AI-Driven Convergence: Energy, Power, and Technology

AI & Energy.GPT

The market reaction to the emergence of DeepSeek two weeks ago is illustrating the increasing convergence of traditional energy, the merchant power producers, and the artificial intelligence (AI) theme in the technology sector. Our prior post Will AI Be Our Salvation Toward A Healthier Energy Evolution? (here) noted the opportunity this could create for healthier narratives and policies toward the broad energy sector (oil and gas, power, and new energies), a trend confirmed by elections around the world in 2024 most notably in the United States. The world continues to move from a “climate-first, net-zero-is-all-that-matters” train of thought to one that recognizes the reality that while software may be eating the world, all software requires hardware, and all hardware requires 24/7/365 power.

Big Tech a core driver to healthier energy narratives

Dramatically growing power demand of Big Technology companies, in particular the so-called “Magnificent-7” trillion dollar stock market behemoths, is arguably the most important development to come to the energy sector over the past 12-18 months or so. Since everyday consumer and business energy usage is widely dispersed amongst most—sadly not all—of the 8 billion people on Earth, it has been easy for anti-energy activists and politicians to target “Big Oil” as the bad guys in their fight against a myriad of environmental and social causes they support. The Russia-Ukraine war sparked the initial awakening from the broader public that “climate only” narratives did not tell the full story. It is now the rise of Big Tech power demand needs that is proving to be the death knell to net zero ideology.

AI as a catch-all for a range of new data and other energy-intensive technologies we are watching

While “AI” gets most of the attention, we are watching a quartet of new areas that will impact future energy demand:

Broad-based digital transformation in conjunction with the AI trend

Autonomous driving

Humanoid robots

Space

Broader digital transformation we think is at least as important as AI at this time as the collective trend drives datacenter and hence power demand growth. In some respects, the AI topic we suspect is getting too much attention relative to broader digital transformation, at least as it will impact power demand growth over the next several years. This is likely especially true if the most power intensive training phase is behind us as DeepSeek might indicate. Those more knowledgeable on technology than us have written about the uncertain profitability profile of the significant AI CAPEX spend being undertaken by Big Tech today. Much more certain, in our view, are the benefits of especially large, legacy companies across a broad spectrum of industries around the world undergoing digital transformation and the rise in power needs that portends. This is a long-running technology sector theme to be sure.

The other big area that has long been touted and may finally be on the horizon is autonomous driving. Unlike AI and digital transformation which we think of as impacting primarily power demand, it is not yet clear that autonomous driving will be limited to impacting the power sector. While we have shared what we think is the consensus view that autonomous mobility goes hand-in-hand with electric vehicles (EVs), there is no reason that internal combustion engine (ICE) vehicles would not also benefit. A recent appearance by former Uber co-founder and CEO Travis Kalanick on the All-In podcast (here) made the case that ICE vehicles (including hybrids) will be necessary as autonomy ramps given his view that electric grids alone won’t be able to handle a significant ramp in autonomous EVs.

Humanoid robots and space currently appear to be a bit longer term than AI and autonomous mobility, and with an even less certain impact on future energy demand. Both are areas to watch. The broader point is that global data needs are only going in one direction—up, up, and up. Cheaper AI, if that is in fact happening, will only accelerate these trends. In addition to the data center piece, there are the issues of (1) an aging grid, a growing share of weather-dependent generation, and the premature retirement of baseload sources of power generation in developed markets; and (2) power needs driven by moving up the economic s-curve in the developing world.

Energy and technology sectors have historically been inversely correlated

Energy and technology are both sectors driven by major, structural long-term trends. Over the course of our nearly 33 year career, we have had three major structural trends:

1990s: Internet boom and bubble benefitting technology while energy struggled from the aftermath of the post-1986 oil bust.

2000s: China/BRICs oil super cycle drove energy, while technology was recovering from the internet bubble bursting.

2010s: Digital transformation and now AI driving technology, with energy struggling through its post-super-cycle bust period since 2014.

