The Right and Wrong Lessons to Learn From Coal's Global Resilience

Resilient Coal

Who knew there was a market for Coal views?!? And here I thought it was a never-relevant sector that any good Wall Street Director of Research would assign as training ground for young, new analysts. King Coal is in fact very much alive and flourishing in the parts of the world that contain the other 5-7 billion people on Earth that are not in Europe or North America.

There is in fact a lot to learn from coal for energy analysts, policy makers, environmentalists, and traditional energy sector executives. If one cares about the health of global economic growth and by extension energy development, and for everyone concerned about efforts to mitigate the world's CO2 trajectory, coal is going to play a defining role whether you like it or not. This discussion about coal is not meant to inflame the ideological ends of the spectrum, but rather to analyze why and where coal is still used and the right and wrong lessons to take away form those facts.

I will observe that traditional oil and gas executives and sector observers (including analysts like myself) have in essence conspired with environmentalists and climate hawks in an attempt to ex-communicate coal as a viable energy source. The former group did so in an effort to promote "cleaner burning" natural gas, while the latter is of course concerned about emissions. So far, it’s not working. In my view, there are right and wrong lessons to takeaway from the resilience of global coal demand, which can be used to inform oil and gas corporate strategy, the role of substantive (i.e., non-virtue signaling) ESG, and intentional and unintentional environmental, climate, and power market policies. All of which I have done here in a Q&A-styled format.

