Geopolitical and Environmental Implications of US Oil & Gas M&A

Geopolitics

This week we take a look at geopolitical and environmental implications of the wave of M&A (merger and acquisition) activity in the US oil and gas sector. A core belief we have at Super-Spiked is that a healthy and profitable US energy industry is good for America's geopolitical security, is good for our allies around the world that demand growing quantities of oil, refined products, and natural gas, and is consistent with improving environmental and climate outcomes.

Key benefits of a healthy US oil and gas industry:

Access to America's massive oil and natural gas resource base.

Energy abundance for consumers, businesses, and the military.

Affordability via lower-than-would-otherwise-be-the-case gasoline, diesel, jet, petrochemical, and electricity prices.

Geopolitical security via reduced dependence on energy producers that are not our allies and do not share American values.

Improved environmental and climate outcomes, which appear to be near perfectly correlated with national wealth.

Rewarding, well-paying jobs for hundreds of thousands of Americans.

Significant taxes paid to local, state, and federal governments.

Given the importance of these benefits, it is reasonable to ask whether the significant M&A trend leads to better or worse outcomes for these metrics. In aggregate, we believe the wave of M&A activity will prove supportive-to-additive to the aforementioned benefits. There have been many deals announced, but we highlight five that we view as especially noteworthy, including ExxonMobil-Pioneer Natural Resources, Chevron-Hess, Diamondback Energy-Endeavor Energy Resources, Chesapeake Energy-Southwestern Energy, and Permian Resources-Earthstone Energy (Note: only PR-Earthstone has been completed; the other four are expected to close at various points in 2024).

It is our view that the post-merger entities are well-positioned in the following regards:

Increased scale in the most important oil and gas basins, including the Permian Basin (oil and gas), Appalachia and Haynesville shale gas plays, and Guyana (oil).

Increased likelihood of sustaining competitive profitability for a greater number of years than was the case pre-merger.

Ability to continue with significant capital spending projects to support oil and gas supply in a "Super Vol" commodity macro environment.

Improved scale and capacity to move toward "near zero" methane emissions in key areas of operations.

A better outcome for most employees as relatively more stable capital spending programs reduce the risk of experiencing classic boom-bust hiring/firing cycles for employees. To be clear, restructuring activities are a never-ending process in any industry, but especially cyclical ones like oil and gas; we would differentiate needed restructuring from being caught by surprise by commodity price downturns or upswings.

What about diminished competition in some of these basins? We are not remotely near having to worry about too few US oil and gas companies be it overall or in any of the specific regions noted above. As a reminder, in many parts of the world, a singular, giant state-owned oil and gas company dominates, e.g., see a list of OPEC+ members. A real strength of the US oil and gas industry is the fierce competition among the many hundreds of publicly-traded and privately-owned firms. That said, we believe what has been missing in the upturn that began in 2021 is a new IPO (initial public offering) cycle; while the energy sector is no longer languishing at its COVID lows, sustained investor enthusiasm has yet to return, which is likely the key to new company formation.

