This week we address ten of the burning questions many of you have about our Obliterating Peak Oil Demand series (here, here, and here) using the popular Q&A format. As we have regularly noted, we welcome feedback and pushback not only from those that usually agree with us but especially from those that most disagree.

Why introduce the notion of a 250 million b/d total addressable market (TAM) for oil rather than the more common approach of ensuring a minimum standard of energy usage for the developing world?

We have little doubt that there is essentially no one on Earth that wants to live anywhere near some minimum standard of energy usage. With the possible exception of (some? all?) monks and perhaps a few other narrow groups dedicated to minimalist “live off the land” lifestyles, we believe everyone else would love to enjoy the kind of lives The Lucky 1 Billion of Us in the United States, Canada, Western Europe, Japan, Australia, and New Zealand take for granted. We believe the conversation around energy needs to explicitly shift its overarching global objective to solving for how to make everyone on Earth as rich as we are.

Currently, The Lucky 1 Billion of Us use about 13 barrels of oil per person per year. The other 7 (soon to be 9) billion people use just 3 barrels per capita annually. We define real social justice as everyone on Earth being similarly rich, which we think would equate to about 10 barrels of annual per capita oil consumption, or a 250 million b/d TAM for oil.

How do you address pushback from the climate & environmental community that everyone cannot be rich without destroying the planet?

At Super-Spiked and at Veriten, we take environmental concerns seriously. In our view, there is little doubt that richer countries have cleaner air, cleaner water, and overall better environmental performance. Is there an example of a poor country that has better air quality in its major cities? Or is performing better on plastics waste? And no, the answer is not for Bangladesh to ban plastic straws!

OK, but how do you address specific concerns from those most passionate about addressing climate change that an “everyone should be rich” mindset will lead to us blowing out remaining carbon budgets?

Long-time Super-Spiked readers know that we do not subscribe to what we view as climate alarmism from those most passionate about addressing climate change, including academics, politicians, and climate media (note: we leave environmental NGOs off this list as we view it as their “job” to defend the environment above all else; the issue we see is with politicians and the media taking NGO views without critical debate). The argument we make to climate hawks is that without solving for how everyone will be rich, so-called climate goals have no chance of being met. By prioritizing “net zero” over other obvious objectives including energy abundance, affordability, reliability, and geopolitical security, we are instead on-track for a “worst of all worlds” outcome that misses on each of those key objectives and does NOT yield desired carbon reductions. That was the motivating driver for the creation of Super-Spiked.

So we should do nothing and just burn unabated fossil fuels forever?

We have never said that and it is not our view, and not because we are trying to be politically correct or have some sub-conscious affinity for climate alarmism. In our opinion, insufficient crude oil (and in many cases natural gas) resources in key developing countries will motivate a shift to alternative energy sources and technologies, most of which are likely to also be lower-carbon in nature. The world is spending trillions of dollars in an attempt to figure out alternatives to importing crude oil and natural gas. Some thing(s) some day will eventually succeed. Our issue is that climate hawks should stop pretending it is all figured out today and that is simply a matter of political and societal will. Profitably scaling new energy sources and technologies is hard, time-consuming, and uncertain work.

How do you reconcile the TAM highlighted for China and India with resulting massive oil import needs?

