Five Big Questions At The Start of 2023

Navigating the Energy Crisis Era

Welcome to Super-Spiked 2023!…and what I expect will unfortunately be year three of the messy energy transition quagmire we find the world in. Traditional energy CAPEX remains closer to trough than even mid-cycle let alone peak levels, supporting (1) an ongoing Super Vol macro backdrop and (2) my continued confidence in favorable underlying ROCE and cash return trends for traditional energy companies.

For the first post of 2023, I want to highlight five key themes and questions that I plan to focus on in Super-Spiked in coming months.

(1) If oil prices and ROCE fall in 2023, does it mean the structural ROCE upcycle is over?

My view: No, so long as ROCE vs oil prices stays "above the regression line".

(2) In a world that favors ROCE and dividends, is a diversified E&P business model preferable to being a pure play?

My view: Yes, in many cases.

(3) How can an E&P company add duration and diversify without upsetting investors in the short term?

My view: It's tricky, case specific, and may not be possible...i.e., it may not be possible to not upset investors.

(4) What does $TSLA's valuation correction mean for EV growth projections?

My view: There will be growing recognition in 2023 that a 100% EV future is a pipe dream, no matter how many decades in the future one looks.

(5) Does the ongoing retreat of European financials from traditional energy matter?

My view: Yes in the short term, No in the long run.

The above list is not exhaustive on possible themes or issues to dive into. Others I expect to come back to include:

ESG 2.0. Both EngineNo.1 and Strive Asset Management I think are broadly mis-understood (including, possibly, by each other) and, in my view, are interesting examples of what I am calling ESG 2.0 (I might need to change the label of this theme to avoid mis-understanding about what I support and don't support when it comes to ESG). The need for ESG reform and clarity of what makes sense and what does not make sense is high.

Good versus bad energy & climate policy. It's easy to criticize, especially western world politicians that exhibit irresponsible rhetoric and corresponding poor policy prescriptions (e.g., the EU, progressive Democrats, MAGA Republicans). That is what it is. But here at Super-Spiked, we try to look past the obvious and search for any changes happening under the surface. On that front, I am increasingly optimistic that there are a growing number of both Republicans and Democrats that have sensible energy and climate policy ideas (serious comment, not being sarcastic). Unfortunately, I am not optimistic that Europe, somehow, is ready to see the light on how awful its energy and climate policies are.

Critical minerals as an energy transition bottleneck. If you don't want to get seriously depressed, don't watch Joe Rogan's interview with Siddharth Kara on the conditions of cobalt "workers" in the Democratic Republic of Congo (link at end of this post). It would be easy to take a pot shot at Apple as an ESG darling. But that wouldn't really help anyone in Congo. Perhaps highlighting the Joe Rogan interview might. If we want to ensure we have enough energy at as small of an environmental and climate footprint as possible, the answer does not start with de facto enslaving DRC children to mine cobalt.

Power markets. In the absence of a nuclear "Marshall Plan", we are going to need a lot more natural gas and LNG to balance the western world's otherwise singular focus on solar and wind along with the developing world's need for non-coal-fired power generation. What investments are needed to have growing electricity availability, ideally with as small of an environmental and climate footprint as possible?

Is Canadian oil cleaner and more profitable than most other sources of oil in the world? The answer is likely yes. I have no idea why everyone accepts the libelous conventional wisdom of Canadian oil somehow being "high cost" and "dirty". Canadian oil needs a rebrand and a fresh look from energy and climate policy makers in particular. Whenever you hear a climate hawk (or European financial institution) discuss the need to avoid "Arctic" and "unconventional heavy oil", these are code words for Alaska and Canada, two regions whose oil and natural gas make the United States and its allies stronger, not weaker. This needs to be recognized and called out.

As usual the focus of Super-Spiked is long-term thematic and targeted to senior energy sector executives, policy makers, and institutional investors, while hopefully being accessible to anyone else with an interest in the most important subject in the world: Energy. Super-Spiked is not about short-term oil price or oil equity forecasting, divisive rhetoric, counting barrels in the near-term sense of it, or similar topics that are more than adequately covered by many other sources.

