A thriving Canadian oil & gas industry is critical to a less messy energy transition era

The Case for Canada, Part 3

I created Super-Spiked last November owning to my dismay as to how the energy transition era was unfolding, how it was being discussed, and the lack of pragmatism and sensible policy prescriptions from the “climate only” crowd. Yet I recognize and believe that there is a need to ensure we have as small of a climate and environmental footprint as possible, while ensuring the world has available, affordable, reliable, and secure energy.

There is perhaps no region more emblematic of how messed up current western world energy transition policies are than the approach being taken toward the Canadian oil and gas industry. In a nutshell, it is my view that we are more likely to have a healthier and successful energy transition era if we have a thriving and growing Canadian oil and gas sector. Full stop. To call it a canary in a coal mine doesn’t do justice to the scale and scope of its energy potential. Canada is blessed with massive oil sands resources and substantial natural gas. The world would be a better place if we produced more good barrels and Mcfs from Canada and fewer bad barrels from countries like Russia and certain Middle East producers.

In my view, the “climate only” ideologies that make the least sense and do the most damage to the economic and environmental health of the world and specifically impair Canada’s energy sector include:

Impeding growth in Canadian oil and gas supply in order for Canada to meet its nationally determined contribution (NDC) to CO2 reductions; NDC accounting that includes domestic oil and gas supply is bad policy and bad accounting. It makes no sense for Canada to limit its good barrels and Mcfs and shift dependency to bad barrels and Mcfs from other countries with worse environmental, climate, and ESG outcomes.

Blocking crude oil pipeline growth from Canada to the United States in order to “keep it in the ground”. Why is it that oil sands and “Arctic” have become two of the most ESG unfriendly areas, which most negatively impacts oil and gas resource development in Canada and Alaska? These policies make energy less available, less affordable, less reliable, and less secure, with negative consequences for the environment and climate as production shifts to less accountable areas of the world like Russia and certain Middle East countries. Why do environmentalists and “climate only” ideologues uniquely target Canada and Alaska?

Instead, I would propose the following:

In my view, NDC policies should focus on reducing/displacing domestic demand of higher carbon products with lower carbon options that benefit “base load” supply/demand. Possible options include no longer exempting SUVs from the most stringent fuel economy regulations, supporting nuclear power expansion, and promoting heat pumps for distributed cooling and heating, to name a few.

More US and Canadian oil and gas supply for developing economies and our allies in the rest of the world coupled with less refined crude oil product demand domestically is an approach that meets the multi-faceted mandate of energy availability, affordability, reliability, and security, with as small of a climate and environmental footprint as possible.

@SuperSpiked on Twitter Spaces, August 7, 1 pm EDT. If you are interested in participating in a discussion on the contents of this post and my latest views on the messy energy transition era we find ourselves in, I have been invited by the Twitter community Canadian Oil Mafia (#COM) to speak on their Sunday afternoon Twitter Spaces conservation on August 7 at around 1 pm EDT. I have written two previous Canada specific posts as well as a broader North America note highlighting the need for more "good barrels" (and Mcfs) and fewer "bad barrels", which you can find here, here, and here. I believe Twitter Spaces is only accessible on the iPhone and Android app versions of Twitter; it is not available on the web, desktop, or iPad versions of Twitter.

The rest of this post discusses my Top 10 reasons for why we need a thriving Canadian oil & gas sector grouped by the key themes by which I believe energy & climate policy should be evaluated: Availability, Affordability, Reliability, and Security, with as small of an Environmental and Climate footprint as possible.

Availability

(1) Crude oil size and growth contribution

Over the past 5-, 10-, and 20-years, Canada has been among the most important contributors to helping meet global oil demand growth. Overall, Canada ranks #4 in total liquids production behind only the USA, Saudi Arabia, and Russia. Exhibit 1 shows that over the last 20 years, Canada was the third most important contributor to meeting global oil demand growth, only slightly behind Russia and ahead of Saudi Arabia, Brazil, Iraq, and UAE.

