As promised, we return this week with our Top 10 Tactical Questions for 2025. While the major topic areas we focused on in 2024 remain the same—(1) macro; (2) geopolitics & policy; (3) sub-sector outlooks; and (4) M&A—there is a greater focus on both the power and natural gas value chains than in the past. You can see our retrospective on last year’s tactical calls here.

We believe 2025 will mark year 1 of the post-The Energy TransitionTM era that narrowly and incomprehensibly prioritized “net zero” as society’s defining objective. As we have now regularly articulated, there is not a person or country on Earth that inverts their hierarchy of needs to prioritize carbon emissions over other objectives. The world is always solving for abundance and reliability first and foremost, followed by affordability and geopolitical security. Paradoxically, we believe that by solving for how to make everyone on Earth energy rich, there will be significant pressure and motivation to discover and commercialize new energy sources and technologies that are by definition low carbon in nature. We will expand on this concept in 2025.

Our tactical questions reflect that evolution to a post The Energy TransitionTM world as well as a growing convergence between traditional oil and gas, power & utilities, and new energies. All forms of energy will be needed in the decades and centuries ahead. In the United States, we have the excitement and promise of a new administration that recognizes energy’s natural hierarchy of needs. That said, our nearly 34 years covering the sector has taught us that energy always surprises in new and unexpected ways. Our preferred phrasing is that energy is in perpetual transition—it’s what has made covering the sector so much fun all these years. For 2025, we can’t wait to see what we haven’t considered or what we will get wrong—it is what gets us up and in front of our Bloomberg Terminal each morning.

Macro-Oriented

Question 1 (Q1): Will energy’s S&P weighting increase in 2025 reversing the 2-year downtrend?

Super-Spiked Answer (A): Yes, we think the correction from the 2022 post-COVID Russia-Ukraine peak has mostly played out even as we recognize the risk that a “final” downdraft in crude oil prices is possible.