I hope to see some of you later this week at the Goldman Sachs Global Energy Conference where Jeff Currie and I will attempt to recreate "The Jeff and Arjun Show" to kick things off Thursday morning.

(1) Will Sector ROCE Remain “Above the Regression Line" in 2023?

A key question that keeps coming up from investors is the risk that if we have lower oil prices in 2023 and resulting lower return on capital employed (ROCE), would that mark the end of the structural upcycle. In my view, it is important to differentiate what I might call spot ROCE changes from the structural cycle. Given a Super Vol macro backdrop, I would fully expect ROCE to be correspondingly volatile on a quarterly or annual basis. I would refer everyone to my ROCE Deep Dive series, which you can find on the right side (scroll down) of the Super-Spiked website (here). I also discussed this in the closing post and videopod in 2022 (here and here).

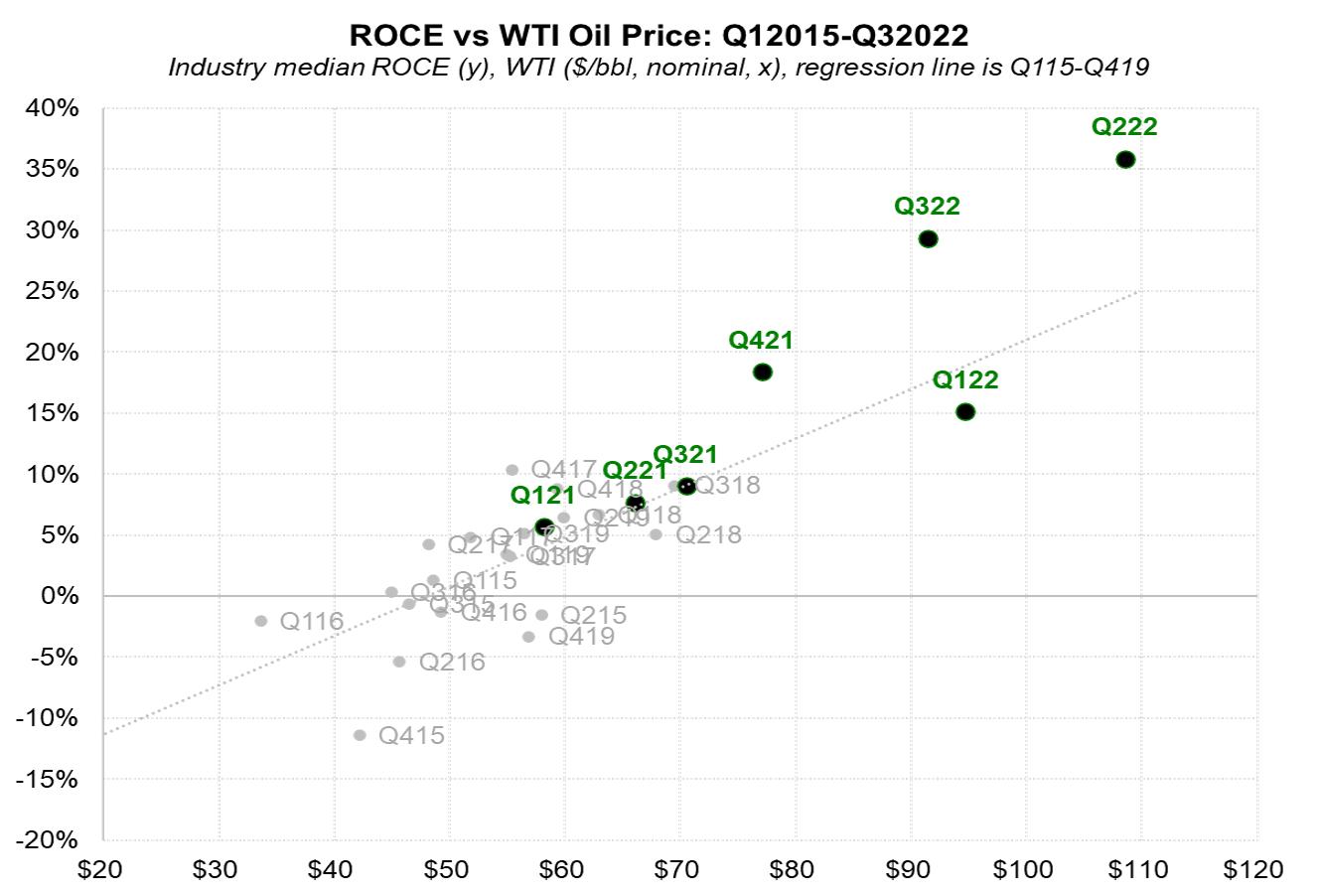

In a nutshell ROCE would need to stay above (or at least in line with) the 2015-2019 regression line of ROCE versus oil prices to indicate the long-term ROCE uptrend remains in tact (Exhibit 1). The indicator that gives me the most confidence this will stay true at the sector level is the fact that CAPEX remains closer to trough rather than mid-cycle let alone peak levels (Exhibit 2).

Exhibit 1: A regression of oil prices versus ROCE can provide insight on whether structural ROCE is improving (above historic regression line) or weakening (below regression line) relative to the level of oil prices. Since 4Q2021, ROCE has generally been structurally improving.

Exhibit 2: Inflation-adjusted CAPEX in the current super-cycle is tracking a similar point in the last super-cycle, though, that is before adjusting for the ~25% bump to global oil demand since the 2000s.

(2) Do High ROCE Diversified E&Ps Deserve a Premium Over Pure-Plays?

When sector ROCE was poor and investors, somehow, were emphasizing a preference for companies with superior volume growth, the pure-play strategy for E&P companies was king. This culminated in large cash flow (EV/DACF or EV/EBITDA) premiums for the Permian pure-plays over most others in the 2015-2019 period. My sense is investors still prefer the pure-plays, especially when you get below the super-caps.

