Whatever it is that happened or didn't happen in Russia last week is the most recent reminder that geopolitical turmoil remains a relevant consideration for energy markets. Some have asked whether a geopolitical risk premium will return to oil markets, even as this particular crisis in Russia has probably passed. In our view, the existence of a geopolitical risk premium is a hard item to tease out of oil price movements. Having spent 30 years evaluating the issue, differentiating between so-called supply/demand fundamentals and softer metrics like geopolitical risk premia is overwhelmingly an art, not science. Regardless, the past year is also a reminder that geopolitical risk can cut both ways, driving oil prices higher and lower; it is hardly one directional risk simply to the upside.

Regarding oil markets, a few points:

SHORT-TERM vs LONG-TERM: Geopolitical risk is often characterized as the risk of a short-term supply disruption. While that is indeed a risk, the impact of geopolitics on country production is often more relevant when looking at its long-term impact.

UPSIDE vs DOWNSIDE RISKS: In the near term, production from "risky" countries could fall but it could also rise. Geopolitical risk cuts both ways; it's not simply an upside price risk.

"I'M FROM THE GOVERNMENT, AND I’M HERE TO HELP”: The greater the layers of separation between a host government and its oil company(ies), the greater the chance that the oil company(ies) can limit the negative influence of domestic politicians/leaders. Efforts to nationalize or interfere with oil company decision making is a recipe for lower production and overall underperformance.

The realities of energy geopolitics also make the case for a variety of policy objectives:

A preference for domestic over imported energy sources.

A preference for all forms of energy supply that can best meet domestic needs without becoming overly reliant on unreliable foreign suppliers.

A goal to improve the multiplier of economic output relative to energy used.

The world needs more good barrels and fewer bad barrels:

From a US and Canadian perspective, a healthy domestic oil & gas industry contributes to significantly reducing our (and Canada's) exposure to rogue nations and outlaw states.

Rising US and Canadian oil & gas production can increasingly be exported to the Rest of the World, in particular to the seven billion or so people that use a fraction of the energy on a per capita basis that the lucky one billion of us that live in the United States, Canada, Europe, Japan, and Australia/New Zealand use.

New energy transition technologies that can displace domestic demand can allow incremental quantities of oil and gas to be exported globally from the US and Canada.

In a nutshell, last weekend's events, no matter how short-lived, are a stark reminder that the world needs more good barrels from the USA and Canada and fewer bad barrels from countries like Russia.

Disruption countries’ production trends

Exhibit 1 looks at monthly production from a quartet of countries that regularly experience supply disruption due to civil strife and geopolitical turmoil, including Libya, Nigeria, Venezuela, and Iran. Exhibit 2 looks at the variance in oil production from those countries versus a rolling 5-year average.

Exhibit 1: Monthly production from what we are calling “disruption countries”

Source: IEA, Veriten

Exhibit 2: Variance in monthly production from disruption countries versus rolling 5-year average

Source: IEA, Veriten

In our view, it makes sense to look at so-called “disruption countries” as a group given that there can be offsetting movements on a short-term basis between the countries. The excuse often made in oil markets is that these increases or decreases are hard to forecast in advance. That is of course true and a challenge for day traders. But for anyone with a medium- or longer-term view, if you instead use a filter of is production currently “on” or “off,” a sense of go-forward risk/reward can be gleaned.

If we focus in on the period from the recent oil price peak in June 2022 to present, a few points to make:

Disruption countries’ production have added just over 1 million b/d of oil production contributing to the loosening of oil market conditions experienced since then.

While on an absolute basis relative to the long-term history, production would appear to have further upside, the reality is that there has undoubtedly been a loss of productive capacity in all four countries that would likely require a meaningful CAPEX cycle.

Production versus the rolling 5-year average likely presents a better sense of risk/reward over the coming five years; on this basis, production seems to be close to a local high suggesting risk is skewed toward lower production in coming years.

In making that last statement, one needs to be careful to watch for a more lasting change in the conditions of a country that might allow for a CAPEX cycle to return. Of these four countries, Libya and Nigeria would seem to have the higher odds of re-attracting capital followed by Venezuela and Iran. To be clear, none of the four are on-track for that today; rather, we are flagging these as countries to watch closely going forward.

Russia: Comparing the collapse of the Soviet Union with current uncertainty

Given the events in Russia last weekend as well as the ongoing war in Ukraine, we wanted to provide some perspectives on Russia oil production and net exports:

When the Berlin Wall fell and the Soviet Union disintegrated, Russia and FSU oil supply fell faster than domestic demand, hence the halving of net exports in the early 1990s (see Exhibit 3).