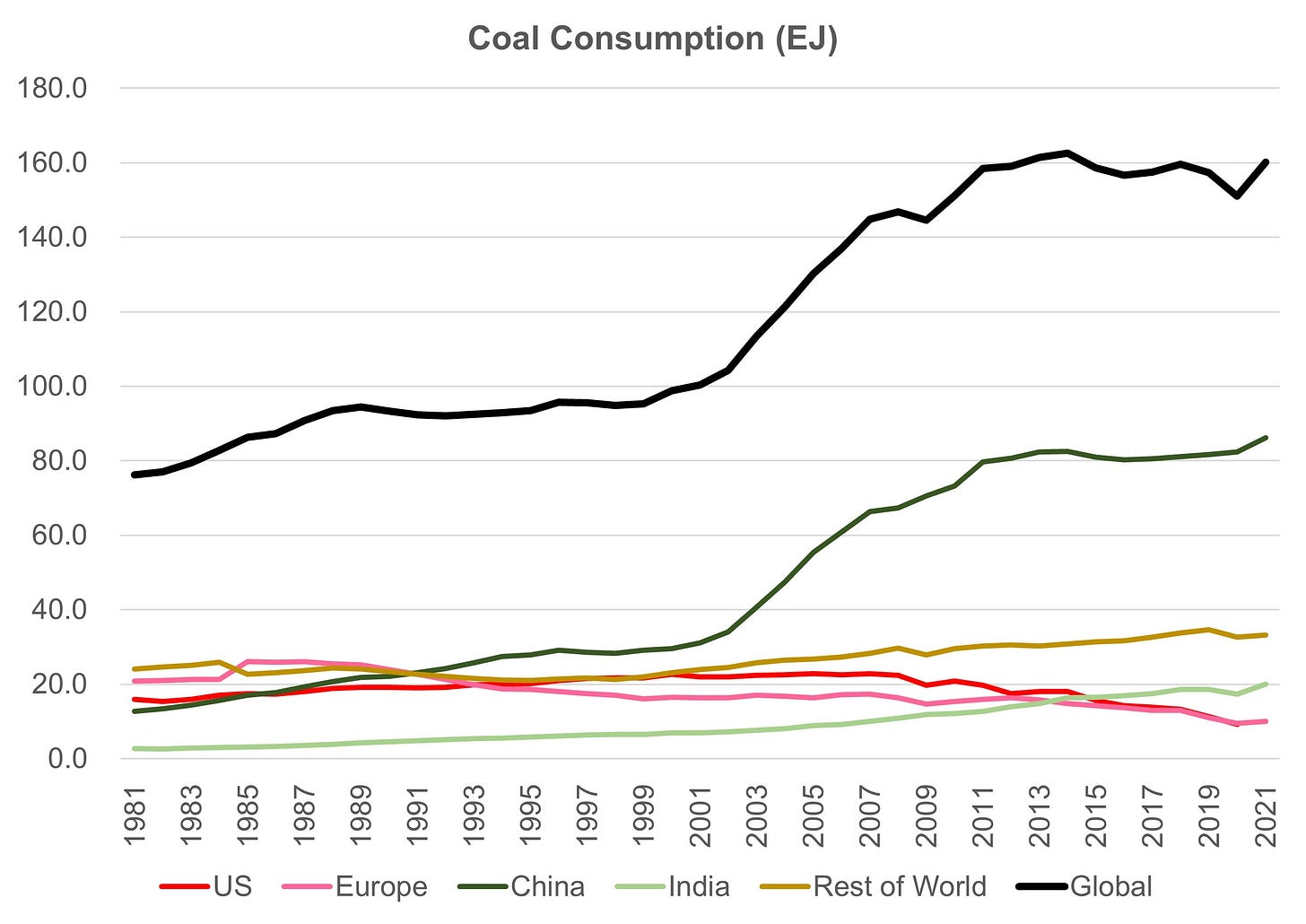

(1) Coal demand is at an all-time high globally, but is in structural decline in the USA and Europe. What lessons can be drawn from these facts?

Energy availability, affordability, reliability, and geopolitical security are far and away the most important characteristics of any fuel choice. Full stop. Environmental and climate considerations are only taken into account after primary needs are satisfied. Many of you will agree, though some will disagree. As an analyst, this is objectively not a close call.

We can see this reality in the fact that coal in the past 20 years has helped China fuel its economic miracle that lifted hundreds of millions of Chinese out of poverty and elevated to China to one of the top economies in the world.

We can also see this realty in Germany restarting lignite coal production (one of the least efficient and "dirtiest" forms of coal) following the loss of Russia gas. Germans are apparently no different than every citizenry everywhere in the world in being unable to live without available and affordable energy for even five seconds.

(2) But in the USA, coal demand has been in terminal decline. Why?

Declining coal demand in the US was due to superior cost and environmental/climate characteristics of natural gas without any sacrifice to reliability or geopolitical security given the massive domestic natural gas resource that exists in the US (and Canada). In a nutshell, the shale gas revolution killed the US coal industry, with an assist from tightening environmental standards.

To be clear, without shale gas, the decline in coal either would not have happened or I believe would have been far slower irrespective of environmental and climate objectives. Energy availability and affordability is primary; environment and climate are secondary, luxury benefits. That is meant as an observable fact, not a personal opinion. So if we are ascribing weights, I give 100% credit to shale gas for displacing coal, with environmental rules secondary. I welcome feedback from those that agree or disagree with the weighing point I just made.

All energy attributes are relevant. Natural gas was first and foremost competitive with coal on an economic basis. It is a massive resource where the only meaningful imports come via pipeline from Canada, our awesome and often under-appreciated (from an energy resource standpoint) neighbor to the north. There was effectively no net change to geopolitical stability or reliability from switching from coal to natural gas as both are dispatchable fuel sources. If anything, our ability to export LNG has strengthened us from a geopolitical standpoint.

(3) What does the US’s coal trajectory mean for China's coal outlook?

A major reason coal demand is at an all-time high is due to the massive domestic coal resources held by China and India. It is not obvious that either would be using as much coal if forced to import it. Coal is inexpensive versus just about all alternatives and, as importantly, it is reliable and geopolitically secure for China and India.

Counting carbon still takes an obvious backseat in China to the need to lift citizens out of poverty. That said, China's resilience to climate change is infinitely better as a richer country than had it stayed poor. This is almost certainly true everywhere.

When we think about the willingness to change to a different fuel source, it will need to compete on all metrics. For a country like China where a range of environmental and climate factors have become increasingly important as national wealth has grown, there is considerable logic to evaluating the role of renewables and nuclear as well as new technologies that can change fuel sources on the demand side such as electric vehicles.

Over the very long term, the only way LNG, in my view, will compete in China's power generation stack in terms of displacing coal is if leadership prioritizes counting CO2. The proof will be in the pudding of coal plant retirements...though the first step for sure it to stop growing the existing fleet of coal plants which has yet to happen!

Over the last decade-plus, China has grown its LNG imports as it has grown coal supply in this case to ensure it could meet its rapidly growing overall energy demand and help provide some fuel diversification. As China’s economy matures and its population enters what appears to be a potentially extended period of decline, I believe LNG may need to compete with coal as a fuel source, likely requiring China to want to reduce its CO2 emissions.

The problem with renewables as a reliable source of energy is well documented. Whether or perhaps when technology and smart grids can compensate is a major question.

