Q&A and Clarifications On Fading “Energy Transition”

The Energy Transition Needs To Transition

We use the Q&A format this week to address burning questions and important points of clarification from last week’s post, So Long “Energy Transition,” Hello Meeting Global Power Growth (here). Key topics include the fading of “energy transition” as a concept, the fate of “net zero by 2050,” why it is not appropriate to demand adherence to consensus views, the role and responsibilities of traditional energy companies, whether new energies equities have become value plays, and, perhaps most importantly, “What Would Lee Raymond Do?” about power sector opportunities.

What do you mean by “the fading of energy transition”?

We believe most observers would define the term “energy transition” to mean a shift out of traditional energy sources like crude oil, natural gas, and coal and into low-carbon energy sources in particular renewables. This definition has never made sense, certainly not within a 2050 time frame.

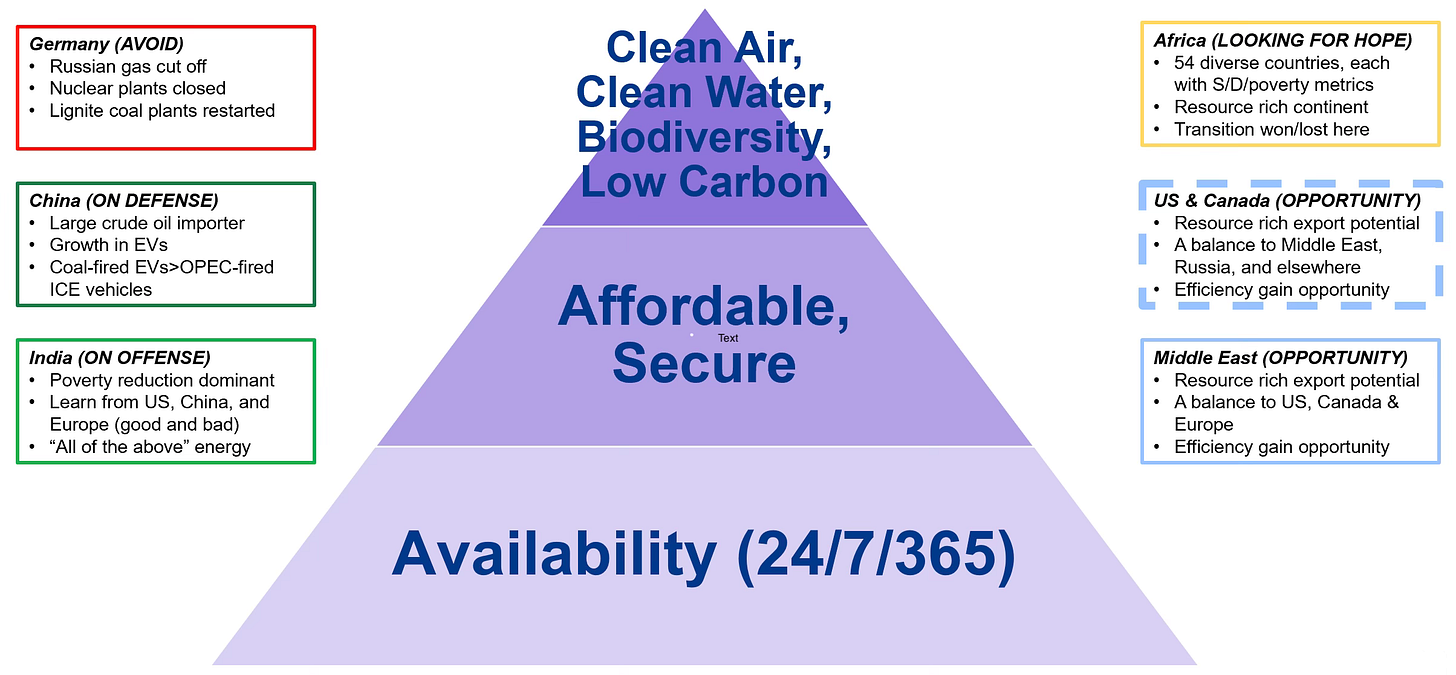

The term “energy transition” itself has historically not bothered us and we have used it in a more general sense of inevitable evolution and diversification of energy sources and technologies. However, much like we do not use the term “clean energy” or “clean tech” and instead use “new energies” (credit to Total CEO Patrick Pouyanné) since clean is not an accurate descriptor of associated technologies, with this post we shall retire our regular usage of the term energy transition. It is simply not representative of the outlook for energy and its continued usage promotes bad policy prescriptions and a mis-understanding of where the world is headed. Energy evolution and diversification that meet a hierarchy of energy needs is an un-catchy mouthful but will have to do for the time being as we work on a better branding (Exhibit 1).

Exhibit 1: A hierarchy of energy needs

Source: Veriten.

Will you be changing the Super-Spiked tagline “A messy energy transition era arrives”?

We have liked the tagline and believe readers understand the point we have been making. We will consider introducing a new tagline in the future. If you have ideas, please feel free to either reply to the email if receiving via Veriten distribution or within the comments section on Substack.

