$XLE Resurrection: So Far, So Good…So What!

Attracting capital flows back to traditional energy, Post #1

Are you an institutional investor concerned that you missed the energy rally and it’s not a sector to chase? Indeed it has been a strong move up off of a generational trough, with the energy sector having recovered to 5.5% of the S&P 500 from an all-time low of 2% seen in October 2020. So far, so good. But here's the "so what" part: Energy equities are not recession proof as evidenced in all prior recessions (link).

With energy broadly speaking—i.e., crude oil/refined products, natural gas/LNG, and coal—on-track to serve as a constraint on global GDP growth, recessions are inevitable. If you don't want to chase and believe you can either time pullbacks or are especially bearish on the economic outlook, then don't chase. Thirty years in the sector and I know with energy (1) it is never easy; (2) it is never a straight line up; and (3) it's not like the tech sector where investors are prone to fall in love with grand visions of the future. I believe a Super Volatility mindset best covers the type of environment we will be in this decade.

With that said, in my view it is still early days for the sector's longer term recovery and that we are perhaps in only year 2 of what I expect to be an excellent decade for traditional energy. Versus a current 5.5% weighting, I expect energy to get to a minimum 10% of the S&P 500 in coming years, driven by its share of earnings within the S&P 500, favorable underlying ROCE trends, and the ongoing strong commitment from just about all companies to return excess cash back to investors. I might argue energy is the MOST important S&P sector as without it, you can't have any of the derivative businesses that currently comprise the remaining 95%. Water. Food. Energy. Everything Else. No way it should only be 5.5% of the S&P.

This will be the first in a multi-part series that looks at the prospect for capital flows to return to traditional energy, as represented by the $XLE. As most of you already know, this is not an investment newsletter and does not aim to make recommendations on what institutional or retail investors should or should not do with portfolio or investment decisions. While I have written extensively about areas like the ROCE cycle and corporate strategy, I have resisted providing a risk/reward framework for energy equities. But if a core mission in creating Super-Spiked is for the world to move to a healthier energy evolution era from the messy energy transition quagmire we are currently in, there is a great need to more directly articulate the reasons for capital to flow back into traditional energy.

What you need to believe to own oil & gas equities this decade

(1) Energy transition? What transition

We are not on track for anything remotely resembling an "energy transition" as commonly portrayed, certainly not this decade. Note: As I have repeatedly stated previously, I support all serious efforts to lower carbon emissions, while also addressing clean air, water, biodiversity, and related environmental and sustainability objectives. However, the anti-fossil fuel ideology that characterizes so much of today’s climate movement is not something I support and, in my view, is leading to really bad outcomes when it comes to economic and, ironically, environmental health to the detriment of all of mankind. At the present, we do not have anything that resembles sensible energy and climate policy anywhere in the world (with the possible exception of Iceland), which is the point of this section, and for that matter, Super-Spiked itself.

I peg 2030 oil demand at 107 mn b/d vs 100 mn b/d in 2019; of course my forecast assumes 7 mn b/d of supply growth that we many not have. If 2030 oil demand is in fact as low as 100 mn b/d, I would strongly suspect that was due to the need for demand destruction to limit consumption to available supply.

This is perhaps THE critical point of this post. To consider investing in the sector, one needs to gain confidence that the relationship between oil demand and GDP is NOT on-track to materially change this decade even with the expected ramp in electric vehicles. Perhaps said differently, it appears a surprisingly large number of portfolio managers and chief investment officers actually believe oil and gas demand may roll over in the coming decade; here-in is the opportunity for those that believe otherwise as I do.

In the absence of a change in the relationship of oil and gas demand to global GDP, the only way to loosen structurally tight energy commodity markets without resorting to recession is to have a major CAPEX cycle.

As the exhibit below shows, there is essentially no evidence that the relationship between oil demand and global GDP has materially changed since the “one-time” step down between the 1990s ($15-$25/bbl oil) and the 2000s ($50-$100/bbl oil). There is a year-in, year-out efficiency gain that has long existed as oil demand grows at a slower pace than global GDP. What you don’t see are any signs there is a rapid rolling over of oil demand for a given level of GDP as is assumed by the “peak oil demand” crowd.

I love the phrase coined by Rapidan Energy’s Bob McNally (author of Crude Volatility): “we are currently at peak ‘peak oil demand’”. Spot on Bob.

What would I need to see to become concerned about structural oil demand growth?

A sharp pickup in efficiency gains. Limiting a combination of horsepower, weight, and size in American and developing world passenger vehicles would be a critical first step. I am unaware of any country/region outside of the EU and Japan pursuing such policies.

As an example, overhauling US CAFE (corporate average fuel economy) standards to require a minimum 30 mpg by 2030, 40 mpg by 2040, and 50 mpg by 2050 for ALL consumer vehicles would be a good start (i.e., sedans, SUVs, and pick-up trucks). And to be clear, I am referring to real world driving and without the myriad exemptions that keep actual mpg closer to the low 20s despite much higher headline standards.

