We follow up on last week's Big Themes post with a tactical look at 2024 from the perspective of traditional energy. We use the popular Q&A-styled format to hit on key issues facing corporates, investors, and policy makers. As is true with all of our posts, feedback is welcomed via the Comments section on Substack, by replying to the Substack or Veriten email (which goes directly to Arjun), or if you are a Friend of Veriten by reaching out directly to Arjun or anyone on Team Veriten.

Q1: Will US shale oil supply growth (finally) slow in 2024?

Super-Spiked Answer (A): Yes, but...

We expect US crude oil supply to slow to around 300,000-400,000 b/d of annual growth this year down from about 1 million b/d in 2023. With that said, the call for a slowdown in US shale oil growth due to "maturity" has arguably been the worst call most energy experts have been making since shale oil first became noticeable in the 2012 time frame. It has been a decade of waiting for a maturity-induced slowdown, which we will simplistically define as diminishing production for a given rig count level.

For 2024, it looks like a reduction in the rig count in 2H2023 will yield slower volume growth in 2024; what is not yet proven is that a higher rig count would NOT result in higher production. Some day this will be true! The iron laws of geology and geophysics say so. In terms of an ultimate peak in US shale oil supply, our forecasts are broadly consistent with estimates made by Enverus and Goldman Sachs, which call for slowing annual shale growth over the next several years and an ultimate peak/plateau reached later this decade.

Q2: Does the build-up in OPEC spare capacity point to a needed downgrade of our "Super Vol" macro framing to "Normal Vol"?

A: No, not really.

Our first post arguing for a "Super Vol" rather than super-cycle commodity macro backdrop was on February 12, 2022 (here); it remains our core macro framework. In a nutshell, we expect crude oil, US natural gas, and global LNG pricing as well as refined product margins to bounce between wide extremes. Overall averages will likely prove sufficient for the top two quartiles of energy companies to achieve mid-teens or better return on capital employed (ROCE). But the mindset for corporates and investors should be about ensuring you can take advantage of inevitable pullbacks and cyclical downturns while harvesting cash flows during high-priced periods.

In an environment where OPEC spare capacity has increased a bit based on 2023 production cuts from Saudi Arabia, United Arab Emirates (UAE), and Kuwait, it is possible that "Super Vol" might warrant a temporary downgrade to simply "High Vol" in 2024. That said, spare capacity of any consequence is essentially limited to Saudi Arabia and UAE. Geopolitical turmoil in the region is at as high of a level as has existed since Gulf War II (US-Iraq).

