FAQ on A Slowing China’s Impact on the Oil & Refining Macro

Perpetual Transition

We follow-up on last week’s Next 10 Years of Perpetual Transition: China post (here), with ten frequently asked questions on China and our macro perspectives.

Question 1: Does “peak China” mean “peak oil demand”?

Answer: No.

First and foremost, we doubt that we are at or near a permanent peak in China from an oil demand perspective. Rather, the sharp rise in EV (electric vehicle) sales in the country could limit future growth in the gasoline component of its demand, which is about 25% of China’s demand barrel (Exhibit 1). As we highlighted with Norway in a previous post (here), rapid growth in EVs did hit gasoline demand, but was offset by growth in other oil products (Exhibit 2).

When we consider China’s demographic maturity, uncertainty over its property market, and other aspects of its macro economic health, we agree with what is a growing consensus view that China will likely stop being the dominant driver of oil demand in coming years. It is even possible it could experience what we will call its first plateau in oil demand by the 2H of 2020s.

What we would disagree with is that some oil market observers, especially those most aggressively promoting “net zero” scenarios, are presuming a moderation in China’s oil demand will translate to a permanent global oil demand stagnation—so-called “peak oil demand.” We do not see how the rest of the world will become energy rich, as is their destiny, without using growing quantities of crude oil for the foreseeable future.

Exhibit 1: EV growth impacts gasoline, which is about 25% of China’s oil demand

Source: IEA, Veriten.

Exhibit 2: Norway’s overall oil demand is flat-to-up despite declining gasoline demand from EV adoption

Source: IEA, Veriten.

Q2. Doesn’t a China oil demand slowdown mean that “energy transition” is in fact happening even if high-profile net zero scenarios are not on-track to be achieved?

A: No, it doesn’t mean that.