2025+: A new age of energy, power, and technology convergence?

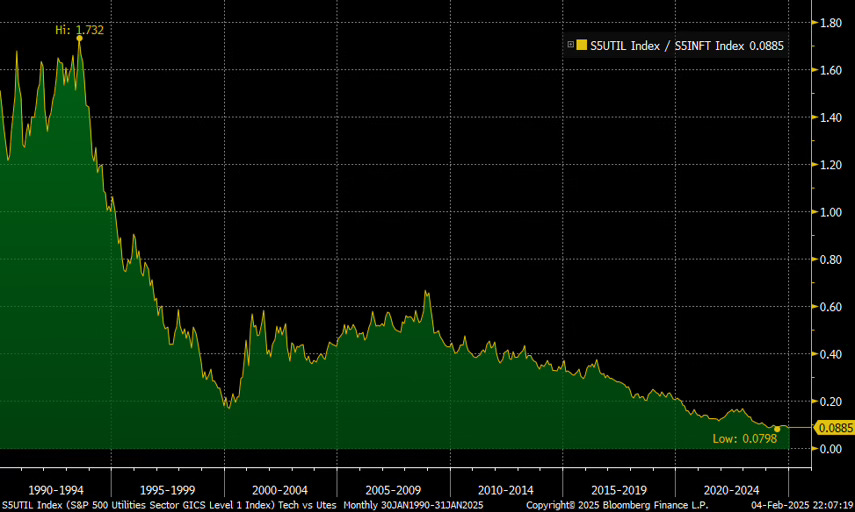

Exhibit 1 shows these periods of exceptional relative performance by graphing the S5ENRS Index, which are the energy equities in the S&P 500, relative to the S5INFT Index, which is the technology equities in the S&P 500 since 1990. When the line is going up, energy is outperforming technology and vice versa. Exhibit 2 shows utilities versus technology (a rising line means utilities are outperforming technology). In the interest of completeness, Exhibit 3 shows energy versus utilities (a rising line means traditional energy is outperforming utilities).

Exhibit 1: Energy and technology sectors have typically moved in opposite directions driven by major respective structural moves; A rising line means Energy is outperforming Technology and vice versa

Source: Bloomberg, Veriten.

Exhibit 2: Utilities sector versus technology looks different than energy does lacking the distinct relative structural movements; A rising line means Utilities are outperforming Technology and vice versa

Source: Bloomberg, Veriten.

Exhibit 3: Energy versus utilities; A rising line means Energy is outperforming Utilities and vice versa

Source: Bloomberg, Veriten.

But that changed with the emergence of ChatGPT and was confirmed by the reaction to DeepSeek