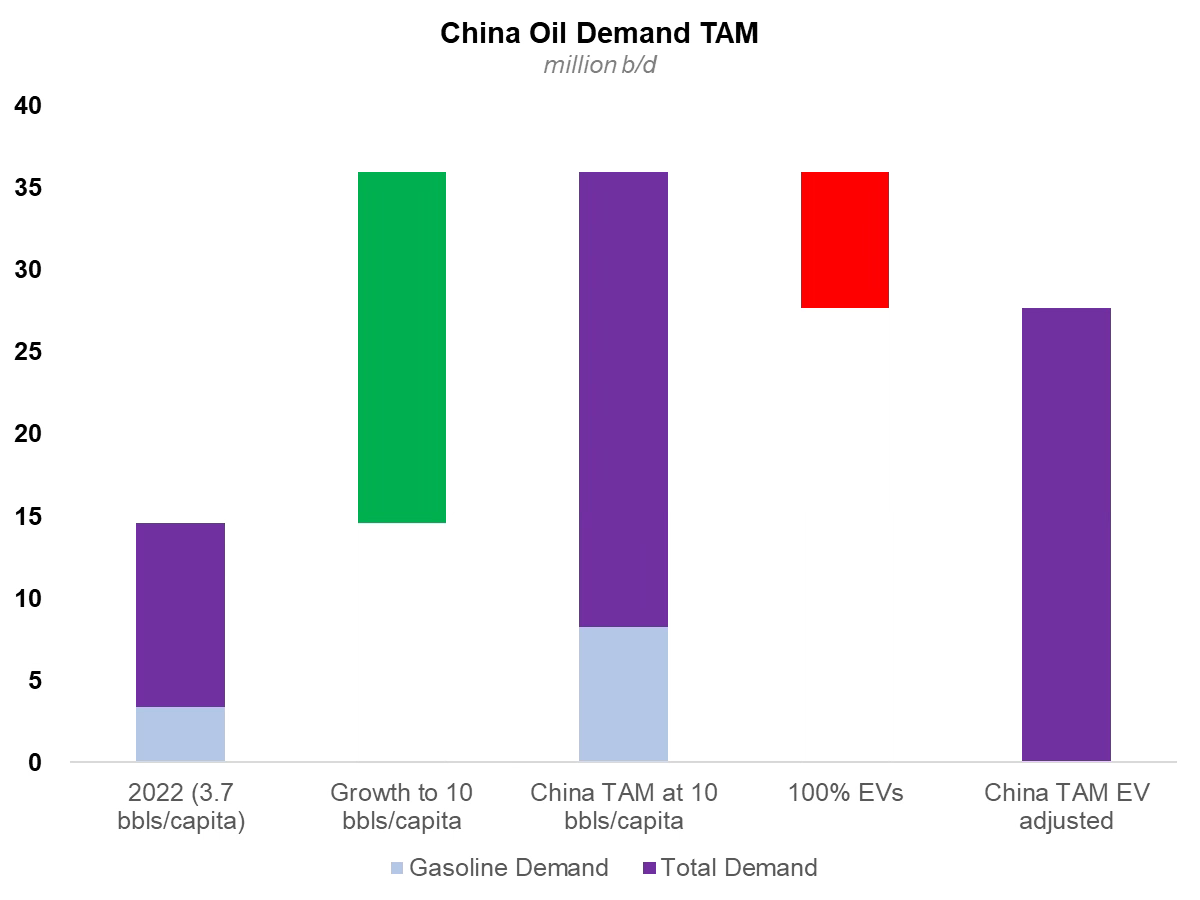

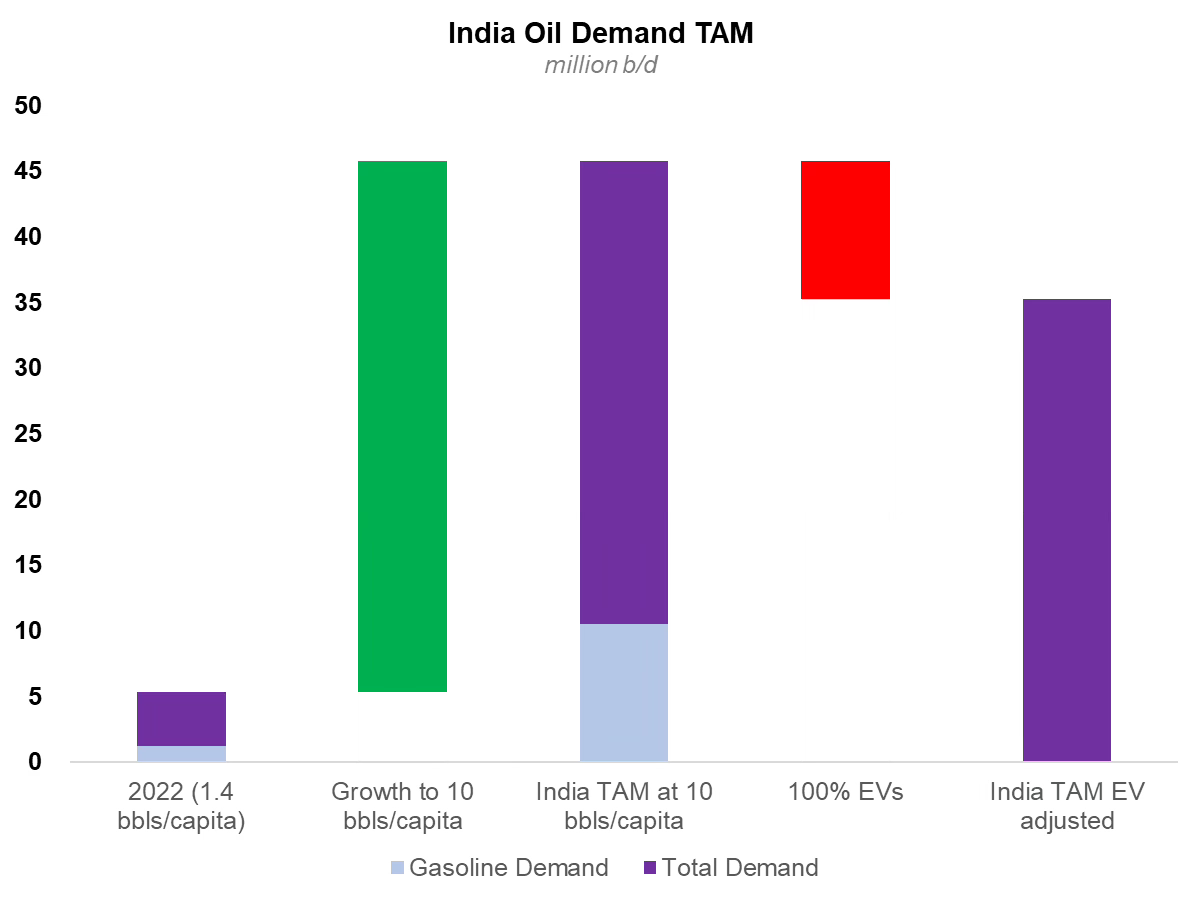

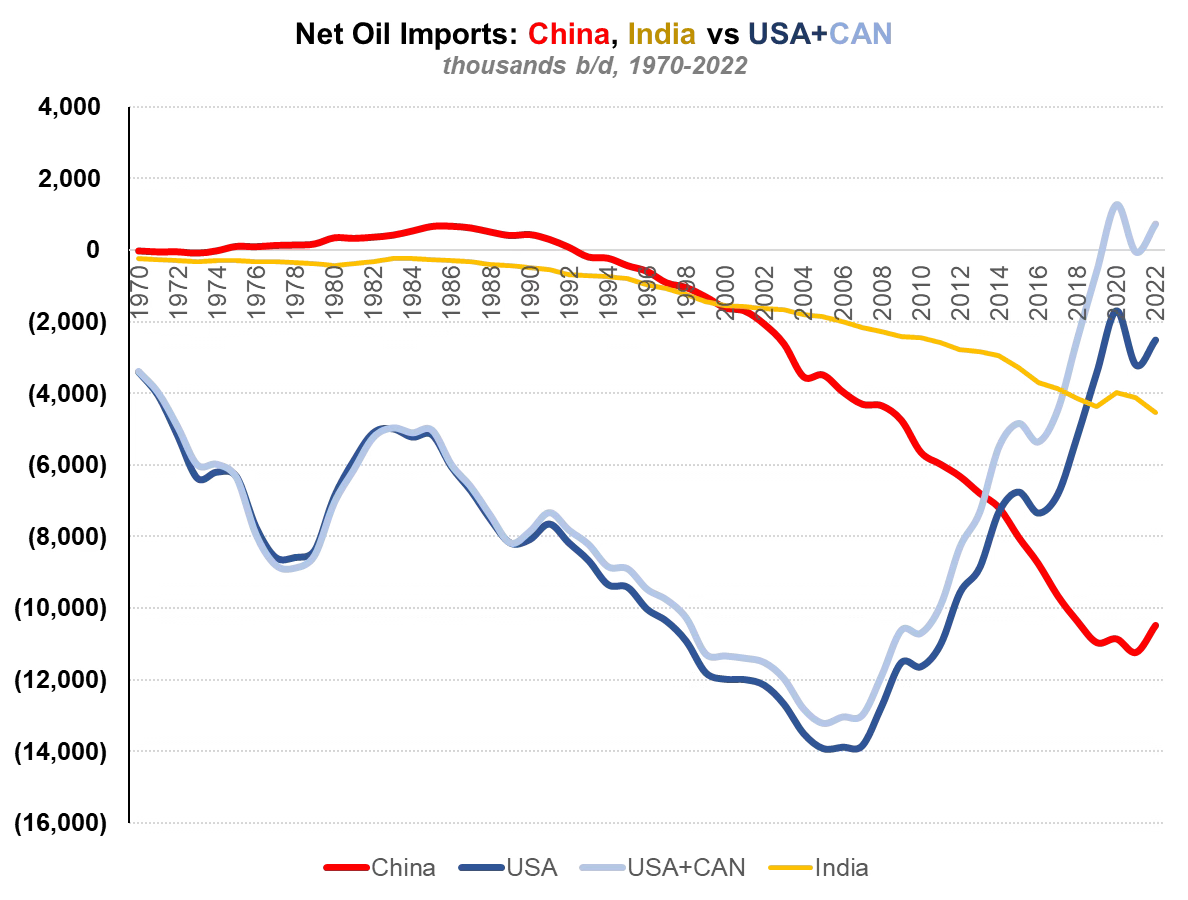

In last week’s video podcast, we detailed a 27-35 million b/d of oil TAM for China versus 2022 demand of 15 million b/d and a 35-45 million b/d of oil TAM for India versus 2022 demand of just 5 million b/d (Exhibits 1 and 2). Exhibit 3 shows oil imports for the United States + Canada versus China and India. In the case of China, we estimate its TAM for oil could drive an additional 12-20 million b/d of oil imports. For India, it is a more staggering, and frankly improbable, 30-40 million b/d of long-term import growth potential to meet its TAM. We highlight TAM as the focus should be on how everyone in China and India can enjoy rich-world lifestyles. We believe the leadership of both countries are working toward that very objective irrespective of what at least some people in the west think should happen.

Based on an admittedly small sample set of the United States and China, once a country gets to circa 10 million b/d of net oil imports, pressure mounts to figure out ways to limit further increases. In our view, limiting future oil import needs will drive the push to find alternatives to oil demand in China and India, a point we can already see via China’s aggressive, and so far successful, ramp in electric vehicle (EV) sales. That said, EVs only address about one quarter of the oil demand barrel. We are unaware of a country on Earth that would take steps to limit economic (and hence oil demand) growth if that is the only means to limit oil imports.

Exhibit 1: China oil demand TAM

Source: IEA, Our World In Data, Veriten.

Exhibit 2: India oil demand TAM

Source: IEA, Our World In Data, Veriten.

Exhibit 3: Oil TAM limiter: Geopolitical security

Source: EI Statistical Review of World Energy, IEA, Veriten.

Why would any government limit access to energy resources in its own country?