But no one, understandably, is asking for superior volume growth. In fact just the opposite: there is a clear preference for superior ROCE, free cash flow, and well articulated cash return strategies. Yet, to my knowledge (cautionary note: I don't speak with anywhere near as many investors on a regular basis as I once did), investors I don't think have recognized that the pure-play E&P model has never been sustainable on a long run basis, and may not be the best model in a world where ROCE and cash return strategies are preferred over volume growth.

Examples of companies that have demonstrated an ability to earn competitive returns on capital, earnings, and cash flows over multiple decades are almost all diversified:

Amoco (pre-merger with BP)

Chevron

Exxon and ExxonMobil (1910-2010 and more recently)

Mobil (pre-merger with Exxon )

Royal Dutch/Shell (1910-2010)

Among pure-plays, maybe we could include a mostly oil sands pure-ish-play like Suncor Energy. Canadian Natural Resources if it can continue its excellent track record might deserve to be added to this list, but isn't really a pure-play even within Canada given its history in conventional natural gas and non-oil sands crude oil.

Essentially every pure-play comes with an expiration date. As with dairy milk, if you overstay your welcome, you will suffer severe stomach upset. The Street is starting to sniff out the limits of shale inventory for some companies. That leaves a few choices: (1) sell before you are found out; (2) diversify into new plays from a position of relative strength; or (3) liquidate.

(3) How Do You Add Duration and Diversify Without Upsetting Investors Short-Term?

This is not a trick question. But it offers no easy answers. I suppose the easiest answer is for the pure-play to sell to a larger, diversified player, which was seen in a few cases in 2020. But I reject that as the only reasonable solution for an existing pure-play E&P. This topic is deserving of its own post to really dig into this issues. But here are a few bullets to start:

Investors in general hate when a pure-play makes a diversifying acquisition; I don't expect that to change and investors are not necessarily wrong based on the many examples where it hasn't worked (I would like to publicly apologize to my former institutional investor clients that read Super-Spiked for giving companies a license to consider diversification strategies…I know it’s super unpopular).