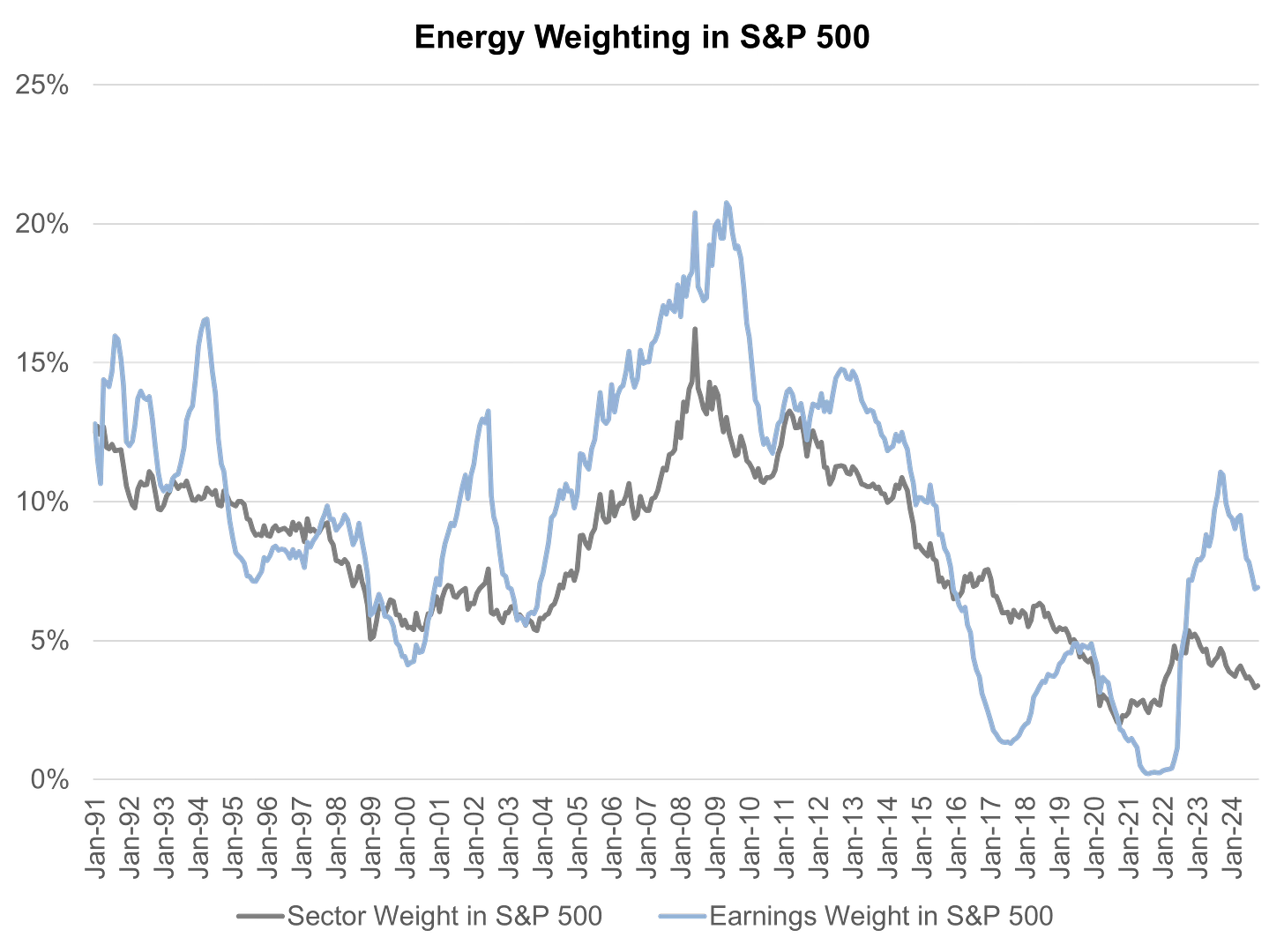

We were originally going to ask if we thought the 2-year negative EPS revision cycle (relative to the S&P 500) would come to end, as that is what ultimately drives equity prices and energy’s market weighting (Exhibit 1). However, even if another bout of downside volatility in oil markets materializes, we suspect the market will at some point in 2025 look through what may be the last big bump in non-OPEC supply for some time, as US shale oil and Brazil oil production appear to be maturing. Natural gas pricing is on-track to reverse its downtrend in 2025 and we believe the decisive end to a narrowly-defined energy transition era that prioritized carbon reductions over all other objectives will support better performance for the energy sector in 2025.

One adjustment we will need to make in evaluating the energy sector’s S&P 500 weighting is to include both oil and gas, power, and new energies companies as representative of “Energy” overall. Historically, we have referenced “Energy” to only include the traditional oil and gas companies found in the S5ENRS index (the energy companies in the S&P 500). Exhibit 1 sticks with our classic definition of Energy; we will make the adjustment in a future post.

Exhibit 1: A reversal in the energy sector’s 2-year EPS downtrend (relative to S&P 500) is needed for outperformance

Source: Bloomberg, Veriten.

Q2: Will we see long-term energy outlooks from high-profile energy organizations stop treating “net zero” as if it were the defining issue?

A: Change is coming, but given how deeply rooted net zero ideology has been, we suspect that in 2025 we will get some wishy-washy language from the IEA and European majors that speak to evolution in their scenarios with a full break not happening until 2026.

There has been no greater disservice to the world’s understanding of energy over the 2021-2024 period than the fact that the only sensitivities to business-as-usual (BAU) (and equivalent variants) were how quickly the world would transition towards “net zero.” Long-time Super-Spiked readers are by now well aware of our view. There is not a person or country on Earth that prioritizes net zero carbon emissions over energy abundance, reliability, affordability, or geopolitical security.

Much needed change is coming to the energy scenario analysis world. As we have said before, the IEA (International Energy Agency) is hardly the only high-profile group to have shifted to a “net zero is all that matters” worldview. Our bigger critique is frankly with many of the European majors that knew better. Appeasement is not a viable strategy. In making investments or engaging in M&A activity, all companies need real scenarios that reflect a broad but ultimately realistic set of possible outcomes. It makes sense to look at tail risks: they just can’t all be in the same direction.