As a Big 7 oil producer, Canadian oil growth helped overwhelm rest of world declines. Going forward, with Russia turning into a pariah state and Canada facing extreme hostility from “climate only” ideologues, the world is suddenly very dependent on the Permian Basin, Brazil, and a combination of Saudi, Iraq, and UAE to offset rest of world declines and meet remaining oil demand growth. It defies all common sense and good judgement to impede Canadian oil supply growth.

(2) Natural gas size and growth potential

It is under-appreciated because post the emergence of US shale gas about 15 years ago, the US is no longer reliant on imports of Canadian natural gas. As shown in Exhibit 2, Canada ranked #4 among countries in global gas production, though basically on par with Qatar and Australia, and has a massive untapped resource that could be developed for LNG export.

There is currently a lot of focus on Qatar’s North Field and the recent announcement of another round of expansion. And there is little doubt that the North Field is perhaps the world’s premier resource for LNG development. Still, there is no reason Canada’s gas potential deserves so little attention, analysis, or effort vis-a-vis Qatar or other regions in Africa or Australasia. Europe and developing economies in Asia, Africa, and Latin America would all benefit from Canadian LNG exports. With strict methane containment that is possible in Canada, but less likely in other parts of the world, Candian LNG could help displace higher emission coal-based power generation in developing areas.

Unlike intermittent sources of energy, Canadian oil and natural gas supply is capable of providing base-load flows to transportation, heating, and power generation markets.

Affordability

(3) Price

Both Canadian crude oil and natural gas consistently trade at discounts to corresponding U.S. benchmarks due to a combination of less favorable crude oil quality and transportation costs to reach export markets (overwhelmingly the USA). Canadian gas (AECO hub) typically trades at a discount to US gas pries (Henry Hub) and meaningfully below TTF in Europe as shown in Exhibit 3 which uses a log scale.

(4) Profitability

Despite a typically lower selling price for its crude oil and natural, Canadian Oils generate profitability that is competitive with both E&Ps and integrated oils in the United States and Europe as shown in Exhibit 4.

Reliability

(5) Consistent oil production growth

Canada has delivered among the most consistent oil production growth over the past 20 years. Canada oil supply has never been interrupted due to domestic or international geopolitical turmoil or strife. The only political risk it faces comes from its own Federal government’s mis-guided approach to satisfying ill-conceived NDC accounting and the US federal government blocking the permitting of new export pipelines. Despite these “own goals”, Canadian oil supply has still found a way to markets via rail to the credit of its industry.

(6) Long-lived production

Canadian oil sands production is long-lived, meaning after upfront capital spending over a 3-5 year period, production can be maintained for 20-25 years with minimal ongoing CAPEX. This is in sharp contrast to US shale oil, which can start production much faster and is far more modular, but requires significant ongoing spending in order to maintain production.

With the Bakken and Eagle Ford shales showing signs of entering, at best, a long-term plateau, continued US oil supply growth is highly dependent on the Permian Basin. While I am personally bullish on the potential for meaningful, long-term growth from the Permian Basin, it is otherwise like other shales: fast declining and dependent on continuous drilling activity. The long-lived nature of Canada’s oil sands represents an excellent complement to shorter-lived shale wells.

Security

(7) No invasions, and unlikely to be invaded

I am not a historian, but I believe Canada has not been invaded since the War of 1812 (according to the Canadian War Museum’s website, in 1812 the US declared war against Great Britain with most of the combat occurring on Canadian soil; this occurred before Canada became a self-governing region on July 1, 1867). Moreover, it appears highly unlikely any foreign power would look to invade it any time soon. The point being, geopolitical risk in Canada comes solely from within the country via ill-advised "climate only" policies pursued by its federal government.

I believe there is effectively zero risk of an externally-driven geopolitical disruption. On the metric of geopolitical disruption risk, Canada stands favorably apart from other major crude oil producers like Russia and certain Middle East countries.

