So long “energy transition,” hello meeting global power growth

The Energy Transition Needs to Transition

We are just past the three-year anniversary of the IEA’s infamous Net Zero by 2050 report that among other things stated “no new oil & gas fields are required” and joined the climate hawk chorus demanding oil and gas firms aggressively transition to new energies that they believed would inevitably render their legacy businesses obsolete.* This is not an “I told you so” post. It is instead intended to raise awareness that corporate strategy needs to be based on a reasonable and well-researched assessment of the long-term macro outlook, competitive advantage, technology development, asset/project economics, and policy considerations. It is certainly not about succumbing to the whims or tantrums of activists, academics, and politicians that have a narrow, ideologically-driven world view that is not always correct.

The fervor of “you must transition aggressively starting right now” has faded sharply as it has become apparent that many of the supposed future energy technologies are some combination of unaffordable for consumers, have uncompetitive economics without massive and persistent subsidies, are unproven beyond lab scale, are not a “100%” solution and are best relegated to niche applications, or require complimentary traditional energy sources to balance intermittency. The corresponding collapse in most new energies equities has cooled investor interest in the topic.

For traditional energy companies that did not succumb to the “you must aggressively transition” mindset, key benefits include:

Avoidance of future write-offs on ill-advised capital projects

Superior stock price performance and valuation

Improved investor confidence that managements and boards have shareholders best interests in mind

Out of the “energy transition” craziness we see a healthier energy evolution emerging that is recentered on why we use energy in the first place: to better human lives (credit to Liberty Energy CEO Chris Wright for the phrasing (here)). Our “Obliterating Peak Oil Demand” series (here, here, here, and here) has highlighted the massive unmet energy needs of the other 7 (soon to be 9) billion people on Earth. The new artificial intelligence (AI) boom is turbocharging power generation demand specifically, most notably in developed markets but eventually the developing world as well. The combination of developing world economic progress and AI advancement supports continued growth in traditional energy sources and will also motivate investments in new energy technologies and sources driven by geopolitical security for countries that are not blessed with abundant crude oil, natural gas, or coal resources.

While we are starting the process of moving past the unhealthy energy transition narratives of the last three years, we believe “sustainability” as a concept is not going away even as a wholesale break from the policies and perspectives favored by the “urgent climate crisis” crowd is critical. Clean air and clean water go hand-in-hand with societal wealth, which is 100% correlated with energy usage that historically (and currently) overwhelmingly comes from oil, natural gas, and coal. New energy technologies and geopolitical security happen to be synonymous with low-carbon opportunities. Biodiversity objectives should not be limited to protecting ecosystems only in rich countries; we will need to drill for oil and gas and mine and refine critical minerals and metals in all regions including the United States and Canada. Drilling, mining, and refining are the lifeblood of bettering human lives. Full stop. Doing so domestically is synonymous with geopolitical security for all countries.

We doubt very many, if any, of those that have most loudly called for traditional energy companies to pursue an aggressive business model transition will offer an apology, self-reflection, look-back on how things are actually unfolding, or what performance would have looked like if more management teams and boards had succumbed to the bullying. Our advice as usual is to do your own work, resist near-term consensus temptations, and speak up when the popular narrative is wildly off base.

* It is nonsense to claim the obvious headline grabbing “no new oil and gas fields are required” line was sufficiently caveated and the weaponization by essentially everyone that is climate obsessed was unanticipated.

A 3-year era of “energy transition” value destruction, in pictures

US vs Euro Oils

It is now well understood that European oils have lost considerable ground to US Super Majors, as many succumbed to climate pressure from European elites. Some even changed their preferred pronoun to “integrated energy company” from integrated oil. The debate a few are engaged in is whether to move their primary listing to the New York Stock Exchange. We suspect it would take a headquarters relocation, not merely a new stock listing, for investors to fully gain confidence that a company has freed itself from unwanted European influences.

Exhibit 1: Market capitalization of US and European Super Majors

Source: Bloomberg.