Q3: Can oil become great again in 2025?

A: That is not our expectation, as Super Vol remains our core theme.

The strength in crude oil prices at the start of 2025 has caught many observers by surprise (note: we are not crediting perma-bulls for being right just because the year started with a pop higher). That said, it is not clear to us that oil markets are on-track for what we think is needed for a sustained bull run: (1) a return to oil demand growth closer to 1.3-1.5 million b/d per year; (2) clear evidence that US shale oil growth will not reaccelerate in the event of say $80-$100/bbl oil prices.

A secular slowdown in China’s economy and oil demand growth seems well understood now (that was not the case a year ago). There is considerable uncertainty with how the new Trump Administration will handle sanctions and related pressure on countries like Russia, Iran, and Venezuela and to what degree they will work with allies in the Middle East (e.g., Saudi Arabia) to offset—or even more than offset—potentially lower production from our adversaries.

Since oil rallied off of COVID lows over 2021-2023, we have resisted the urge to call for a new oil super-cycle even as we dismissed concerns that oil demand would permanently peak any time soon. Our “obliterating peak oil demand” theme is multi-decade in nature. In the nearer-term (i.e., the mid-2020s) the world seems stuck in a sluggish global GDP paradigm. Oil and other commodity markets are also dealing with China fading from being a decisive growth driver to merely another important country impacting markets.

It is worth mentioning that our “Super Vol, not super-cycle” framework for oil may seem at odds with our expectation that the energy sector will see an increased S&P 500 weighting in 2025. However, a recovery in natural gas prices, a fading of net zero ideology (and the corresponding concern about the long-term future of the oil and gas industry), and the potential for markets to at some point look through a near-term peak in non-OPEC growth all support our energy outperformance expectation.

Geopolitics & Policy

Q4: Will the Inflation Reduction Act be repealed, reformed, or left alone?

A: Reformed.

With energy dominance and re-shoring key Trump Administration themes—coupled with a razor thin majority in the House and only a handful of votes to spare in the Senate—we believe an outright repeal of the IRA is not likely. That said, there is significant room for improvement, consistent with our “reform” call.

The current and prior administration share a re-shoring philosophy, which is part of the IRA. There is also growing common ground among many Republicans and some Democrats that “all of the above” makes the most sense for energy sources and technologies. What could use reforming is explicit or de facto mandates as well as excessive subsidization of uneconomic technologies, which we would differentiate from incentives to ensure capital in new technologies is invested in the United States.

Q5: Will Trump make the Arctic great going forward?

A: Yes.

The usual “again” doesn’t apply here, though perhaps we are under-appreciating the initial developments at Prudhoe Bay and surrounding fields 40-50 years ago. For a variety of reasons, including a warming climate in the Arctic, the strategic value of the region has arguably never been higher. Yet, we have been in a world where former president Biden and Canada’s soon to be former prime minister Trudeau have effectively declared the Arctic off limits to energy investment. A similar situation exists in Norway. There is zero chance it makes sense for three friendly democracies—the United States, Canada, and Norway—to forego the Arctic at a time adversaries like Russia are going in the opposite direction. Whatever the outcome, there is logic to President Trump pondering how the United States could become closer to Greenland, which leads us to conclude the Trump Administration appreciates the strategic value of the Arctic.

In the United States, Alaska remains a highly prospective region for oil investment. The active hostility of the former Biden Administration to development opportunities in the state we expect will mercifully come to an end under President Trump. We believe an improvement in the investment climate in Alaska could present opportunities for new players that are thinking about the decades ahead to look to our 49th state. In order to maintain energy dominance, the United States will eventually need to supplement shale production with new sources of supply.

We are less familiar with the attractiveness of Arctic oil opportunities in Canada (we have vague memories of the Mackenzie Delta) or Greenland. Norway clearly has some prospective regions that we understand are currently not available for investment. With Norway essentially the Permian Basin of Europe, we see no logic to voluntarily foregoing domestic energy supply opportunities.