Diversification strategies require management expertise and a competitive edge that does not necessarily exist at all or even most companies. How can companies take a page out of the private equity playbook and partner with best-in-class executives that can help with entry into a new area?

What is the running room in the new area in terms of bolt-on acquisitions or exploration potential? What edge does your company have to assess future drilling or project economics?

How many new areas are required to be truly diversified? Two? Three? Ten? Six?

Wouldn't it be easier to simply sell as a pure-play? Sure, but that may not be an option.

What about liquidating rather than attempting diversification? Yes, that is an option as well.

In my view an example of a company that has regularly shifted its core asset exposures over the course of my career and has remained a leader among the E&Ps is EOG Resources. I suppose EOG has never been a "pure-play" in the sense I am using the term in this section. But they have an outstanding track record of making some major strategic shifts over the past 30 years and are the best example I can think of as a company that has gotten things far more right than wrong via diversification efforts.

(4) What Does Tesla’s Valuation Correction Mean for EV Growth Projections?

Alternative question #1: Are we at peak EV penetration forecasts for 2030-2050?

Alternative question #2: Are we at peak "peak oil demand"? (framing of this question inspired by Super-Spiked friend Bob McNally)

In prior stock market bubbles, we have seen the "new paradigm" darlings that achieved a massive valuation advantage over stodgy legacy peers, force a business model adjustment on the old guard. To be sure, there often is an element of needed evolution from the legacy players. The long-term, post-bubble question is: What is the reasonable middle ground for how much of the "new paradigm" shift persists?

Let me be clear about some aspects of my view of Tesla:

First, I have loved driving either a Model S or Model 3 over the past seven years; I am unlikely to ever again have an internal combustion engine as my primary vehicle.

Tesla can be both a "real" company (i.e., not a fraud as some claim) with what has been a revolutionary impact on the luxury vehicle market, and at the same time be massively over-valued on the inflated expectations for robo-taxis or Level 5 autonomous driving or an outsize long-term EV growth forecasts (e.g., the expectation that EVs could some day be 50% or 100% of global auto sales).

Tesla, in my view, has the best advanced driver assist function of the car brands I have tested; however, it is a far cry from "full self driving".

Tesla's market cap growth coincided with a 14 year period of essentially free money which mixed with mis-guided (in my view) climate policy prescriptions calling for 100% EV sales by some year (2035 or 2050 in most cases) in key regions like California and many European countries (Exhibit 3).

Exhibit 3: Despite a sharp sell-off in 2022, TSLA shares (and ARKK, Bitcoin, and the S&P 500) have still performed better than the Energy sector (XLE) since 2015

Like the diversified versus pure-play section, this is deserving of its own post. The question as it pertains to the focus of Super-Spiked is a simple one: How much of the attempted business mix shift toward EVs and away from ICE vehicles by legacy OEMs will prove sustainable in a world where Tesla’s valuation is potentially massively deflated from its free money, bubble peak?

In my view, zero ICE vehicles by 2035 (as mandated by California and New York and in various European countries) is not a realistic outcome for numerous reasons, including affordability, raw materials constraints, infrastructure constraints, and the nature of recharging when one doesn't live in a single family home in the suburbs, to name a few.

So, if we look at 2030 EV sales projections, I would peg consensus bid-ask as being 25%-50% of global 2030 new vehicle sales (Exhibit 4). Anyone else besides me up for taking the under on the bid? Maybe well under? How about the bid-ask on 2050 global EV sales of 50%-100%? Anyone else think that in 2023, market participants will start taking the (well) under on that as well?

I'll say it again: I am personally bullish both EVs and oil demand. But a bullish EV outlook can still fall well short of 100%, 50%, or even 25% market shares relative to global auto sales.

Exhibit 4: There has been a broad-based consensus expectation for sharp increases in EV penetration in coming decades…I suspect these expectations will be sharply scaled back in 2023 and coming years, even as the EV market continues to expand.

(5) Does The Retreat of European Financials Matter?

Alternative question #1: Will Europe matter to traditional or new energy in 10 years?