This is one of the more perplexing questions facing especially some political leaders in the United States, Canada, and Western Europe. Whether you love, hate, or are indifferent to traditional energy companies (or management teams), why would any leader support steps that limit or impede domestic energy development? Do they like their foreign counterparts better? Should there be strict labor and environmental standards, including in areas like zero worker injuries and zero methane flaring/venting? Yes, of course. But there is no logic to outsourcing energy development to foreign countries—friend or foe.

Why is it OK to export energy and minerals development to foreign countries?

A related question is why at least some in the western world think it is OK for energy and minerals development to occur in the developing world but not in their own country. For those in the camp of debating where “the last barrel of oil” will be produced, why are you so quick to cede that point to producers in the Middle East or Russia?

Is China better positioned to handle environmental and climate concerns today versus 20 years ago?

It is our view that richer countries are better positioned to handle all the issues the world throws at them. This would include any potential future impacts from a changing climate. For China, it has been a remarkable two decades of dramatic economic improvement. Is there a person that believes China would have been better off staying poor? Why would India choose to stay poor? Or any of the other developing countries in southeast Asia, the Middle East, Africa, or Latin America. China, and the so-called Asia “Tigers” and “Tiger Cubs” before it, shows that meaningful economic gains can happen within a generation, plus or minus. There is not a country on Earth that is looking to stay poor.

What was the basis for the 2030 oil demand estimates under high-profile net zero oil demand scenarios?

