Dumb Calls I Made as a Street Analyst

Post #1: OXY post the March 2000 Altura Energy acquisition

This is not an attempt at false modesty. This is about applying lessons learned from 30 years in markets in an effort to be a better analyst looking forward. Today’s post will go back to March 2000 and what was a really bad call I made on Occidental Petroleum at the very start of my Goldman career—a negative view on what turned out to be a home-run, company making acquisition of Permian Basin properties (I launched coverage at Goldman in December 1999). This was a time when the Permian Basin specifically and oil properties generally were massively out of favor, and after a decade-plus of very poor financial and stock price performance from Oxy on an absolute basis, relative to energy, and relative to the S&P 500. There was absolutely no reason to think this bold move would work out as well as it did; and there-in lay the foundations of my mistake.

The good news for Super-Spiked subscribers is I boast a robust collection of dumb calls to learn from and this will likely be an ongoing series. Think of this as my recognizing that the practical application of a rigorous, analytically-driven approach that I am detailing in my ROCE Deep Dive series (here and here) does not always yield the desired outcome. Excel driven precision is rarely the answer; judgment, perspective, risk/reward discounting scenarios, and good luck are just as important.

The calls I got most wrong, like Oxy, weren’t because I didn’t do the work. In fact, just the opposite — I always did a ton of work. Being Goldman’s Major Oils analyst was a 24/7/355 kind of job. I loved it! Rather, a combination of recency bias, anchoring, and model-driven overconfidence were usually the main culprits. 355 is not a typo; the 10 days around Christmas/New Years were always welcomed downtime. Toward the end of my career, I’d say the 355 was down to 330 with 3 weeks of summer holiday plus other odd days; one of the reasons I knew it was time to hang it up.

Occidental Petroleum post the Altura Energy acquisition, March 2000

Background on what it was like to cover the integrate oil and E&P sectors in March 2000

Oil had spent the better part of a decade trading between $14-$22/bbl in nominal terms.

As articulated here in ROCE Deep Dive Post #1, the companies that were generating good returns on capital were focused on cost reductions, limited capital reinvestment rates, and primarily long-lived international upstream projects.

Onshore the United States, including the Permian Basin, was viewed as a mature, high cost region not deserving of investor capital. Deepwater and international were perceived as the places to be.

Setting the stage: What it was like to cover OXY in March 2000

OXY shares had massively underperformed the S&P 500 and energy stocks within the S&P (S5ENRS) over the previous decade (see Exhibit 1).