Renewables can make sense for a portion of a country's generation mix and for niche uses. Renewables screen well on geopolitical security assuming you are not dependent on it for more than it can deliver on its worst day. Zero variable cost energy clearly has its advantages as well, though again one needs to evaluate this on trough availability days.

(4) How does a country being long or short crude oil or natural gas impact usage?

If a country is short (i.e., does not hold in sufficient quantities of) crude oil or natural gas resources, alternative energy sources like solar, wind, and nuclear and new technologies like EVs might outcompete oil and natural gas on security and possibly even affordability metrics depending on the price of crude oil and imported LNG.

At a minimum, fuel source and technology diversification is a favorable characteristic of new energies. The point being that the trend toward diversifying away from sources of energy you do not control is irresistible for resource-short countries.

No one should assume crude oil or natural gas demand growth is guaranteed, especially in resource poor countries, simply based on the favorable cost characteristics for resource long countries.

When we look at key developing areas: both Latin America and Africa overall are long crude oil and natural gas resource (versus current demand), though for individual countries in each region, results may vary significantly. Developing Asia I generally think of as light on crude oil or natural gas resource, though results here can be quite country specific. The desire to diversify fuel source mix and end demand technologies is likely highest in developing Asia.

(5) Goodness gracious, are you bullish or bearish crude oil and natural gas demand? I thought you were constructive, at least versus "net zero" doom and gloom scenarios, but now I can't tell from all the back-and-forth above

I expect crude oil demand to grow well into the 2030s. Slowing population growth coupled with the potential for improved efficiency gains and a slow transition toward EVs eventually becoming a non-trivial mix of our transportation fleet (on a miles-driven basis) will lead to an eventual long-term plateau. The population part of all this is under-discussed and highly relevant.

I expect natural gas demand to grow into the 2040s. That said, there has always been much more choice in terms of power generation alternatives. Natural gas will have to remain competitive with nuclear in particular for base-load demand. And as the start of this note implied, the case for coal-to-natural gas switching is not compelling on an economic basis for countries with large domestic coal resources and that would need to import natural gas in its liquefied (i.e., LNG) form.

Natural gas is also facing growing skepticism as a materially cleaner burning fuel than coal when methane flaring/venting/leaks are taken into account. For a country to want to import higher-priced LNG as a diversifying fuel, in particular China and India, I predict producers will eventually need to be able to attest that "near zero" methane has been achieved across the LNG value chain. There is even less doubt that European LNG imports will require a "near zero" methane attestation.

Some will want to debate this methane point, and its a discussion worth having. Is this simply polite, rich country, affluent analyst talk about the need for clean(er) natural gas? I don't think so. Beyond the diversification benefits of natural gas/LNG, I believe it's ultimate growth potential could become limited if producers cannot indisputably show that on an all-in basis inclusive of the methane issue, it is materially less carbon intensive than coal.

It's for a future post, but methane is perhaps the climate issue where the oil and gas industry can have a material, positive impact. For at least the first portion, the cost of addressing methane is likely to be less than the revenues generated from selling the captured molecule. Just do it.

(6) How do you get China off coal and encourage India to develop with lower-carbon forms of energy?

This is a big topic that I will come back to in the future, but I think it is worth introducing here.

Is this the example where we could really use carbon border taxes or some equivalent mechanism? Keep in mind that coal in China and India in general does not involve US or western companies. In the US, “being tough on China” is an area of bi-partisan support. Could Rs, Ds, geopolitical China hawks, labor, business, and the enviornmental community all align on an obvious issue of agreement?

How can it be OK that we hold our companies to high environmental and climate standards but are willing to purchase goods and services from countries like China with lower standards? If China wants to use coal, they certainly can and will. Our strategy of only punishing and yelling at our own companies seems insane. How about raising the floor on labor, environmental, and climate standards for imported goods and services?

A final suggestion: Let’s not ban “fossil gas” stoves on the US coasts only to import coal-fired, forced labor-built induction stoves from China. Please.

🎤 Stream of the Week

On January 26, I had the great pleasure to join Vivek Ramaswamy, co-Founder and Executive Chairman of Strive Asset Management, for a 1:1 webinar hosted by Strive. I had not previously met Mr. Ramaswamy but am of course familiar with his growing presence in what many describe as the "anti-woke ESG" investment world. Vivek and I share many views and perspectives. But we have different backgrounds, areas of expertise, and points of emphasis on the broader ESG topic. As he states, he is from the biotech world as a CEO and investor, whereas I am a career-long Wall Street energy equity research analyst.