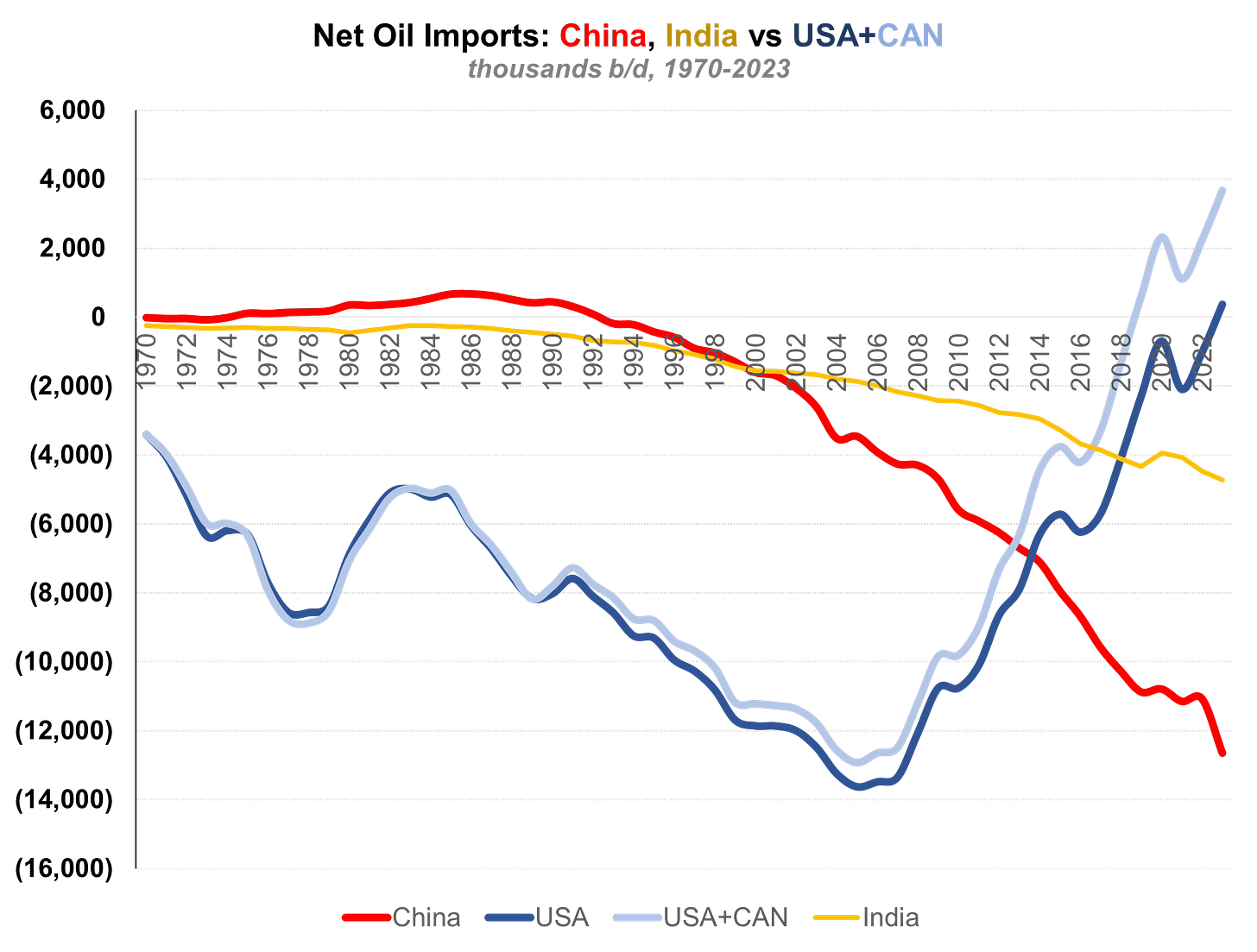

It remains our view that China is highly motivated to limit, as much as possible, future increases in its oil imports (Exhibit 3). Currently, China oil demand is a mere 4 barrels per person per year, a fraction of the 20+ barrels per person per year used in the United States, Canada, and South Korea or even the 13 barrels per person per year used on average among Lucky 1 Billion People rich countries. We believe geopolitical security is the over-arching driver of China’s aggressive push to ramp up domestic EV sales and at least put a dent in the 25% of the oil demand barrel attributed to gasoline-fueled cars.

If China were to reach the 7 barrels of oil demand per capita that Thailand currently uses—never mind the 13 barrel rich country average—it would imply crude oil imports would rise another 10 million b/d to nearly 23 million b/d from around 12.5 million b/d in 2023. In our view, geopolitical security is the number one motivator of oil demand substitution for countries that are short crude oil (i.e., that do not have sufficient quantities to meet domestic consumption).

Exhibit 3: China is now by far the world’s largest oil importer

Source: Energy Institute, Veriten.

Q3: If China plateaus in 2H2020s, does that mean its oil demand will never grow again?

A: Unlikely.

