Five Big Calls To Get Right Over The Next Ten Years

Navigating The Energy Crisis Era

This week we turn to the topic of big calls and strategic decisions we think corporates and investors need to get right over the coming decade. The five areas we highlight this week are not intended as an exhaustive list. We will add to and update areas in the months and years ahead. The discussion in this post is a quick introduction to the first three of the five calls.

Our initial list of the Big Calls To Get Right Over The Next Ten Years includes:

OIL: What comes after Tier 1 US shale oil?

GLOBAL NATURAL GAS: What does European natural gas demand look like a decade ahead?

NEW ENERGIES: Where, when, how, and whether to gain exposure?

POLICY: How to navigate energy policy uncertainty?

VOLATILITY: What is your framework for embracing commodity macro volatility and path uncertainty?

We would note what is not included in this list:

Specific oil or natural gas price forecasts

Guessing a round number year when "peak oil (or natural gas) demand" will occur

An assumption of stability be it with policy, asset exposures, or commodity prices

Looking backwards and assuming that the last 10 years will predict the next 10

A pre-determined outcome of the "right" strategy

A singular focus on "net zero by 2050." This framing that at least some investors, activists, and policymakers utilize needs to massively evolve to something that places “energy-for-all” at its core. We do not see "net zero by 2050" as a guiding strategy or investment driver. Carbon intensity is a metric to monitor, not a strategy driver. Instead, providing energy-for-all, including new energies, should be the guiding principle.

We would note that unlike essentially all prior energy cycles, the outlook for the Rest of the World is far more important than what happens with the Lucky 1 Billion of us that live in the USA, Western Europe, Canada, Japan, Australia, and New Zealand. Both corporates and investors, especially those located within Lucky 1 Billion people regions, will need to evolve the lens through which they view the world toward understanding how the future areas will approach meeting their significant energy needs.

OIL: What comes after Tier 1 US shale oil?