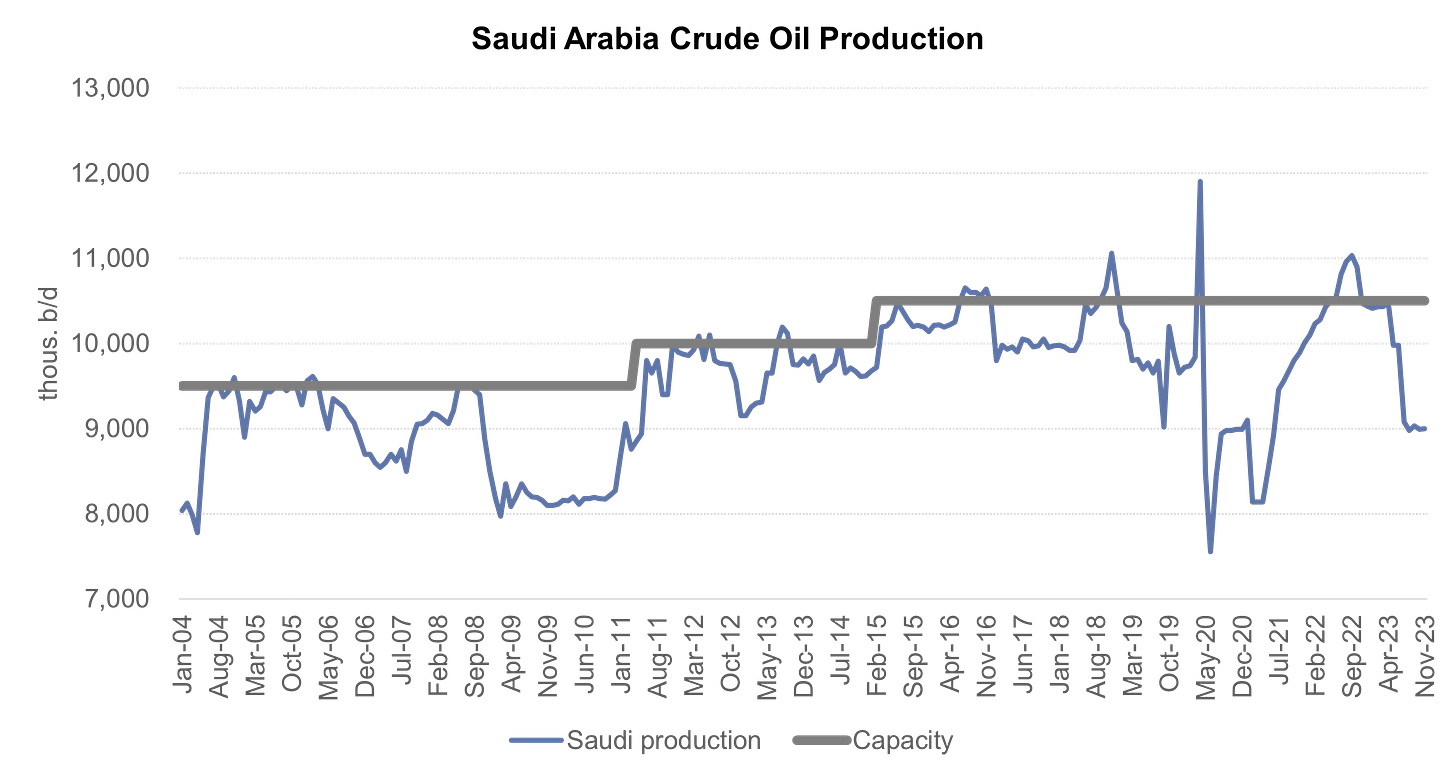

It remains our view that most observers over-state spare capacity in most OPEC countries. We believe Saudi Arabia today has about 1.5 million b/d of demonstrated, deliverable spare capacity in contrast to the 3+ million b/d that many observers suggest. We peg Core-5 OPEC (Iran, Iraq, Kuwait, Saudi, UAE) deliverable spare capacity at around 3.5-4.0 million b/d today, well below much higher figures many others cite (Exhibit 1).

Exhibit 1: Saudi has never sustained production over 10.5 mn b/d

Source: Veriten.

Q3: Will demand for oil, natural gas, coal, EVs, and renewables grow in Asia?

A: Yes, of course...and the answer will be "yes" for the foreseeable future.

The concentration of humanity contained within the three of our four 1.4 Billion People Club members located in Asia is staggering. There are 1.4 billion people in China, 1.4 billion people in India, and 1.3 billion people in the rest of southeast Asia excluding China, India, and Japan. Any one of these areas has a larger population than the Lucky 1 Billion of us that live in the USA, Western Europe, Canada, Japan, Australia, and New Zealand. There are 5.1 billion people in developing Asia that are definitively moving up the economic and energy s-curve that promises improved living standards. Energy demand is only beginning to grow in these areas. It is the most pressing energy and environmental issue of our time.

For all the progress China has made over the past 20 years, there is still considerably more room to go than has been achieved thus far if its population is to achieve living standards comparable to what The Lucky 1 Billion of us take for granted. India is at an even earlier stage of development. The rest of southeast Asia ex-China, India, and Japan is collectively closer to China than The Lucky 1 Billion.

