The PTSD Pullback, Part 2: Goodbye Europe…Hello Rest of World?

Where Are We In The Energy Cycle

We’ve seen the movie before, right?

Random bank you had never heard of before suddenly collapses and it matters! The Fed announces news of its fate on a Sunday afternoon, pre-Asia open.

A week later, also on a Sunday, a legendary institution everyone absolutely knows is taken under by a larger peer, with monopoly money government guarantees that are a mind-boggling multiple of residual market capitalization. It’s a sad week for the hard-working rank-and-file that were not responsible for executive mis-management and poor governance of a historic institution.

Markets whip up and down in the interim as everyone debates contagion risk.

Recent broad market and energy sector turmoil has an eerily familiar feel for anyone who lived through 2008 and the Great Financial Crisis (GFC). I personally don’t believe this is GFC2, but I also do not have a track record of successfully having called GFC1, so who knows. Clearly, the more severe a potential recession and the more global its nature, the worse the outlook would be for energy commodity demand and likely short-term price movement. However, unlike 2008, there are some notable differences (see Exhibits in subsequent section):

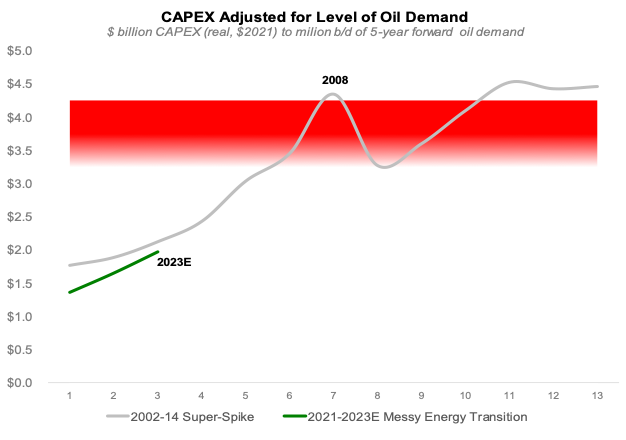

The energy CAPEX cycle has barely started…we were in year 6 of booming CAPEX back then.

ROCE vs oil prices was deteriorating by 2008…there is no evidence of that this time around.

Net debt was rising back then…today it is still falling.

Energy had reached 15% of the S&P 500 in July 2008…today it is hovering around a more modest 5% level.

I think you get the picture. When the rebound inevitably happens, be it next week (no contagion/no recession), next quarter, or next year (recession now, recovery later), the risk/reward for energy commodities looks to be quite favorable. I believe we remain in the early stages of a decadal Super Vol macro backdrop and an ROCE super cycle for traditional energy when one adds up the peaks and troughs along the way. For investors, I leave the “trying to catch a falling knife” trader guessing game to the Wall Street pros as I noted in Evolution of a Structural Bull Market: The PTSD Pullback (here). While I am now un-retired, Veriten is neither a research broker-dealer nor an investment bank so I mercifully am not being paid to make short-term trading calls.

Rather, Super-Spiked has been focused on long-term energy macro themes. As it is now presented by Veriten, this post will look to address how the current banking crisis, or whatever it is, might impact the long-term outlook for the energy sector.

My over-arching takeaway is that the crisis will accelerate the end of the European financials sector as being relevant to traditional oil and gas. This may not be fully evident over the next 1-3 years, but ten years from now capital markets and insurance access for traditional will almost certainly look very different than it has historically. Some, especially those in the United States, will say good riddance to Euro banks, who cares, and have they really mattered in recent years anyways? As an American, I get the sentiment. I thank God every day my parents emigrated from India to the United States in the 1960s and not anywhere else.

But capital markets accessibility, banking relationships, and insurance markets I do not believe should be taken for granted by any company in any region. When an important region, the EU in this case, decides that a specific sector is no longer socially acceptable for investing—no matter how mis-guided and unfortunate that perspective is—it needs to be taken seriously by corporate executives, board directors, and investors. The opportunity to take risk to achieve differential returns will be greatest for companies that recognize that much of yesteryear’s playbook no longer holds and to plan ahead for reasonable outcomes of what the future world will look like.

Where are we in the cycle, in pictures

Exhibit 1: CAPEX well below “danger zone” and a far cry from 2008 excesses

Exhibit 2: ROCE trending favorably this cycle, so far

Exhibit 3: In 2008, ROCE was degrading vs oil prices before falling off a cliff due to excess CAPEX: Avoiding the quadrilateral of death should be a key objective for traditional energy this cycle

Exhibit 4: Net debt continues to fall this cycle

The beginning of the end of the European financials sector as energy relevant

The sudden demise of Credit Suisse should be a wake-up call to anyone that has chosen to downplay recent actions by Munich Re, HSBC, and ING to no longer finance or insure new oil and gas projects. They each claim this is called for by The Science™ that underpins the IEA Net Zero by 2050 report. Europe, in my view, is on track to basically go away as a meaningful capital markets and insurance provider to traditional oil and gas. The current challenges in the banking sector I believe will accelerate the trend as companies rationalize operations and areas of emphasis, and are under greater explicit or implicit government control.