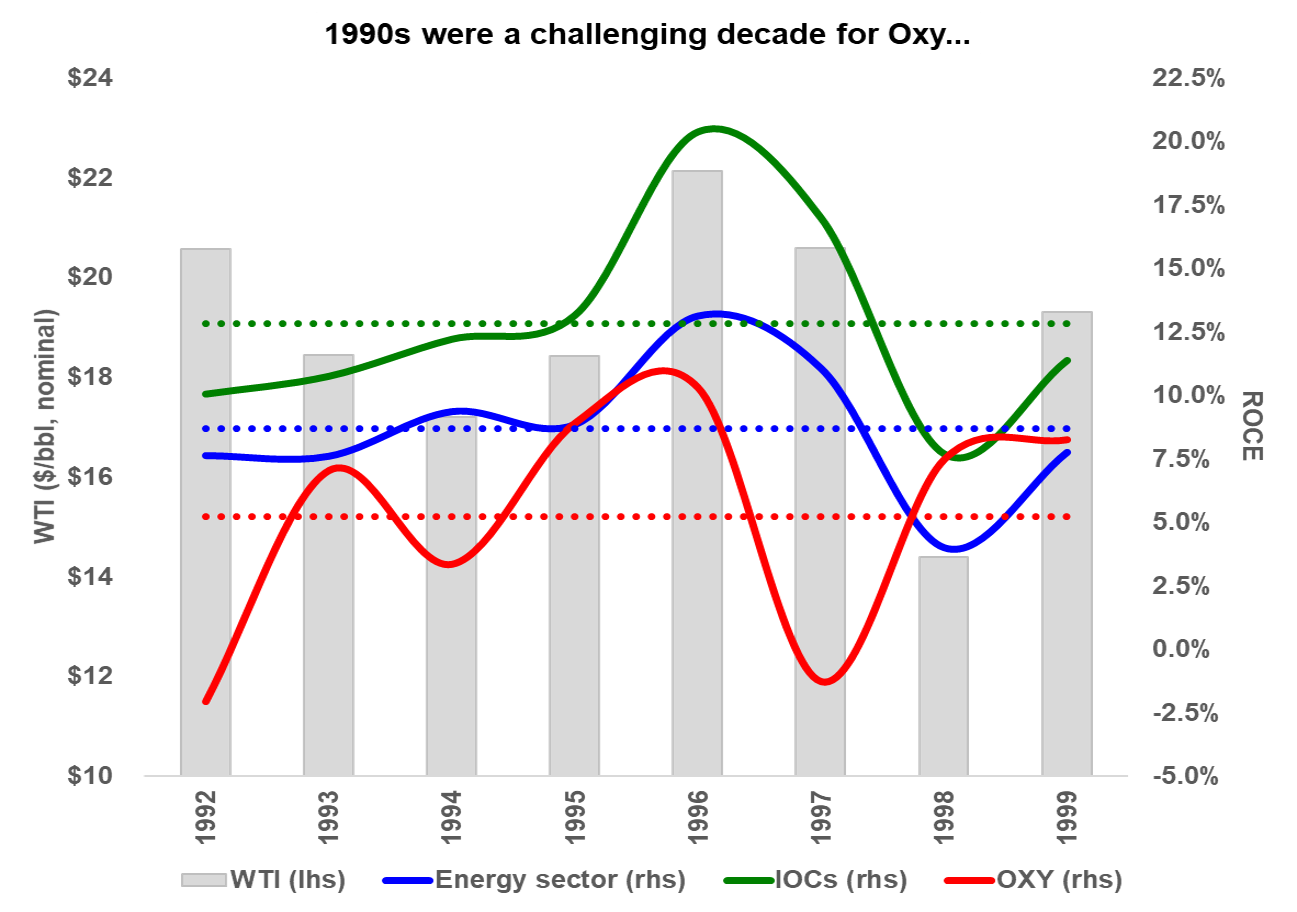

OXY’s 1992-1999 ROCE averaged 5.2%, well below the 8.7% energy industry average, and substantially lower than the 12.8% generated by the major integrated oils (see Exhibit 2).

OXY was led by long-time Chairman and CEO Dr. Ray Irani. Let’s just say that in March 2000, Dr. Irani would not have made any Street analyst’s “Top 100 energy CEOs on the verge of substantial value creation” list. I don’t think I am over-stating this point.

OXY had spent the 1990s zigging and zagging, as it tried to find an identity post the 1986 oil bust. It was technically an “integrated oil” in those days, but did not have the size or scale of an Exxon, Chevron, Mobil, Texaco, BP, or Shell. To borrow a phrase from a former competitor and current Super-Spiked subscriber in describing a later generation of companies: Oxy was “dis-integrating” in the 1990s; turned out that was a good thing.

Only the super deep value folks gave Oxy any attention. One analyst I clearly remember making the right call post Altura was J.P. Morgan’s Jay Wilson (now a veteran Hess executive).

Altura Energy acquisition

On March 8, 2000, Oxy announced it had purchased Altura Energy, a Permian Basin join venture between BP (then BP Amoco) and Shell for $3.6 billion, a major purchase for Oxy at the time.

While the E&P “acquire and exploit” business model was a thing back then — most notably and successfully executed by Apache under legendary founder Raymond Plank — Oxy was not known as an “acquire and exploit” E&P.

Acquire and exploit was the strategy of buying mature oilfields from an integrated oil, cutting costs post purchase, and spending some capital to add incremental reserves/production at a low cost to extend field life. While there was some appreciation that especially skilled E&Ps could pull this off, the overwhelming investor preference was for organic growth via long-lived, complex international or offshore assets. Only the brave few thought Oxy would succeed with Altura.