M&A adds resiliency and sustainability to the US shale revolution

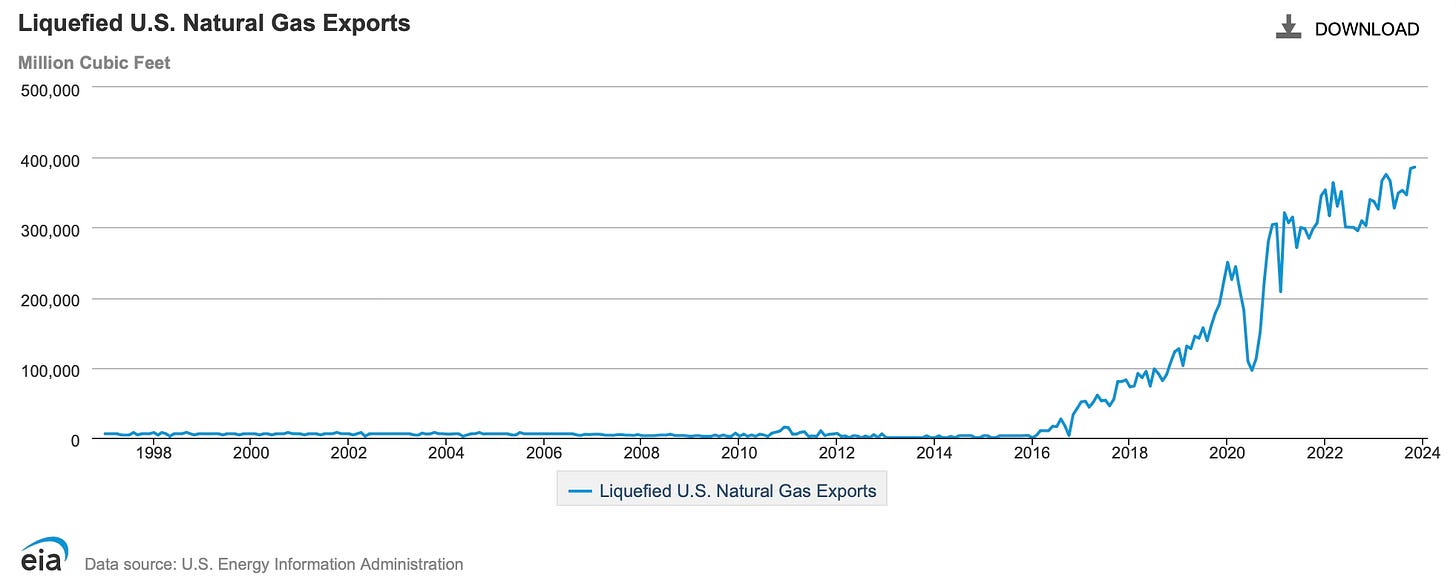

It is difficult to overstate the importance and positive impact to America and the world from the US shale revolution. US shale has accounted for essentially all net crude oil growth over the past decade (Exhibit 1), US domestic natural gas prices are among the lowest in the world, and US LNG (liquefied natural gas) exports have boomed to the benefit of our allies in Europe and Asia.

Exhibit 1: US shale oil has been the overwhelming driver of global oil supply growth

Source: IEA, Veriten.