Alternative framing of question #1: Isn't the outlook for Asia, the Middle East, Latin America, and the United States more important than Europe?

Well, another one bites the dust: HSBC has joined Munich Re in forgoing new oil and gas financing in the name of "climate" and the IEA’s unfortunate Net Zero by 2050 report. You can find HSBC’s new energy policy (here). I believe the moves represent the worst of uninformed ideological insanity.

Private companies are free to make decisions they see as in the best interests of their shareholders. That said, I predict the world will look back in 10 years at the climate-driven decisions many have taken, including HSBC and Munich Re, as especially non-sensical (polite phrasing). They will prove bad for energy availability, affordability, reliability, and security. They will be bad for the least fortunate among us. They will do nothing to change the trajectory of carbon emissions. They will weaken the environment. I will refer newer subscribers to my October 22, 2022 post on Munich Re (here) for fuller perspectives on how awful of a decision I believe this is.

For the purposes of this post, I will look to progress my views to asking: How meaningful is it for the traditional energy sector to potentially lose access to a decent portion of the European financial services sector? A number of market participants have rightfully asked me: "Why should anyone care what European financial institutions do? Are any of them really important to the future of finance be it in energy or any other sector?"

It's an interesting perspective. I for one do not take lightly the potential for a growing exodus of Euro financials from engaging with traditional oil and gas. We are two years into a serious energy crisis, in particular in Europe, yet the list somehow is growing of companies promising to divest from oil and gas financing. What the heck?!?!? It's a deeply disturbing sign of the times. I think it has the potential to most meaningfully negatively impact non-super cap traditional energy companies that may find it more difficult to secure financing, especially if options in the insurance (and reinsurance) market become limited.

An alternative perspective is that the various actions being taken by the European Union with non-sensical energy and climate policies will result in Europe diminishing in its relevance to the rest of the world. Do growing economies in Asia or the Middle East need European financial companies? What about Latin America and Africa? Do those of us in the United States or Canada need Europe? From the perspective of its importance to the global economy, is Europe headed the way of Japan in terms of growing irrelevance?

⚡️On a personal note… 🐥

I'd like to end the holiday season with an expression of gratitude: I am very grateful we live in a world where social media exists.

I might infer that everyone that subscribes to Super-Spiked is well on their way to having "made friends" with social media. There is simply way too much super interesting and entertaining content on many social media platforms to simply disavow one or some platforms based on their worst users (or CEOs).

My personal journey on incorporating social media into my analysis and understanding of energy markets started in 2020. I recognized that I needed to up my social media game. I started with Twitter. Good decision! (seriously) And it was somewhat ironically an April 2020 Twitter prompt from a journalist at the Financial Times, David Sheppard (@OilSheppard), that sparked my engagement.

I used to avoid looking at my Twitter time line which was filled with US political vitriol from all sides. So I mass-unsubscribed from those that post divisive rhetoric (i.e., the social media accounts for most politicians and large media companies/journalists). I created lists by topic: "Energy", "Markets", "EVs", "Bitcoin”, "Politics". I added the Tweet Deck (and now Tweeten) Mac app to easily monitor and view the lists (also comfortably done on the primary Twitter app on an iPad). And I continuously high-grade who I chose to follow and who I don't, with an aim of not limiting myself to a curated echo chamber. I have numerous self-imposed rules on when and on what I can Tweet or engage on (e.g,. don’t drink and Tweet).

The bottom line is that I love Twitter. The fact that some people are fan boys and many more seem to despise its new CEO has had zero impact on how I have consumed Twitter since Elon Musk took over. I don't get the obsession with Mr. Musk as it relates to one's individual use of Twitter. It is only because Tesla's outlook is relevant to energy that I have any interest beyond voyeurism to even care about his "management" of Twitter.