My view of Altura in March 2000: Bad deal for Oxy

From my March 9, 2000 OXY note:

There is no change to our Market Performer rating as a result of Occidental Petroleum’s announced acquisition of Altura Energy. Based on our model of the deal’s economics, the long-rumored Altura transaction would only make sense if WTI spot oil prices were to persist for an extended period of time above $25/barrel, which we are not forecasting. Rather than debate whether our $17.50/bbl normalized WTI oil price is too high or too low, we would note that our estimates show that this transaction will keep OXY’s ‘all-in’ upstream cost structure at the higher end of the integrated oil industry; hence our Marker Performer rating.

That write-up fully and accurately reflected my view at the time. I would surmise that there was zero confusion on the part of my institutional investor client base that I was not a fan of the acquisition based on my opinion that it required a much higher oil price than what I was forecasting and that I was skeptical Oxy could meaningfully lower the cost structure of the asset. While over 21 years later I stand fully behind the clarity of the original text both in language and intent, it is also pretty clear it is in analyst speak.

So lets do a 2021 Google translation of 2000s era analyst speak to modern retired partner speak:

This is a bad deal made by a dumb management team that has done nothing but squander investor capital for a decade now. How do they even still have jobs?!? The Permian Basin? Are you kidding me? You can not make money in the Permian going forward. What’s next, horse buggy whips? These fools are making a bullish oil price call! How ridiculous is that?!? We all KNOW oil will never, ever again sustainably rise and that the only value creation for larger companies is to emulate Exxon.