This go round, most oil market observers have been surprised at the relative strength of Russia net exports since the Ukraine war started. The Russia oil industry is in a very different place than it was under Soviet rule and has now had 30 years of learning to operate more independently and with volatile resource allocation.

That said, Russia net exports have yet to return to pre-COVID levels, as about 0.5 mn b/d of lower supply plus 0.4-0.5 mn b/d of demand growth have resulted in not much change in net exports from what were thought to be voluntary COVID reductions (i.e., the initial OPEC+ pact). Is there any real evidence Russia has participated in OPEC+ volume adjustments pro-actively?

The recent relative resilience of Russia oil demand is interesting at a time it has faced major US/Euro sanctions, the evacuation of most western companies, etc. Russia oil demand has proven to have been more resilient to both sanctions and war.

The collapse of the Soviet Union is almost certainly a bigger shock than would be the possible collapse of Putin. So, a 50%-ish order of magnitude net export drop seems unlikely. Obviously, there are lots of caveats around this in what would undoubtedly be a very volatile situation.

Exhibit 3: Russia/FSU net exports

Source: IEA, Statistical Review of World Energy, Veriten

OPEC reaction?

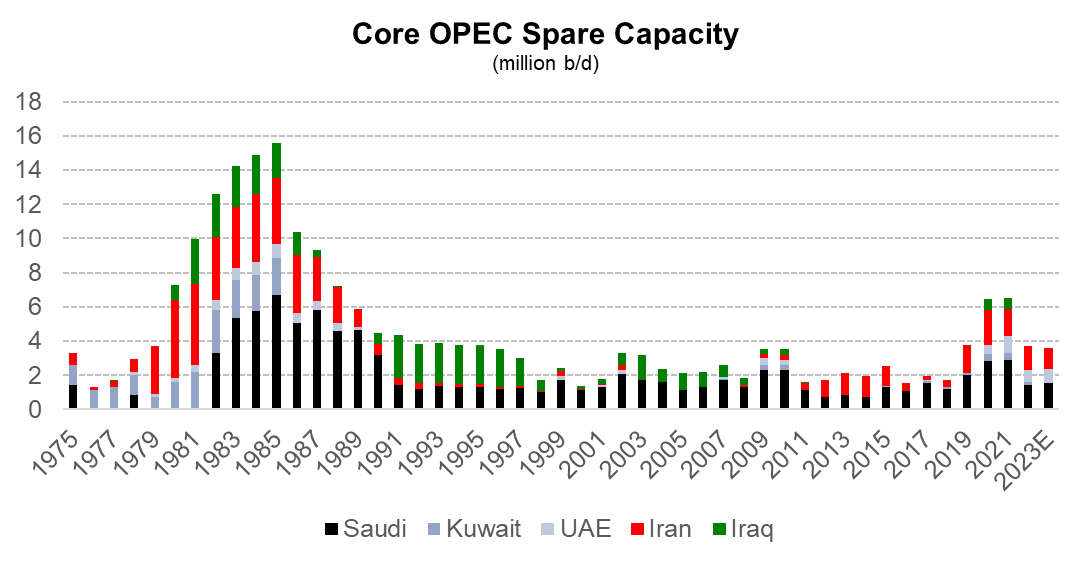

It has long been our view that OPEC spare capacity is overstated (see Exhibit 4).

In our view, the group can manage short-term minor disruptions.

However, we seriously question core-OPEC’s ability to handle a sizable, sustained disruption, which we would characterize as one that was over 2 million b/d for a sustained period of time (quarters/years not months).

Exhibit 4: OPEC Core-5 spare capacity

Source: IEA, Veriten

Takeaways:

If there were to be regime change in Russia, there would likely be at least some downside risk to Russia net exports from simply the volatile nature of this situation, suggesting oil price upside risk, all else equal.

It is hard to see how there would be any upside to Russia net exports, barring the unexpected outcome of a collapse in demand without a commensurate reduction to oil supply.

Oil markets are likely over-conditioned to the idea of Russia net export resilience given the many incorrect calls for a Russia supply collapse post Ukraine.

Markets are likely overestimating OPEC’s ability to handle a sustained, large-scale disruption in the event one occurs.