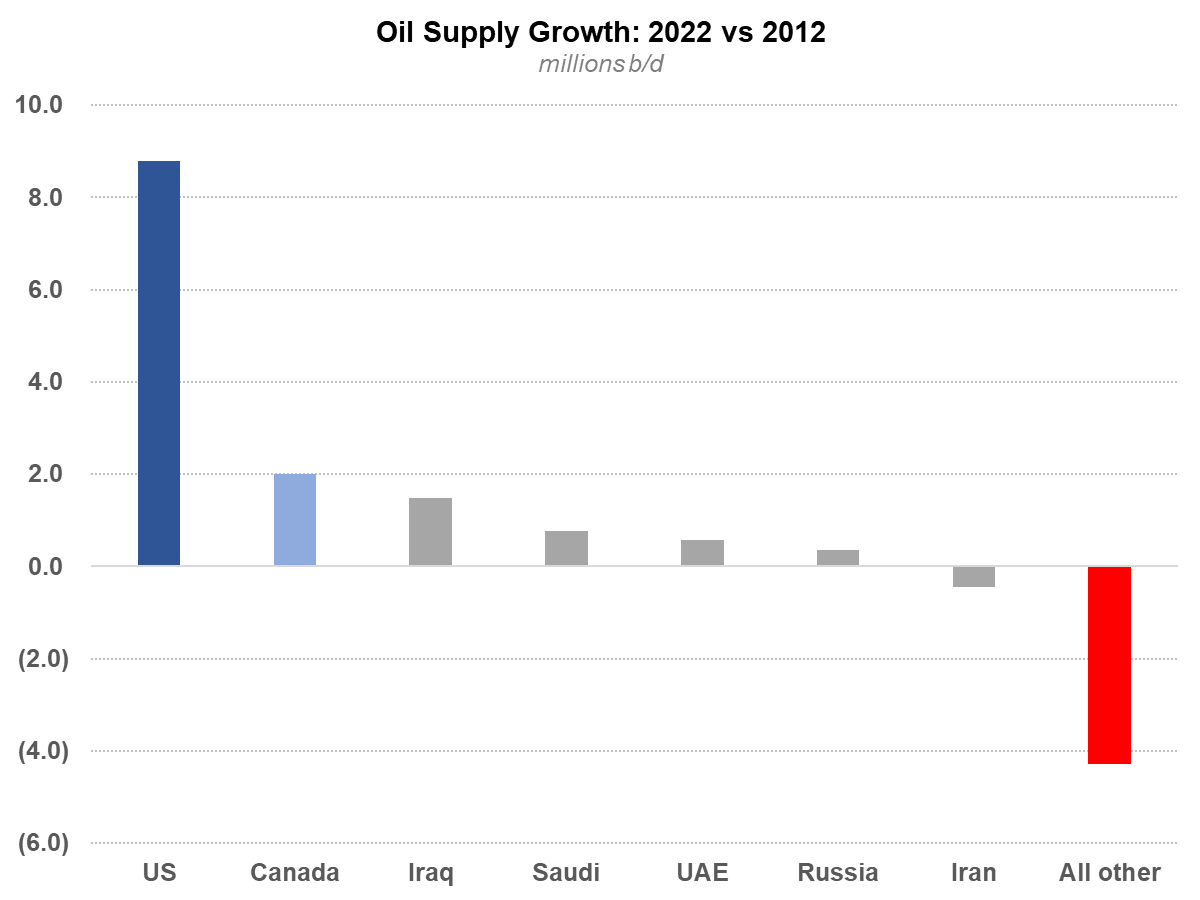

US shale oil accounted for over 80% of net global oil supply growth last decade (Exhibit 1). Think about that for one second. A handful of counties in Texas, New Mexico, and North Dakota were the overwhelming contributor to global oil supply growth for a full decade. While there is an intense debate among energy specialists on the exact year the current slate of development areas will peak and either plateau or decline, no one really debates that we are approaching a more mature era for US shale oil. To be clear, for this point we are referring to so-called Tier 1 acreage which we would define as drilling locations that can justify investment at $60-$70/bbl WTI (or lower) in order to generate at least 8%-10% corporate-level returns on capital employed (ROCE).

Exhibit 1: Oil supply growth from key regions

Source: IEA, Veriten.

We believe Tier 2 and Tier 3 acreage offers significant upside potential to some combination of future growth or maintaining plateau, but almost certainly requires a meaningfully higher oil price in order to justify spending. The potential for future technological gains to lower long-term break-evens for Tier 2 and 3 is an area the market will undoubtedly track closely.

A few observations:

Growth in US shale resulted in significantly diminished investment flows to just about all other upstream regions.

Growth in US shale created a perception that short-cycle oil projects like shale obviated the need for long-cycle investment in areas like Canada's oil sands, various deepwater areas, or other global opportunities.

In the US, a large portion of the US upstream industry became "shale only" or "shale mostly." Skillsets like exploration and global have broadly atrophied.

Canadian oil and gas was left for dead, especially by non-Canadian companies and investors.

National and non-US international oil companies that did not enter shale have similarly retreated from global spending.

Going forward, we believe companies and investors need to be mindful of the following:

There is little evidence that oil demand will be peaking any time soon.

Yet, there is little effort being made to look for new oil supply opportunities outside of shale.

During the early 2000s super-cycle, the world tried many different supply areas before recognizing that US shale was the answer; shale development really didn't start until nearly a decade into that super-cycle.

This time around, there is very little effort being put forward to figure out what will be next.

The outlook for US shale oil supply is of course highly relevant to not just E&Ps but also midstream and downstream companies. Local oversupply of light-sweet crude oil in the United States has benefitted local (i.e., US) crude oil differentials. As a reminder, classically many US refiners, especially those in the Gulf Coast, are well positioned to run medium- and heavy-sour crude oils. The outlook for future supply growth from Canada's oil sands, the Middle East, or even certain countries in South America will be important to monitor along with the likelihood of US shale producers moving more aggressively to develop Tier 2 and Tier 3 areas.