Unlike myself, Vivek has written a very thoughtful book, Woke, Inc. (link) which I read over the holiday break and thoroughly enjoyed. If you really want to understand where he is coming from read the book, which I'd note offers the chance for nuance and perspective that is simply not possible in Wall Street Journal OpEds. There is an underlying philosophy about the purpose of corporations, the purpose of democratically elected governments, and the proper place for societal policy questions that is refreshing and frankly well beyond the simplistic "anit-woke ESG" labeling Strive is often tagged with.

The question I believe I answered least well from Vivek is the following (paraphrasing): "When you say that you are in favor of lower carbon energy sources but at the same time lay out a bull case for oil demand, are you being sincere in the former point or just trying to not offend ‘polite society’? Why come across as half apologizing for your oil demand view?"

It was a very fair question. And I can totally see how my commentary seems at least partially (if not fully) staged to not offend the center-left. It is not my intention to use polite, centrist analyst speak. I seriously do not have any issues with attempting to move to lower-carbon energy sources. I do have major issues with numerous policies and approaches that, frankly, have been a motivating driver of the creation of Super-Spiked: those that result in a worst of world's outcome of unavailable, unaffordable, unreliable, insecure energy and likely no change, if not a worsening, of enviornmental and climate metrics.

I believe there is lots of room to push back on climate fear mongering and"climate crisis" religiosity while still believing we are looking to bend the curve on carbon emissions. No, I do not believe CO2 is "pollution" as it is clearly needed for life. But the greenhouse gas effect is in and of itself not a controversial concept. Rather it’s how quickly and in what manner you can and should try to mitigate it that is the debate. I will always prioritize gross zero energy poverty as the over-arching objective. And whether I prioritize that or not, it will clearly be the over-arching goal society moves toward. You can not deny people energy. But there are many good reasons beyond climate to motivate new energy technologies and supply sources, including availability, affordability, reliability, security along with biodiversity, clean air, clean water, and climate considerations.

⚡️On a Personal Note

One of the best parts of being an energy analyst are the field trips to see industry assets and the people that run the assets. My first ever visit was circa 1993 to the Sweeney refinery owned by Phillips Petroleum; I still remember the plant manager’s emphasis on safety as both the right thing to do and as a key driver of generating earnings. My first oilfield trip was to the Midway-Sunset field in Bakersfield, California, also in 1993 or 1994 with Santa Fe Energy Resources.

The first overseas expedition was to Hassi Berkine in the Algerian desert—which also served as the first time I have been in a vehicle where security used mirrors to look under the car for explosives. Growing up in suburban New Jersey, the risk of car bombs were not a thing. Lucky for me. My last trip as a covering analyst was with Chevron in 2014 to the massive Gorgon complex in Western Australia.

My favorite industrial city is Ras Laffan, Qatar, which I’ve been to twice, including with a former Goldman colleague in the midst of a crazy sand storm. With hindsight, I think Chukri and I were pretty lucky there was (apparently) no one else on the road as the driver never slowed down during what was zero visibility.

My least favorite visit was to a rendering plant I think in Iowa that makes biofuels (or was it renewable fuels?). It was absolutely sickening for a non-hunter like myself. Wood-chip refineries, algae conveyor belts, and cellulosic lab experiments were more ho-hum and never seemed like they could ever pose a serious threat to traditional oil and gas.

But I’ve never been to a coal mine! As I have noted, it’s never been a major investment sector in my career and I have never directly covered any coal equities. I kind of recall some of the integrated oils selling residual coal assets at the start of my career. Since it’s not too late, I would love to visit a coal mine.

⚖️ Disclaimer

I certify that these are my personal, strongly held views at the time of this post. My views are my own and not attributable to any affiliation, past or present. This is not an investment newsletter and there is no financial advice explicitly or implicitly provided here. My views can and will change in the future as warranted by updated analyses and developments. Some of my comments are made in jest for entertainment purposes; I sincerely mean no offense to anyone that takes issue.

Great article again. Coal mines are the new tobacco stocks. The Aussie miners are cash cows and will be for a long time based on the current strip pricing. Give us a shout when you come down under and we can do a coal mine golf tour.

Pure gold: Energy availability, affordability, reliability, and geopolitical security are far and away the most important characteristics of any fuel choice. Full stop. Environmental and climate considerations are only taken into account after primary needs are satisfied. Many of you will agree, though some will disagree. As an analyst, this is objectively not a close call.