All forms of energy will be growing for the foreseeable future. How is this even a question? There will be motivation to prioritize domestic energy sources and technologies; this is a key driver of new energies but will also drive growth in domestic coal in China, India, and a number of other Asian countries.

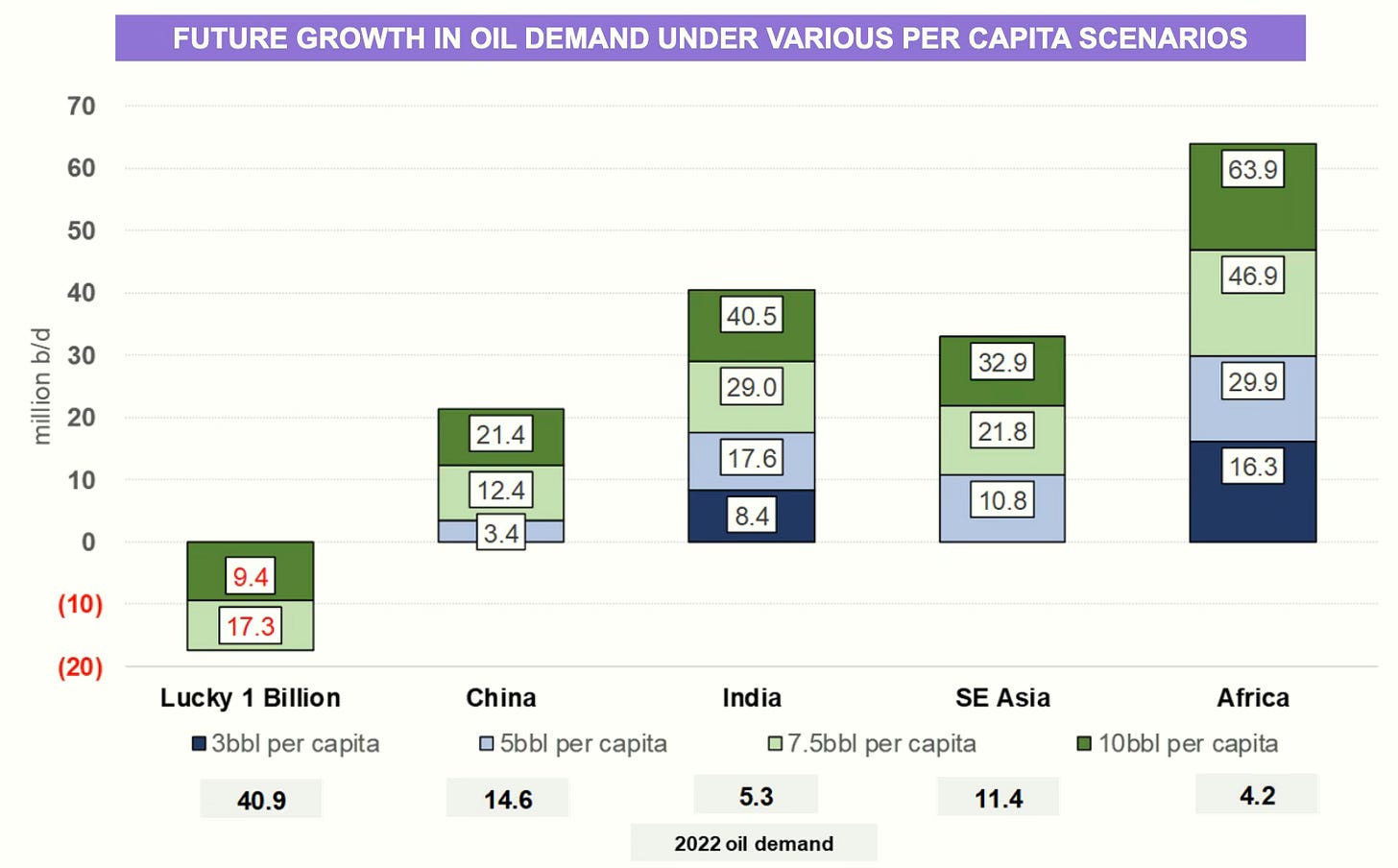

Exhibit 2 shows the implied oil demand growth if China, India, and the rest of southeast Asia were to achieve a mere 10 barrels of oil demand per capita, which is about half the level of where the United States, Canada, and South Korea currently are, though it is comparable to present day Europe.