In terms of corporate and investor positioning, we would ask:

What are the areas to focus on going forward to generate advantaged returns?

What portfolio options can one add today that may currently be out-of-the-money but could come back into vogue as or when US shale oil plateaus or rolls over?

What skillsets or knowledge in various areas should be added today?

GLOBAL NATURAL GAS: What does European natural gas demand look like in a decade?

It will not come as a surprise to long-time Super-Spiked readers that we are broadly speaking not fans of European Union energy and climate policy. We have often characterized our perspective as "Goodbye Europe, Hello Rest of World." In looking at the future of overall energy demand growth (both fossil fuels and new energies), we believe it is appropriate to re-center perspectives and analysis away from Europe and toward the Rest of the World.

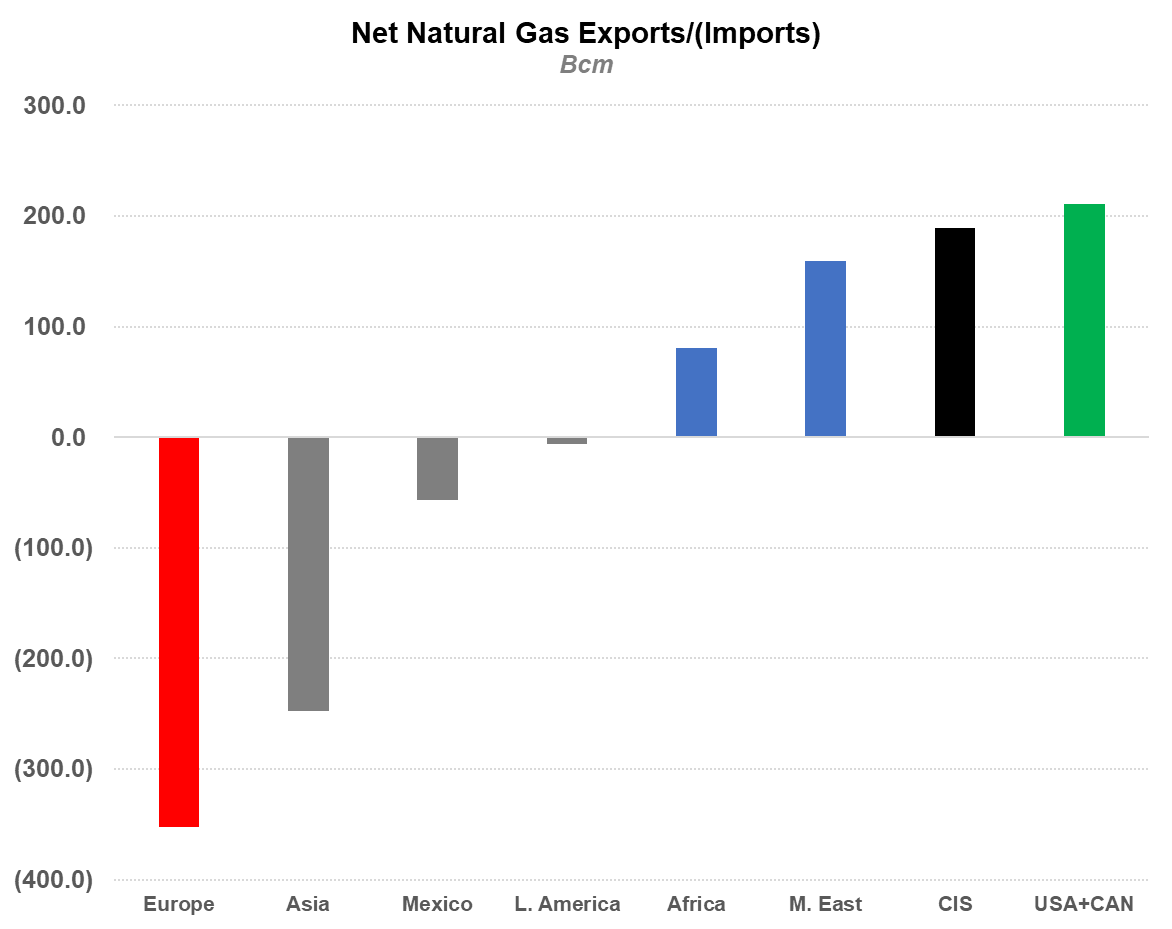

But we have received reasonable pushback that such a view understates the importance of European natural gas demand to the outlook for LNG over the coming decade. Europe as an important economic region may well be diminishing, but it will still matter quite a bit to the global LNG outlook over the next 10-20 years (Exhibit 2). We therefore acknowledge the validity of the pushback.

Exhibit 2: Europe is the largest net importer of natural gas

Source: EI Statistical Review of World Energy

The sudden loss of Russian gas supply to Europe in early 2022 drove a massive spike in global natural gas and spot LNG prices, as Europe desperately sought to offset the loss of Russia with LNG cargoes from everywhere else in the world. A very warm winter in 2022-2023 coupled with industrial sector economic contraction contributed to a significant easing in spot LNG and global gas prices in 2023.

Looking forward, Europe notionally has the strongest stated policies and targets in an attempt to reduce long-term usage of fossil fuels, including natural gas. Embedded in Europe's view is a major ramp in solar, wind, and "green" (i.e., from renewables) hydrogen. On the hydrogen piece in particular, we are highly skeptical that Europe can sufficiently ramp green hydrogen at a favorable cost by 2030 to meaningfully displace the need for substantial quantities of LNG.

That said, there is downside risk to our base-case view of broadly stable European natural gas/LNG demand over the next 10 years. It is especially possible that de-industrialization results in lower LNG demand. It is of course possible, no matter how remote, that we are too pessimistic on the viability of green hydrogen at scale by 2030. The outlook for European natural gas demand is material to the outlook for global gas pricing including LNG. The flow through impact to global gas producers and LNG suppliers could well be material.