It has been a bi-partisan effort over multiple decades to water down CAFE standards in the United States to the point of irrelevance. In my view, it is the single largest obstacle to actually being able to start down a path of decoupling at least gasoline demand from GDP growth. If you really want carbon emissions to roll over; this is a great place to start.

The current political preference by climate ideologues to mandate electric and ban internal combustion vehicles is not a serious policy to decouple oil demand from GDP growth, certainly not on any time frame that would correspond to their stated “net zero by 2050” goals.

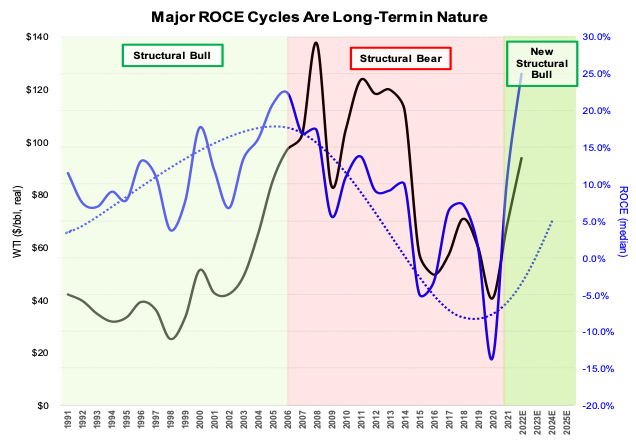

(2) ROCE cycles are decade-plus in nature

ROCE cycles are long-term in nature: 10-15 years up, 10-15 years down. I have written about this extensively in my ROCE Deep Dive series (see links on right side of Super-Spiked website).

We just finished a 15 year down-cycle in 2020. We are currently in the middle of year 2 of a new upcycle.

While I expect year-to-year ROCE to be volatile consistent with a Super Vol commodity macro backdrop, ROCE over the decade I believe will average at least 12% and possibly as much as 15% for the sector. Top quartile companies I expect will generate 15%-30% ROCE on average this decade.

What would I need to see to become concerned that structural ROCE was not on-track to be in a new, multi-year upcycle?

The most direct answer is that ROCE upcycles ALWAYS end when capital intensity rises sharply after a multi-year upturn in capital spending; we are currently much closer to trough CAPEX and expected future increases still seem on-track to be more subdued than in prior cycles.

For the top two quartiles of upstream producers, the quality of the shale resource base is likely the biggest downside (or upside) risk; I believe flat-to-modest production growth for leading shale players would be consistent with a mid-teens or better ROCE and corresponding free cash generation.

For downstream companies, unexpected twists and turns in policy and regulation can always make things worse; for example, a refined product export ban in the US could be negative for downstream earnings.

(3) Companies will continue to compete on shareholder returns, not production growth

Unlike every prior traditional energy cycle, there is little appetite for anything more than modest supply growth, with dividends and stock buybacks taking priority over volume growth objectives as the key consideration.

At no point in my 30-year career has just about every company competed on maximizing shareholder payouts; it has usually been just the largest integrated oils and maybe a smattering of others.

In every prior cycle, all upstream companies including the Super Majors sought to grow at least 3%-5% p.a., with smaller companies and E&P pure-plays typically seeking even higher production CAGRs. This was true in the 1990s, 2000s, and 2010s. It is not happening now.

What would I need to see to become concerned that the commitment to returning excess cash was wavering?

The concerns noted in the ROCE section hold here.

Realistically, this is likely more of a micro (i.e., individual company) concern rather than a macro point. Individual companies could face deteriorating upstream acreage quality, which would lead to deteriorating ROCE and free cash generation.

This point is inevitable for ALL upstream producers. The better ones will anticipate well in advance; hence, my M&A Inevitability theme.

🌅 Welcome Back to Traditional Energy…in pictures

(1) Energy weighting in S&P 500 correlated to ROCE; I believe we are early in a multi-year ROCE upcycle

(2) Energy tends to “punch its earnings weight” in the S&P 500; Energy expected to be over 10% of S&P’s earnings in 2023, yet is only at a 5.5% market cap weighting

(3) Across the broader market, Value (RLV Index) is just off a generational low versus Growth (RLG Index)…Energy is a Value sector

(4) Similarly, Energy (S5ENRS Index) is just off a generational trough versus Tech (S5INFT Index)…Tech is a Growth sector

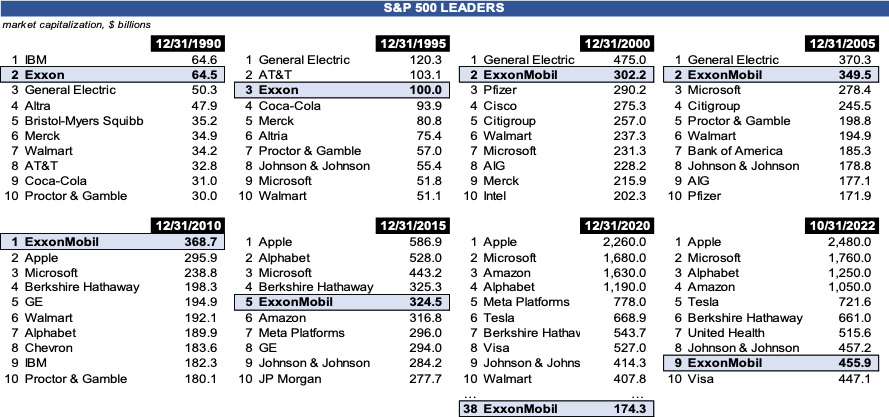

(5) ExxonMobil back among Top 10 largest S&P 500 stocks and I believe can return to its long-standing Top 3 status (note: this is general observation about Energy’s rising S&P relevance, not a specific recommendation of XOM shares)