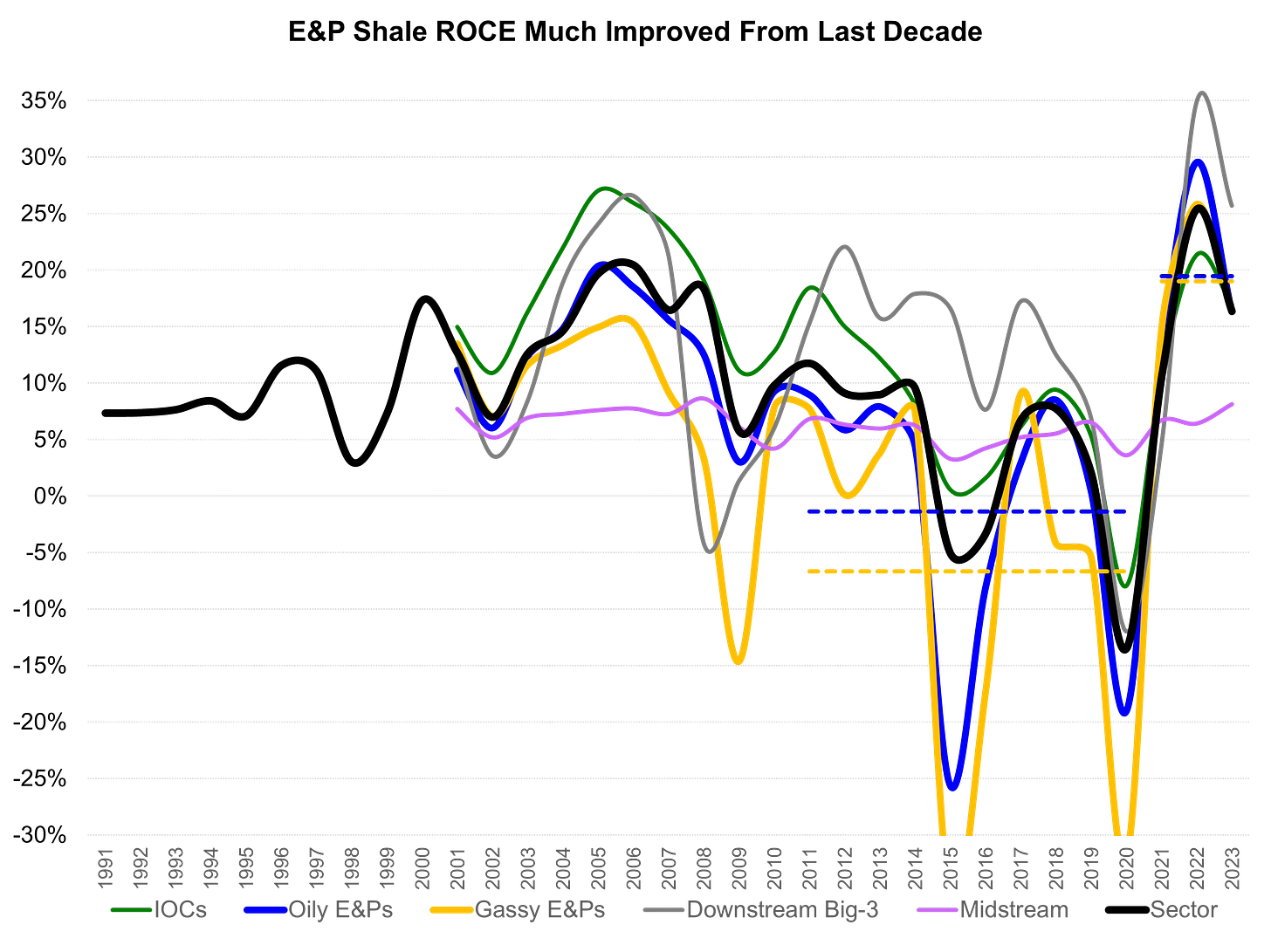

A major concern of ours pre-2021 was that the massive growth in shale volumes (both oil and natural gas) did not come with competitive profitability for most upstream companies (midstream and downstream companies fared better) (Exhibit 2). The improved profitability seen over 2021-2023 has been encouraging.

Exhibit 2: Profitability for shale oil and gas E&Ps was non-existent last decade, but is now improved

Source: FactSet, Veriten.

In our view, the consolidation trend improves the likelihood of sustaining competitive profitability for the leading companies in key basins for the following reasons:

Greater inventory of current Tier 1 or Tier 2 acreage that will allow for more efficiently optimized development programs over the larger, combined acreage size.

Ability to spread needed costs for midstream, other infrastructure, and environmental areas like methane abatement over a larger number of wells.

Ability to spend risk capital to elongate the natural life of shale acreage through the eventual development of current Tier 2 and 3 opportunities (i.e., future Tier 1).

We would argue that none of our confidence in sustained, better profitability comes from stifling competition. It is the opposite in fact; it is spreading the significant capital spending required in the oil and gas business over the combined company's asset base that is the key to recent M&A.

Note: We define "Tier 1" acreage as being at the lower end of the industry cost curve, which means a required price of <$50/bbl for WTI (West Texas Intermediate) or <$3/MMBtu for Henry Hub natural gas in order to earn a reasonable return on capital.

Rising US oil and gas exports are needed competition to large producers that are either not our allies or do not share our values

What is most troubling about rhetoric and actions to limit US oil and gas pipeline and export infrastructure is the negative implications this would have on our friends in Europe, Asia, and other parts of the world and the corresponding strength it gives to hostile nations such as Russia, Iran, and Venezuela, to name a few. Given the global nature of refined product pricing specifically, policies that limit crude oil and refined product exports would likely backfire, if anything. In the case of LNG exports, our domestic resource base is substantial; we see little risk of runaway natural gas prices in the U.S., even as shorter-term (several years in duration) price cycles are always possible.