Key focus for corporates and investors: A view on 2030-2040 European natural gas demand is needed.

NEW ENERGIES: Where, when, how, and whether to gain exposure?

Writing about new energies is complicated by the diversity of energy sources and technologies and the global nature of both policy and investment uncertainty. Some new energies are at a very early stage of development; others are more mature. One should be careful about making blanket statements that it is all good or all bad.

We remain on record that there is neither urgency nor necessity for traditional oil and gas companies to have to invest in new energies. But flexibility and non-mandates should not be interpreted as meaning traditional oil and gas companies should only stick with oil & gas. In at least some cases, there could well be logical adjacencies or other areas of opportunity. It is in fact quite possible that successful entry (key word: "successful") could provide favorable investment differentiation. As an example, there is little doubt that ExxonMobil purchased Denbury for its carbon capture utilization and storage (CCUS) infrastructure, not its legacy oil fields.

For traditional energy corporates and investors:

How are you ramping up knowledge and expertise in the new areas, if for no other reason than to simply understand the potential impact on the pace of traditional energy demand growth?

What corporate culture and personnel enhancements are needed to embrace a broader range of future investment options?

To the extent capital-intensive sectors are likely to be inherently cyclical, including new energies, how do you avoid chasing unprofitable growth during the good times, while contemplating adding exposure to sensible future areas on pullbacks?

What is the right business model to consider new energies investments? Investing in venture capital funds? Having your own low-carbon division? Buying expertise or assets or companies? Simply studying the topic for the time being, but otherwise “sticking to your knitting”?

⚡️On A Personal Note: Top 10 Things I LOVE About Europe

Long-term Super-Spiked readers surely realize that I am not a fan of European Union energy and climate policy. There is really no part of it beyond some of the efficiency measures that I would want to see emulated in the United States or any other region of the world. Fortunately, I believe Europe's influence on the broader world is steadily diminishing; most notably, 1.4 Billion People Club regions are increasingly capable of self-determination.