We Need More Good Barrels and Fewer Bad Barrels

As we wrote in our March 12, 2022 issue of Super-Spiked (here), the world needs more good barrels and fewer bad barrels. A healthy energy evolution era includes a strong and growing US and Canadian oil and gas industry. US and Canadian liquids supply today accounts for just under 25% of global oil markets. We are in a position of strength to potentially help our allies meet their energy needs in coming decades.

We would highlight that since 2010, US and Canadian liquids have grown at twice the rate of Core-5 OPEC, reducing the latter's influence on global energy markets (Exhibit 5). However, a significant portion of US and Canadian growth has of course come from US shale, which is expected to experience slower growth in the years ahead. As such, oil production from Canada’s oil sands, the Gulf of Mexico, and non-shale US plays in both the Lower-48 and other oil producing regions of the US will be important.

It remains our view that a core objective of US and Canadian energy policy should be to grow its net exports over the next decade to further reduce the impact of both OPEC countries and rogue nations that may or not be part of OPEC. Exhibit 6 highlights our view that it is possible to grow US and Canadian net exports by 10 million b/d over the next decade through a combination of supply growth and reductions in domestic demand (the latter coming from EV growth and potential fuel economy gains).

Exhibit 5: Growth in US and Canadian oil versus OPEC Core-5 since 2004

Source: IEA, Veriten

Exhibit 6: A path to 10 mn b/d of net exports from US + Canada

Source: IEA, Veriten

⚡️On a Personal Note: Independence Day

Happy Birthday America! The first Independence Day I remember was the Bi-Centennial when America turned 200 on July 4, 1976. My parents had become American citizens the year before. I was seven. We went to Memorial Field to watch the fireworks. As far as I remember, that was the end of my parents being "Indian." No more wearing saris for my Mom. We stopped eating Indian food every night. Burgers were in even as my parents remained vegetarian.

Forty-seven years later, I remain deeply grateful my parents emigrated here and nowhere else and that they fully assimilated to American culture. My life and the life of my children are immeasurably better off for that decision. It's not a close call. Given that fact, at age 54, I have decided to forgive my parents for voting for Jimmy Carter instead of Gerald Ford in the first presidential election I remember. No family had more Carter-Mondale bumper stickers than we did. At least their Carter over Reagan votes didn't matter. I think they may have become Reagan Democrats by 1984, though I have a vague memory about my mom holding out hope Geraldine Ferraro would become Vice President. They were fans of Lyndon Johnson's Great Society narrative, even as advanced education, hard work, family values, and self-reliance drove their integration and acceptance into the American melting pot as it was then called (in my view, that concept should return even if the descriptor may need modernizing).

In 1961, a newly married couple born in colonial India came to America with $25 and two suitcases to attend graduate school at Cornell University. Within one generation, living the American Dream has resulted in an expanded family that includes a retired Goldman Sachs partner, a mother of two wonderful (now adult) children and career-long American Airlines flight attendant, a PhD academic, seven American grandchildren, and one golden doodle (Winnie, my parents' chocolate lab, passed many years ago). Great job Mom and Dad and thank you America for all you've given my family!

⚖️ Disclaimer

I certify that these are my personal, strongly held views at the time of this post. My views are my own and not attributable to any affiliation, past or present. This is not an investment newsletter and there is no financial advice explicitly or implicitly provided here. My views can and will change in the future as warranted by updated analyses and developments. Some of my comments are made in jest for entertainment purposes; I sincerely mean no offense to anyone that takes issue.

Arjun.

I’m happy to hear how you use the phrase U.S. and CANADIAN oil production/supply consistently together. Though makes sense due to your knowledge and common sense.

I remember 10-15 years ago before the shale oil "revolution" really developed U.S. oil security/supply was always being called in American media as "North American" oil security/supply in terms of the thinking that when one "included" all the Canadian oil sands reserves along with our conventional oil (and Mexican to a far lesser degree) the sum being the security/supply.

Then as the shale oil supply increased so quickly and dramatically the term "North American Oil Supply" disappeared from the media commentary.

It went back to "U.S. Oil Supply and U.S. Oil Self Sufficiency" only.

Pipelines became politically toxic (especially pipelines from Canada, but also to a degree domestically).

As this U.S. shale oil growth/supply starts to roll over and decline (and it's starting) and when the idiot class start to be forced to acknowledge the absolute essential nature of oil to the U.S,'s (and all other countries economic well being), I will just smile when I see the media re-start the phrase......

"North American Oil Security/Supply.

Watch for it.

In my humble opinion. 🙂

Great posts. Look forward to each week.

Thanks Arjun...great writeup !!

From a beat up oil bull..hope 2H / 23 is better

🐂🤠