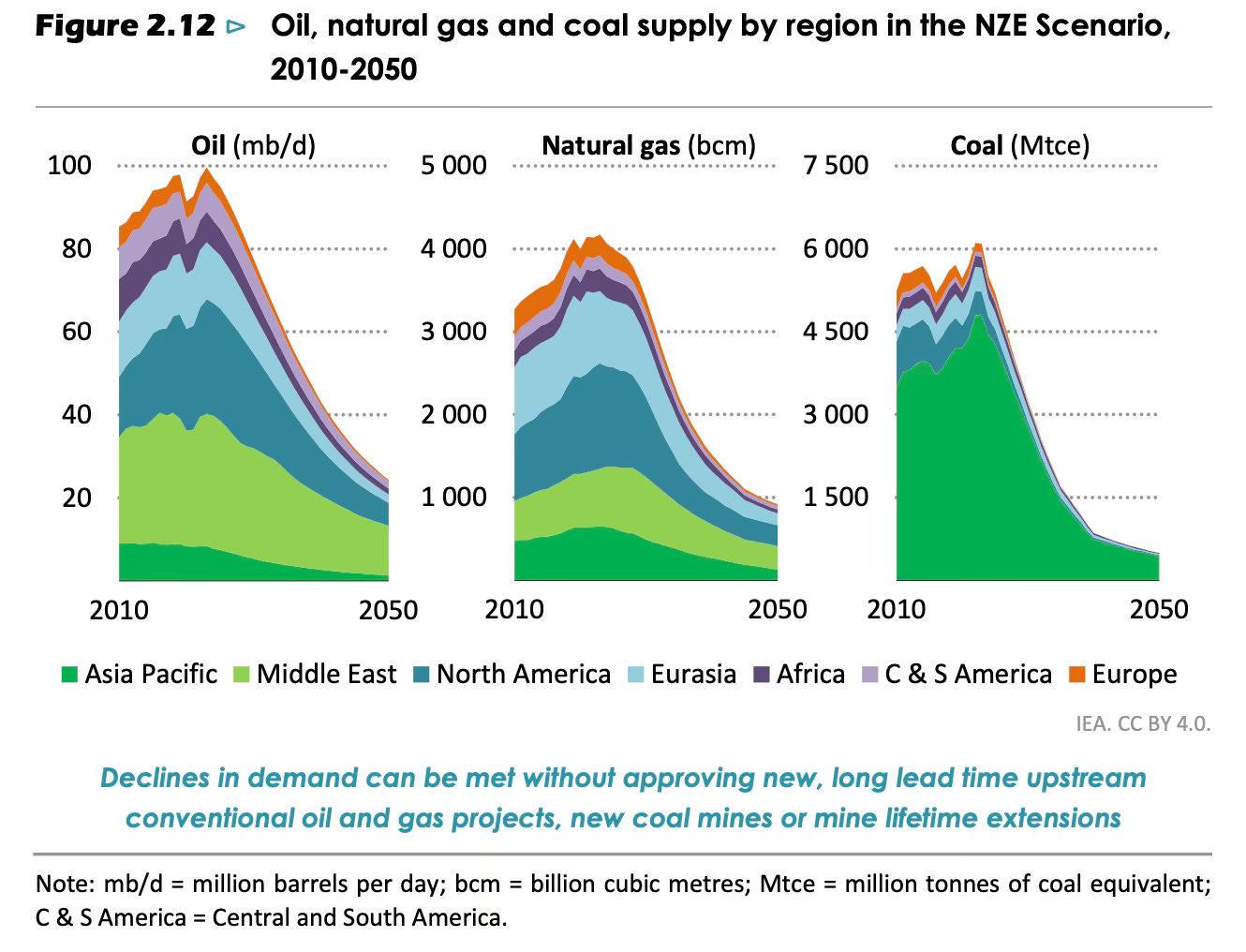

This is a tough one to figure out. There are a number of high-profile “net zero by 2050” scenarios that show on the order of a 30% drop in oil demand by 2030 (Exhibit 4). It has been explained to us that these were merely “what if” scenarios that detail what would need to happen to get the world on-track for net zero carbon emissions by 2050. Yeah, sure.

We can similarly paint a hypothetical picture that if you only count the innings where the New York Yankees—the greatest sporting franchise in the history of the world—have scored more runs than their opponent, they could win all 162 regular season games played and every playoff and World Series game for every year between now and 2050. Frankly, it is unclear which is the more likely scenario: a perfect Yankees record for the next 26 years or the oil, natural gas, and coal demand trajectories found in high-profile net zero scenarios.

Exhibit 4: 2030 oil demand in various “net zero” scenarios look improbable; the IEA’s latest scenario is shown here but there are many others that have similar outlooks

Source: IEA (“Net Zero Roadmap: 2023 Update” report).

Why hasn’t coal peaked?

A common theme among all net zero scenarios we have seen is a near-term peak and then aggressive decline in global coal demand. Take a minute to look at the far right graph in Exhibit 4, which is a typical “net zero” outlook for global coal consumption. In our view, this is even less probable than the forecasted peak in oil demand, as many of the key developing countries actually enjoy sizable coal resources, which are geopolitically secure, inexpensive, and provide significant jobs and tax benefits to host countries. By all indications, those countries are on-track to continue to develop their own coal for the foreseeable future. Unlike oil, there are many mature alternatives to coal that is used for power generation. Yet, developing world coal demand continues to grow at a healthy clip with no end in sight.

And to be clear, this is not a defense of coal per se. It is meant to be a reality check for “net zero by 2050” fantasies.

⚡️On A Personal Note: TJ Mac and Jordan’s “flu game”

This week’s OAPN section is dedicated to my decade-long golfing partner and fellow Goldman retiree TJ Mac. We both stopped at Goldman at about the same time and enjoyed regular weekday golf at our local club for the past decade until my un-retirement last year. Last Saturday was the President’s Cup trophy qualifying round at our club. TJ texted me early Saturday morning to let me know he had not slept Friday night owing to all that comes with either food poisoning or a stomach bug. Still, he was willing to give it a go; we both noted that since golf is an outdoor sport, exposure risk to a possible bug would be negligible for me or our playing partners (whom we knew and alerted). TJ was offered a cart by our head pro, which he used, and had the added benefit of protecting our caddie from possible exposure.