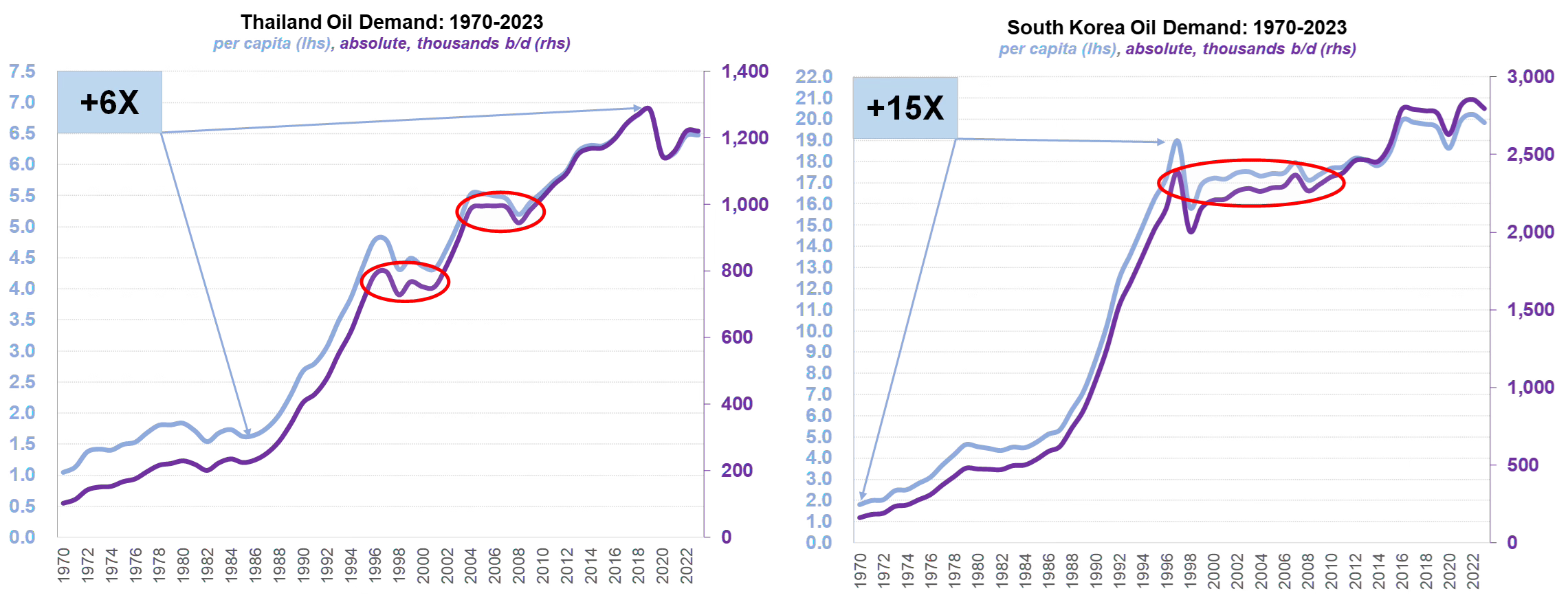

We highlight the examples of Thailand and South Korea, each of which have experienced multi-year periods of oil demand stagnation before eventually moving higher (Exhibit 4). In the past 30 years, Thailand has had two periods of growth stagnation, after the Asia Financial Crisis from 1997-2001 and then again over 2005-2009 following the quintupling in oil prices to around $100/bbl from around $20/bbl. Notably, Thailand today is again moving toward all-time highs in oil demand.

Exhibit 4: Thailand and South Korea oil demand

Source: Energy Institute, Veriten.

Q4: Can India and the rest of Asia compensate for a slower China?

A: Eventually, but probably not immediately.