Exhibit 2: There is massive upside potential to global oil demand as the Rest of the World develops

Source: EI Statistical Review of World Energy, IEA, Our World In Data, Veriten,

Q4: Will median ROCE remain at mid-teens-plus levels for the traditional energy sector?

A: Yes.

In order for the traditional energy sector to earn a median ROCE of 15%, WTI oil prices we estimate would need to average at least $70/bbl in 2024, a bet we would be willing to make. Industry CAPEX remains closer to trough levels than even mid-cycle let alone peak levels, supporting the continuation of superior profitability. In our view, three years of mid-teens or better ROCE should begin to sway some of the doubters that the real super-cycle is one of profits as opposed to commodity prices, which are secondary in importance.

Q5: Will US refiners/downstream remain best-in-class on ROCE?

A: We think so.

It has been a decade since we closely covered the US refining/downstream sector at Goldman Sachs. We were big proponents of the group owing to our then outlook for sustained profitability improvement. We find it remarkable that nearly a decade later, the essence of that long-term call still holds. The group has matured to where it really is no longer just about US refining margins, as various forms of diversification among the US Big-3 (Marathon Petroleum, Phillips 66, and Valero Energy) have been value enhancing.

For a group that is uniquely exposed to potential long-term declines in US gasoline demand, the outlook is remarkably healthy. Global oil demand continues to rise and refining capacity closures (including conversations to renewable diesel facilities) in the US and Europe have positioned the US Big-3 refiners to benefit from export growth as well as ongoing domestic demand (even with actual or possible declines in some products domestically). Unlike most E&Ps, the US Big-3 have logical new energies business they can pursue such as renewable diesel.

Perhaps most importantly, if you agree that there is no appetite for aggressive CAPEX growth for upstream companies, there is even less desire for refining/downstream growth CAPEX, which bodes well for structural ROCE. Unlike the E&P sector, inherent asset life is longer with (generally) lower maintenance CAPEX. Refining margins are inherently more volatile than crude oil prices, which is what it is.

The Super Majors and mega-cap non-integrated oils we believe will eventually return to an 80%-90% relative P/E versus the S&P 500 before the current upcycle is over. We believe the US Big-3 refiners can similarly attain "going concern" status, but the higher earnings volatility likely argues for a discount to the Super Majors and mega-cap non-integrated oils, i.e., something below an 80% relative P/E.

Q6: How do Pipeline/Midstream companies fit into our outlook for traditional energy?

A: Super interesting with a significant, diverse opportunity set.

We believe somewhat analogous to the refining/downstream sector, North American pipeline/midstream companies have an important role to play in helping meet the world’s energy needs. Unlike US refining, there has been interest and efforts to meaningfully grow pipeline/midstream businesses driven by US shale growth (oil and natural gas) as well as growth in Canadian oil and gas.