How it went: Home-run deal heading into a super-cycle

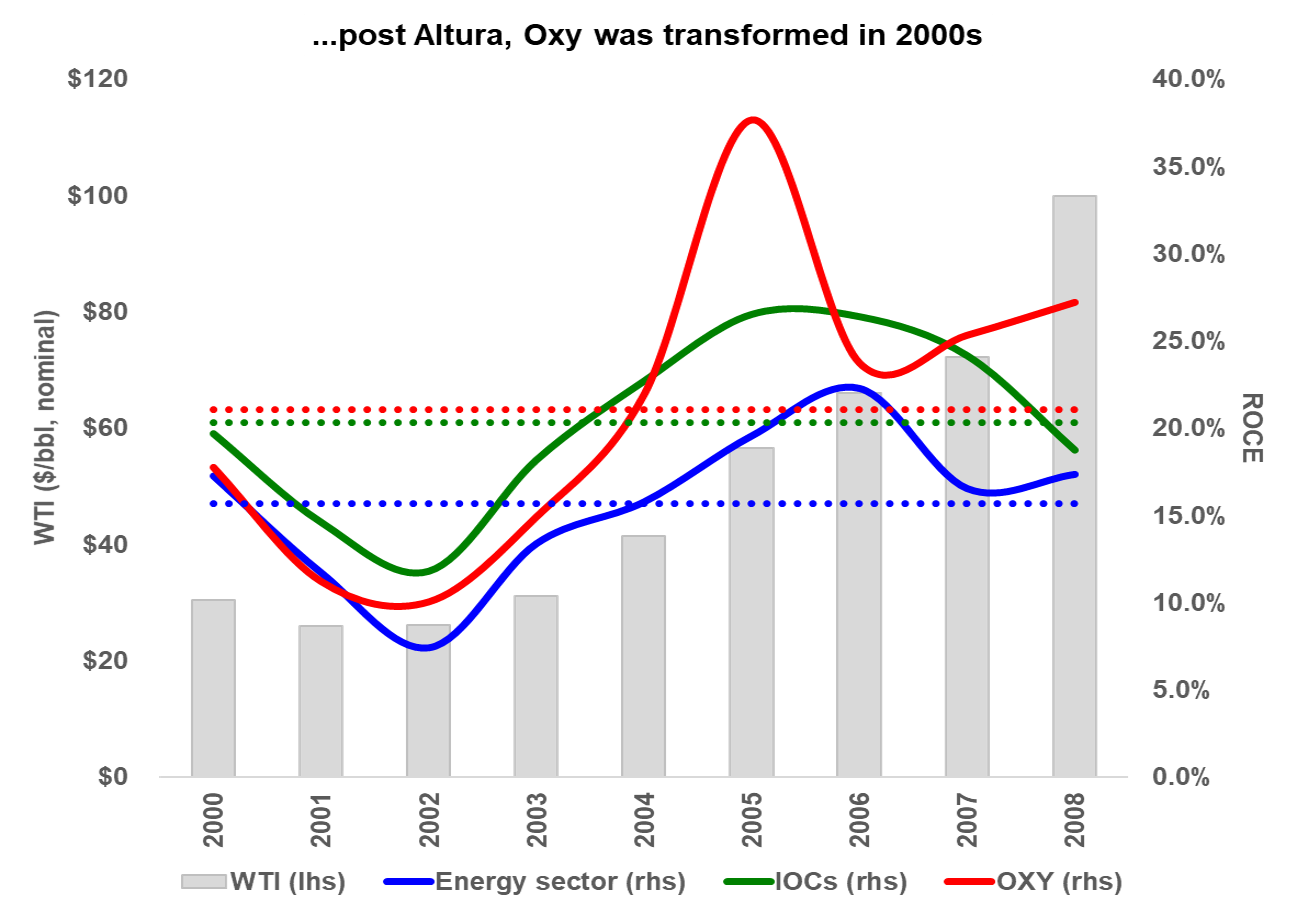

OXY crushed both energy stocks and the S&P 500 in the 2000s (see Exhibit 3). Over 2000-2008, OXY’s ROCE averaged 21.1% versus 20.3% for the major integrated oils and 15.7% for the sector (see Exhibit 4).

As Dr. Irani told me at the analyst meeting dinner at the Four Seasons Restaurant (if memory serves) held post announcement, “Arjun, I think you are missing the fact that Altura currently has 850 million BOE of proved reserves that we will produce over the next decade. In 10 years’ time, we will still have 850 million BOE of reserves. There is a lot of low-hanging fruit on this asset.” I remember him telling me that like it was yesterday. He was right.

What I got wrong

Basically, there was no part of the analysis that I got right, despite having done a lot of in-depth modeling and analysis at the time. In a nutshell, past (ROCE) performance was not indicative of future performance. As they say, a model is only as good as its inputs and your ability to analyze the outputs.

Specifically:

The asset did indeed have significant low-hanging fruit after an extended period of neglect from its prior major oil owners.

While conventional drilling was mature in the Permian and was not an exciting business at $17.50/bbl (or lower) long-term WTI, that is not the macro environment that transpired.

Purchasing neglected assets from super majors at a time oil markets are out of favor and sentiment is uber-bearish is about as tried and true of a value creation strategy as any in the traditional energy business. I think I knew this at the time, but was overwhelmed by my mis-trust of management.

While my $17.50/bbl long-term WTI view looks laughably too low in hindsight, leading European Super Major CEOs were in a race to the bottom in declaring $16, no $15, no $14, no $12/bbl would be the future long-term oil price. One company was even rebranded to focus on a green future beyond the oil & gas business. Any of this sound familiar?

I would guess now that $20/bbl is all that would have been needed for Altura to have been a good deal. We ended up north of $100/bbl.

However, I should emphasize that OXY had not simply gotten lucky with a more bullish oil environment. This asset specifically was able to stay lower cost for a longer period of time than other assets. This is critical if a company is to NOT suffer from return normalization (i.e., lower returns) as oil prices advance due to rising industry costs. A full explanation of this dynamic is for a future post. Suffice to say, OXY’s ROCE advantage improved versus peers due to a superior asset base.

Lesson’s learned

As an analyst, you need to have a view and preferably a strong, out-of-consensus one at that. Having a strongly stated but ultimately in-consensus view isn’t usually helpful. The perception that all bearish or negative calls on Wall Street are out of consensus is simply not accurate.