Sub-Sector Outlooks

Q6: Will power-exposed sectors lead the way in 2025?

A: Yes.

We recognize that this is a consensus call, but it’s hard not to remain excited about structural growth opportunities in the power sector. We will define our “yes” answer as continued healthy share performance from the combination of merchant power producers and leading utilities as well as companies that support infrastructure growth (e.g., transmission line expansion, turbine manufacturers, etc.).

Q7: What new technology area are you watching more closely to break-out in 2025?

A: Autonomous driving.

In our view, the most interesting new area to watch is autonomous driving. We believe it is as close as it has ever been to going mainstream. To be clear, ubiquitous “robotaxis” are still likely at least several years (or more) away. And we are in no way saying that any person, anywhere will be able to purchase a full self driving car where you can fall asleep at the wheel (i.e., purposely and without risking a crash) in 2025. But unlike the over-hype around how quickly EVs (electric vehicles) in general would achieve near 100% worldwide share (it was never going to happen by the 2030s as some were calling for just a few years ago), the advancement of autonomous driving could be the more meaningful mobility game-changer.

At this time, it is too early to be specific about what this would mean for miles driven overall or by technology (i.e., gasoline cars vs EVs), but we suspect it will be massively positive for miles driven and support the next leg of EV growth. A surge in miles driven would be a surge in energy demand—the exact form of which is the question.

We remain optimistic that nuclear as part of the solution to a healthier energy environment will continue to gain momentum in 2025. Nuclear is notoriously long-term and slow moving in nature, but we expect both the new Trump administration and many other countries to continue to turn back to nuclear as an important component of the future power generation mix.

We will continue to study geothermal and long duration storage, but have no strong views that 2025 will be breakout years for either. We remain most bearish on Big Wind and so-called “green” hydrogen among the other newer technologies

M&A

Q8: Will we see an acceleration of oil & gas sector firms entering power markets, and if so, do you expect it to be via larger-scale M&A or organic?

A: Yes and organic (i.e., non-large-scale M&A).

Thus far, we have seen a trio of SMID-cap oil services companies enter the merchant power generation market. In December 2024, ExxonMobil revealed it would invest in a natural gas-fired power plant dedicated to providing power to data centers. We expect more of these kind of developments in 2025.

In terms of larger-scale M&A, we are not expecting traditional oil and gas firms to acquire or merge with say a merchant power producer or utility. We are also not expecting US or Canadian oil and gas firms to directly enter either the solar or wind markets. Same thing with nuclear, though in this case, there may be opportunities to invest in nuclear-focused companies that can provide power for their operations.

Q9: Does the Venture Global IPO signal that tide is turning with energy sector capital formation?

A: Yes.

In our view, the tide is turning for energy sector capital formation. To be sure, exposure to the natural gas and power value chains look like they are back in vogue, more so than the crude oil value chain. Consolidation in the traditional oil-exposed areas seems likely to continue. For energy capital formation to be truly back and our “yes” answer to be judged accurate at the end of year, we would expect to see more new companies come public than we lose through consolidation. In judging this call at year-end, we will take an expansive definition of energy to include traditional oil and gas, power, and new energies.

Q10: Will we see a surprising mega merger in energy?

A: Yes.

Let’s start with what would not be surprising: a continuation of the general consolidation trend in the E&P sector via larger companies buying smaller ones or two SMID-caps getting together that are driven by some combination of inventory optimization or cost cutting. When BP announced it was acquiring Amoco in the late 1990s, that was surprising. So was the subsequent tie-up between Exxon and Mobil. To be surprising, there has to be a wow factor. To be clear for the purposes of this call, we are not limiting the term “mega” to only mean M&A involving super major oil companies. Constellation-Calpine would be an example of a surprising mega merger, but since it has already been announced, we won’t count it in assessing our call at year-end.