XLE/XOP/OIH (traditional energy) vs ICLN/TAN (new energies)

We are showing this graph since the start of 2021, which coincides with peak “you must transition now” mania. To be sure, if you start this graph say five years earlier, traditional and new energies equities (using the indices shown) have performed more closely. The point being timing matters. Jumping into energy transition at peak sentiment never made sense.

Exhibit 2: Traditional energy has smoked new energies since 2021—the peak of “you must transition now” hype

Source: Bloomberg.

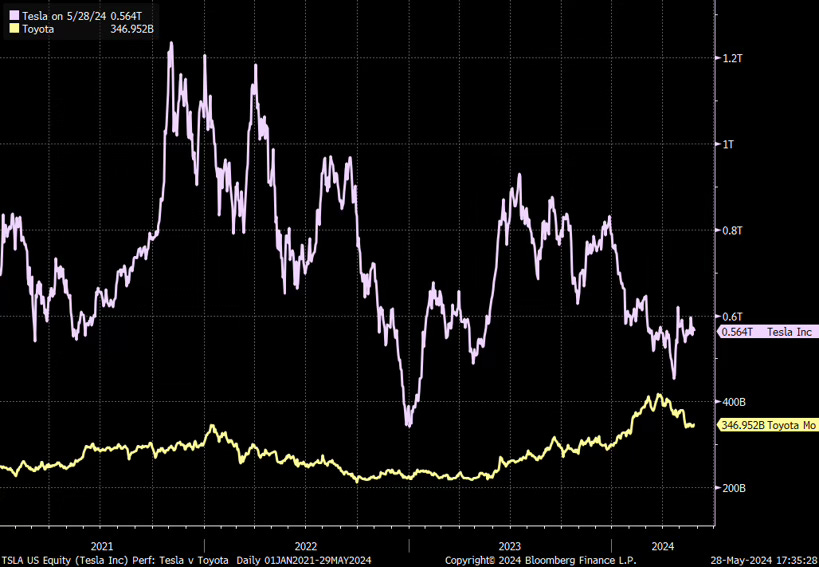

Toyota vs Tesla

Toyota’s legendary CEO Akio Toyoda is well known for his skepticism about an “EV only” future, with Toyota believing a variety of drivetrains are needed to support global transportation markets. Despite facing at times sharp criticism for not jumping on board with consensus wisdom that an electric vehicle (EV) only future was necessary and inevitable, Mr. Toyoda is in the process of having his views vindicated.

Exhibit 3: Tesla market capitalization catching-down to Toyota, the traditional Autos leader that has historically expressed the most skepticism about the viability of an EV only future

Source: Bloomberg.

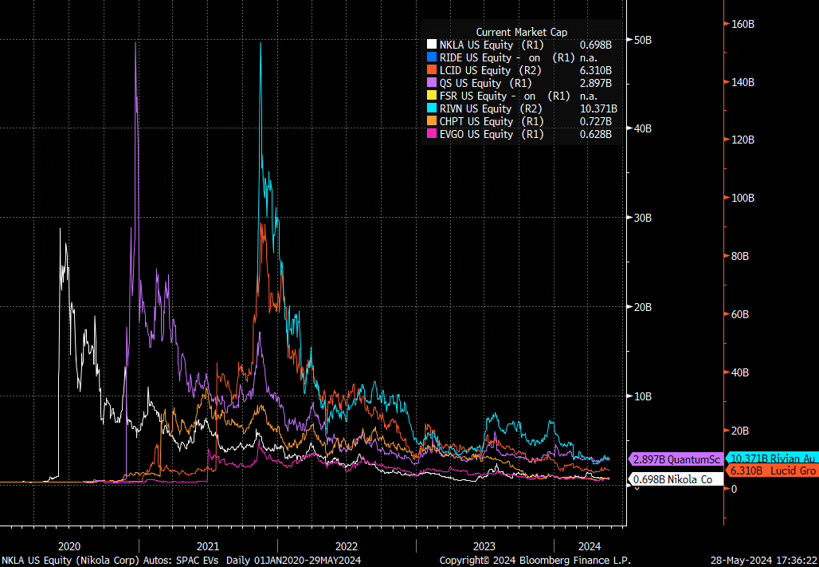

EV and New Energies Market Caps

EVs are hard. Starting a new EV company is especially hard. The same is true for the broader new energies space—capital intensity and new technology ramp is never a sure thing.