However, my strong aversion toward Europe's approach to energy & climate should not in any way be confused as implying a dislike of the regular people of Europe, its culture and history, or the beauty of its landscape. In an attempt to bring some positivity to my often dour European commentary, here are the Top 10 things I love about Europe (including the United Kingdom):

#1 Links golf! There is nothing better than links golf in Scotland. If I could only play golf in one region for the rest of time, it would be in the Kingdom of Fife. Top courses in Fife in order of preference: (1) The Old Course (2) Kingsbarns (3) The Castle Course (4) The Jubilee Course (5) Balcomie Links (Crail) (6) Golf House Club, Elie Links (7) The New Course (8) Dumbarnie Links (9) Lundin Links and (10) Craighead (Crail). I rate Leven Links as the #1 course to play after an over-night flight on the way to St Andrews. I would also add that the people of Scotland, or at least of Fife, are super friendly.

Exhibit: Nothings beats links golf in the Kingdom of Fife

Source: Super-Spiked selfie.

#2 August vacation. I am all-in on the traditional Puritan work ethic that has helped make America the greatest country in the history of the world. But with one exception: a month of vacation in August is a no brainier. Good job by many European countries on this one.

#3 Guinness on tap. I have no idea why but Guinness on tap in the Old World is significantly better than whatever version of Guinness we are drinking in the New World. Why is that?

#4 Scottish whisky and the Bordeaux and Chianti wine regions. I believe this requires no further explanation.

#5 College that costs one-third less than American private high school and 50% less than most US private colleges. How is this even possible?

#6 55+ mpg SUVs. Last summer, I drove 571 miles around Scotland in a Toyota Hybrid CH-R. Edinburgh to Inverness 156 mi + Inverness to Lochness 50 mi (round trip) + to Nairn 64 mi (RT) + to St Andrews 150 mi + St Andrews to Crail 52 mi (RT) + to Dumbarnie 46 mi (RT) + to EDI drop off 53 mi. And the “SUV” averaged 58.9 mpg. Incredible! This is the energy and climate policy Europe and the UK get very right: real world fuel economy gains.

#7 Credit card reader brought to your table. Given obvious privacy and security concerns, why don’t we do this in the USA?

#8 Hofbrau Haus in Munich. I had my first international beer in college visiting my late Uncle Thangu and Aunty Koenig in 1991.

#9 Not every head of government is a super old man. A Google search of current (or very recent) female leaders in Europe that hold actual and not merely symbolic power include six nations: Denmark, Estonia, Finland, Iceland, Serbia, and Sweden. The US has a minimum age to be president (35). How do we not have a maximum age?

#10 New musical artists including Amon Amarth (Norway), Children of Bodom (Sweden), Gojira (France), and The Ocean (Germany). Check them all out on Spotify or Apple Music. As I have previously noted, for those you especially passionate about climate, Gojira is the band for you; Toxic Garbage Island and Amazonia are two good ones. For those of you that are geologists or petroleum engineers, you will love The Ocean (sometimes called The Ocean, Collective), with now ten paleontology-themed albums. And I am just noticing The Ocean’s newest album Holocene was just released. I suggest starting with Devonian: Nascent. For Amon Amarth, my favorite song is The Pursuit of Vikings. For Children of Bodom, I’d start with Morrigan and Needled 24/7.

⚖️ Disclaimer

I certify that these are my personal, strongly held views at the time of this post. My views are my own and not attributable to any affiliation, past or present. This is not an investment newsletter and there is no financial advice explicitly or implicitly provided here. My views can and will change in the future as warranted by updated analyses and developments. Some of my comments are made in jest for entertainment purposes; I sincerely mean no offense to anyone that takes issue

Thanks again Arjun. I value everything that you write. “On A Personal Note” is spot on 1 thru 9. Sadly and regrettably, I have no knowledge of #10. A sign of my age.

Let’s not forget about the plastic bottle caps that stay attached, and no bisphenols in that thermal paper WTF.