You already know how this story ends. Michael Jordan’s flu game was less impressive than the golf TJ played on Saturday. A 12-14 GHIN golfer, he shot a solid 85 on a windy day under tournament conditions and accounted for no less than 13 of our 18 “low net best ball” scores. We finished net two under and 13th overall out of the field of 54 teams. We easily qualified for the Round of 32 and won $70 of golf shop credit to boot!

The high point was when I was standing on the 13th tee, TJ was sitting on a nearby bench slumped over his driver unable to keep his head lifted upright. I told him that if he needed to stop, he had done more than enough over the first 12 holes (accounting for 10 of our 12 scores). He looked up, trudged to the tee box, and smoked a 240 yard drive to the left-side first cut. With a tail wind from 135 yards out, he hit a pitching wedge to the green and then executed a difficult two putt for an improbable net birdie on one of the more difficult holes on our South Course. TJ is about four years my senior and comes from a generation that did not take mental health rest days or months of “family leave.” If you weren’t in the hospital, you were in the office, visiting a client, coaching your kid’s baseball game, or on the golf course.

The next day’s Round of 32 was under even more challenging northeast spring golf conditions—cold and wet with a steady drizzle through most of the round. Our Sunday opponents were in their late 30s-to-early 40s—a younger, softer generation. The opposing team of two was down to one player as the other player’s spouse was upset about a late arrival from the previous day’s round and effectively told him he needed to stay home on Sunday. Grounded from a tournament round! Yikes. It is why I didn’t take up golf until retirement and my kids were in middle school.

Well, you know how this story ends as well. The young guy who was down a teammate smoked TJ and I in a “low net best ball” match play format. For those unfamiliar, it is really hard to win 1 versus 2 in net best ball match play. While the round technically ended “3 and 2” after 16, the final score was really not indicative of young guy’s domination as he won holes 7, 8, 9, and 10 after playing to a draw over the first six for a commanding 4 hole leading going into the final stretch. He one chipped and one putted us to death all morning despite his own 13 GHIN. To him, we were undoubtedly two old guys limping around the course, dressed as if we were next heading out on an Arctic expedition, and offering only a mild challenge, while he was having fun in the rain as the apparent beneficiary of having made better choices in his life partner (she let him play back-to-back and respected tournament competition!).

I played my two worst rounds of the year last weekend, with a disastrous short game the unmistakable culprit. TJ was solid on Sunday but couldn’t match Saturday’s stomach bug heroics. I have three weeks to prepare for our flagship member-member over Memorial Day weekend. TJ and I are twice defending champions of the coveted Flight 11 (of 20) and last year advanced to Round 2 of the shoot-out, where one of us chipped in from the back of the green to help us advance. I need to get my short-game back on-track over the next three weeks.

⚖️ Disclaimer

I certify that these are my personal, strongly held views at the time of this post. My views are my own and not attributable to any affiliation, past or present. This is not an investment newsletter and there is no financial advice explicitly or implicitly provided here. My views can and will change in the future as warranted by updated analyses and developments. Some of my comments are made in jest for entertainment purposes; I sincerely mean no offense to anyone that takes issue.

)

I think your premise that everyone in the world is driving toward energy sufficiency, however defined, is 100% correct, and that it remains an incomprehensible fantasy that net zero will ever arrive. Personally, I have always subscribed to the idea of acting in the most efficient manner as possible when it comes to issues like this, as efficiency will, as a natural consequence, utilize more of the inputs more effectively, thus reducing the outputs.

Thanks Arjun. (BTW-OilPrice article is over 20K views.) Always appreciate your sharing your creative thinking and new ways of looking at problems/challenges. It is refreshing to a see a positive spin on oil demand. In my blog on Seeking Alpha I am researching a number of African centered oil companies. One theme that rings true from country to county is the welcoming of development capital for hydrocarbon resources. As you say, they are tired of being poor. Keep em coming. Cheers