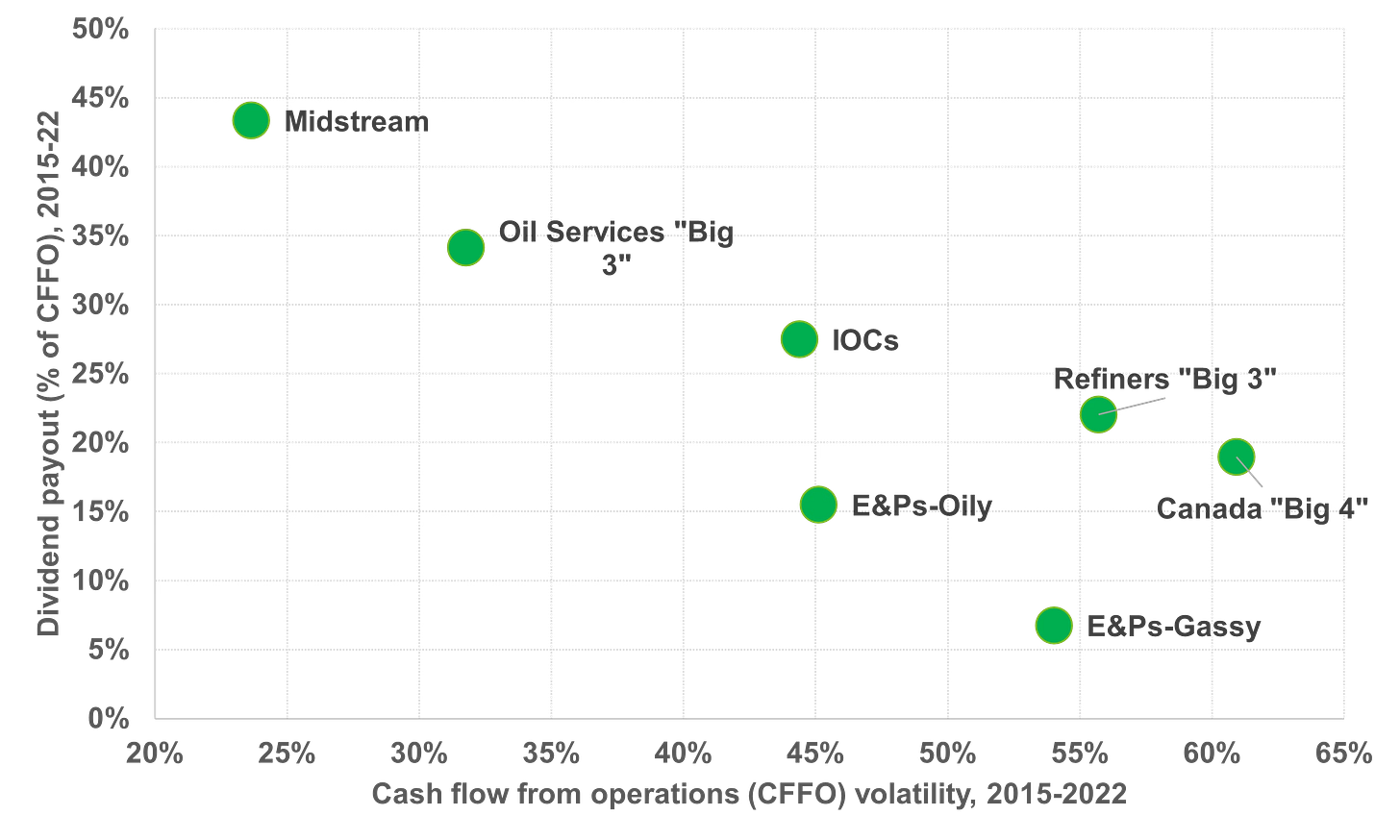

The nature of pipeline/midstream businesses is that many of the earnings streams are significantly less volatile than refining margins. As such, the sector is able to take on greater financial leverage and commit to a dividend stream that is a larger portion of generally more stable cash flow. In essence, pipeline/midstream names are more clearly “yield vehicles,” something other energy sectors are attempting to emulate but with the challenge of much higher inherent cash flow volatility (Exhibit 3).

Exhibit 3: Cash flow volatility versus dividend payout (as % of cash flow from operations)

Source: FactSet, Veriten,

Q7: Is E&P-oriented M&A good, bad, or neutral for the traditional energy sector, especially at a time commodity prices are not obviously near trough levels?

A: It depends...