What about “net zero by 2050”? You imply the world isn’t on-track for it but don’t really say so explicitly

A bit like “energy transition,” we have always considered “net zero by 2050” as more of a cudgel for corporations to reduce emissions over time rather than a hard target that is on-track to be met on a global basis. We have admittedly been quieter about this phrasing primarily because we have appreciated its use as a general stand-in for environmental progress even as we do not believe there is a company or government on Earth on track to literally meet the aspiration.

Somewhat ironically, nearer term corporate targets that call for 30%-50% reductions in Scope 1 and 2 emissions by 2030 or 2035 that many publicly-traded companies in the United States, Canada, and Europe have seem directionally attainable—the so-called low-hanging fruit of carbon abatement. It is the last 50%-70% that we think is going to be more challenging. Moreover, we see little chance of the developing world having anything other than rising emissions from growing energy usage for the foreseeable future (measured in many, many decades to come).

“Net zero by some round number year” is unlikely to work as a primary objective for the world. It will have to be considered along with energy abundance for all, affordability, reliability, and geopolitical security, the latter of which we believe will be the key motivator of low-carbon investments.

If “energy transition” and “net zero” objectives were stretched to 2100, would that be more believable?

The short answer is “yeah, sure, I guess so.” The longer the time frame, the greater the odds that the world will have cracked the code on non-traditional energy sources and technologies. The Lucky 1 Billion of Us have greatly benefited from the use of fossil fuels. Many of the other 7 (soon to be 9) billion people will be motivated by geopolitical security to solve for economic growth with non-traditional energy sources. However, it is not even remotely realistic to think this is possible by 2050. But it is similarly foolish to not think codes could be cracked by 2100.

So you don’t accept the consensus that it is critical to reduce carbon emissions as fast as possible?

In our view, this perspective should never have been turned into a religious cause. What we repeatedly argue is that the first order of business has always been and will always be ensuring everyone on Earth has access to abundant, reliable, and affordable energy. Pretending otherwise is non-sensical, including for everyone in the “urgent climate crisis” crowd. And to be clear, abundant and reliable are the priorities followed by affordable followed by geopolitically secure. Our definition of social, economic, and environmental justice is everyone has the opportunity to be similarly rich as discussed here and here.

All of our experience as an equity research analyst over the past 32 years gives us high conviction that going with consensus is the best way to lose money and succumb to momentum trading traps. It is buying at the peak and selling at the trough. It is staying bearish in the last year of a bear market and vice versa after a bull run. It’s not that consensus is always wrong; there are usually elements of truth. But there are times when it is as clear as daylight that the path a company, industry, or the world at large is headed in is a bad one and that going the other way is clearly the right call.

In this bucket, we feel most strongly about the fact that there is not a decade let alone year where anyone today can declare oil, natural gas, or even coal demand will definitively peak or plateau. We also believe traditional energy is on-track for a decade-plus of sharply better profitability after a really poor 2010s.

My father is a career-long physicist who worked at the famed Bell Laboratories in the 1970s and 1980s and has been in academia ever since (until finally retiring a few years ago). I will quote him from a recent podcast: “you should have a questioning attitude.” To believe in science is to always question assumptions and opinions. It has more in common with being a leading equity research analyst than I ever realized.

The demand from the “urgent climate crisis” crowd that there can be no questioning of “the accepted scientific consensus” on climate change is mis-guided and unhealthy. It is the opposite of having respect for the scientific process. The “denier” labeling is particularly galling, and it is leading to a plethora of really bad policy choices like de facto internal combustion engine (ICE) bans in some states/countries by arbitrary round number years, and, worse, early retirement of reliable power plants.

The attempt to silence critics and stifle debate deserves far more pushback than it receives. Perhaps we should take some comfort in farmer protests in Europe, trucker convoys in Canada, and those that fashionably wear yellow vests in France.

But “climate action” is quite popular, no?

LOL. No, it’s not (here). We are unaware of anyone anywhere that wants unreliable, expensive energy. Expedia defaults to listing airline prices by lowest cost, not highest cost when factoring in sustainable aviation fuels (SAF). We would guess it is the lack of broad-based popular support for so-called climate policies that drives the motivation to demonize traditional energy companies and executives.

Don’t young people really care about addressing climate change?

The best advice we could give young, middle aged, and old people is to study energy more broadly and to tune out mainstream narratives that depict energy sources as clean vs dirty, green vs brown, good vs evil. Those are not actual energy attributes. Cost of supply, reliability, geopolitical security, as well as things like NOX, SOX, and carbon content are variables to understand. All energy sources have pros and cons on all actual metrics.

While a tiny minority of really loud youth eco activists grab headlines and engage in anti-social behavior, we are highly skeptical they represent “the youth” more broadly in particular those not living in Lucky 1 Billion countries. For example for Indian children that live in tents on the side of highways in Mumbai breathing in burning cow dung, it does not seem a stretch to believe that addressing the urgent climate crisis is not their number one priority. Solve for their energy needs.

Isn’t there a responsibility for traditional energy companies, especially the largest firms, to help move to a lower carbon economy?

