Lessons From Asia “Tigers”: Significant Oil Demand Growth Ahead For India and Africa

The Energy Transition Needs to Transition

In last week’s Super-Spiked we discussed the significant energy growth potential in India and Africa in coming decades as 1.4 billion people in each region seek better economic outcomes, poverty reduction, and ascension to the modern lifestyles we take for granted in the United States and Western Europe. We believe India and Africa will unquestionably grow using all forms of energy, both traditional fossil fuels as well as newer technologies and alternative energy sources. It is the crude oil component of future energy demand that at least some have cast doubt on. We doubt the doubters.

Fears of “peak oil demand” are in the process of being obliterated, notably at a time of generally rocky GDP in the three largest oil consuming areas of China, Western Europe, and the United States. In a nutshell, the other 7 billion people on Earth will continue to strive for the better lifestyles and economic outcomes enjoyed by the lucky 1 billion of us that live in the USA, Western Europe, Canada, Japan, Australia, and New Zealand. Income growth and energy growth are 100% positively correlated. The use of modern energy is similarly 100% correlated with better societal outcomes; India and Africa have the right to self-determination in improving the lives of literally billions of people. It is a staggering challenge.

In order to gauge the oil demand growth potential of India and Africa, we take a look at a former Asia “Tiger,” South Korea, a “Tiger Cub,” Thailand, and the behemoth that made us forget about tigers, China. Even if South Korea and Thailand have moved to the back burner of energy analyst focus, the stories are reasonably well known that we will keep the post short and direct. The very simple point is that as all three countries moved up the income ladder, oil demand increased by 3X for China, 6X for Thailand, and 18X for South Korea versus per capita starting points similar to where India and Africa are today. We are still waiting for oil demand to peak in China, Thailand, and South Korea. Only South Korea has thus far reached western world levels of oil demand penetration.

Eventually, an expected slowdown in global population growth will likely be the catalyst to leveling off overall energy needs beyond that required to move up the income ladder. Challenging situations with government personnel and policies is the other major factor that limits upward income mobility in some areas. On a year-to-year basis, recessions and otherwise weak periods of GDP growth can cause a short-term leveling off of crude oil demand as we have at times seen with global coal. Those risks notwithstanding, the massive energy needs of the developing world suggest that fears of an imminent (within the next 5 years) peak in oil demand are misplaced.

Oil demand in India and Africa expected to grow by multiples of current demand

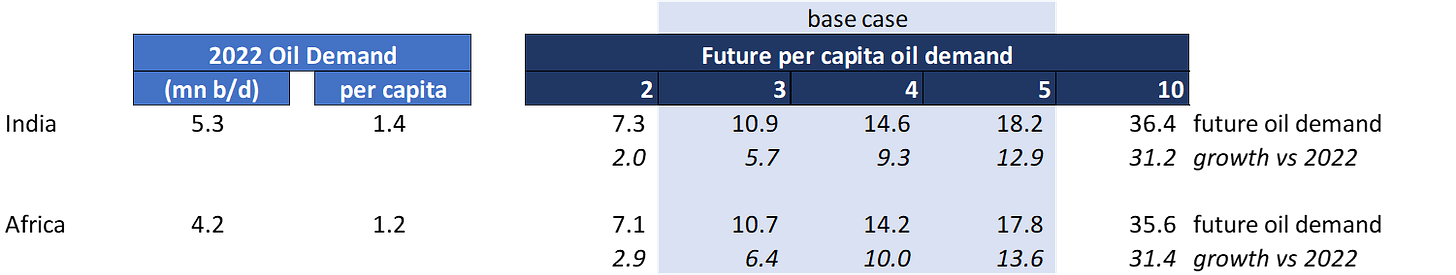

India and Africa are currently using 1.4 and 1.2 barrels of oil per capita per year (bpc), respectively. Exhibit 1 shows the significant potential growth in oil demand in coming decades as both areas move up the income curve.

Exhibit 1: Substantial room for oil demand to grow in India and Africa in coming decades

Source: IEA, Our World In Data, Veriten.

