The Energy Transition™ era of 2019-2024 is coming to a welcomed close. What we dubbed “the arrival of a messy energy transition era” was our motivating drive to start publicly re-engaging on Twitter in 2020, create Super-Spiked in November 2021, and eventually un-retire to Veriten in March 2023. We are optimists by nature so will start with the positive: we believe the energy conversation is starting to move in a healthier direction toward our perspective that everyone on Earth deserves to be energy rich as its centering point.

With this reframing, true economic and social “justice” will be achieved, which is the eventual attainment of rich-world living standards for all human beings irrespective of national origin. It will likely take many decades, perhaps even beyond the end of this century, for everyone to ultimately get there, but that is undoubtedly the direction of travel. We take comfort in the fact that Japan (1945-1980s) and South Korea (1970-2010s) prove that a country can go from poor to rich within half a lifetime. Notably, neither Japan nor South Korea were blessed with abundant domestic energy resources. Both countries are worthy of deeper study to understand the drivers, policies and societal conditions that led to their respective transformations.

The prioritization of societal wealth gains, in our view, is fully consistent with improving environmental outcomes. Clean air, clean water, and resilience to adverse weather events are 100% positively correlated with wealth. Unfortunately, biodiversity is often inversely correlated and we believe deserves significantly greater attention than it receives. So-called “sustainability” objectives should be centered on biodiversity and finding an appropriate balance between continued economic progress and protecting ecosystems.

As almost all economic improvement since the Industrial Revolution has been fueled by the rising use of coal, oil, and natural gas, carbon emissions have been positively correlated with societal wealth gains. The combustion of fossil fuels that has bettered human lives has also contributed to the 1.2-1.3 degrees Celsius of warming seen since the 1850s, with about another degree of warming expected by 2100. Our issue with the major policies and alleged solutions of the past five years was that they prioritized the end goal of “net zero” carbon emissions above all other societal objectives. Forget about the year, “net zero carbon emissions” is not the priority for literally anyone anywhere, including those that purport to be proponents. There are but a handful of people on Earth (e.g., monks) that voluntarily choose to live energy poor lifestyles. Sadly, there are 7 billion people on Earth—7 billion!!!—that use a fraction of the energy The Lucky 1 Billion of Us take for granted.

Paradoxically, we believe progress toward decarbonization will be achieved via the pursuit of maximum societal wealth, which we will define as everyone on Earth achieving Lucky 1 Billion living standards. As billion-person scale economies in Asia move up economic and hence energy s-curves, there will be an overwhelming motivation to control and secure diverse sources of energy, which will eventually lead to the scaling of non fossil fuel-based energies. The pursuit of geopolitical security, reliability, and affordability (price and capital flows) will motivate countries with large population centers that have insufficient oil, natural gas, or coal to seek out de facto low-carbon alternatives that they can control. Significant capital and effort are already being put forth toward those ends. In our view, decarbonization will never be achieved via “net zero by round number year” mandates, global climate accords, or immoral attempts to limit developing world economic growth. Goodbye and good riddance to the failed policies and perspectives of the last five years.

R.I.P. The Energy Transition™

The most common definition of energy transition is the idea that the world needs to quickly move off fossil fuels by 2050 by rapidly ramping up renewables and other low-carbon technologies in order to limit the Earth’s warming to under 2 degrees Celsius relative to pre-Industrial Revolution levels. The actual policies implemented in the western world mostly involved yelling at publicly-traded oil and gas companies for being responsible for “carbon pollution,” pursuing “keep it in the ground” energy policies in the United States, Canada, and Western Europe, prematurely retiring base-load power generation sources like coal and nuclear in those same areas, and subsidizing (currently) uneconomic low-carbon energy technologies and sources, all while pretending primary energy consumption in the developing world could be limited by efficiency gains and the electrification of everything. Frankly, the Super-Spiked tagline of “a messy energy transition era” did not do justice to the insanity of the last five years. It is this definition of “The Energy Transition” to which we bid farewell.

A few observations of The Energy Transition™ era:

We date the start of the era to 2019, which coincides with what we believe were the first “net zero by 2050” corporate targets from Repsol and Nestle (source: ChatGPT, perplexity.ai), just four years after the 2015 Conference of Parties (COP) in Paris that spawned the net zero madness.

The energy transition era coincided with the rise of the ideological ESG (environmental, social, and governance) movement in financial markets that prioritized corporate climate action over traditional, and we would argue more sensible, ESG objectives around governance, quality of management teams and boards, and non-climate health, safety, and environmental corporate performance.