As to the critique from some readers, especially those in the United States, that will understandably say “Who cares? Since when did European financial institutions really matter anyway?” I agree to a point. However, in insurance and reinsurance markets, Europe has some of the giants. If you look at shale E&P equity financing in the 2015-2017 period, Credit Suisse’s excellent US investment banking and capital markets team were perhaps the major financier of the shale boom (yes, it is quite likely US E&Ps would have been better off if Credit Suisse hadn’t been so successful raising capital, but the resulting poor ROCE story is now well understood and not the focus of this post).

For all its shortfalls and socialist tendencies, Europe is still a major economic and financial region with an economic relevance and population that historically has been closely aligned with the United States. Replacing European financing with firms in the Middle East or Asia is no sure thing. And even if we find future capital providers, who will be the future insurance industry giants supporting traditional energy?

Will US financial institutions follow Europe’s path?

Let us pray: Dear Lord in Heaven, please give the leaders of US financial institutions the strength to resist following in the path of Europe, to resist succumbing to Glasgow Financial Alliance for Net Zero (GFANZ) dictates, and to resist treating the IEA’s “Net Zero by 2050” scenario as if it was one of Your Commandments. Amen.

We can only hope that the sensible and brave stance taken by mega money manager Vanguard earlier this year is the beginning of the awakening of US financial institutions to the unholy alliance of GFANZ with IEA Net Zero by 2050. I also have huge respect for JP Morgan’s legendary CEO Jamie Dimon, a rare, outspoken voice of pragmatism when it comes to energy and environmental policy.

I, for one, do not take capital markets access in the United States for granted. The mega banks in the United States are all under extreme pressure from environmental activists to “end fossil fuel financing now.” Rather than vocally push back on the clear economic and societal harm from such a stance, most mega banks offer Sustainability and ESG platitudes. No one should feel comforted. Ten years from now when the current crop of US mega bank CEO’s are no longer in charge, are we sure the next group will be as committed to energy and environmental pragmatism or will “climate only” extremism be the rule of the day?

How many of you in the investor or corporate world have spent time with the increasingly important Sustainability groups at the mega banks that closely advise the c-suite? To be clear, there are many excellent, thoughtful people staffing those roles whom I know, respect, and whose opinions and perspectives I value and benefit from. But at your bank, how would you characterize energy-specific knowledge versus “climate only” interests? And more importantly, what will be the staff make-up of these groups in 10 years?

Are you a smaller producer in the middle of the country that doesn’t bank with coastal elites? The issue is the trickle-down effect of potentially losing the mega banks coupled with growing uncertainty on what it will mean to be a regional bank post Silicon Valley, Signature, and First Republic. I do not believe any US-based company can hide from the risk of EU-styled “climate only” contagion to the US financials sector, no matter how small or physically removed one is from the money-center mega banks.

Is your company prepared for a less welcoming capital markets and insurance landscape?

The point of the previous section was not to be overly dramatic or borderline fear mongering about a future fade in capital and insurance markets access for traditional energy in the United States. But tell that to the US coal sector. My suggestion: Hope for the best. Plan for the worst. And figure out what your options are likely to look like 5-10 years from now.

For a large company, it will be tempting to think the demise of Europe is manageable and that options will always exist. That is probably true but it’s hard not to think that now is the time to plan ahead. For smaller companies, especially those in say Texas or Oklahoma, it is probably even easier to think that your local banker and insurer will always be there. But is there any part of the past several weeks that makes you feel better about regional banks?

For both publicly-traded and private companies based in the United States, I would argue the following:

There is no such thing as too strong of a balance sheet. Maybe net debt zero is the future? How about negative net debt (i.e., more cash than debt)?

Who among your capital markets and insurance providers is signed up for GFANZ? If they are part of GFANZ, now is the time to ask some tough questions and measure your comfort whether their answers will stand the test of time, especially if senior management changes down the road. What is the culture of the bank you use? Who is in their Sustainability group? To what degree are they using corporate speak to try to please everyone, in particular environmental activists?

If in the future, insurance is not as readily available for oil and gas companies, what is the back-up plan? Self insure? Industry consortium?

Macro implications

It’s easy to say that less capital availability for traditional energy, especially in an environment of rising underlying commodity demand, is bullish for the sector. I believe it will be a contributing factor to meaningfully higher average ROCE over the 2020s versus the 2010s. But as I have now stated many times, insufficient structural supply growth, especially during a period of higher-than-normal geopolitical turmoil, is a recipe for a continuous boom-bust pricing environment, what I have called a Super Vol macro backdrop. The past few weeks have reinforced that view. Average ROCE, or any metric, will likely prove fleeting as we whip from peak to trough and back again.