Notably, social media is not limited to the mega sites like Twitter, Facebook, Instagram, or TikTok. My favorite "social media" location besides Twitter is the Slack channels at Columbia University’s Center on Global Energy Policy, where I am an advisory board member. I am fortunate to have the opportunity to engage on energy and climate policy with some of the best and brightest—including many that have very different perspectives than I do on how to address the world's energy and climate challenges. There are a number of Discourse forums and Discord servers that I subscribe to on topics like the economy, technology, crypto, and EVs that are invaluable sources of education and entertainment. I wouldn't be on Substack or YouTube without their inspiration.

I wouldn’t be able to engage with most of you without social media. May God Bless the creation and continuation of social media.

🎤 Streams of the Week

I am an avid podcast listener, with circa 90 streams (audio and on YouTube) to which I subscribe. Staring with this post, I plan to regularly highlight favorite episodes from the past week. Here are three I listened to over the holidays I would recommend.

Siddharth Kara on The Joe Rogan Experience (Spotify)

Siddharth Kara is an American author, activist, and expert on modern-day slavery and human trafficking, child labor, and related human rights issues (Wikipedia). In this interview, he discusses his forthcoming book Cobalt Red: How the Blood of the Congo Powers Our Lives (here). Warning: It is brutal to listen to.

Motörhead on No Bull with George Noble on Twitter Spaces (YouTube or Apple/Spotify podcasts)

George Noble’s “No Bull Market Talk with George Noble” Twitter Spaces are must listen events. If you don’t catch the discussion live on Twitter Spaces, episodes are available for streaming/download on YouTube, Apple Podcasts, and Spotify. In this discussion, George interviews a veteran autos analyst based in Japan and dives into his bearish outlook for TSLA shares.

Grace Stanke, Miss (Nuclear) America 2023 on Max Gagliardi’s Talk Energy Podcast

Max Gagliardi hosts the “Talk Energy” podcast (YouTube/Apple/Spotify). He almost always has an interesting guest, with Grace Stanke no exception. I know I am always excited to see a younger person that shows real interest in the energy sector. In this case, Ms. Stanke is a nuclear engineer that happens to have recently been crowned Miss America 2023. As she notes, “Miss America” is a job, and at least based on this interview, I believe she will prove to be an articulate, effective, and passionate advocate for nuclear power—something the world urgently needs to get on board with if we are to solve our energy and climate challenges. The world needs more young people to advocate for sensible energy and climate policies—we need more Grace Stankes. Don’t let the crown distract you from her otherwise excellent insights on the nuclear sector.

⚖️ Disclaimer

I certify that these are my personal, strongly held views at the time of this post. My views are my own and not attributable to any affiliation, past or present. This is not an investment newsletter and there is no financial advice explicitly or implicitly provided here. My views can and will change in the future as warranted by updated analyses and developments. Some of my comments are made in jest for entertainment purposes; I sincerely mean no offense to anyone that takes issue.

I just subscribed - finally found someone with a common sense macro analysis of the energy sector. I am a petroleum engineer working in the Permian Basin for a small privately owned O&G company. I have more than a few grey hairs and have seen a lot in my career, but the extreme push to renewables is alarming and will end in misery for many. In the 90's I took a detour into nuclear waste disposal analysis, joining a team responsible for the environmental impact analysis of several of the large waste repositories in the US. Safe storage of nuclear waste is possible in well-engineered sites, and nuclear makes much more sense when considering the environmental damage caused by over-building wind and solar. Keep up the great analysis, Arjun!

Arjun, I have 3 questions: While you give examples, have you defined "diversified" in a previous post? When I see Exxon and Chevron I think of integrated oil companies, but I'm not exactly sure that is what you mean, because you also mention duration which I've been interpreting as having additional long term supply capacity (which investors are not rewarding companies for presently); On the Canadian pure plays, my theory had been that they provide vital heavy oil which our refining system developed in the 70s needs to mix with domestic light sweet crude. We used to get a lot from Venezuela and of course we import heavier sour crude from the Saudis for our Gulf Coast refiners. So what is the "shelf life" for the Canadian pure plays in your opinion; Finally, what about natural gas. As we develop more LNG export capacity to replace Russian gas, shouldn't the spread drop more as export demand increases?