In our view, future large-scale M&A will be about positioning for the decade ahead. Our key themes include: (1) the natural gas value chain: LNG (liquefied natural gas), natural gas liquids and midstream expansion, and natural gas-fired power generation; (2) power super-cycle, where demand growth in both developed and developing markets presents a host of business model opportunities. For crude oil, it is always about figuring out what will be the next, big lower-cost-of-supply opportunity. Will it be in Canada, Alaska, or other parts of the world? And can you gain exposure organically or are there M&A opportunities?

⚡️On A Personal Note: Give Me Liberty And Give Me An Opportunity To Better Human Lives

It is my honor and great pleasure to have joined the board of directors of Liberty Energy earlier this week (here), a company that has been led by president Trump’s choice for energy secretary Chris Wright. My Goldman compliance training is still with me—and our former research compliance head is a Super-Spiked subscriber…big brother is still watching!—so like with the other publicly-traded company on whose board I sit, this will be one and done in terms of commenting on Liberty Energy in Super-Spiked.

Exhibit 2: An important piece of oilfield equipment that helps generate the energy we use every day in everything we do

Source: Super-Spiked.

I was unfamiliar with Liberty until the 2020 time frame, when they were one of a small handful of companies to counter-cyclically engage in M&A at the COVID trough. I remember thinking, who are these guys—and an oil services company no less—brave enough to do a deal in this environment? I then ran their ROCE and CROCI profitability numbers and was instantly in love.

As I have articulated in this space before, I am a huge fan of Liberty’s Bettering Human Lives (BHL) “ESG” report (here). There must be thousands of oil and gas sector companies around the world. Yet, somehow, a SMID-cap, Denver-based pressure pumper has been the only one to eloquently, forcefully, pragmatically, and in an entertaining manner articulate the case for why everyone on Earth uses and would benefit from more energy (honorable mention goes to Amin Nasser, CEO of Aramco). BHL is a spiritual twin of Super-Spiked. It was that common ground that led me to getting to know Mr. Wright.

One of my kids asked me if joining a board is a lot of work and how this fits in with my other engagements. Good question! All of my engagements are in and around the energy sector. They are all synergistic with each other. My Goldman/JPMIM/Petrie equity research analyst training is how I still self-identify—I have an equity research analyst’s mindset. The now two public board positions are complemented with a senior advisor role at a leading private equity firm. I have gained a considerable understanding of energy public policy from both left-of-center and right-of-center perspectives via my advisory board positions at the Center on Global Energy Policy and ClearPath, respectively. And all of that is brought to bear at Veriten, where we help energy companies think through macro and strategic outlooks.

Is it a lot of work? None of it is “work.” What could be more fun than being an equity research analyst engaging in the energy sector? The sector is always changing. It is global. It is critically important to everyone—there is nothing any person does that doesn’t at its core represent a use of energy. Nothing is more important than energy abundance and reliability. And I have a chance to engage with energy from five viewpoints—equity research analyst, public company board member, private equity advisor, public policy advisory board member, and as a Veriten partner. From a career standpoint, I am the luckiest person on Earth.

As an added bonus, Liberty’s Denver headquarters is only a two-ish hour drive to Vail and Beaver Creek, my two favorite ski resorts. I am an intermediate and occasional single black diamond skier that is a bit afraid of heights (when there is not protection or when you can see the bottom of the run from the peak). I at times ski way too defensively and unathletically. Yet, I absolutely love hitting the slopes. It’s hard to explain.

Exhibit 3: Hitting the slopes at Vail last weekend

Source: Super-Spiked selfie.

⚖️ Disclaimer

I certify that these are my personal, strongly held views at the time of this post. My views are my own and not attributable to any affiliation, past or present. This is not an investment newsletter and there is no financial advice explicitly or implicitly provided here. My views can and will change in the future as warranted by updated analyses and developments. Some of my comments are made in jest for entertainment purposes; I sincerely mean no offense to anyone that takes issue.

Congratulations on joining the board at Liberty Energy. It pleases me that your brilliance is recognized and that you will have a larger role in shaping our energy future. My selfish desire is that you will still be able to post your weekly commentary.

Wonderful news that Liberty seeks someone with your experience and perspective on their board. And conversely, it is easier for them to continu Bettering Human Luves with board members who share that vision fervently.