete shock, we went through an entire and typically contentious US presidential election WITHOUT much mention of energy or climate from any of the three major party candidates that participated (i.e., Trump, Biden, and Harris). Let sleeping dogs lie applies here. The less publicly said, the better. Energy systems are complex, capital intensive, slow moving in nature, and with numerous tradeoffs around reliability, affordability, geopolitical security, and environmental considerations. Keeping energy out of the national media and political headlines is a step toward at least having the opportunity for some measure of pragmatism and needed compromise to creep into the discussion.

Our apologies to president elect and former president Trump, president Biden, and vice president Harris for having so little confidence in your collectively abilities to mostly steer clear of talking about energy and the environment.

⚡️On A Personal Note: Landman (WARNING: mild spoilers)

My wife and I are through episode 5 of Landman on Paramount+ and absolutely love the show. If you aren’t watching it, you are missing out. Billy Bob Thornton (Tommy Norris) is outstanding as always, but so is the rest of the cast. The crazy ex-wife, colorful daughter, Jon Hamm as the oil boss, and all of the supporting cast do a great job. I’d also recommend my X (Twitter) friend Chuck Yates’ post show discussions on his YouTube channel (here), where you can hear Chuck and real landmen offer their takes on the show. Chuck should join one of Bill Simmons’ shows on The Ringer network to discuss Landman; he provides quality analysis and in that style.

If a show could symbolically mark the end of The Energy TransitionTM era, it is Landman. Think about it: this is a show about the oil industry where the main character regularly explains and defends why we use energy and why the oil and gas industry exists and remains critically needed—whether the broader American public understands any of this or not. “The world has already convinced itself that you are evil, I am evil by providing them the one thing they interact with every day” is a key line from Jon Hamm (Monty Miller) and a core underlying philosophy of this show. The decision by a major Hollywood writer and producer to create a show that attempts to shift the public discourse around oil and gas from non-stop demonization to one of explanation and entertainment is simply stunning.

For those of you in the industry that take issue with some of the portrayals and Texas oilman caricatures, this is of course a fictional show that is prioritizing entertainment value over literal interpretations. This is not Landman: A documentarian’s look at an under-discussed area of our global energy system. In the same way I find depictions of Wall Street bankers or traders to often be exaggerated and ridiculous, the same is true here. It’s meant to be a fun show. No one that is in the oil and gas industry should lose sight of the fact that this is an incredible first step toward ending the demonization and discrimination you all have undeservedly faced from many Americans (and Europeans and Canadians), including some of our most senior government officials.

I agree with Chuck and his guests that the worst part of the show is the opening music; there are plenty of upbeat and edgier country songs they could have gone with instead. I also cringe at the HSE (health, safety, environment) violations that I am 99% sure are not accurate or at least grossly exaggerated in today’s Permian Basin. I am pretty sure you can’t bring firearms or other weapons to man camps or well sites. I am even more confident that you cannot smoke cigarettes while actively drilling a well. And I would pray that the scene where the crew meets their demise couldn’t happen in the way that it did on this show.

The one-liners from the daughter are pretty funny with some sweetness included. “I won’t quit you Daddy, even if there’s another oil bust.” The crazy ex-wife seems realistically portrayed. I agree with some of the criticism Chuck has mentioned that the broader portrayal of women in the show leaves something to be desired, though, again, I am a big fan of Billy Bob’s family.

The scene I found to be especially unrealistic was the one on the golf course. It is not within any country club’s culture that I have been to where the group behind aggressively tries to play through in the way they did on this show. There can be observable annoyance from a distance. But I’ve never seen anyone accosted by the group trying to play through as was depicted here. At least Jon Hamm looked like he may actually be a golfer.

Billy Bob’s “get real about energy transition” speech to the attractive young Gen Z lawyer has been well received by energy pragmatists everywhere. No need to send him my Reflections on the End of The Energy Transition Era post; Billy Bob and Taylor Sheridan already get it.

⚖️ Disclaimer

I certify that these are my personal, strongly held views at the time of this post. My views are my own and not attributable to any affiliation, past or present. This is not an investment newsletter and there is no financial advice explicitly or implicitly provided here. My views can and will change in the future as warranted by updated analyses and developments. Some of my comments are made in jest for entertainment purposes; I sincerely mean no offense to anyone that takes issue.

Happy Holidays, Arjun! Your work shared here is much appreciated.

One can note that TV and movies often visit everything bad that has ever happened to anyone in the realm portrayed upon their protagonists. Sheridan's 1883 was a case in point with wagon trains. A Vietnam vet friend points out that most war movies do the same thing. So here we are five episodes in with four deaths and multiple non-lethal injuries. Not realistic, but not going to stop either. I love the show, anyway.

Merry Christmas and happy holidays Arjun,

Speaking of the two industries, oil and Wall St. (oil and Bay St. here in the perhaps-maybe-one-day 51rst state), I can't think of many movies that depict either industry accurately. Although it's set in a struggling real estate firm, Glengarry Glen Ross (1992) I think does a good job of capturing the general atmosphere of some of what happens in some areas of the business. When I was starting out we'd often quote lines from Glengarry because they were so fitting. I'm trying to think of a single movie that portrays the oil business in a realistic way, there might be but I haven't seen it.