Environmental & Climate Footprint

(8) Pathways Alliance to Net Zero

I am a huge fan of the efforts made by Canada's largest oil producers to band together to address carbon emissions via the Pathways Alliance to Net Zero initiative (link). Canada’s major producers are serving as an excellent role model to other basins.

Mission: Our goal is to achieve net zero greenhouse gas emissions from our operations by 2050, while supplying the energy the world needs. That’s why we’re working with the federal and provincial governments to help meet Canada’s climate goals.

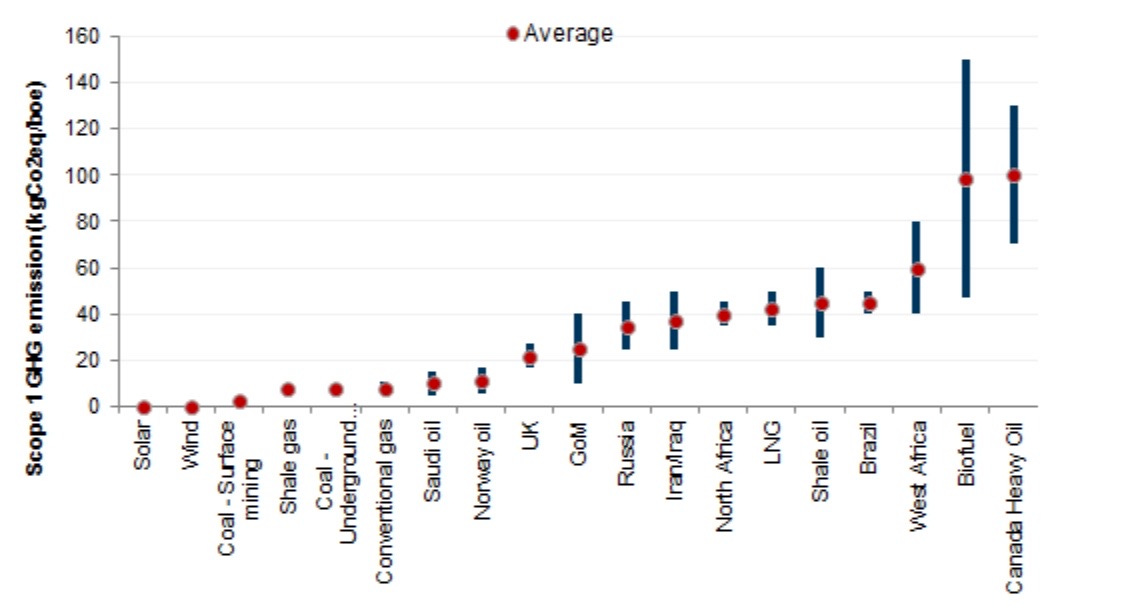

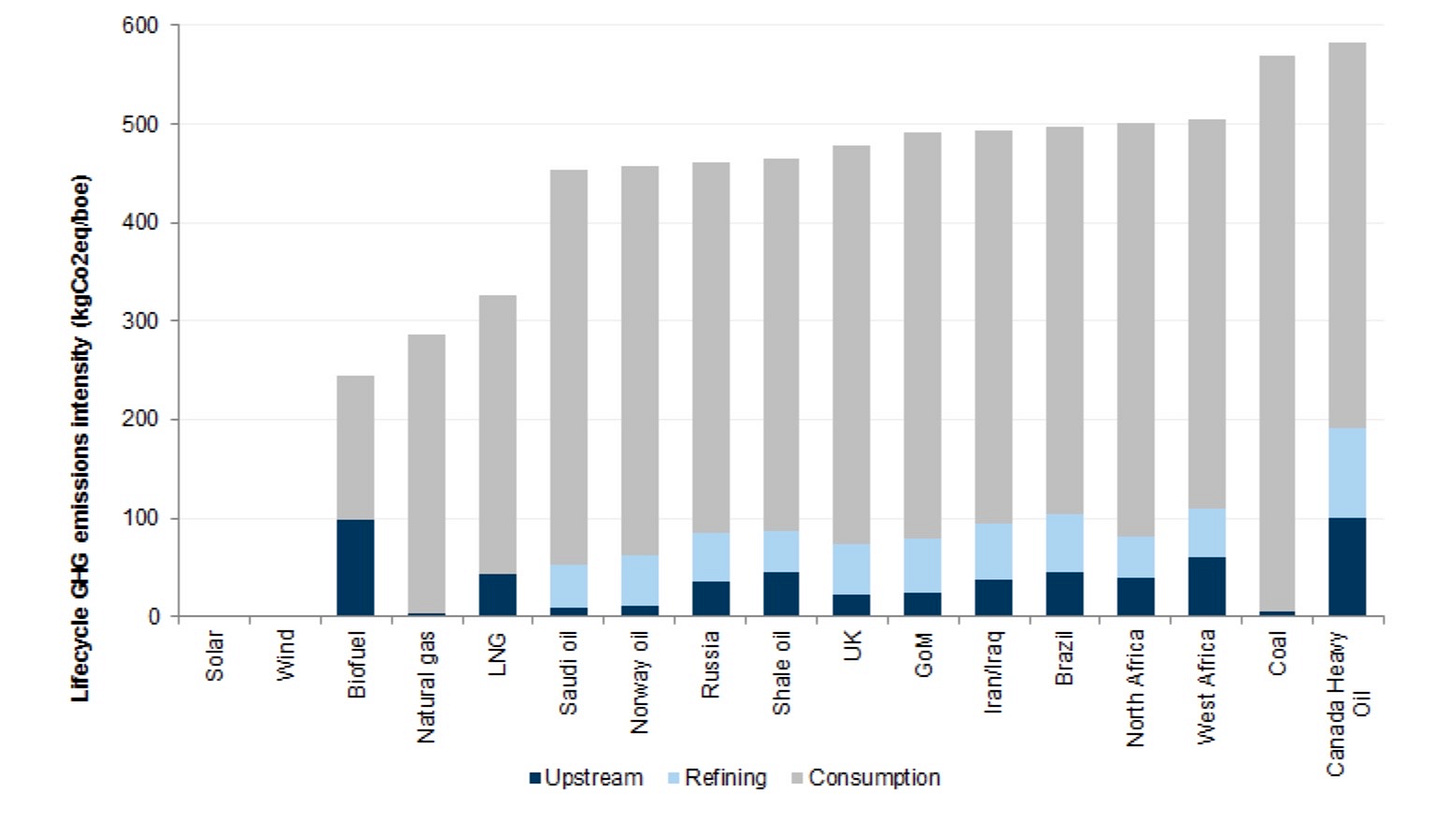

Canada's oil sands are often maligned as the "dirtiest barrels in the world" by environmentalists, which is lazily parroted by many in the media. The bulk of Canada's oil sands CO2 delta is in Scope 1 emissions which the Pathways Alliance plans to address (Exhibit 5). I would note that the overwhelming majority of carbon emissions from crude oil comes when consumers drive SUVs, trucks, and other cars manufactured by automakers that burn refined crude oil products via driving. When looking at combusted barrels on a lifecycle basis, there is frankly little effective difference between “best” and “worst” using solely the metric of CO2 emissions (Exhibit 6). If the Pathways Alliance can reach its objectives, there will be essentially no difference between Canadian oil sands barrels and production from the rest of the world. As such, I believe when considering all other factors discussed in this post, it is a blatant mis-direct on the part of “climate only” ideologues to brand Canada’s oil sands “dirtiest barrels in the world.”

(9) Traditional HSE emphasis and potential for feedback

A core feature of the publicly-traded oil and gas companies in the United States, Europe, and Canada is an emphasis on traditional health, safety, and environment (HSE) metrics. Suncor Energy, remarkably, has faced shareholder activism and a recent CEO change due to challenges it has faced in recent years in the HSE area (including far too many tragedies that resulted in loss of life). While HSE is noted at companies like Saudi Aramco and some OPEC producers, it is pretty hard to believe producers in other parts of the world are as focused as are Canadian (and US and European) oils on ensuring best-in-class HSE efforts.