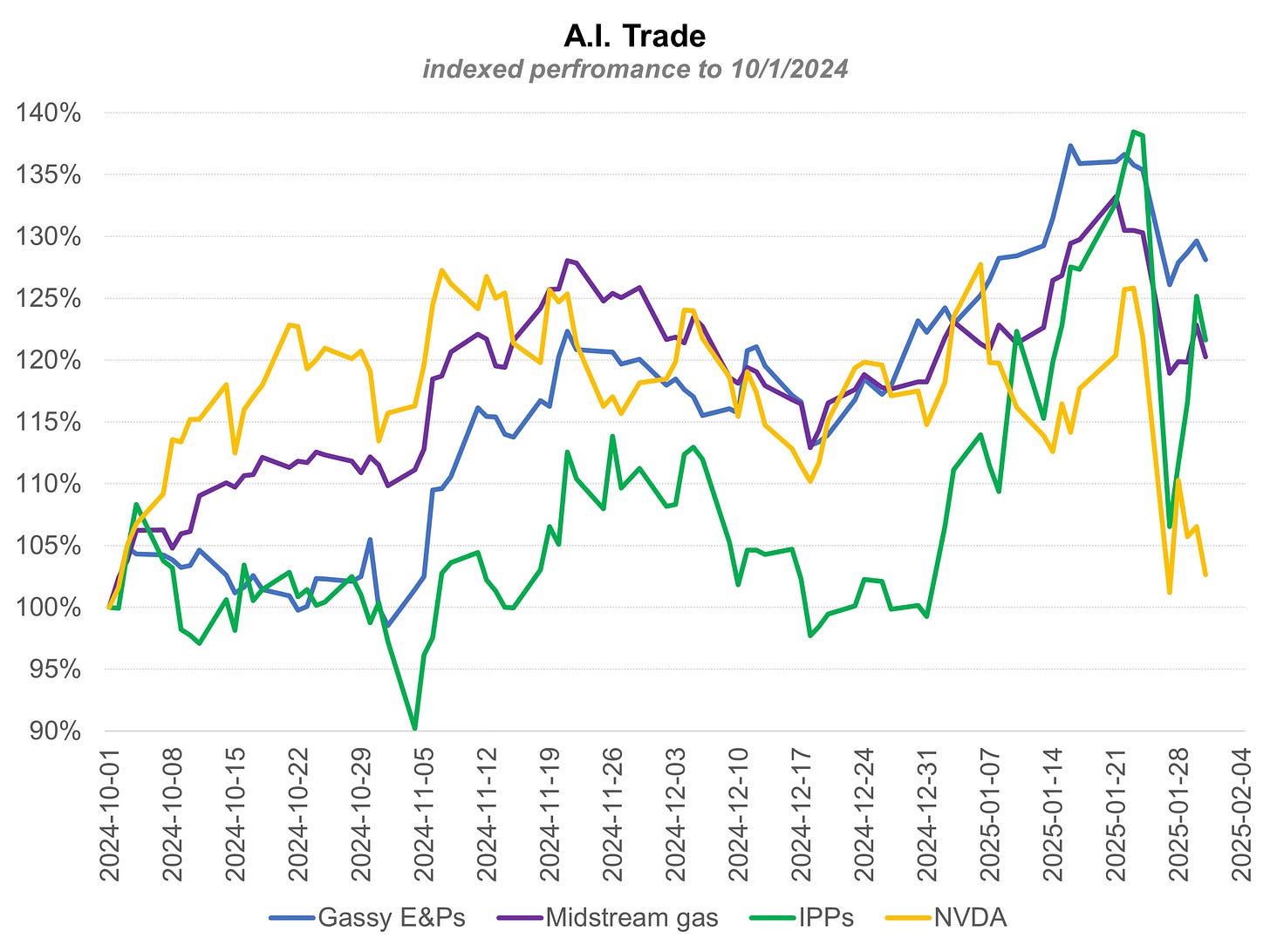

We have previously observed that a trio of leading merchant power producers have moved similarly to NVIDIA since mid-2023 (Exhibit 4). As the market has gained confidence that natural gas-fired power generation is likely to be an important future generation contributor, we can add gassy E&Ps and midstream to the list of companies impacted by the AI trend (Exhibit 5).

We cannot recall a time where from an energy sector perspective we spent even one minute on technology company CAPEX plans. Personal investing interest has at times led us to look at the sector, but never from the perspective of what it would mean for the energy companies we are professionally analyzing. Post DeepSeek, we found ourselves scouring earnings call transcripts from META, Microsoft, and other leading technology companies for any discussion of future CAPEX.

Exhibit 4: A trio of leading merchant power producers have been viewed as part of the AI trade since mid-year 2023

Source: Bloomberg.

Exhibit 5: Since Q42024, natural gas-exposed E&Ps and midstream companies have joined the AI trade

Source: Bloomberg.