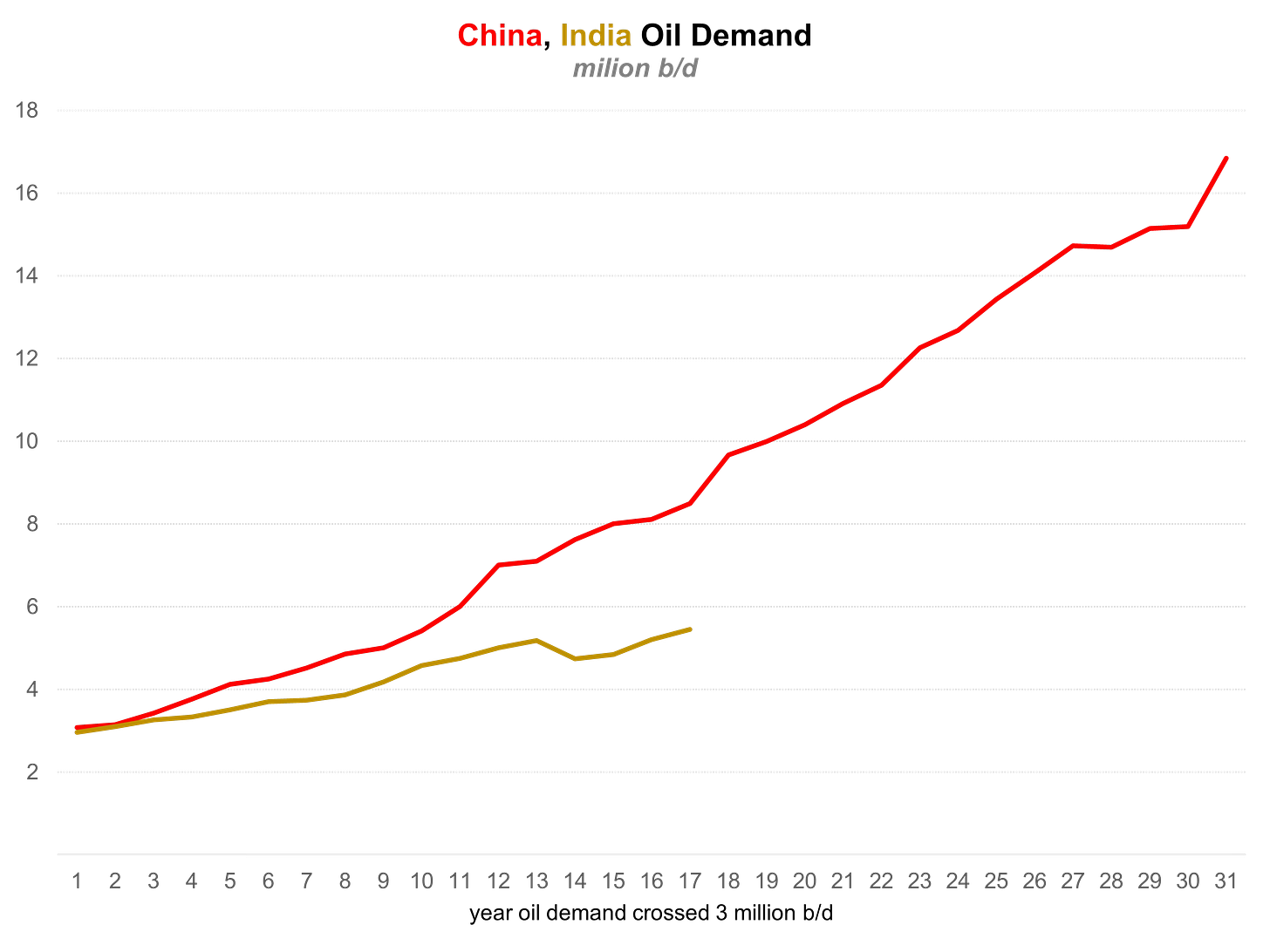

The nature of economic growth in India is likely to be different than China, which relied on energy-intensive export and property market growth. India’s economy seems likely to be more diversified and with a more meaningful domestic, consumer component. Energy usage will still grow significantly over long periods of time but is not growing at the same clip China experienced when it started taking off 20 years ago (Exhibit 5). As such, there is risk oil demand growth over the remainder of this decade slows to something at or below 1 million b/d per year, rather than staying at its 20-year average of 1.2 million b/d per year, or higher.

Exhibit 5: India’s oil demand has substantial upside, but the slope of its oil demand line is less steep than China’s

Source: Energy Institute, Veriten.

Q5. What can be learned from coal markets about the trajectory for oil demand?

A: A lot, as we discussed here, here, here, and here.

Global coal demand has experienced two prior plateaus over the past 30 years (Exhibit 6). The first was a 10-year stretch from 1989-1999. China then single-handily contributed to about 50% growth over the next decade before ostensibly plateauing over the 2013-2020 period. China, with an emerging contribution from India, is now helping global coal consumption reach new all-time highs.

Exhibit 6: Global coal demand has seen two plateaus over the past 40 years

Source: Energy Institute, Veriten.

Q6: Last week you expressed a view that slower China oil demand was a bigger risk for crude oil markets rather than refining; but if gasoline demand potentially flattens out (or declines), aren’t gasoline exports out of China a bearish risk?

