WATCH the video on YouTube by clicking the RED button above.

LISTEN to audio only via the Substack player by clicking the BLUE button above.

STREAM audio only on Apple Podcasts, Spotify, or your favorite podcast player app.

DOWNLOAD a pdf of the slide deck by clicking the blue Download button below.

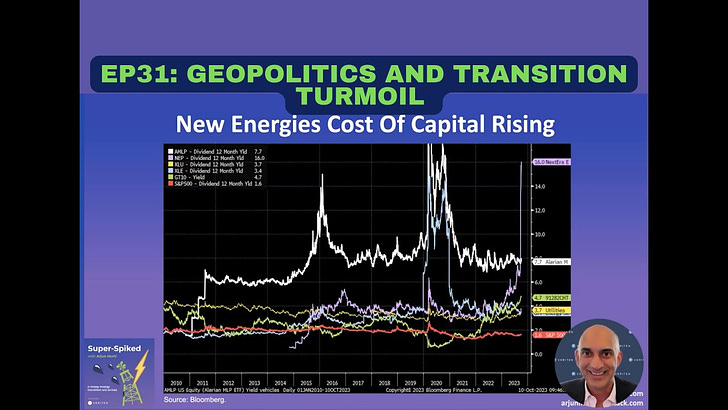

We focus on the long-term implications to the energy sector of the sharp rise in geopolitical turmoil, especially following the terrorist attack in Israel last weekend, coupled with continued stock market turmoil among past energy transition darlings like Orsted and Next Era Energy Partners among many others.

We make the following observations:

The unmet energy needs of the other 7 billion people on Earth is massive and points to significant long-term growth potential in all forms of energy, both new technologies and traditional sources like crude oil, natural gas, coal, and nuclear.

Yet, almost no one is calling for oil and gas companies to grow CAPEX and the major decline in New Energies equities and rising cost of capital in that space points to slower New Energies CAPEX as well, at least versus prior forecasts.

Rising Middle East tensions and the ongoing war between Russia and Ukraine come at a time of generally low OPEC spare capacity, even after considering the recent supply cuts from Saudi Arabia.

The number of oil projects in particular being pursued continues to shrink and the cost curve is steepening.

While we continue to characterize the commodity macro as "Super Vol" rather than "super cycle" due to economic uncertainty in three of the largest energy consuming regions--China, Europe, and the USA--the addition of new geopolitical risks in the Middle East coupled with turmoil in the New Energies space suggest it is just a matter of time before we hit a major pinch point for energy commodity prices.

The traditional energy sector continues to be generally under-appreciated by most investors, policy makers, politicians, and academics. And we would at some point expect to find value among some New Energies equities whenever the dust settles, though that day may still be some ways into the future.

🔔 4 Ways to Subscribe

All Content: If you subscribe to Super-Spiked via email, you will receive all content to your inbox and it is also all on the Super-Spiked website. I have been aiming to publish about once a week, usually on Saturday.

Veriten: You can now also subscribe to Super-Spiked content via the Veriten website (here) and also receive Veriten’s flagship COBT video podcast.

YouTube channel for video only: You can subscribe directly to the video feed of

Super-Spiked Videopods on my YouTube channel Super-Spiked by Arjun Murti.

Apple Podcasts, Spotify for audio only. You can subscribe directly to the audio only feed on Apple Podcasts, Spotify or your favorite podcast player app. The podcast is simply the audio for the YouTube videos.

⚖️Disclaimer

I certify that these are my personal, strongly held views at the time of this post. My views are my own and not attributable to any affiliation, past or present. This is not an investment newsletter and there is no financial advice explicitly or implicitly provided here. My views can and will change in the future as warranted by updated analyses and developments. Some of my comments are made in jest for entertainment purposes; I sincerely mean no offense to anyone that takes issue.

📜 Credits

Intro & Outro music: Wolf Hoffman: Concerto for 2 Cellos in G Minor, Rv 531: I. Allegro Moderato.

This episode of Super-Spiked Videopods was edited and produced by Veriten Productions.

Share this post