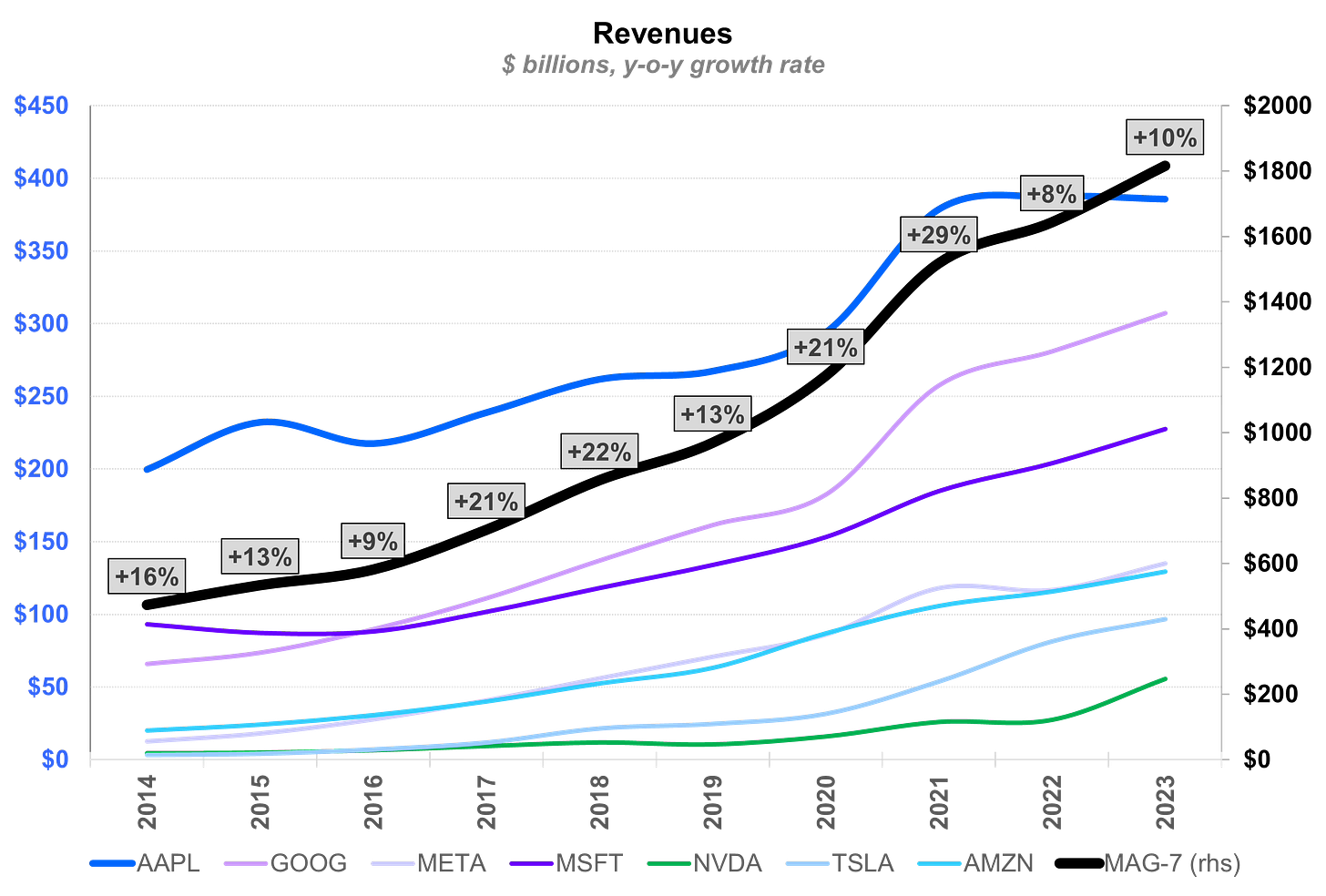

Technology is understandably massively favored by investors based on growth and profitability

There is a tendency of some (many?) in the energy-dedicated space to be dismissive of the stock market performance of the technology sector, with the word “bubble” thrown around a lot to describe market valuations. For Wall Streeters, it is very easy to be jealous of the in-favor sector! The reality is that leading technology companies have generated superior growth AND profitability over many years, significantly outperforming energy and utilities on both metrics (Exhibits 6 and 7). Mid-teens structural revenue growth with 40% average ROCE for mega-cap Mag 7 stocks is simply stunning.