The fact that the first Trump administration withdrew the U.S. from the Paris Accord had no observable bearing on the movement, which gained significant momentum during the latter part of his first term.

While the Biden Administration were vocal supporters of “climate action” and regularly stated that climate change was an existential risk to mankind that warranted aggressive policy measures, we believe the arc of The Energy Transition™ era was distinct from the administration itself.

All the handwringing about the fate of “climate action” based on which party would win the US presidency speaks to an excessive focus on the outlook for the United States. While we are the world’s largest and most important economy, future energy usage is overwhelmingly going to come from the developing world, not from the USA, making the angst from those most passionate about addressing climate concerns mis-placed. Everyone needs to spend more time focused on China, India, the rest of Southeast Asia, the Middle East, and eventually the countries that make-up Africa and Latin America.

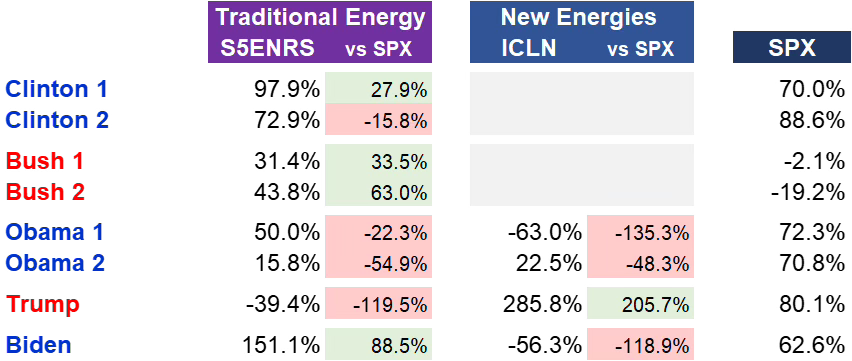

The greatest of all ironies is the fact that during Trump 1 the iShares Clean Energy exchange traded fund (ICLN ETF) had its best four years and oil and gas equities (using S5ENRS Index, which is the traditional energy stocks in the S&P 500) had four of its worst years ever. Counterintuitively, the opposite occurred during the Biden Administration (Exhibit 1).

Exhibit 1: ICLN performed well during Trump 1 and poorly during Biden, with oil & gas doing the opposite, counter to what consensus expected

Source: Bloomberg, Veriten.

What We Got Right About The Last Five Years

We are most proud of having regularly articulated the following views:

The aforementioned common definition of The Energy Transition™ was fundamentally flawed from the outset and the world would eventually wise up and move on from it.

Energy is a hierarchy of needs where abundance and reliability are easily what everyone on Earth care about most, followed by geopolitical security and affordability.

The gap between The Lucky 1 Billion of Us versus the other 7 (soon to be 9) billion people on Earth deserves to close via everyone else reaching rich country living standards and corresponding energy usage.

The speed of the likely scale-up for most new energies technologies was being grossly overstated, even as certain areas like solar and electric vehicles were gaining market share.

The concept of perpetual transition is more accurate than an overarching The Energy Transition, as subsets of the energy landscape do experience meaningful change. An example we have used was the transition from the Asia Tiger + Tiger Cubs + Japan as important drivers of oil demand growth in the 1980s and 1990s to China over the last 20 years. The quick rise of LNG trucks in China is a more recent example. The energy business is always changing in at times dramatic and unpredictable ways—sometimes quickly, sometimes slowly.

Super Vol rather than super-cycle is the better commodity macro descriptor, especially in a sluggish global GDP environment with significant uncertainty on the health of the Chinese and US economies that has characterized the last five years.