(6) Versus FAANG leaders, ExxonMobil has passed NFLX and META…TSLA looks to be next

Calibrating an appropriate Energy weight in the S&P 500

Energy’s S&P 500 weight is correlated to its profitability (ROCE) and earnings. As my friend and former Goldman colleague David Kostin has often articulated, “energy tends to punch its earnings weight in the S&P 500.”

When energy was 2% of the S&P 500, the market appeared to be discounting a continuation of the previous decade of essentially 0% ROCE...a very bad kind of net zero.

Measured over rolling 30-year periods, I would expect commodity producers to earn a return on capital that approximates its cost of capital, which would allow for sufficient CAPEX in order for supply to match demand. In the oil and gas business, I would peg long-run cost of capital as on the order of 8%-10%. There are many moving factors but broadly speaking that might translate to an mid-to-upper single digit S&P weighting.

Over the coming decade, as noted above, I believe the energy sector overall will earn a competitive ROCE of at least 12% and possibly over 15% on average; in a big picture sense, I believe this will translate to energy returning to a minimum 10% weighting in the S&P 500.

⚡️On a personal note…

I first saw Megadeth live in concert on April 17, 1988 during my freshman (and only) year at Cornell University’s College of Engineering. I had a great time at Cornell though engineering was definitely not for me…but that story is for another day. Megadeth played on campus at Bailey Hall, the same location as my Psychology 101 class, which I recall having a circa 2,000 student enrollment. They were touring for the namesake album of this post. It’s a philosophy I have mostly adhered to in 30 years as an equity research analyst and industry advisor, and is basically similar in spirit to legendary Intel CEO Andy Grove’s “Only the Paranoid Survive” worldview.

A consistent theme over Megadeth’s nearly 40 year musical career has been the idea of a dystopian future. It was prevalent among 1980s heavy metal bands to write songs about the Cold War and risk of nuclear holocaust. Today, Cold War doom and gloom has been replaced by climate alarmists predicting the apocalypse if we don’t decarbonize urgently.

On April 17, 1988 it was not possible to imagine the Berlin Wall falling and the Cold War ending a mere 1.5 years later. There is always hope that the current “climate only” ideology and messy energy transition quagmire we find ourselves in can suddenly and unexpectedly give way to a healthier energy evolution era. Is that possible by April 2024? Seems optimistic. So what!

⚖️ Disclaimer

I certify that these are my personal, strongly held views at the time of this post. My views are my own and not attributable to any affiliation, past or present. This is not an investment newsletter and there is no financial advice explicitly or implicitly provided here. My views can and will change in the future as warranted by updated analyses and developments. Some of my comments are made in jest for entertainment purposes; I sincerely mean no offense to anyone that takes issue.

Regards,

Arjun

📘 Appendix: XLE

XLE is the ticker symbol for a fund run by State Street Global Advisors that represents the energy stocks in the S&P 500. From the SSGA website (link):

The Energy Select Sector SPDR® Fund seeks to provide investment results that, before expenses, correspond generally to the price and yield performance of the Energy Select Sector Index (the “Index”)

The Index seeks to provide an effective representation of the energy sector of the S&P 500 Index

Seeks to provide precise exposure to companies in the oil, gas and consumable fuel, energy equipment and services industries

Allows investors to take strategic or tactical positions at a more targeted level than traditional style based investing

Institutional investors (and most likely knowledgable retail investors as well) use the XLE as a proxy for the energy stocks in the S&P 500, as I am doing in this post.

What a fantastic piece! I would only add that the language of energy is heavily biased at this point. For example, “clean energy” isn’t clean. There is the environmental impact of intensive mining operations, the burning of fossil fuels to make EVs, etc., and other negative impacts such as wind turbines killing raptors. Mark Mills has shown that an EV produces 10+ tons of carbon dioxide before the engine is even turned on.

And there has never been, I. The history of the world, an “energy transition”. Each new source of energy is additive to those that existed before.

Oil and gas is a generational investment opportunity and you are all over it!

Arjun,

Thanks for another excellent column. Do you see any indication that the US government may change its energy policy after the mid term election ? It seems to me that the later the government changes its energy policy, the longer will be the duration of the current bull market. When you restrict the supply of an item that is necessary for life but without a viable cheap substitution , you will only make price of the item higher. Interestingly, Crude Chronicles has shown that the best annual return of oil and gas historically took place when Democrats control White House, House and Senate (https://thecrudechronicles.substack.com/p/you-may-not-like-the-guy-in-the-white?utm_source=profile&utm_medium=reader2).