A: Yes, we agree that a changing mix of China’s oil demand (i.e., less gasoline, more other products) could have different impacts on specific product cracks such as gasoline versus diesel or jet fuel.

As we noted in last week’s post, we do not see potentially slower China oil demand growth as a meaningful headwind for global refining margins, given that China added sufficient refining capacity to meet its domestic obligations, which contrasts with crude oil where its imports have grown substantially (Exhibit 7). In other words, China has NOT had a growing call on refined products over the past 20 years as it has in crude oil markets. Still, it is worth monitoring the degree to which China’s mix shift (less gasoline demand vis-à-vis other products) impacts specific product crack spreads.

Exhibit 7: China oil demand slowdown a headwind for crude oil, not refining markets

Source: Energy Institute, Veriten.

Q7: Last week, you talked about a WTI flush to $50-$60/bbl clearing the decks for the next big move up for energy, but don’t we really need better global GDP growth?

A: Yes, of course.

The difference between sub-1 million b/d of annual oil demand growth in a weakening global GDP environment versus something closer to 1.5 million b/d of growth when global economies are healthy is meaningful to oil markets. The combination of modest US shale oil growth (+100,000-300,000 b/d per year) plus Canada, Brazil, Guyana and higher OPEC production can comfortably meet sub-1 million b/d of oil demand growth. In global GDP terms, a return to 3.0%-3.2%+ growth versus something closer to 2.5%-2.7% is the difference between healthier versus more lackluster oil markets.

Q8: If there is downside risk to oil in a weak GDP environment, should companies hunker down and remain risk averse?

A: We favor counter-cyclical investing and M&A, if possible.

The traditional energy sector overall did an excellent job using the high oil price period of 2022-2023 to reduce debt and dramatically improve balance sheet health. While aggregate industry debt levels have ticked up over the past several quarters on the back of M&A activity, balance sheets overall remain very healthy. We believe that as or if macro conditions weaken, it could present an opportunity for stronger players to lean-in to the downside via counter-cyclical M&A or share repurchase or both.

Q9: Aren’t major stock buybacks rare in downcycles?

A: Yes.

In fact, its worse than that. Stock buyback programs are classically pro cyclical, meaning companies usually repurchase more shares when macro conditions and cash flows are healthy but share prices are also higher. Given various post Goldman Sachs roles we have held, we do have greater sympathy for how hard it is to repurchase stock when conditions are weak. No executive team or Board wants to put the financial health of a company at risk when the ultimate duration or depth of a downside is unknowable in real time.

So how about this instead: the next time oil rallies above $100/bbl, which will happen at some point, instead of special or variable dividends, companies might consider building cash on the balance sheet to be utilized during an inevitable future downcycle.

Q10: Why do so few people solve for how everyone on Earth will become energy rich?

A: We have no idea.

A major problem plaguing especially those of us living in Lucky One Billion People countries is that our energy conversations are stuck in the doom loop of “climate crisis” versus “climate minimalization." The other 7 soon to be 9 billion people are instead solving for how they are going to achieve economic growth that raises living standards, which in turn requires massive incremental quantities of all forms of energy.

For countries that have insufficient quantities of crude oil, there is a strong motivation to figure out alternative technologies and sources of energy supply to ultimately limit import needs. Over the next 10-20 years, it is only recession or otherwise weak global GDP growth that can limit continued increases in oil demand, in our view. That said, the sheer magnitude of under-demand for oil in a world where everyone is energy rich—which we peg as on the order of a 250 million b/d total addressable market (TAM) for oil—suggests it is foolish to believe that nothing will be invented over say the next 50-75 years that could result in oil eventually receding in importance.

⚡️On A Personal Note: Seeing the world with the energy sector

For me, the best part of covering the energy sector has been the fact that it is global. You get to visit and learn about many different countries and regions around the world. Incredibly, what happens in one area often has investment relevance to another half a world away. Growing up in suburban New Jersey in the 1970s and 1980s, I was not a world traveler. I believe the countries I had visited by the time I had graduated college included India (twice that I remember), Canada (if you count Niagara Falls), and college Spring Break trips to Cancun, Mexico and to Germany where my sister was spending a semester. It’s a different story for my kids for sure, but traveling extensively oversees I do not recall any of my childhood friends doing either.