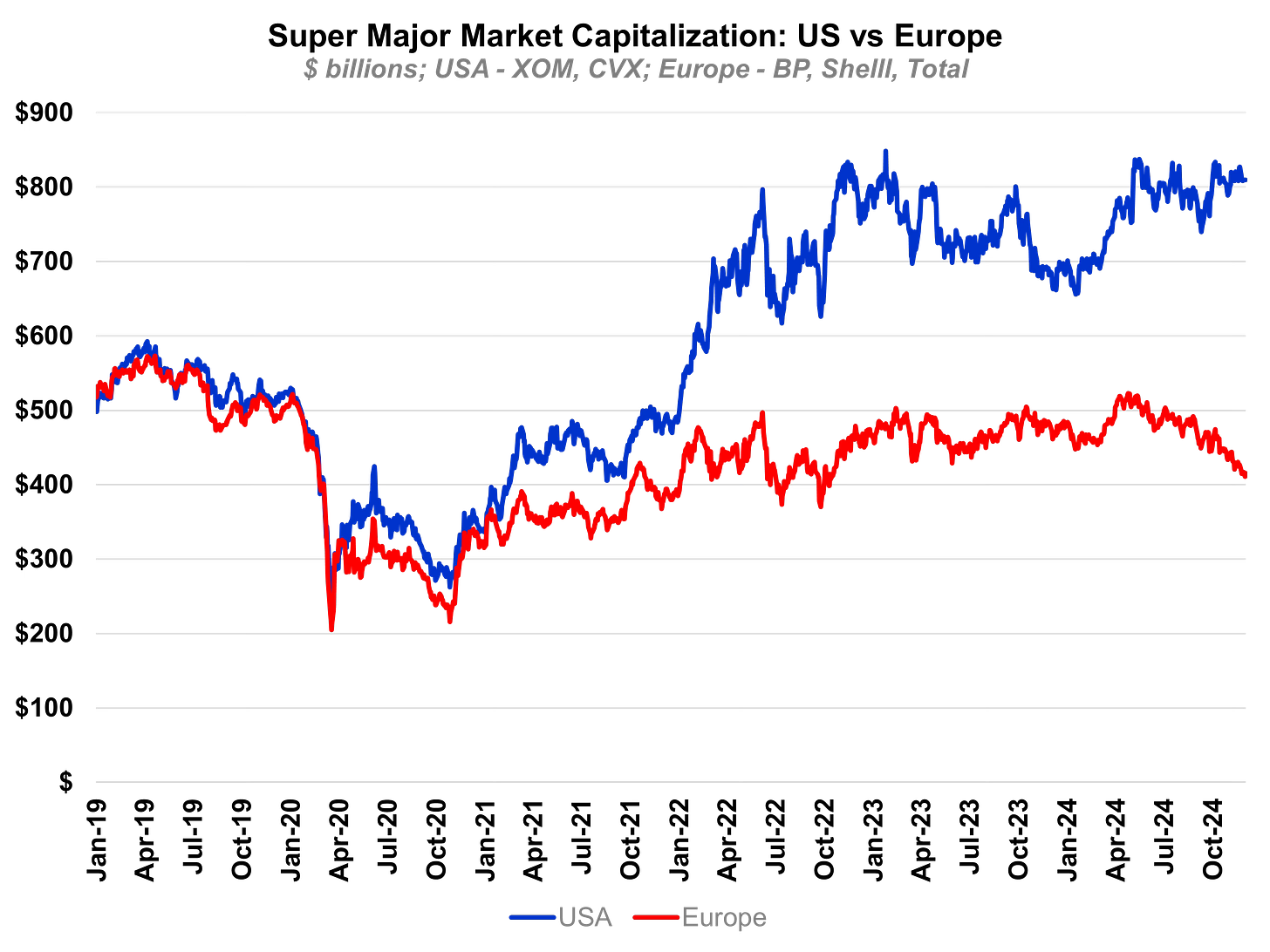

It did not make sense for traditional oil and gas companies to aggressively move into new energy technologies and sources. Pressuring companies to “get on board and become energy transition leaders” was a cudgel we vehemently disagreed with. The recent retreat by European Oils that were especially aggressive in pursuing transition strategies we believe is vindication of our view (Exhibit 2).

Traditional energy companies are capable of generating profitability in excess of cost of capital, including in U.S. shale.

Exhibit 2: US Super Major oil companies have significantly outperformed European peers that re-identified as ”integrated energy” companies

Source: Bloomberg, Veriten.

What We Got Wrong About The Last Five Years

It pains us to have gotten wrong, missed, or otherwise were late to recognizing the following:

We spent a lot of time discussing traditional oil and gas versus new energies and until recently spent very little time on power markets, which has emerged from The Energy Transition™ era as the critical area of focus going forward (Exhibit 3). It was a big miss on our part—i.e., the idea that power is superseding crude oil as the most important energy topic.

The negative EPS revision cycle for traditional energy has lasted longer and been a larger headwind to sector performance (versus the S&P 500) than we explicitly discussed. While Super-Spiked is NOT an investment newsletter, we could have provided more analysis in a timelier manner on how EPS revisions impact sector performance. This is a point we have only recently started to emphasize as we have pressed the message on the need for companies to take risk and find new growth opportunities while still aiming for competitive profitability.