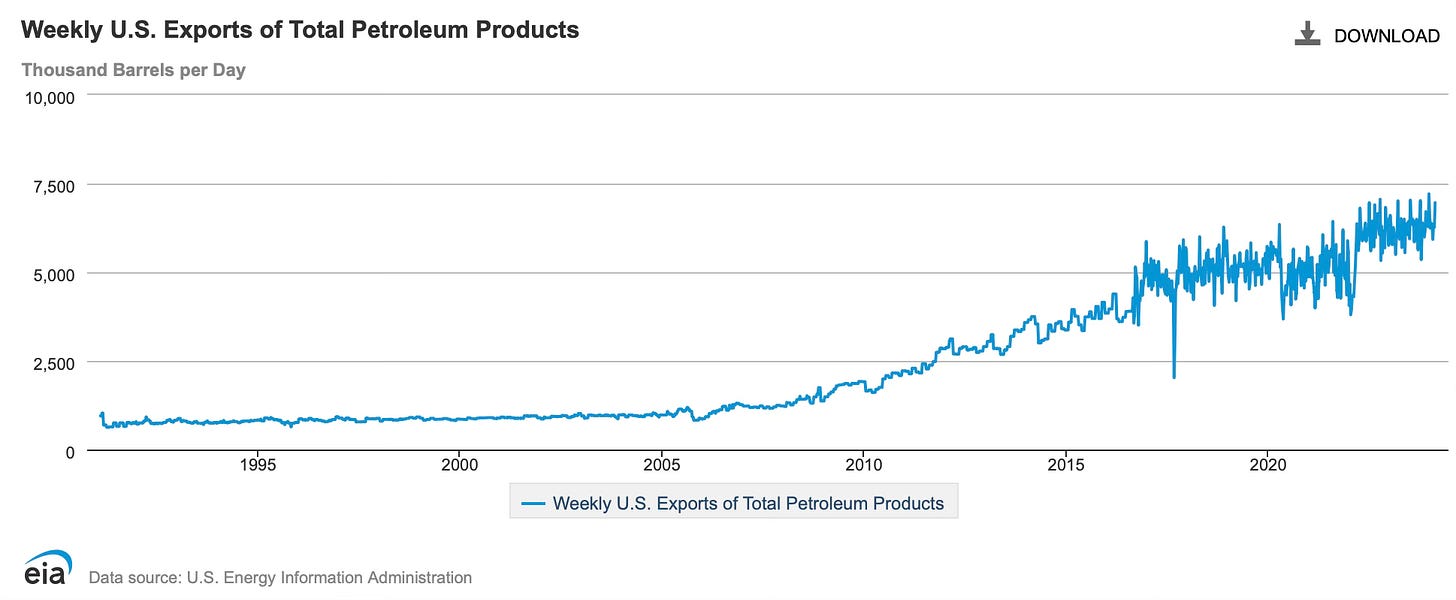

Exhibits 3-5 show the significant growth in US crude oil, refined products, and LNG exports that has occurred since the start of the shale revolution in the 2010s. For crude oil, we have added more than an “Iraq” or “Iran” worth of exports since 2015, which is simply stunning. Given the relative maturity of US energy demand vis-a-vis developing nations, in addition to domestic policies that are attempting to shift energy usage away from crude oil-based products in particular, the scope for further structural growth in US oil and gas exports is meaningful.

Exhibit 3: US crude oil exports

Source: EIA.

Exhibit 4: US refined products exports

Source: EIA.

Exhibit 5: US LNG exports

Source: EIA.

Climate implications: The likelihood of achieving “near zero” methane improves with scale

The biggest opportunity we see for the oil and gas industry to contribute to a world aiming to sharply lower the intensity of carbon emissions in coming decades is via the effective elimination of methane flaring, leaks, and venting. On a technical, technological, and cost understanding basis, considerable progress has been made in recent years in making "near zero" methane a realistic possibility for the US oil and gas industry.

We recognize there are a range of views on the merits and feasibility of addressing methane for the US oil and gas industry. Let us be clear on where Super-Spiked stands: we unequivocally support efforts to move the US oil and gas industry—including upstream, midstream, and downstream companies—to near zero methane emissions. This is NOT about appeasing activists and others that are especially passionate about climate, as we believe a non-trivial number of them will seek the elimination of the American oil and gas industry regardless of steps taken on methane. Rather, we believe the long-term health and profitability of the US oil and gas industry would be enhanced by becoming bulletproof on methane.