Exhibit 6: Big Tech profitability has been off the charts outstanding and consistently excellent

Source: FactSet, Veriten.

Exhibit 7: Top-line revenue growth has also been best-in-class and remarkable for companies of this size

Source: FactSet, Veriten.

What energy lacks in growth and return, it makes up for via longer duration and lower disruption risk

The Achilles heel to the leading technology companies remarkable track record of exceptional growth and returns is the risk of disruptive innovation. We have said this many times before, but we remain blown away by the fact that companies like ExxonMobil, Chevron, and Shell—and their predecessor entities (Standard Oil for ExxonMobil and Chevron and Royal Dutch Petroleum and Shell Transport & Trading for Shell)—were the largest, most profitable oil firms at the industry’s founding the late 1800s and remain so to this day. Does anyone believe any of today’s Mag 7 will be able to say the same 100 years from now? How about 50 or 25 years from now? We doubt that there is an investor or analyst that believes a full 150 years from their founding, today’s Mag-7 will remain at the top of the technology sector and stock market rankings.

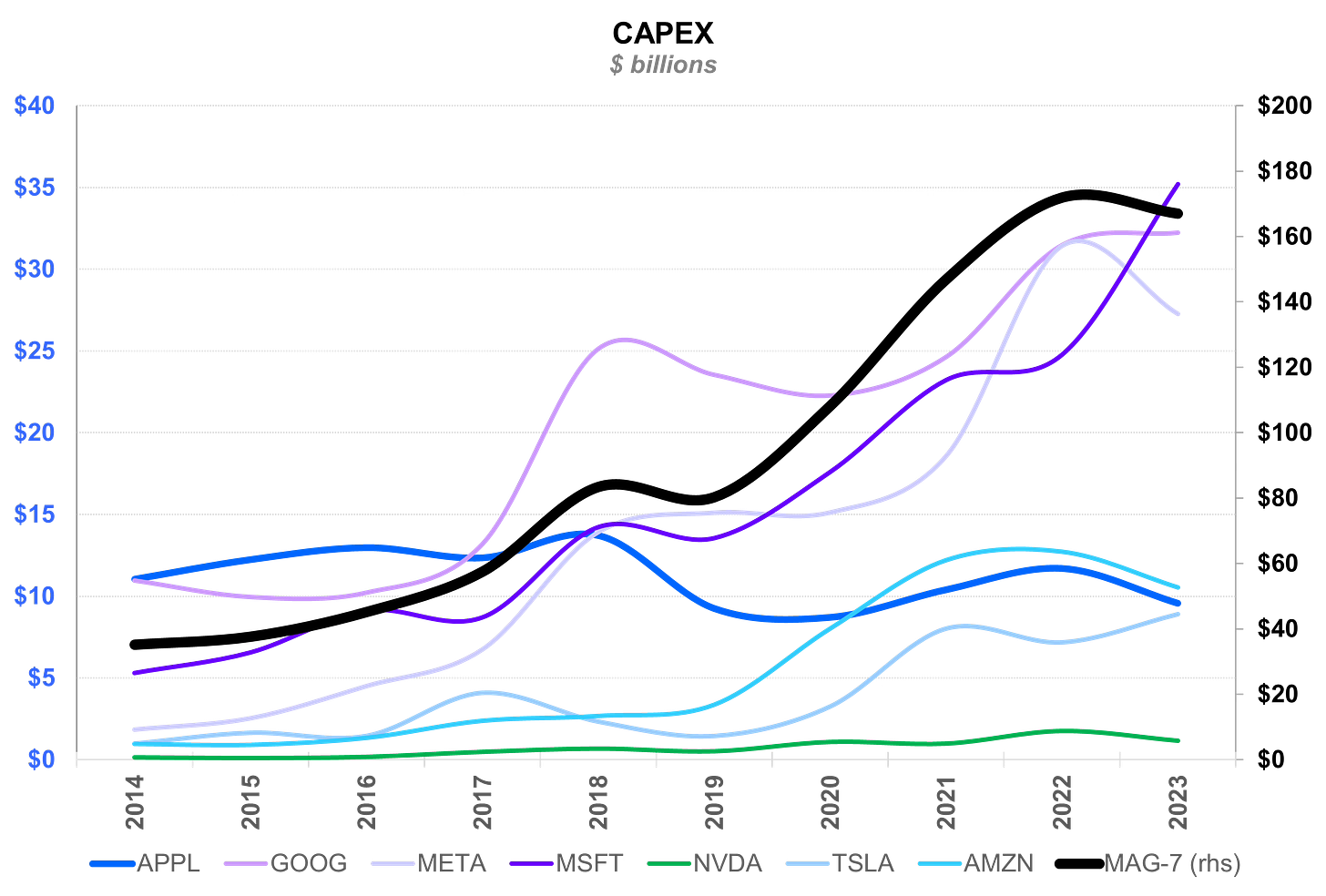

It has been net zero ideology coupled with the exceptional fundamental performance of the technology sector that in recent years has cast a pall on the duration and disruption risk points for oil and gas companies. Ironically, we now have the power needs of technology companies helping vanquish the net zero world, and revealing the critical importance of healthy, domestic energy and power companies. We see zero chance large-cap energy or power companies would be able to match the combination of growth and returns exhibited by leading technology companies. But both energy and power entities have the opportunity to sustain otherwise acceptable levels of profitability (i.e., companies in the top two profitability quartiles) and face far more limited disruption risk relative to the tech sector. The sharp rise in CAPEX from the leading technology companies we noted in last week’s video podcast (here) is recognition of the innovation disruption opportunity and risk Big Tech faces (Exhibit 8).

Exhibit 8: CAPEX is rising sharply for leading technology sector companies

Source: FactSet, Veriten.

⚡️On A Personal Note: What if I had switched to the tech sector in 1999?