M&A is inevitable as we have previously written (here, here, and here). In our view, "good" M&A is typically done counter-cyclically (i.e., at lower points in the commodity cycle). That said, deals happen when they happen. For acquiring companies, we have rarely, if ever, found the traditional accretion/dilution metrics that management teams usually highlight to be helpful in evaluating transaction merits. We would ask the following questions:

If commodity prices returned to tough levels within 12 months, how would cash flow and balance sheet metrics look versus pre-acquisition estimates?

Does the acquisition add duration to your low cost-of-supply opportunity set? And when you discuss low cost-of-supply is that inclusive of the acquisition premium?

Will this deal help your company outperform your relevant commodity price/margin or are you risking under-performing commodity prices based on the price paid or other deal considerations?

How is near-term dilution to ROCE offset (or not) by extending the duration of advantaged profitability into the future?

What unique skillset or competitive advantage does management bring to the acquired asset or company?

What next steps are set up by this transaction?

Q8: Will we see new company formation in traditional energy?

A: We need it, but it's likely only if energy significantly outperforms the broader market.

We disagree with the (admittedly entertaining) line that there are too many CEOs per barrel of oil equivalent (BOE) in the energy sector. There may be too many management teams that over the long run will generate insufficient profitability that we agree are not worthy of investor sponsorship. But the issue isn't "too many CEOs." In our view, it is not enough new or existing companies with interesting new strategies or opportunity sets in traditional energy; that is where there is sector bloat.

Traditional energy is in desperate need of new capital formation; we appear to be far from it as evidenced by the broad-based exit of private equity, the significant underweight among publicly-traded companies, and the dearth of capital markets activity. Does anyone have a new idea about how traditional energy can participate in substantial future energy demand growth?

TXO Partners is one company that is new to the publicly-traded sector with a well-regarded management team (former XTO Energy executives). It has a differentiated strategy versus many other US E&Ps in that it is pursuing long-lived, conventional assets as opposed to Permian Shale. We are fans of Permian Shale, but it is great to see a high-profile team going in a different direction. It’s early days, but since it began trading publicly, TXO has modestly outperformed major energy indices (Exhibit 4).

Exhibit 4: TXO Energy shares have performed better than the key energy indices since going public

Source: Bloomberg

Q9: Amongst the new energies carnage, is there an area that traditional energy should venture into to?

A: There must be.

New energies opportunities encompass an especially wide array of future technologies and opportunities. We expect rapid growth in coming decades, given the substantial unmet energy needs of the other 7 (soon to be 9) billon people on Earth that are not among the Lucky 1 Billion that live in the rich, developed world. In our view, it is reasonable for companies to research what could be a logical extension or new opportunity. In terms of energy sectors, we can see how the Super Majors, mega-cap non-integrated oils, North America pipeline/midstream, and North America refiners/downstream sectors might participate in new energies. It is less obvious to us how non-mega-cap E&Ps might get involved.

Q10: Will a US presidential election year present an opportunity for healthy dialogue and intelligent debate around pressing energy and environmental issues?

A: LOL! 🤣

Ugh, another US presidential election cycle is upon us. Of course four years can be an eternity when America chooses poorly; definitely glad we have an opportunity to make a change when warranted.

This is probably as good a time as any for a reminder that at Super-Spiked we absolutely despise partisan politics. Both sides s—k. There HAS to be overwhelming bi-partisan support for a constitutional amendment to ratify a maximum age limit. If 35 is the minimum, how about 70 as the maximum for a first term president (a double of 35 seems reasonable) as of Inauguration Day.

Perhaps technology can soon create an AI virtual president that embodies the best attributes of Ronald Reagan (defeated communism; promoted deregulated capitalism domestically), Bill Clinton (balanced budget; worked across the aisle), JFK (man on moon; positive charisma), Harry Truman (ended World War II; Marshall Plan), Teddy Roosevelt (trust buster; created national parks), Abraham Lincoln (ended slavery; won Civil War), Thomas Jefferson (helped found country; drafted Declaration of Independence), and George Washington (helped found country; won Revolutionary War).