Industrial policy is likely to be an overwhelming motivation—[insert your country’s name] First—for just about all countries going forward, a major departure from the free trade era of the last 30 years that we supported.

US shale oil growth has sharply lowered the geopolitical risk premium in oil markets.

It is not enough to talk about energy demand growth, societal wealth, and sector profitability without also explicitly discussing environmental objectives and alternative approaches to achieving those goals.

Exhibit 3: While we debated traditional vs new energies, merchant power turned out to be the most interesting energy sector

Source: Bloomberg.

What Comes Next and What Do We Most Need To Do Going Forward

The most meaningful area of needed change is with energy scenario frameworks from which everything else falls out, including corporate strategy, public policy, and financial market outlooks. Energy frameworks need to change from only iterating on various “net zero” and degrees of warming scenarios to instead focusing on the timing and pathways to everyone on Earth some day becoming energy rich and the inherent trade-offs between reliability, geopolitical security, affordability, and environmental outcomes.

The International Energy Agency (IEA) has received significant criticism for its Net Zero by 2050 advocacy. Frankly, the IEA is hardly alone in its “climate action is all that matters” framing. The publicly available energy outlook scenarios produced by Super Majors are broadly similar to what the IEA produces. Thus far, it is only OPEC Research that has attempted to produce an outlook driven by an energy-abundance-for-all framing.

We are guilty of being critics of net zero advocacy without offering explicit alternatives. While we have not wanted to engage in short-term “barrel counting” and commodity price forecasting at Super-Spiked and Veriten, we can certainly offer more detailed commentary and analysis on end goal aspirations, levers that can be pulled that address the various trade-offs, and corresponding risk/reward scenarios for all forms of energy sources and technologies.

Pushbacks to Everyone Deserves To Be Energy Rich

Pushback #1, from climate advocates: It is simply not possible for everyone to achieve rich-world living standards without destroying the planet.

Our take: We couldn’t disagree more. First and foremost, we reject Malthusian pessimism, The Population Bomb, The Club of Rome, and all similar ideologies. At Super-Spiked, we are pro-capitalism, anti-socialism. In terms of progress potential, we highlight Japan and South Korea as examples of having gone from poor to rich in less than 50 years; the progress China has made in the last 20 years in going from poor to at least middle income is remarkable.

It is reasonable to debate the timing by which various countries will get their act together to drive economic progress. But the idea that it is impossible and environmentally unsound we do not agree is true. In fact, it will be economic progress in billion-person scale economies that will drive de facto decarbonization and better environmental outcomes over the long run, given the reality that no one on Earth wants to be poor.

Pushback #2, from those that are not concerned about rising carbon emissions: Fossil fuels enabled the western world to become rich and will obviously be the driver of societal wealth gains in the developing world. New energies are inherently uneconomic and are only being promoted by anti-oil & gas, anti-capitalism crusaders. Even if there is a warming trend due to burning fossil fuels, it is being massively over-stated as a risk factor.

Our take: Essentially the bizarro world view vis-à-vis climate activists. Putting aside potential climate impacts from burning fossil fuels, we believe geopolitical security, reliability, and affordability (price and capital flows) will motivate an eventual shift to non-fossil fuel energy sources. China is an excellent example via its obvious motivation to limit future growth in its already substantial crude oil imports. In other words, we disagree with the idea that all new energies are climate motivated. Those of you that are especially passionate about addressing climate concerns should also take note of this observation.

Pushback #3: The choices are not devout climate advocacy versus maximum societal wealth but something in between that looks more like the current, lackluster global GDP outlook, especially given decelerating population growth and outright population declines in a growing number of countries most notably China.

Our take: We suspect that this is the best pushback to our view that someday everyone on Earth will be energy rich. Declining global birth rates could lead to a future population bust, which might imperil long-term economic growth. It is well beyond the scope of Super-Spiked to have a view on how humanoid robots might compensate for a future population bust and the impact that would have on societal well-being.

Pushback #4: You were contrarian, perhaps even brave, in defending oil and gas companies over the past several years when the sector was deeply out of favor, but you are now engaging in the exact climate appeasement you have been decrying by talking about eventual decarbonization in an everyone-deserves-to-be-energy-rich scenario.

Our take: We do not believe in appeasement as a viable corporate or personal strategy. We reject the notion that we are looking to appease anyone by discussing future decarbonization or agreeing that burning fossil fuels has contributed to 1.2-1.3 degrees Celsius of warming to date. In talking about eventual decarbonization, we are analyzing it as a function of geopolitical security, reliability, and affordability, which, for us, has always been the key reason to evaluate non-fossil fuel energy sources and technologies. Energy control is economic control, and fossil fuels are not spread evenly across Earth.