Exhibit 4: Market capitalization of EV start-ups have collapsed…

Source: Bloomberg.

Exhibit 5: …as have other new energies equities

Source: Bloomberg.

Key lessons for traditional energy

Key lessons from the last three years of “you must transition quickly” pressure and value destruction:

There is no substitute for focusing on core competencies and areas of competitive advantage.

When subsidies drive the bulk of a project’s economics, be careful.

When activists, academics, and politicians are screaming for business strategy changes, it probably makes more sense to go in the opposite direction.

It is reasonable to study new technologies and business lines in the event something does emerge in the future that would make sense for your company; in this bucket, we have been supportive of the various low carbon business segments and venture capital portfolio approaches pursued by a number of traditional energy companies. With that said, we believe it should be a high hurdle to investing meaningful dollars outside of a company’s core competency.

There is a need to remain open minded about how the future might evolve. Right now, that means believing that one cannot yet pinpoint the round number year when oil or natural gas demand will peak. We see scant evidence a peak is imminent any decade soon.

Is the merchant power moment a repeat of the new energies bubble or a leading indicator of future energy growth?

Merchant power producers are the new hotness driven by the artificial intelligence (AI) boom and recognition that US power demand is likely to start growing at a noticeable clip after barely growing over the past two decades. Access to affordable, reliable power has become a major developed market challenge along with being a long-standing objective in the developing world. The question for traditional oil and gas companies (integrated, upstream, midstream, and downstream) is whether future investments in and around the power sector make sense. Historically, the answer had been a hard “no,” as power has been appropriately considered distinct from oil and gas.

Exhibit 6: Merchant power generation stock prices are surging

Source: Bloomberg.

In our view, power markets are more interesting than most of the major areas of “energy transition,” which to us means it is worthy of evaluation but not necessarily investment.

Is the opportunity to earn competitive returns in the power sector better than many of the major “energy transition” areas? Quite likely.

Will power returns compete with legacy business in the upstream, midstream, or downstream? It depends on a range of factors; different business models and corporate structures may be appropriate for traditional energy companies that choose to pursue power market opportunities.

Is there a major opportunity to help Big Technology companies secure reliable power generation for AI datacenters? Yes!

What do traditional energy companies have to offer Big Tech? Energy sector expertise (macro, regulatory, general knowledge, mega project competency), land, natural gas resource (for power generation), and an ability to execute capital intensive projects.

Is there an opportunity to figure out where natural gas power generation can provide both baseload power supply but also backup power for intermittent renewables? Yes.

Should upstream-only companies “integrate” into downstream power? Not sure about that.

Should integrated oils become integrated gas and power companies? We have a favorable view of Total’s strategy in this regard and are sympathetic to others studying the issue.

Should traditional oil and gas companies (across the value chain) study power markets to figure out where there might be opportunities for investment or collaboration? Absolutely!

Are we succumbing to “stock price envy” in a growing (or future) merchant power bubble? Possibly.

Geopolitical security in developing world key to new energy technologies: What technologies are developing countries going to pursue?

As a term, “energy transition” should probably be put to rest. However, there remains a strong incentive for developing world countries that do not enjoy abundant oil, natural gas, or coal resources to figure out non-fossil fuel technologies and energy sources. “Energy diversification” is perhaps the better descriptor, driven by geopolitical security. In fact, a country may prefer to pay a slightly higher price for energy if it did not have to be imported from another region on a regular basis. Cheapest does not always win. In our view, there is a strong logic to figure out the energy technologies that would make the most sense for major population centers in Asia, Africa, and Latin America. Meeting the world’s energy needs in order to better human lives is the first, second, third, and only job that really matters.