As for US energy policy in 2024, we can at least be assured that Washington gridlock will keep bad policy from being enacted in an election year with a split Congress/Executive branch. No policy is better than bad policy.

BONUS Qs: What about questions related to US natural gas, global LNG, oilfield services, Canadian oils, Latin American energy, exploration, and coal in traditional energy as well as nuclear, geothermal, renewables, and all the other new energies sub-sectors?

A: Yes, we recognize global energy is a massive topic! This is only the second post of 2024. We need to save material for future weeks, and we try to keep Super-Spiked posts to 2,000-3,000 words.

🎤 Stream-of-the-week

Over the holidays, I appeared on the Fire2Fission podcast (below).

⚡️On A Personal Note: Powder Day at Killington

Most Super-Spiked readers are well aware of my passion for golf. This will be the first ski post since Super-Spiked's creation. Skiing is one of those funny sports where I am definitely NOT fearless on the mountain, yet I really enjoy the slopes. I would describe myself as an intermediate skier capable of skiing most runs on a mountain. However, for the black diamond, mogul run to be fun, it requires hitting that sweet spot of confidence, good snow, and encouragement from a friend, son, or instructor.

Tree-lined blue or single black diamond trails with short pitches, some bumps, and then regular flatter portions (for rest!) are my favorite. Something like Roger’s Run (single black diamond) at Vail off the Highline Express lift is the kind of run I love. It is the continuous, never-ending, no breaks along the way blue or black runs that I can do without. I fight the mountain and ski defensively in those situations. I also don’t like to be able to see the parking lot from the top of the run; makes me unsteady. The more trees that are blocking anything but the immediate view, the better.

Growing up and now again living in the US Northeast means the desire to ski has to be balanced with the reality that Colorado and Utah are a plane ride away; that problem we hope will go away once Veri-Plane becomes a reality! I have to say that my college-aged son and I really liked Killington (Vermont), which I would rank ahead of Stowe or Mount Snow, the other “resort” mountains we have skied in Vermont. Okemo is a terrific "local" mountain and on the Epic Pass.

Out west, Vail is my #1 followed by Beaver Creek, Park City, and Sun Valley. Jackson Hole is a great mountain if you are fearless, an expert skier, and like to see the parking lot from the peak; none of that describes me. I'd like to go back to Snowmass, which I last visited in 1998 with my then girlfriend and current wife (I am describing one person to be clear). I'd also like to get back to Deer Valley, which I haven't been to since Enron took us there for an analyst meeting in the mid-1990s. Between Killington and Deer Valley, I might need to get an Ikon Pass to go with my Epic Pass.

The three ski days last week at Killington and Okemo bring my 2023-2024 ski season-to-date total to three days! It's too early to set a # of days per season skiing goal; we still have a senior in high school with us. But a future empty nester objective will be to figure out a respectable goal for number of ski days. I am thinking something around 20 would be a good start. 20 days on the slopes plus 80 rounds of golf per year make for 100 days of athletic fun, with the other 265 dedicated to my number one interest which is analyzing the energy sector.

Exhibit: Killington, my new #1 on the East Coast

Source: Super-Spiked

⚖️ Disclaimer

I certify that these are my personal, strongly held views at the time of this post. My views are my own and not attributable to any affiliation, past or present. This is not an investment newsletter and there is no financial advice explicitly or implicitly provided here. My views can and will change in the future as warranted by updated analyses and developments. Some of my comments are made in jest for entertainment purposes; I sincerely mean no offense to anyone that takes issue

I need to start reading your substack in more depth. Great ideas, I will definitely start doing research on my own for energy investing

Fantastic column this week. I really like this Q&A format.

RE shale growth: I’d say the consolidation we have already seen, and that yet to come, should keep a lid on growth. The privates blew their wad in 2022 drilling best inventory and then sold. Big boys have learned that self-control isn’t just a biblical virtue, but also a business one.