For investors, it’s really a question of whether you want to buy-and-hold through the ups and downs or try to cycle time. Many institutional and some retail investors will focus on short-term trading. Fine by me, but it is not the focus of Super-Spiked. I personally approach the sector from a long-term buy, hold, and occasionally-trade-around-the-edges perspective.

⚡️On a Personal Note: Credit Suisse First Boston

Even as a big chunk of my career was as a competitor at Goldman Sachs, I have always had deep respect and frankly have been a pretty big fan of Credit Suisse’s energy equity research teams over the years. Jim Clark and Gordon Hall were my absolute favorites in the 1990s when I was their client as a young buy-sider at JPMIM. I traveled the world with them. Tom Petrie and Jim Parkman who gave me my start were First Boston alum, as the US firm was then known. It is a little known twist of fate that I joined Goldman Sachs instead of CS in 1999, a decision aided by a superior offer and my concern about joining a European headquartered bank. Good call on the latter point.

Whether I was a client or competitor, Credit Suisse has a long history of US energy excellence. In my post Goldman advisor/board roles, I came to appreciate it extended to their capital markets and investment banking professionals as well as research. I have no idea what the future US energy franchise will look like once merged with UBS. I do know that the hard-working professionals can and will find new opportunities, if desired, at new firms or perhaps with the merged entity.

We are in the midst of a great, new energy cycle, there is a shortage of expert domain knowledge, and there are only so many of us willing to come out of retirement to rejoin the labor pool. If you are looking to bolster your energy expertise, I recommend looking at those covering energy at Credit Suisse First Boston.

⛳️ The Un-Retirement Blog: Episode 2

My first week at Veriten was my first ever CERAWeek. It was sufficiently grueling that a 4-day spring break trip to Sedona couldn’t come soon enough!

Free advice to those of you early in your career: It is definitely not a best practice to take vacation 1.5 weeks into a new job. Yes, Super-Spiked was not missed, emails were answered, and I’m at a different point in my career, etc. But still, I don’t recommend it as a general rule. Fortunately, Veriten is a family friendly employer.

However, I will say that when your junior in college offers to join her parents at whatever resort they are planning to go to—we had not at that point made any Spring Break plans—you should drop everything and schedule something suitable to her liking. She is our first born child. Her birth forever changed my life in the most favorable way possible. Thumbs up to Enchantment Resort in Sedona!

I actually got 2023 golf round #1 in at the nearby Seven Canyons golf club, a beautiful course that was under significant renovation (mostly bunkers). I played on Saturday, Super-Spiked publication day, with a mid-morning Arizona tee time. Last summer I played plenty of Saturday mornings. But it wasn’t the same feeling of not caring about incoming emails/posts, since I was voluntarily publishing it for free then. The 3 hour wrong way time zone change didn’t help my mental state.

Saturday morning golf at our local club is pretty fun, so I am going to have to figure this one out. I really like the publication time: 8:59 am ET Saturday morning, every week excluding major US holidays (Memorial Day, Independence Day, Labor Day, Thanksgiving, Christmas). Perhaps a disclosure will suffice? If you are a Super-Spiked subscriber or part of the Veriten network, I will get back to you either at the turn or as soon as the round is over. Afterall, it’s Saturday. You too should be playing golf or engaging in a similar leisure activity! Changes to the energy sector are long-term in nature; replies can wait until Saturday afternoon.

Seven Canyons, Sedona, site of 2023 round #1 (score: undisclosed)

⚖️ Disclaimer

I certify that these are my personal, strongly held views at the time of this post. My views are my own and not attributable to any affiliation, past or present. This is not an investment newsletter and there is no financial advice explicitly or implicitly provided here. My views can and will change in the future as warranted by updated analyses and developments. Some of my comments are made in jest for entertainment purposes; I sincerely mean no offense to anyone that takes issue.

Arjun - thanks for your kind comments about the CS energy banking and research team. I had the great honor of working with this great group of people for two decades and I will always have fond memories of my colleagues. The energy cycle has given me an opportunity to redeem myself for schlepping energy companies through Boston as we, perhaps unknowingly at the time, for doing too good a job in raising capital and having a hand in destroying the economics of the sector, but that was then. Our family office has an entirely different view of balance sheet integrity and optimal capital structures today to say the least. Tuition in the oil patch is expensive, and so will the lessons to be learned by those that choose ideology over economic reality. I look forward each week to your work.

Hi Arjun,

Thanks again for another excellent column. Even though I know that CapEx has been grossly insufficient for the past several years and that I should be, just like uncle Warren, looking over the short term valley, the current market still hits my nerves. Believe me, your columns have been great comfort to me during time like this.

Any significant bailout of banks will lead to some sorts of "nationalization" of banks. Once the government has them under control, it will be not unimaginable that to set different interest rates for the loans to companies in different sector.

In case you missed, here is an important column: https://www.bostonherald.com/2023/03/24/caruso-new-climate-change-regs-a-burden-for-business/

Try this link if it behind the paywall for you: https://archive.ph/HjNj6