⚡️On A Personal Note: Summer reading

I try to read about two books a month, or 25 per year. I find books to be a nice change of pace from the overwhelming quantity of short-form content that otherwise consumes all of us. Here are my 10 favorites from the past year, a few of which I have previously highlighted:

Energy History

Oil Man: The Story of Frank Phillips and the Birth of Phillips Petroleum by Michael Wallis

The Big Rich: The Rise and Fall of the Greatest Texas Oil Fortunes by Bryan Burrough

The King of Oil: The Secret Lives of Marc Rich by Daniel Ammann

Mining

The War Below: Lithium, Copper and The Global Battle to Power Our Lives by Ernest Scheyder

Cobalt Red: How the Blood of the Congo Powers Our Lives by Siddharth Kara

Business, Investing, and Financial Crimes

Founder vs Investor: The Honest Truth About Venture Capital from Startup to IPO by Elizabeth Joy Zalman vs Jerry Neumann

Poor Charlie’s Almanac: The Essential Wit and Wisdom of Charles T. Munger by Charles T. Munger, edited by Peter Kaufman

Money Men: A Hot Startup, A Billion Dollar Fraud, A Fight for the Truth by Dan McCrum

Leadership & Civics

The Hero Code: Lessons Learned from Lives Well Lived by Admiral William McRaven

The Bill of Obligations: The Ten Habits of Good Citizens by Richard Haas

Bonus: The book I was most surprised to enjoy reading

Climate Capitalism: Winning the Race to Zero Emissions and Solving the Crisis of Our Age by Akshat Rathi

The book I read in the past year that I was most surprised to have enjoyed reading was Climate Capitalism by Akshat Rathi. While I have always enjoyed my direct interactions with Akshat, a Bloomberg journalist focused on climate, I would describe our world views as quite different if not near polar opposites. In a nutshell, the second half of his book title is not a view I share. Similarly, I would not expect to ever see Akshat endorse the global economic, geopolitical, or environmental benefits of rising US shale or Canadian oil sands production.

I read the book basically because we were due to meet in New York around Columbia University’s annual energy summit (via the Center on Global Energy Policy) and, since I like him on a personal basis, I thought I would at least give the book a skim in order to be able to politely say, “yes I read your book. Congratulation on its publication!” While I still do not share Akshat’s world view, what I loved about it is the positive framing about business and leadership success stories in and around creating new energy sources and technologies and improving environmental outcomes. I expected a scolding, “the end is near” fatalism that usually accompanies everyone in the “urgent climate crisis” crowd.

This is a business book first and foremost. There is an obvious massive opportunity to help meet the substantial energy needs of everyone on Earth, and I would argue that is the story Akshat tells. Yes, his perspective is still focused on solving for zero carbon emissions and the climate side of the ledger. But he wrote a business book that is a quick, fun, and informative read on a topic that is usually divisive, negative, and doom-and-gloom in nature.

Akshat, congratulations my friend on winning the first Super-Spiked “Book I was most surprised to enjoy reading” award. I thoroughly enjoyed the style and tone you took, which more people that share your views on climate should consider employing. My only critique is I would substitute out “The Fixer” for people like Jay Faison or Rich Powell. The latter two may not be as well known, but I believe support energy and environmental policies that would move the world in a healthier direction.

⚖️ Disclaimer

I certify that these are my personal, strongly held views at the time of this post. My views are my own and not attributable to any affiliation, past or present. This is not an investment newsletter and there is no financial advice explicitly or implicitly provided here. My views can and will change in the future as warranted by updated analyses and developments. Some of my comments are made in jest for entertainment purposes; I sincerely mean no offense to anyone that takes issue.

“Under no scenario will demand for oil in 2040 fall below current levels”, Goldman Sachs this week. I finally read Gregory Zuckerman’s “The Man Who Solved The Market” about Jim Simons and quant investing. I really enjoyed it. Thanks Arjun. Enjoy your summer.

The part less spoken in the mainstream. What now?

https://cedarowl.substack.com/p/coal-is-en-vogue-and-begging-for