🎤 Streams

Smarter Markets podcast: Last Saturday Arjun teamed up with his former colleague Jeff Currie on The Smarter Markets Podcast hosted by fellow Goldman alum David Greely (here). Arjun and Jeff talked about what the new Trump Administration might mean for the state of “energy transition,” recognizing the substantial energy needs of the rest of the world, the importance of geopolitical security as a driver of energy source diversification, and the topic of “de-dollarization.”

Gulf Intelligence’s Half-Time Talk: Earlier this past week, Arjun appeared on Gulf Intelligence’s Half-Time Talk The Smarter Markets Podcast (here), where he discusses the outlook for oil markets and OPEC, the incoming Trump Administration, and the need for new energy scenario frameworks.

⚡️On A Personal Note: Holiday Season Reading

I aim to read about 25 books per year. I find long-form content to be a welcomed respite from the fire hose of short-form, hot take, quick bite information that overwhelms during most of our waking hours. Below are my Top 10 favorite books I read this past year, several of which I did mention in a mid-year “summer reading” version of this list.

BUSINESS:

Elon Musk by Walter Isaacson (here). Whether you love, hate, or are indifferent to Elon Musk, Walter Isaacson does a great job telling Elon’s story. You may not like every Tweet, but his success with Tesla, SpaceX, and Starlink are remarkable, never mind the many other ventures he has led or started.

On The Edge: The Art of Risking Everything by Nate Silver (here). I like Nate’s gambling probabilities approach to assessing outcomes.

Poor Charlie's Almanack: The Essential Wit & Wisdom of Charles T. Munger by Charles T. Munger, edited by Peter Kaufman (here). Great advice from the late, legendary investor.

GOVERNMENT & SOCIETY

Rigged The Incredible True Story of the Whistleblowers Jailed After Exposing the Rotten Heart of the Financial System by Andy Veritey (here). The LIBOR scandal never made sense to me; this is a good book explaining what happened and who was and who was not responsible.

Dark Wire: The Incredible True Story of the Largest Sting Operation Ever by Joseph Cox (here). An unbelievable FBI wiretapping story, which now seems quite relevant to understand.

The Bill of Obligations: The Ten Habits of Good Citizens by Richard Haas (here). Most Americans would benefit from taking a civics class, one that is unbiased and non-partisan, if possible.

ENERGY

Power Density: A Key to Understanding Energy Sources and Uses by Vaclav Smil (here). Dr. Smil is arguably the greatest energy thinker of our age, perhaps along with Dan Yergin.

Oil Man: The Story of Frank Phillips and the Birth of Phillips Petroleum by Michael Wallis (here). The book details the story of the founder of Phillips Petroleum during one of my favorite periods of American history.

Climate Capitalism: Winning the Race to Zero Emissions and Solving the Crisis of Our Age by Akshat Rathi (here). This may seem like an out-of-place selection in a post about the end of The Energy Transition era, but Askhat’s book is really about energy business success stories. We may have different worldviews, but I always enjoy my interactions with him and this book was a lot of fun to read.

The War Below: Lithium, Copper and The Global Battle to Power Our Lives by Ernest Scheyder (here). A reminder that all energy sources, whether traditional or new, require some notion of extraction. It is now more broadly understood that critical minerals and metals mining, refining, and processing is an important component of new energies technologies.

⚖️ Disclaimer

I certify that these are my personal, strongly held views at the time of this post. My views are my own and not attributable to any affiliation, past or present. This is not an investment newsletter and there is no financial advice explicitly or implicitly provided here. My views can and will change in the future as warranted by updated analyses and developments. Some of my comments are made in jest for entertainment purposes; I sincerely mean no offense to anyone that takes issue.

Arjun. What a tremendous, thoughtful and detailed summary of your theses on the energy transition era. You are a knowledgeable, articulate teacher. You are willing to firmly take positions. Yet do so without attacking those with opposing views. Merry Christmas to you and your family. As one who's followed your work I thank you. Look forward to your next analysis.

Always good to read your thoughts, Arjun, and you make a convincing case.

I feel you’ve missed any mention of the pandemic, though. Surely that point when WTI went negative and oil companies worried about the writing on the wall was when we really saw that big transition concept accelerate.

As normality returned, so there was a reversion to business as usual.