Prior to joining Goldman Sachs in 1999, I had a handful of opportunities to move into technology-sector analyst positions at other firms. I remember thinking at the time, “I have 7 years of energy experience, why throw that all away and switch to a new sector.” Mind you, this was as the internet bubble was reaching new heights. I remember being very interested in the tech sector at the time, but perhaps in the back of my mind wondering how long the rally could last.

It's hard to know what would have happened if I had made the switch shortly before the internet bubble burst. It’s easy to assume that on a LIFO basis, I would have lost whatever job I had just taken, etcetera and so forth. The reality is there is no way to know what kind an alternative career I could have had. With the benefit of 25 years of hindsight from that point, I obviously made a sound decision to join Goldman Sachs as its integrated oils analyst and to stick with energy.

A few takeaways from this experience:

It’s better to be lucky than to be good!

You make your own luck…or can at least position yourself to benefit from luck when it arrives.

It’s an unknowable fine line between being lucky and unlucky.

Things don’t always go as planned, but everyone reading this is among The Lucky 1 Billion, and we are all really fortunate to be in that grouping.

Energy is an awesome sector that is critical to the world at all times.

Technology is an awesome sector that is critical to the world at all times.

Without energy you cannot have technology, but the opposite is not true…energy is a basic need.

When you have the chance to work at world-class firms, it’s hard to go too wrong; I would include leading boutiques in that description such as Petrie Parkman for myself and TPH for many of my Veriten colleagues.

Energy has always matched my contrarian nature, global interests, and “value” oriented mindset.

It is always fun to learn about new areas, technology in particular.

It is unhelpful to be myopic about one’s area of focus.

There are some fun characters in the energy business and I am really glad I stuck around to meet them!

⚖️ Disclaimer

I certify that these are my personal, strongly held views at the time of this post. My views are my own and not attributable to any affiliation, past or present. This is not an investment newsletter and there is no financial advice explicitly or implicitly provided here. My views can and will change in the future as warranted by updated analyses and developments. Some of my comments are made in jest for entertainment purposes; I sincerely mean no offense to anyone that takes issue.

Great article this week! Thanks for your hard work on this.

Glad you stuck with energy, and certainly hope you continue to do so.