Below are my Top 5 favorite memories from the pre-wife, pre-children days of traveling in the 1990s. There is no substitute for visiting companies in their offices or taking field trips to visit assets. I don’t remember the exact dates for any of these trips, but all occurred most likely between 1996-1998 when I was at J.P. Morgan Investment Management.

The Sahara Desert in Algeria to see Anadarko Petroleum’s new discoveries. This was my first time in Africa. My first time staying in a worker’s camp. And my first time on a prop plane where I did everything in my power to not get sick while the pilot was making a bunch of twists and turns over the desert landscape. I still remember the hug he gave me after we landed for keeping it together, against all apparent odds. I was in the front seat next to him. He didn’t speak English (only French I think), but he appreciated my effort!

Prudhoe Bay with ARCO Alaska. A great trip with three fellow buy-siders that was hosted by ARCO investor relations executive Steve Enger. My first time on the North Slope. My first time sticking my hand in the Arctic Ocean. My first time experiencing near 24 hours of daylight. And I think the first and only time I had a reindeer burger (might be mis-remembering this one).

Moscow, Almaty, Baku with CSFB. This was a Credit Suisse First Boston-hosted trip circa 1998 on a chartered plane that we were told was previously the property of Eduard Shevardnadze. Keep in mind, Cold War memories were still fresh, and this trip was within a decade of the fall of the Berlin Wall. This was my first time being with an armored driver CSFB had assigned to us to go site seeing ahead of our first day of meeting. The driver, for whatever reason, felt compelled to draw his gun every time I got out the car. Needless to say, there is not a site worth seeing if it required the driver brandishing his weapon at each stop. Baku was easily my favorite of the three cities. To my regret, I had to skip the last stop which was to Kiev, Ukraine.

China with Morgan Stanley. My first ever visit to Beijing was in the 1996 time frame, a full six years before China’s growth miracle took root. Doug Terreson of Morgan Stanley was the host, and we had the use of Morgan Stanley jet, something I am sure is no longer common for any research analyst at any firm to have the use of today. Upon joining Goldman Sachs in 1999, I visited China at least every other year through 2014, but I have not been back since. To see the incredible transformation of that country from that first visit to today speaks to what is possible within a generation or less for all other developing countries.

Thailand, Malaysia, Singapore with Royal Dutch/Shell. Shell in those days was a member of the S&P 500 and its analyst trips were a mix of US and European analysts. We visited the Map Ta Phut refinery in Thailand, which was a new asset back then. We came to understand the incredible value in having long-term relationships with host governments in Malaysia, where Shell (and Exxon’s) assets fared much better during the downturn caused by the Asia Financial Crisis than did producing assets in other regions like the North Sea or United States. Flying Singapore Airlines over and back was the first time I became aware that airline quality and service can vary and that at least some other parts of the world were doing better than the U.S.!

⚖️ Disclaimer

I certify that these are my personal, strongly held views at the time of this post. My views are my own and not attributable to any affiliation, past or present. This is not an investment newsletter and there is no financial advice explicitly or implicitly provided here. My views can and will change in the future as warranted by updated analyses and developments. Some of my comments are made in jest for entertainment purposes; I sincerely mean no offense to anyone that takes issue.

Great note Arjun. The shift in importers from USA/Canada to China/India tells it all. And thank you for making the point that crude oil is used for more than just gasoline … one question: If China and India increasingly pay for imports in currencies other than the US dollar, how do you think this impacts the US$ price of oil? Would seem to me to make it go up over time as the US $ weakens …

Loved the personal section. I too grew up in the 70’s in New Jersey and traveled then even less than you. Turn the clock up a few decades and I now live in Hong Kong and have a small business in mainland China.