We expect all energy sources to be evaluated on a range of metrics, including availability, geopolitical security, affordability, and climate & environmental attributes. By moving to “near zero” methane, US oil and gas will ensure it remains “best-in-class” on ALL attributes, not just the first three. The issue is most noticeable when it comes to the prospects for long-term growth in LNG exports, especially to European nations but possibly various countries in Asia over the long run. At the end of the day methane is energy that can be captured and sold. If one of our over-arching themes is caring about meeting the substantial unmet energy needs of the other 7 billion people on Earth not amongst The Lucky 1 Billion of Us, there is little logic to squandering any form of energy.

While most of the larger, publicly-traded oil and gas firms are already committed to near zero methane in coming years, we see recent M&A as enhancing the odds of moving toward industry-wide solutions with the most important companies leading the way. OGMP 2.0 (website) is an industry organization we support. Essentially all of the largest western oil and gas companies have joined OGMP 2.0 or a similar organization and have made good faith promises to significantly reduce methane intensity.

What we don't understand is why climate activists and others that are especially focused on climate spend so much time attacking the large, western, publicly-traded firms. There is a need to figure out global, industry-wide solutions that includes the far greater number of smaller companies as well as midstream and other parts of the value chain around the world, including foreign national oil companies, that we believe are lagging the larger western, upstream-oriented and Super Major companies on methane commitments. The large oil and gas firms are going to need to figure out what can be done to get domestic smaller players on board. The midstream companies are also an important part of the solution.

Expected pushbacks to our view

"Arjun, this is fossil fuel propaganda you f---ing industry shill; Apocalypse Now if we don't Just Stop Oil!"

We would observe that most of the pushback we get to Super-Spiked from those especially passionate about climate does not come with counter analysis; it is usually a mix of polite or not so polite name-calling, accusations of being "fossil fueled" and paid for, etc. Our affiliations are publicly available. Throughout our career we have welcomed and in fact embraced constructive pushback: the intense debate with our institutional investor client base was the best part of our job at Goldman Sachs. As a life-long equity research analyst, the only objective we have when it comes to our public and private energy sector analysis is to try to make the correct call as to what is actually going to happen. We do not necessarily wish for certain outcomes; we call it like we see it.

As an example, if coal demand is on-track to grow in China, India, and other developing Asian nations, we see little point to pretending it will magically decline in coming decades. We would instead ask what the technology and policy changes are that Asian countries could pragmatically implement to provide abundant, low-cost, geopolitically secure energy for their citizens without using growing quantities of coal. The answer to that question is hardly obvious at this time; why pretend otherwise? It is our observation that most mainstream "net zero by 2050" scenarios seem to wishfully project Asian coal declines. How? Why?

The climate cannot handle rising US oil and gas production

This has become perhaps the most tiresome of the pushbacks from those most passionate about climate. Yes, we understand you sincerely believe the world needs to eliminate most oil and gas supply within coming decades. But we are choosing to live in reality, and the world is on-track for rising oil and natural gas demand for the foreseeable future whether you or anyone else wants that or not. In that world, it makes zero sense for American oil and gas supply to be "kept in the ground" only to be replaced by supply from hostile nations. We believe future carbon emissions will be higher, all else equal, if future supply only came from non-North American sources.

Bigger is not necessarily better

Agreed. We addressed this in last week's post (here).

Shale is maturing, so the geopolitical points about our supply importance become less relevant

We agree that what is today considered Tier 1 US shale acreage is maturing; we are probably past the half-way point so to speak. However, the US oil and gas industry has proven time and time again, it is constantly reinventing the definition of Tier 1. We believe the development of what today is considered Tier 2 or 3 acreage will be advanced in coming decades.

There are also many areas that were forgotten during the shale boom, including the deepwater Gulf of Mexico, Alaska, US Rockies, and California. Clearly, there is political risk in some of these areas, most notably California and, to a lesser extent, Alaska. All the more reason M&A is needed to ensure adequate capital and balance sheet strength exists to pursue future risk opportunities.