The job of the management teams of publicly-traded traditional energy companies is the same as that of companies in all other sectors: to profitably provide products or services that consumers and businesses demand. Currently, the 8 (soon to be 10) billion people on Earth demand energy 24/7/365 for transportation and power needs, of which around 80% is generated from crude oil, natural gas, and coal. The world is a better place with a healthy US, Canadian, and ideally European traditional energy sector. The overwhelming best use of the talent and capital within traditional oil and gas firms is to provide the oil and gas that the world desperately needs.

So traditional energy companies have no responsibility for improving environmental outcomes or to help address climate concerns?

We have never said that. We support “near zero” methane as a realistic goal and a clear area for optimism. We appreciate that environmentalists in this case have recognized the need to include national oil companies in the conversation. Captured methane is an energy source that is in demand globally. There is no need to waste it. Favorable progress on technology and cost understanding over the past decade has made “near zero” methane a goal that could be achieved well before 2050.

We also continue to support addressing the blight that is “orphan wells,” which we see as an industry issue, not one specific to any particular company. We don’t have a solution to offer other than suggesting that the leadership of important industry trade groups make it a priority.

Finally, we believe leading companies will make progress in sharply reducing Scope 1 and 2 emissions. As we have noted, a 30%-50% reduction from 2015-2020 levels (companies use various baseline years) by 2030-2035 seems directionally attainable. While the specific path to further reductions toward zero is unclear, it is likely that breakthroughs will happen given the capital, time, and effort being spent on it.

Have new energies equities become value stocks after the sharp correction?

A major challenge with new energies equities is the lack of history and uncertain path to unsubsidized profitability for the various sub-sectors. Solar equities have been around the longest and likely can be analyzed from a cyclical perspective. Beyond those names, it is not obvious what the value proposition is unless as an investor or company you have more conviction that a particular technology will profitably scale.

Haven’t we seen merchant power bubbles before? Why chase it now?

No doubt this isn’t the first time we have seen a sharp rise in merchant power equities. There was no advice given in last week’s post on whether investors should chase the current rally or not. Instead we asked about the merits of legacy oil and gas companies (integrated, upstream, midstream, and downstream) contemplating investments, joint ventures, or some sort of participation in the power sector. In our view, the positive inflection in U.S. power demand coupled with the growing contribution of intermittent power sources suggests there is likely to be opportunities for participation. How to structure or consider such opportunities is the question.

What Would Lee Raymond Do (WWLRD) about power sector opportunities?

There is no doubt in our mind that there is zero chance Exxon’s legendary and Hall of Fame CEO Lee Raymond would have succumbed to “you must transition now into new energies” pressure (here). But what about the power sector? If we focus our memory of Mr. Raymond’s analyst presentations on the heart of what he preached (paraphrasing): “At Exxon, we are not trying to guess future oil prices, we are trying to invest in projects that will be at the low end of the future cost curve.” Applying that logic to power markets and recognizing the advantaged integrated nature of Exxon’s refining and petrochemical asset base under Mr. Raymond, we suspect he would not have pursued straight-up merchant power projects. Instead, if there was an opportunity to monetize low-cost natural gas resources via downstream (i.e., power) integration, perhaps that would have been considered.

While under Mr. Raymond, Exxon was not known for having a trading business, other majors have been reasonably successful at commercializing infrastructure, which is really the better descriptor than “trading.” Given the inherent volatility of power prices, commercialization opportunities undoubtedly exist.

Would Mr. Raymond have partnered with Big Tech? This does seem plausible when one considers the partnerships Exxon (and all super majors) have with host governments around the world. Whether it is oil concessions or the liquefied natural gas (LNG) business, the biggest oil and gas firms including Lee Raymond’s Exxon had a core skillset in deriving long-term value from major partnerships. If you are used to dealing with emirs, kings, and other autocrats around the world, American Big Tech business development arms would seem like welcome partners.

ExxonMobil CEO Lee Raymond

⚡️On A Personal Note: Podcasts

Last week I highlighted some of the favorite books I’ve read over the past year, with a target of reading about 25 per year. I also subscribe to over 80 podcasts including YouTube channels. I can’t say I listen to or watch every single episode, but podcasts are my background sound when driving/traveling, exercising, doing Excel modeling, or when watching regular season games for my favorite teams (Yankees, Knicks, Cowboys, Rangers). Below are 25 of my favorites within the categories of energy & the environment, automotive, and general business and markets.

Veriten

Energy & Climate

Autos & EVs

Business & Markets

Stratechery bundle: Dithering; Sharp China; Sharp Tech with Ben Thompson

⚖️ Disclaimer

I certify that these are my personal, strongly held views at the time of this post. My views are my own and not attributable to any affiliation, past or present. This is not an investment newsletter and there is no financial advice explicitly or implicitly provided here. My views can and will change in the future as warranted by updated analyses and developments. Some of my comments are made in jest for entertainment purposes; I sincerely mean no offense to anyone that takes issue.

Well done for pointing out these politically-motivated terms. As one commentator noted, we are still waiting for “peak wood”

Thank you for sharing your thoughts on this. Must bookmark this post for further review of your book recommendations!