Risk/reward scenarios are a good evolutionary step, but to make a real call, you still need a somewhat specific point-estimated path that is your base-case. The lesson is NOT that all calls should be couched to allow for any number of possible paths. Rather it is to analyze and understand the weighting investors are currently placing on possible outcomes and how those probabilities might change.

Since that time, I think I have gotten much better at identifying when consensus fully believes in a specific path, such that even if the odds change only slightly to a different outcome, you get much bigger moves in the opposite direction to what everyone currently expects.

European Super Majors have a history of thinking the oil & gas business is going away. Do the opposite.

E&Ps are capable of significant value creation through counter-cyclical risk taking. The problem with the sector or individual companies usually arises via continuing to over-spend at the above-normal portions of the cycle.

As a young analyst in 2000, I should have spent more time asking Dr. Irani pointed questions about what happened in the 1990s so I could have had a chance to come away with more confidence that change was possible. To his credit, he was actually quite open to meeting with me early in my career as I recall. I don’t think I really knew how to to take advantage of that opportunity in those days. By the time of Altura, Stephen Chazen—one of my all-time favorite energy executives—had joined the senior leadership team, suggesting something was changing for the better at OXY.

Applying lessons learned to today’s energy market

E&Ps are capable of following a value destruction decade with a decade of much improved performance.

Oil is a deeply cyclical business critical to human prosperity. As an analyst, it is worthy of doing work on traditional energy when it is deeply out of favor, as it has been since 2016 and especially 2020.

If European super majors are diversifying away from oil & gas, it is probably a good time to consider increasing oil & gas exposure (read more here).

Never give up on your dog…it can always learn a new trick(s)!

OXY Post Script

The astute observer of Exhibit 4 will notice that OXY’s differential ROCE improvement abruptly reversed in 2006, even with continued strong underlying WTI oil prices. Before you read on, any guesses (or remembrances) on what happened?

(pause reading)

The acquisition of Vintage Petroleum, which the market correctly recognized as I recall would not be anywhere near the second coming of Altura. Believe it or not, I could write a second “Dumb calls I made as a Street analyst” post on my wrongly bullish call on Oxy over 2010-2014. To make a long story short and skip another 2,500 words, the wrongly bullish OXY call basically repeated the same mistakes as this one, just in the opposite direction. Bottom line: no one should listen to my forward-looking calls on OXY. But they have always been a super interesting company to cover.

On a personal note…

Some of my favorite memories from my Goldman years were in the 2007-2010 time frame. I would like to dedicate the “lessons learned” aspect of this note to my former co-Directors of Research from that era; great, tough bosses that were truly awesome to work for and spent time encouraging us to learn lessons from the stock market crash and recovery in 2008-2009. Sadly, one of the two, who was about my age, is no longer with us.

I would like to wish everyone a Happy Holiday season, Merry Christmas, and Happy New Year. To all my early Super-Spiked subscribers, I very much appreciate your support and kind words over what is now one month of being live. New subscribers are always welcome, but it’s especially nice to see so many former clients, colleagues, and even competitors signed up.

Disclaimer

I certify that these are my personal, strongly held views at the time of this post. My views are my own and not attributable to any affiliation, past or present. This is not an investment newsletter and there is no financial advice explicitly or implicitly provided here. This is a look back to a call I made on Oxy over 20 years ago; it has been seven years since I actively covered Oxy and I have no public view on the current incarnation of the company. My views can and will change in the future as warranted by updated analyses and developments. Some of my comments are made in jest for entertainment purposes; I sincerely mean no offense to anyone that takes issue.

Regards,

Arjun

Appendix: Definitions and Clarifications

All data is from Bloomberg and S&P Capital IQ.

In the ROCE exhibits, median ROCE is used for the energy sector and average ROCE is used for the integrated/international oil companies (IOCs).

As always, ROCE is on an “as reported” basis and not adjusted for the infinite items analysts focused on shorter time horizons might choose to ignore.

Would love to hear your thoughts on OXY's acquisition of Anadarko.

Would enjoy reading more in this series, we learn more from our mistakes than our successes much of the time, and always better to learn from someone else's mistakes than from one's own ;-)