US shale oil does not shield US consumers from oil price spikes

Yes, we agree. But the existence of aggregate US and Canadian oil supply that about matches US oil demand shields Americans from the risk of export embargoes akin to what occurred in the 1970s. In the case of natural gas, we do not face the risk of Russian exports suddenly turning off as Germany and much of Europe have just experienced. Our balance of payments is significantly better than it otherwise would be if we were still importing, on a net basis, massive amounts of crude oil as we were just 15 years ago (Exhibit 6).

Exhibit 6: Thanks to the US shale boom + Canada, the US no longer has an oil import dependence problem

Source: IEA, Veriten.

What about Canada?

Canada is very much a part of the solution to a healthier energy outlook! This post was focused on recent US M&A; hence the emphasis on American companies. It remains a core view of ours that Canada's oil sands region and natural gas basins are critical sources of potential energy for the world. We strongly disagree with many bank & insurance company sustainability and climate statements that single-out "oil sands" as not worthy of being financed. While as private enterprises it is their choice, we believe there is nothing climate-friendly or "sustainable" about de facto attempting to keep Canadian oil in the ground. These policies are virtue signaling at their worst, and, in our view, represent a fundamental misunderstanding of the significant benefits Canadian energy can provide to its citizens and the Rest of the World.

⚡️On A Personal Note: One Year Un-Retirement Anniversary

With the publication of this post, I have reached my one-year un-retirement anniversary! While I have made many wrong stock and oil price calls over the course of my career, I will say that I am now 4 for 4 on having great career stops and 8 for 8 if you include my main board/advisor positions. That is lucky! I recommend my path to anyone interested: 22 years of continuous, no-such-thing-as-a-work-life-balance effort to start a career followed by 9 years of retirement and board/advisory work to catch the kids during middle and high school and then un-retirement as they head off to college at the start of a new industry cycle.

Best parts of un-retirement:

Working with the great team Maynard has assembled at Veriten.

The opportunity to work closely with the management teams and board directors of our partner (i.e., client) companies.

When traveling, I do not have meetings that start at breakfast, run all day, and end with dinner before flying to the next stop as was often the case at Goldman.

The mixture of traditional equity analysis, macro perspectives, and energy policy has been rejuvenating, as is learning about new energies, the environment, and climate perspectives.

Being on the wrong side of 50 means I have made many mistakes, learned lots of lessons, and have had some successes that can be shared with clients and colleagues.

I have been saying "yes" to more travel golf; thank you to everyone that has invited me to play some great courses (including the ones where I couldn't make it).

Worst parts of un-retirement:

I am now older than a non-trivial number of management teams, though I am at least still on the younger side of most board directors.

It is hard to stay at my optimal playing weight when traveling; those last five pounds are hard to work (and keep) off.

The number of days on the road is up significantly. Given Veriten is Houston-based, and with the vast bulk of the traditional energy sector headquartered in the great states of Texas and Oklahoma, this is not a surprise. As our baby goes to college next Fall, and assuming our first born doesn't move back in (which she is more than welcome to do!), spending more time in the middle of the country will ease the travel burden.

⚖️ Disclaimer

I certify that these are my personal, strongly held views at the time of this post. My views are my own and not attributable to any affiliation, past or present. This is not an investment newsletter and there is no financial advice explicitly or implicitly provided here. My views can and will change in the future as warranted by updated analyses and developments. Some of my comments are made in jest for entertainment purposes; I sincerely mean no offense to anyone that takes issue

Over and over my comment is the same. Even though I repeat myself, I am sincere. Thank you Arjun. You are an important part of my Saturday mornings.

"What we don't understand is why climate activists and others that are especially focused on climate spend so much time attacking the large, western, publicly-traded firms."

.

really?

1. availability heuristic. most don't look beyond their noses.

2. illusion of control. maybe some engine #1 activity will save the world.

basically it's just foolishness, ignorance and narcissism, as i'm sure you well know.

.

and thank you for super-spiked.