22:54

Most Popular

View all

Super-Spiked

Super-Spiked focuses on the mission of everyone on Earth someday becoming energy rich and what that would mean for corporate strategy and energy & environmental policy, markets and commodities

The Rise of The Energy Pragmatism Era

Everyone Deserves To Be Energy Rich

Navigating The Energy Macro

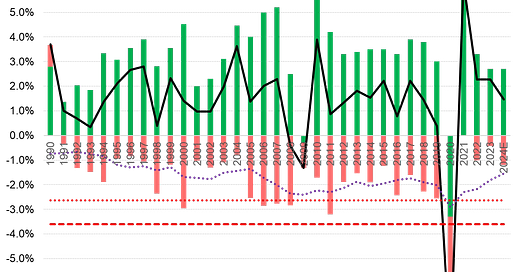

The Good, The Bad, and The Misunderstood Amidst Massive Macro Cross Currents

A Look At Traditional Energy Profitability Amidst A Trade War-Driven Macro Mess

Top 10 Tactical Questions for 2025

Big Themes for 2025: Energy Scenario Normalization, Power Surge, Technology-Driven Growth

A Look Back at 2024 Tactical Questions

FAQ On Rising Middle East Turmoil and Energy Markets

AI & Energy.GPT

Corporate Strategy

Lessons Learned

Geopolitics & Policy

Obliterating Peak Oil Demand

Perpetual Transition

Profitability Deep Dive

© 2025 Arjun Murti

Substack is the home for great culture