Thailand

Exhibit 2 shows Thailand oil demand in absolute terms and on a per capita basis since 1970. A few highlights:

Between 1986 and 1992, Thailand oil demand nearly doubled on a per capita basis from 1.6 barrels per capita (bpc) to 3.2 bpc.

Over the corresponding period, absolute oil demand doubled from just 233 thousand b/d (mb/d) to 478 mb/d.

By 2003, oil demand had crossed the 5 bpc threshold (897 mb/d) and in 2012 it reached 6 bpc (1,144 mb/d).

In 2022, Thailand oil demand was 6.7 bpc, or 1,325 mb/d, a near 6X increase versus 1986.

We would highlight that in the aftermath of the Asia Financial Crisis that started with the devaluation of the Thai Bhat in July 1997, per capita oil demand essentially stagnated for six years before making a new high in 2003. In the developing world, as is true among rich countries as well, it is not always a straight line up.

Exhibit 2: Thailand oil demand, 1970-2022

Source: EI Statistical Review of World Energy, Our World In Data, Veriten.

South Korea

South Korea, an original Asia Tiger, has had an even more remarkable history. Exhibit 3 shows South Korea oil demand in absolute terms and on a per capita basis since 1970.

In 1970, per capital oil demand was 1.8 bpc. In 2022, it stood at 20.2 bpc, essentially on par with the United States and Canada.

It has also not always been a straight line up, but from a 1970 starting point of 162 mb/d, 2022 oil demand was a remarkable 2,874 mb/d, or nearly 18X higher.

Exhibit 3: South Korea oil demand, 1970-2022

Source: EI Statistical Review of World Energy, Our World In Data, Veriten.

China

Both Thailand and South Korea are on the smaller side by Asia standards with respective 2022 populations of 72 million and 52 million. By contrast, China rivals India and Africa with circa 1.4 billion people. Exhibit 4 shows China oil demand in absolute terms and on a per capita basis since 1970.

Most people know the China economic story well by now. In 2001, China's oil demand was 1.4 bpc. A decade later it had doubled to 2.8 bpc in 2012.

Absolute oil demand grew from 5 million b/d (mn b/d) in 2001 to 10 mn b/d in 2012.

By 2021, it had grown another 5 mn b/d to 15 mn b/d, or 3.9 bpc. That is a tripling in absolute terms over 20 years and net growth of 10 mn b/d.

The lessons from Thailand, South Korea, and China are overwhelming. Oil demand will grow by multiples of its starting point as a country moves up the poverty reduction ladder. The idea that India or African countries will achieve similar progress without using many multiples of current crude oil demand is pure fantasy.

Exhibit 4: China oil demand, 1970-2022

Source: EI Statistical Review of World Energy, Our World In Data, Veriten.

Avoiding China’s dependence on oil imports likely to be a key objective of India

While we see a significant increase in oil demand as inevitable for a country like India, we believe India will make every effort to avoid fully following in China’s path of significant oil import dependence (Exhibit 5). As we have previously written, we see China’s effort to grow electric vehicle (EV) usage as part of a plan to favor coal-fired EVs over OPEC-fired internal combustion engine (ICE) vehicles. There is little doubt that India will also seek significant growth in electric vehicles as it develops.

Exhibit 5: China versus USA net crude oil imports

Source: IEA, Veriten.

However, we are highly skeptical that India or China or Africa are going to be 100% EV any decade soon. It will be a mix. Critical minerals, infrastructure, affordability, grid stability and availability, and related reasons point to the use of both EVs and ICE vehicles for the foreseeable future. The bigger question is whether a place like India will avoid the SUV-ifcation effect as we have seen in the United States, where the bulk of our expected fuel economy gains were negated by increased vehicle weight and size.

As far as oil demand goes, it is worth remembering that consumer transportation fuels are anywhere from about 25%-40% of the demand mix. Trucking, shipping, jet, and petrochemicals will all be harder to displace. We are most optimistic about oil being largely eliminated as a power generation fuel.