(10) ESG leadership

The Canadian oil and gas industry are among the leaders on ESG metrics.

E - Discussd above

S - Western values on respect for human life, gender equality and inclusion

No journalist has ever been brutally killed in the offices of a Canadian oil company to my knowledge. Canadian oils do not poison or “disappear” adversaries like equity analysts or environmentalists that have negative views on their company. LGBTQ+ rights are respected by the Canadian oil and gas industry. The same cannot be said on these points for some of the other top oil producers that are either explicitly or de facto government owned and controlled.

G - Privately owned, responsive companies

Unlike government owned or heavily government influenced companies in other parts of the world, the Canadian oil and gas industry is fully privatized and comprised of publicly-traded or privately-held companies. In my view, this is a infinitely preferable to being government owned.

⚡️On a personal note…

This week I offer a Canadian vacation idea, a book that effectively makes the case for why we should not want to become more dependent on Russia oil by limiting Canadian oil, and finally more great 1980s-era Canadian music.

A vacation idea: Banff and the Icefields Parkway to Jasper

The Icefields Parkway from Banff to Jasper has to be one of the most scenic highway drives you will ever experience. Stay at the Rimrock hotel in Banff (the Fairmont is chaos) or at a place in Lake Louise. Take the kids; it’s spectacular and very much like touring a US National Park.

A must read book: Frozen Order by Bill Browder

Bill Browder was founder and CEO of the investment firm Hermitage Capital and is now a political rights activist who has written two best selling books about his experiences with the Russian government, Red Notice (Amazon), which was published in 2015, and Frozen Order (Amazon) which came out earlier this year. Both books are dedications to the late Sergei Magnitsky who worked for Mr. Browder and was brutally killed by the Russian government while awaiting trial in a Russian prison. Frozen Order does a far better job making the case for why we don’t want more Russian barrels and would be far better off with more Canadian oil than I ever could.

A Canadian music recommendation: Exciter

Exciter was formed in Ottawa, Canada in 1978, a full four years before the 1982 Canada Act came into existence. Exciter was a pioneer of the thrash/speed/death metal genre. War Is Hell (below) is one of my all-time favorite songs; the full album, Violence and Force (Spotify), which was released in 1984, has stood the test of time. Unfortunately, I have not found good video footage of Exciter from that era. Amazingly, Exciter still boasts circa 30,000 monthly listeners on Spotify! (My apologies to anyone offended by the 1980s-era album imagery below; didn’t think anything of it when I was a teenager...as an older parent now, not sure it has stood the test of time, though I think we can spin it positively that the attack is seemingly being foiled.)

⚖️ Disclaimer

I certify that these are my personal, strongly held views at the time of this post. My views are my own and not attributable to any affiliation, past or present. This is not an investment newsletter and there is no financial advice explicitly or implicitly provided here. My views can and will change in the future as warranted by updated analyses and developments. Some of my comments are made in jest for entertainment purposes; I sincerely mean no offense to anyone that takes issue.

Regards,

Arjun

It's not just government policy that's a problem in Canada, they've got eco-terrorists that have attacked oil workers and pipeline workers. One of the points brought up by the trucker's convoy people was that these anti-oil terrorists where handled with kid gloves by the government, iirc they weren't even prosecuted.

Hi Arjun,

Thanks for another excellent column. I am looking forward for tomorrow's space.

In a previous cycle, Canadian dollar would reach a near parity with US dollar when oil price is as strong as today. Canadian dollar, however, remains very weak (about 29% from the parity) in the current cycle. How much of the current high ROCE of Canadian energy producers is due to the weak currency?

By the way, if one just wants to be a passive listener in a Twitter Space, one can use any desktop web browsers.