For Africa, the eventual mix between various energy sources has more uncertainty

Africa is often treated by the west as “a region” rather than a diverse mix of 54 individual countries, each with their own supply/demand balances for oil, natural gas, coal, critical minerals, and other resources. Different countries might be at very different stages of economic development and many of course have what can at best be described as challenging government situations. Therefore, it is not about a cross-continent policy of favoring this, that, or something else.

What is clear is that in a perhaps unrealistic “best case” scenario, African countries could seek to figure out intra-regional trade and economic growth opportunities that eliminates dependence on European institutions in particular. It is mind boggling that a continent using a mere 1 barrel of oil per capita is facing overt hostility from primarily European activists and institutions toward a singular oil pipeline from Uganda to Tanzania. Seriously, what the heck? If there is a region that most deserves the opportunity to finally have self-determination after centuries of “interference,” we would argue it is Africa.

So we ask a simple question: In what year do Africans deserve that chance to stop having to answer to rules set upon them by European/Western institutions and companies? Apparently, some believe that 2023 is not that year. We disagree. The growing use of modern energy can free Africa from the shackles of western influence and impact.

⚡️On a Personal Note: Jeff Currie

Congratulations to my friend and former partner Jeff Currie on his retirement from Goldman Sachs after 27 years. 27 years!!! I was a buy-side client of Goldman when Jeff was hired to join Steve Strongin’s Commodities Research team that then included only Allison Fleischmann and Steve at the time. The analysis and perspective were highly differentiated then and remained so through all the ups and downs of commodity markets over the past three decades. Love or hate Goldman Sachs, agree or disagree with any of the calls: if you are involved with energy commodities, you were going to either work with, read, or listen to what Jeff Currie had to say about the outlook. Jeff will be a first ballot Commodities Analyst Hall of Fame inductee.

Working closely with Jeff as we built our careers during the Revenge of the Old Economy-Super Spike era was about as good as it can get in terms of a mutually beneficial relationship that took each of us to career heights. Jeff and I pushed each other in a way that is frankly impossible to replicate. There was no tolerance for consensus calls. Even in those days, a 1 standard deviation move in oil prices was $10-$15/bbl, at least, if not $20/bbl. Being plus or minus $5 of the forward curve or Street consensus would provide zero help for our clients. Street consensus huggers do not need to be employed.

We had different client bases: I was focused on equity investors, Jeff on corporates, governments, and macro funds that engaged in hedging and trading commodity markets. Jeff is a macro economist by background. I still identify as an equity research analyst. We brought out the best in each other. We didn’t let the other person settle for a simply serviceable call. We called “BS” on each other when needed. It was a once-in-a-lifetime working partnership.

Congratulations and best wishes Jeff!

Source: S&P Global.

⚖️ Disclaimer

I certify that these are my personal, strongly held views at the time of this post. My views are my own and not attributable to any affiliation, past or present. This is not an investment newsletter and there is no financial advice explicitly or implicitly provided here. My views can and will change in the future as warranted by updated analyses and developments. Some of my comments are made in jest for entertainment purposes; I sincerely mean no offense to anyone that takes issue.

🙏 Special Thanks

We would like to thank our summer intern, Paul Kamer, for his contributions to this post.

Thanks Arjun, another great article. This is off topic, but one thing I've also noticed is how China and India and other developing countries are going "full steam ahead" with nuclear power generation for electricity, while the U.S. and Europe aren't. In the west, the old time environmentalists are still very anti-nuclear power, but it seems to be a pretty green technology to me in terms of carbon output and the amount of waste produced (e.g. some day we may figure out how to efficiently recycle solar panels to recover the rare earth elements and other valuable and in some cases toxic materials and also recycle multi-layered composite wind turbine blades when they wear out approximately in 20 years). If these new small modular reactors work out, it might be a way for developing countries to scale nuclear up with less financial risk. Any thoughts on this?

A brilliant read ! Thank you Arjun!